Motion to redeem

What this document covers

The Motion to Redeem is a legal document filed in bankruptcy proceedings, allowing a debtor to reclaim personal property from a secured creditor by paying the current market value of the asset. This form is distinct from other bankruptcy motions, as it specifically addresses the redemption of property, enabling debtors to regain control of essential belongings while managing their debts during bankruptcy.

What’s included in this form

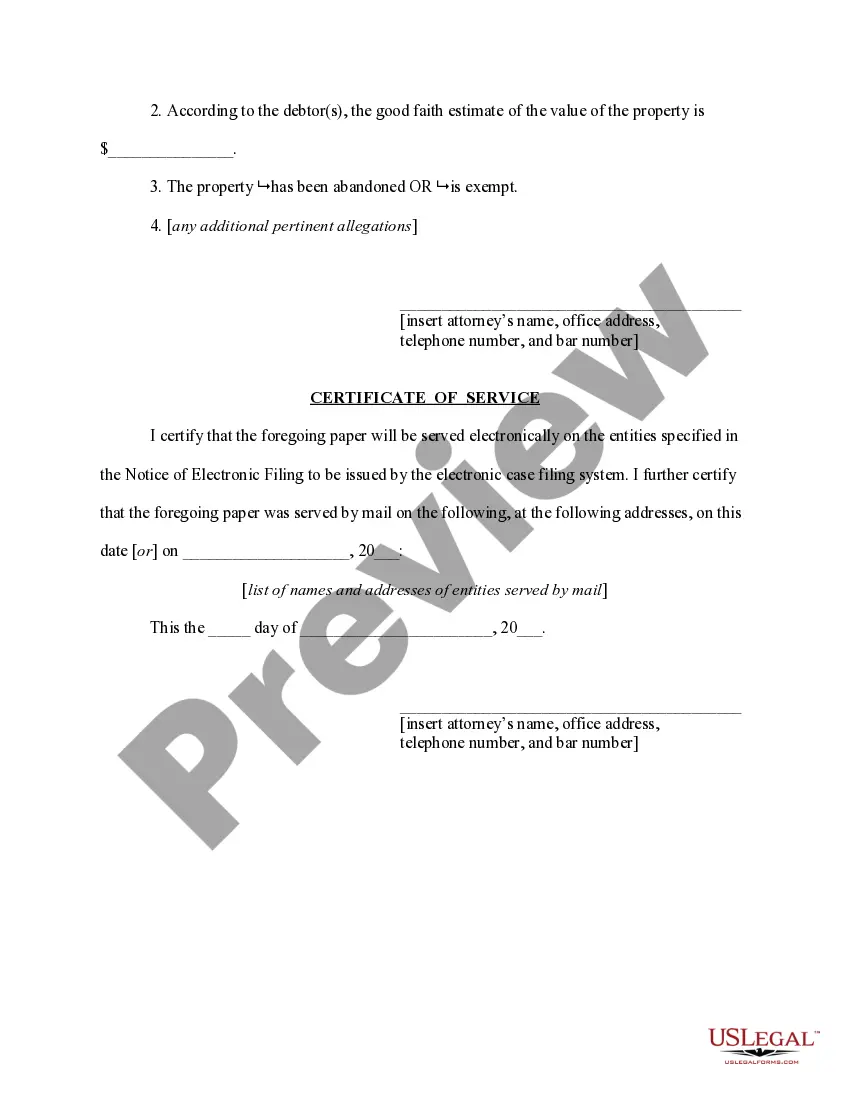

- Court information: Details about the bankruptcy court and case number.

- Motion title: Clearly states the purpose of the motion.

- Property description: Specifies the property being redeemed.

- Value estimate: A good faith estimate of the property's market value.

- Debtor assertions: Indicates whether the property is exempt or abandoned.

- Certificate of service: Confirms that the motion has been served to relevant parties.

Common use cases

This form is used when a debtor seeks to redeem a secured asset during the bankruptcy process, specifically under Chapter 7 bankruptcy. Individuals may need to file this motion if they wish to retain valuable property, such as a vehicle or other essential items that have a lien placed on them. It is appropriate when the debtor believes they can afford to pay the current market value of the property to the creditor instead of allowing it to be sold or repossessed.

Who can use this document

- Individuals filing for Chapter 7 bankruptcy who wish to redeem specific secured property.

- Debtors seeking to regain possession of property that is important for their personal or professional life.

- People who have a good faith estimate of the value of their property and are prepared to pay that amount to the secured creditor.

Instructions for completing this form

- Identify the court where the bankruptcy case is filed and enter its details.

- Provide a clear description of the property you wish to redeem.

- Estimate the current market value of the property and input this figure.

- Indicate whether the property has been abandoned or is exempt.

- Include the required signatures and attorney information, if applicable.

- File the completed form with the bankruptcy court and serve it to relevant parties.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to file the motion within the required timeframe set by the court.

- Incorrectly estimating the value of the property, which can lead to rejection of the motion.

- Not serving the motion to all relevant parties, causing potential legal issues.

- Missing signatures or improperly completed sections, which may result in delays.

Why complete this form online

- Convenience: Download and complete the form at your own pace.

- Editability: Easily fill in the necessary fields without the hassle of paperwork.

- Guidance: Access to reliable templates drafted by licensed attorneys ensures accuracy.

Looking for another form?

Form popularity

FAQ

Subsection (b) specifies that the discharge granted under this section discharges the debtor from all debts that arose before the date of the order for relief. It is irrelevant whether or not a proof of claim was filed with respect to the debt, and whether or not the claim based on the debt was allowed.

The automatic stay requires creditors to cease actions against the debtor and the debtor's property as described in 11 U.S.C. § 362(a). The automatic stay remains in effect until the case is closed or dismissed or, in an individual case, until the granting or denial of the debtor's discharge, whichever happens first.

Chapter 7 contains a provision called redemption that can be of great advantage to debtors in this situation. Using redemption, the debtor buys back an item of secured personal property by paying its current value, which is often much less than the amount owed on the loan.

It authorizes an individual debtor to redeem tangible personal property intended primarily for personal, family, or household use, from a lien securing a dischargeable consumer debt. It applies only if the debtor's interest in the property is exempt or has been abandoned.

Section 722 of the bankruptcy code allows you to file a motion or bankruptcy case and redeem your auto from the lender ing to its market value. Redemption is the ability to save or pay the lender the retail value and have the lien released. You can pay cash or finance, paying off the old lender.