Self-Employed Independent Welder Services Contract

Overview of this form

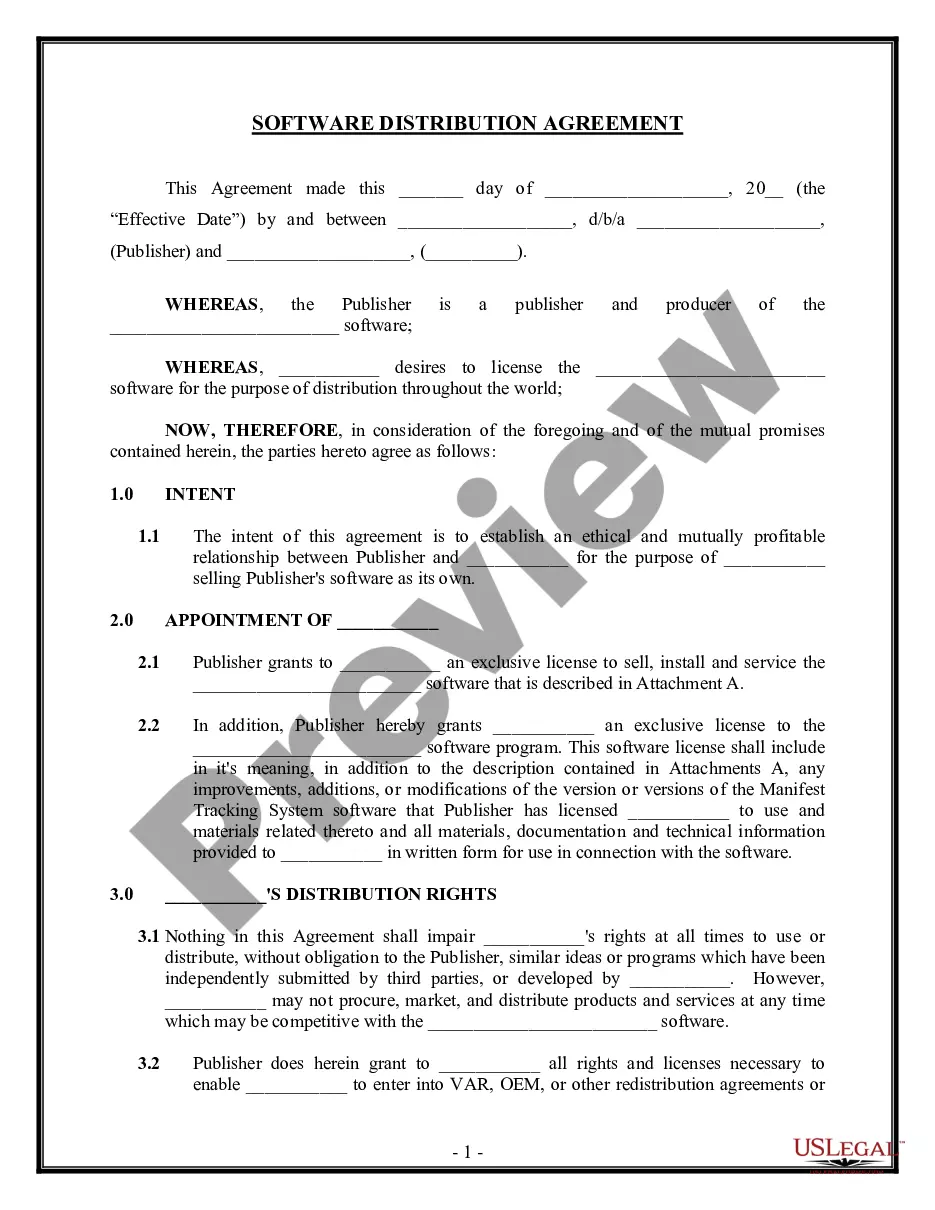

The Self-Employed Independent Welder Services Contract is a legal agreement that outlines the terms and conditions under which an employer hires a welder as an independent contractor. This contract is specifically for various welding projects or for an agreed period of time. Unlike other employment contracts, it emphasizes the independent status of the welder, ensuring clear expectations regarding the scope of services and responsibilities.

