An Indemnity Agreement is a contract between two parties where one party agrees to protect the other party from any losses or damages they may incur. This protection is usually provided in exchange for payment, though it can also be an act of good faith. Indemnity Agreements can be used for a variety of different purposes, ranging from protecting business partners to shielding employers from employee liability claims. There are two main types of Indemnity Agreement: General Indemnity Agreements and Specific Indemnity Agreements. General Indemnity Agreements provide broad protection against any losses or damages incurred by a party, while Specific Indemnity Agreements are tailored to a particular situation and provide protection against specific types of losses or damages. Both types of Indemnity Agreement can include provisions for the payment of compensation, indemnification of costs, and reimbursement of expenses.

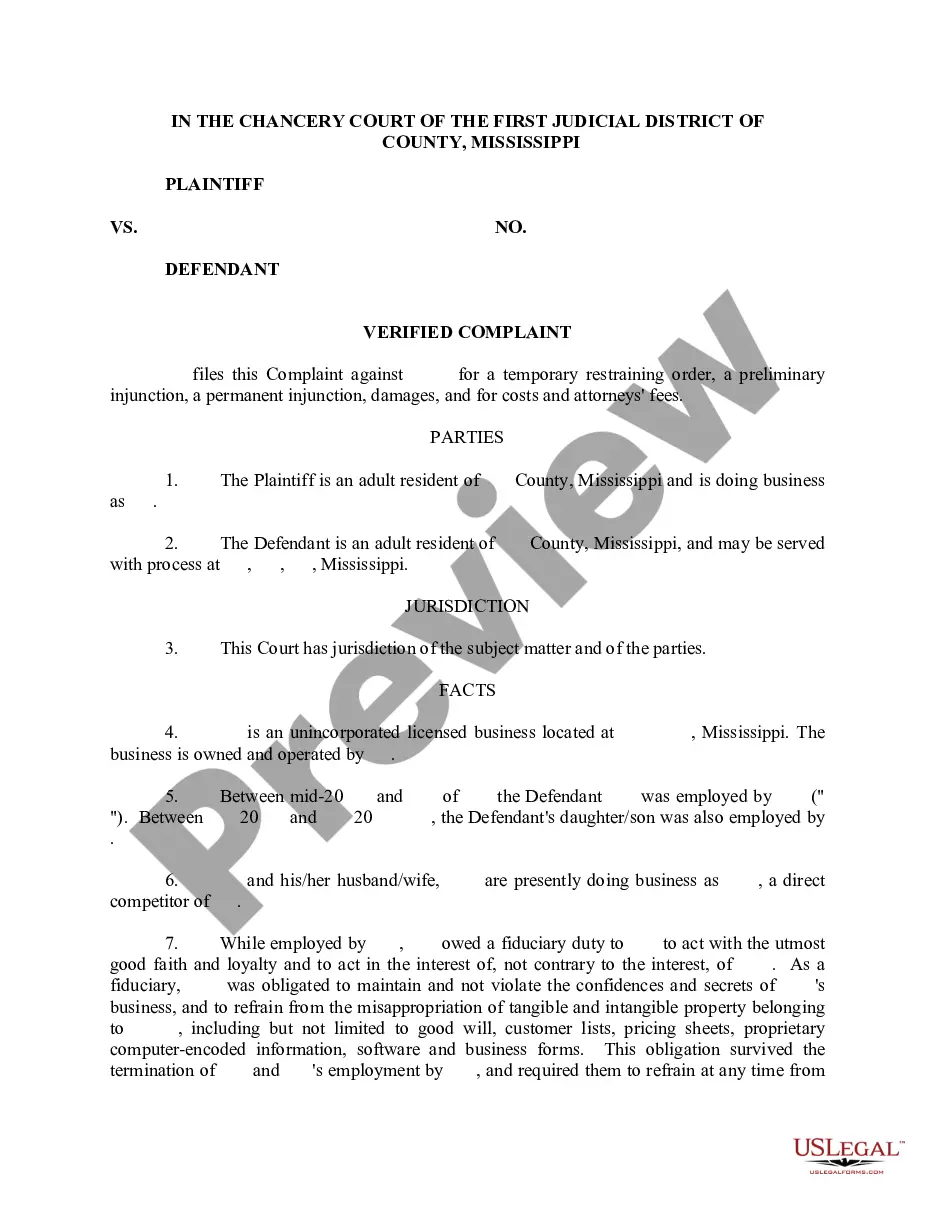

Indemnity Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indemnity Agreement?

If you’re searching for a way to appropriately complete the Indemnity Agreement without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business situation. Every piece of documentation you find on our online service is designed in accordance with federal and state laws, so you can be sure that your documents are in order.

Follow these straightforward guidelines on how to obtain the ready-to-use Indemnity Agreement:

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and choose your state from the list to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Indemnity Agreement and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

?Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal.

Example of Indemnity in Business The owner of a commercial property has been paying an insurance premium to an insurance company so that she can recover the costs for any loss or damage if a future bad event were to happen to the establishment.

Indemnity agreements, also known as indemnity clauses, play an integral role in contracts. That's because they are designed to punish the nonperforming party and reassure the damaged one they will be reimbursed for losses caused by the errant entity.

?To indemnify? means to compensate someone for his/her harm or loss. In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.

Indemnification clauses allow a contracting party to: Customize the amount of risk it is willing to undertake in each transaction and with every counterparty. Protect itself from damages and lawsuits that are more efficiently borne by the counterparty.