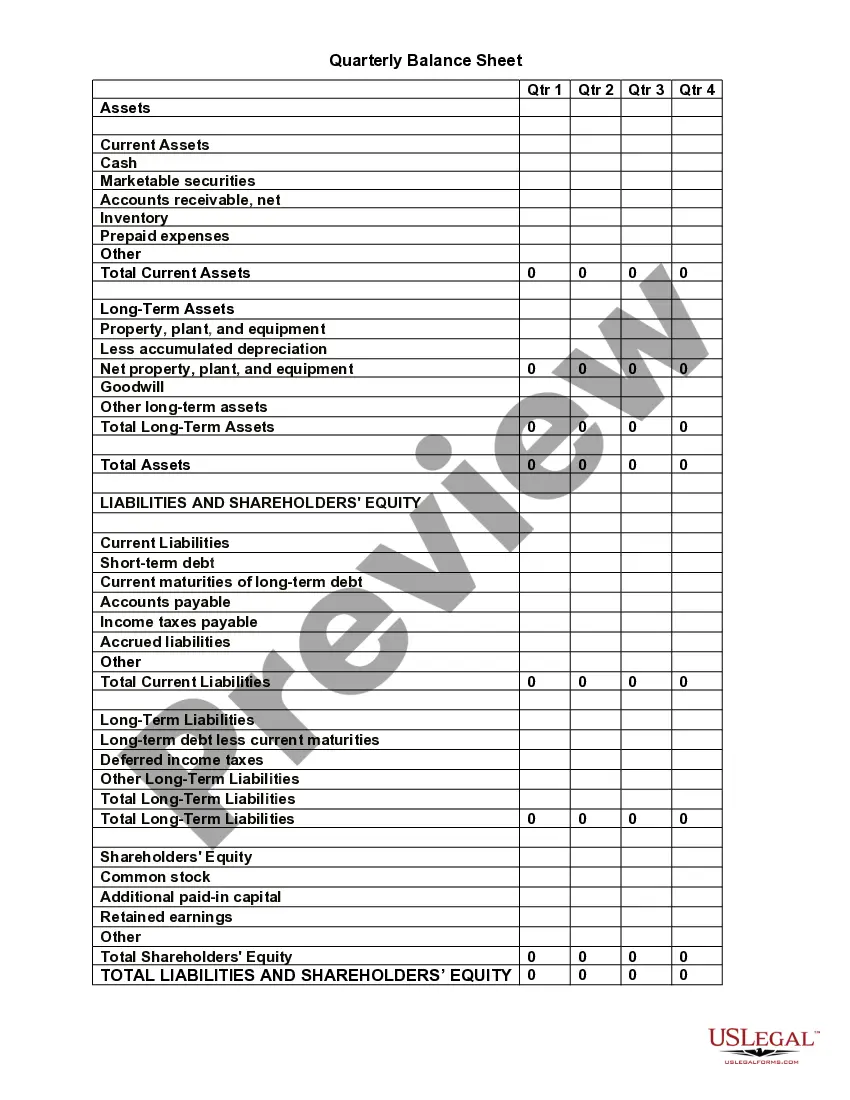

Period-End Closing And Analysis is a process that is used to close out an accounting period or fiscal year, and prepare financial statements for reporting. It also involves the review and analysis of financial and operational data to ensure accuracy and completeness in financial data and the ability to make informed business decisions. The key steps in period-end closing and analysis are: 1. Account reconciliation: This involves the reconciliation of accounts in the general ledger with their corresponding sub-ledger accounts, including fixed assets, accounts receivable, accounts payable, and inventory. 2. Accruals and deferrals: Accruals and deferrals are used to record transactions that have not yet been invoiced or received. 3. Preparation of financial statements: Financial statements are prepared to summarize the company's financial position and performance. 4. Analysis of financial statements: This involves the review and analysis of financial statements to identify trends and anomalies. 5. Variance analysis: This involves the comparison of actual results to budgeted or prior-period results in order to identify any discrepancies. 6. Closing of the books: The books are closed by recording all transactions, adjusting entries, and adjusting the balance sheet and income statement accounts. There are two main types of period-end closing and analysis: internal and external. Internal period-end closing and analysis is conducted by the company's internal staff and is used to ensure accuracy and completeness of the company's financial data. External period-end closing and analysis is conducted by external auditors and is used to provide assurance of the accuracy and completeness of the company's financial statements.

Period-End Closing And Analysis

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Period-End Closing And Analysis?

If you’re looking for a way to properly complete the Period-End Closing And Analysis without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business situation. Every piece of documentation you find on our online service is drafted in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use Period-End Closing And Analysis:

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and select your state from the list to find an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Period-End Closing And Analysis and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

The month-end close is an accounting procedure that finalizes and closes out all financial activity for a business for the preceding month. This timeframe represents a well-defined period for accounting purposes. The process involves reviewing, documenting, and reconciling all financial transactions for that period.

The period end dates the end of your financial year. The period (or month) end date is used to report your business activity.

The closing process involves four steps to make that happen. Close revenue accounts to Income Summary. Income Summary is a temporary account used during the closing process.Close expense accounts to Income Summary.Close Income Summary to Retained Earnings.Close dividends to Retained Earnings.

Period-end closing is the work carried out at the end of a period as a part of cost controlling. To perform period end closing, it is required to transfer the data from other SAP Components. You should perform all the posting in Finance Accounting.

The month-end close is an accounting procedure that finalizes and closes out all financial activity for a business for the preceding month. This timeframe represents a well-defined period for accounting purposes. The process involves reviewing, documenting, and reconciling all financial transactions for that period.