Key parts of this document

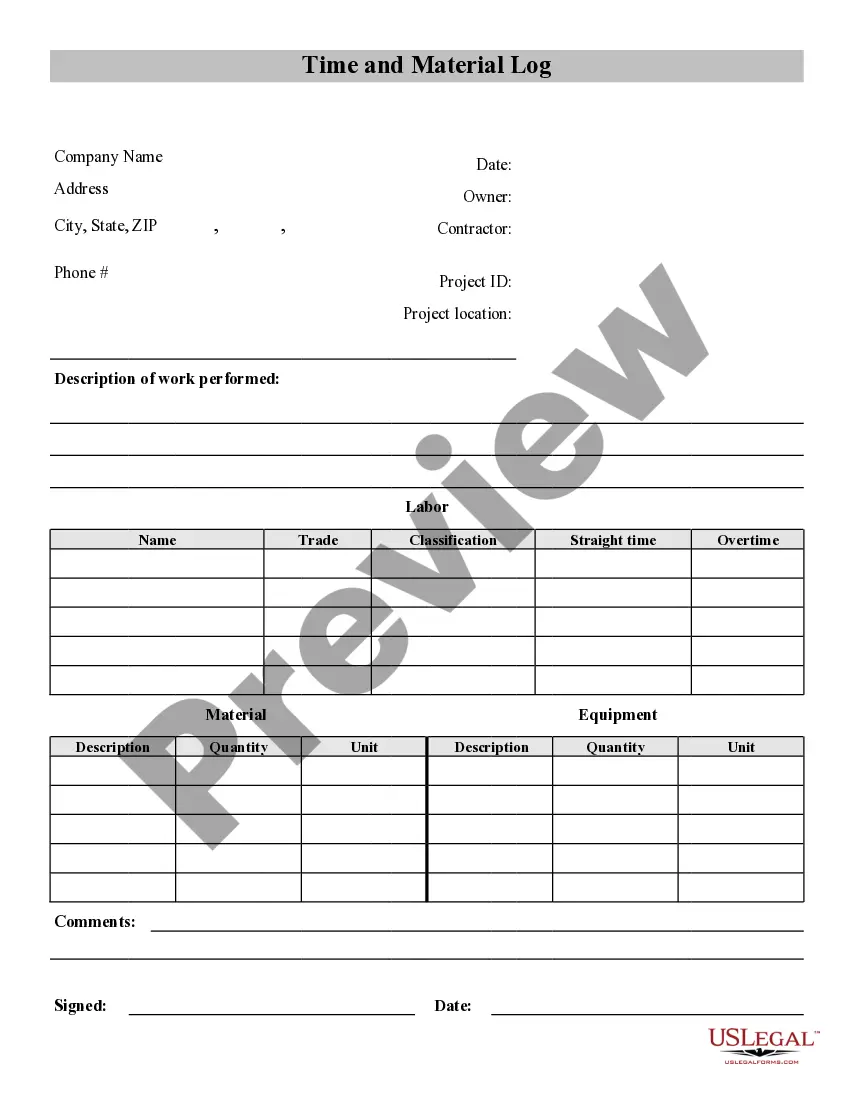

- Scope of Services: Describes the specific welding services to be performed.

- Duration: Specifies the length of time the welder will work on the project.

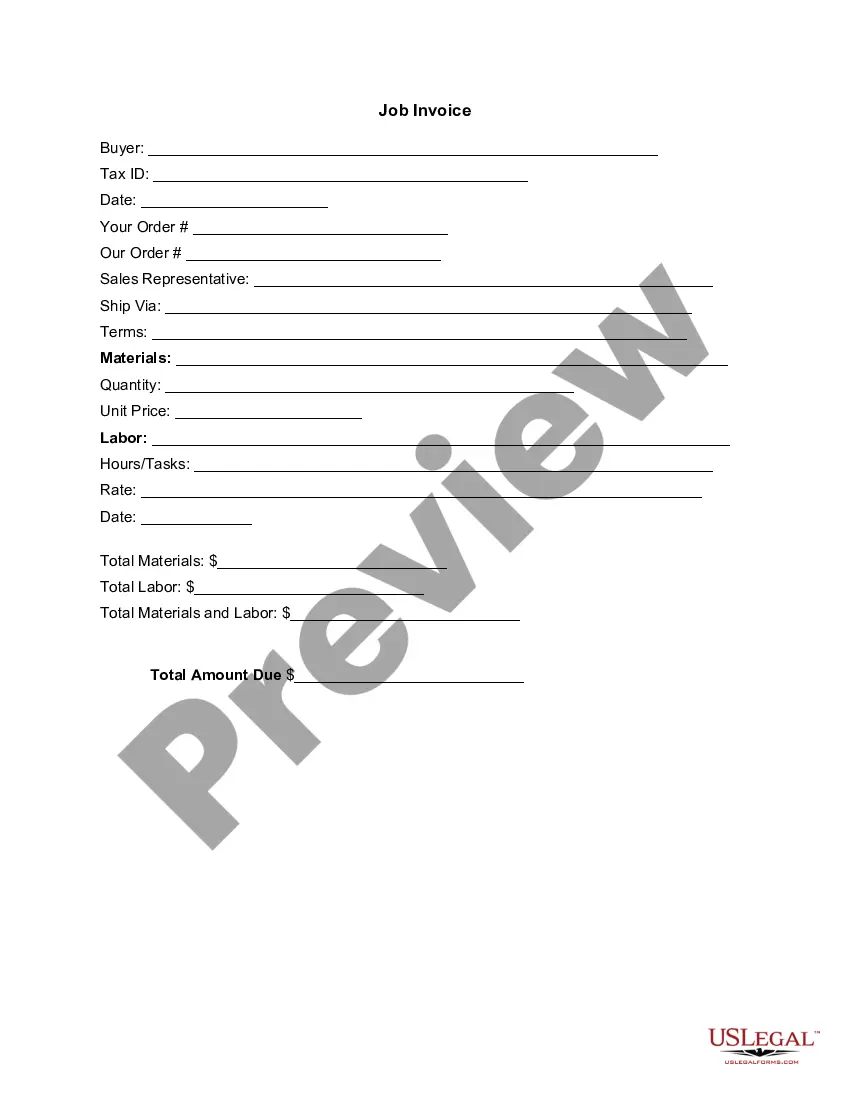

- Payment Terms: Details the compensation structure for the welderâs services.

- Termination Clause: Outlines conditions under which the contract can be terminated by either party.

- Liability Limitation: Addresses the liability of the parties involved in case of issues arising from the services provided.

Common use cases

This contract should be used when an employer requires welding services for a specific project and prefers to hire the welder as an independent contractor rather than an employee. It is particularly useful in cases where the employer needs a welder for a limited period or for a specific task that does not necessitate a long-term employment relationship.

Who can use this document

- Employers looking to hire welders on a short-term or project basis.

- Self-employed welders who wish to formalize an agreement with their clients.

- Businesses in need of specialized welding services without establishing an employment relationship.

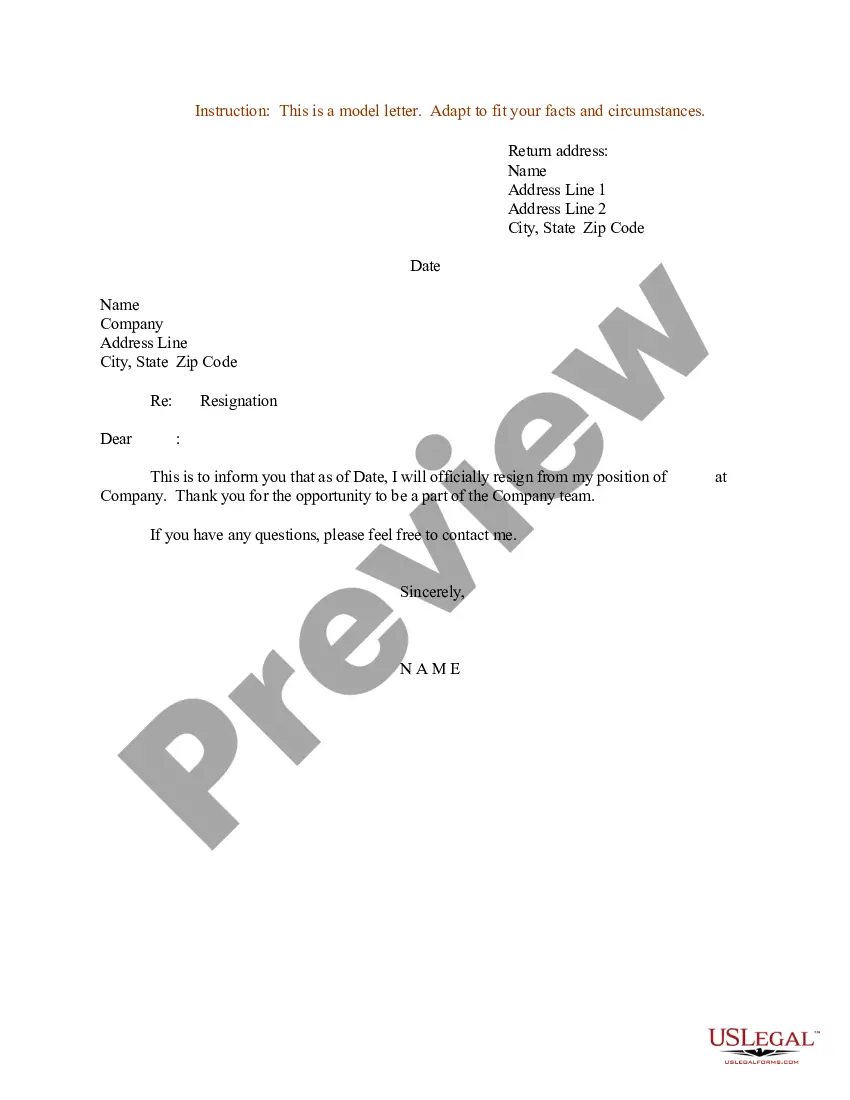

Steps to complete this form

- Identify the parties: Clearly state the names and contact information of both the employer and the welder.

- Specify the services: Describe in detail the welding services to be performed.

- Set the duration: Enter the start and end dates of the contract or the specific project timeline.

- Outline payment terms: Include the compensation amount, payment method, and any milestones.

- Review and sign: Ensure both parties read the contract and provide their signatures to make it legally binding.

Is notarization required?

This form does not typically require notarization unless specified by local law. It is advisable to check state regulations to ensure compliance with any notarization requirements.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not clearly defining the scope of services, leading to misunderstandings.

- Failing to specify payment terms, which can cause disputes later.

- Omitting dates, which can result in legal complications regarding the duration of the contract.

Benefits of completing this form online

- Convenience: Downloadable at your convenience without the need for legal consultations.

- Editability: Customize the form easily to fit specific project needs.

- Reliability: Templates are drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

Union, licensing, regulatory, occupational and trade associations fees. Liability insurance costs. Uniform upkeep and the cost of any gear or clothing that cannot be worn outside the course of work. Tools or equipment replaceable within a year.

Occupational Operating Expenses. Supplies and Materials. Home Office. Snacks and Coffee. Business Entertainment. Travel. Child Care. Cleaning Services.

Educator Expenses. Student Loan Interest. HSA Contributions. IRA Contributions. Self-Employed Retirement Contributions. Early Withdrawal Penalties. Alimony Payments. Certain Business Expenses.

Where to Find Welding Jobs. Check with your local Chamber of Commerce to find out if they offer networking services that may help you connect with businesses that outsource welding jobs. Welding Bid Site Visits. Create a Bid Package. Pricing Your Welding Bid. Meet the Job Poster's Requirements.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

While there is no limit on the number of deductions you can claim, some deductions are limited by factors such as your income, the level of the expense or other qualifying criteria. The home mortgage interest deduction, for example, can be claimed for mortgage debt up to $1 million.

A write-off is a business expense that is deducted for tax purposes.The cost of these items is deducted from revenue in order to decrease the total taxable revenue. Examples of write-offs include vehicle expenses and rent or mortgage payments, according to the IRS.