Missouri Appointment of Successor Trustee

Description

Key Concepts & Definitions

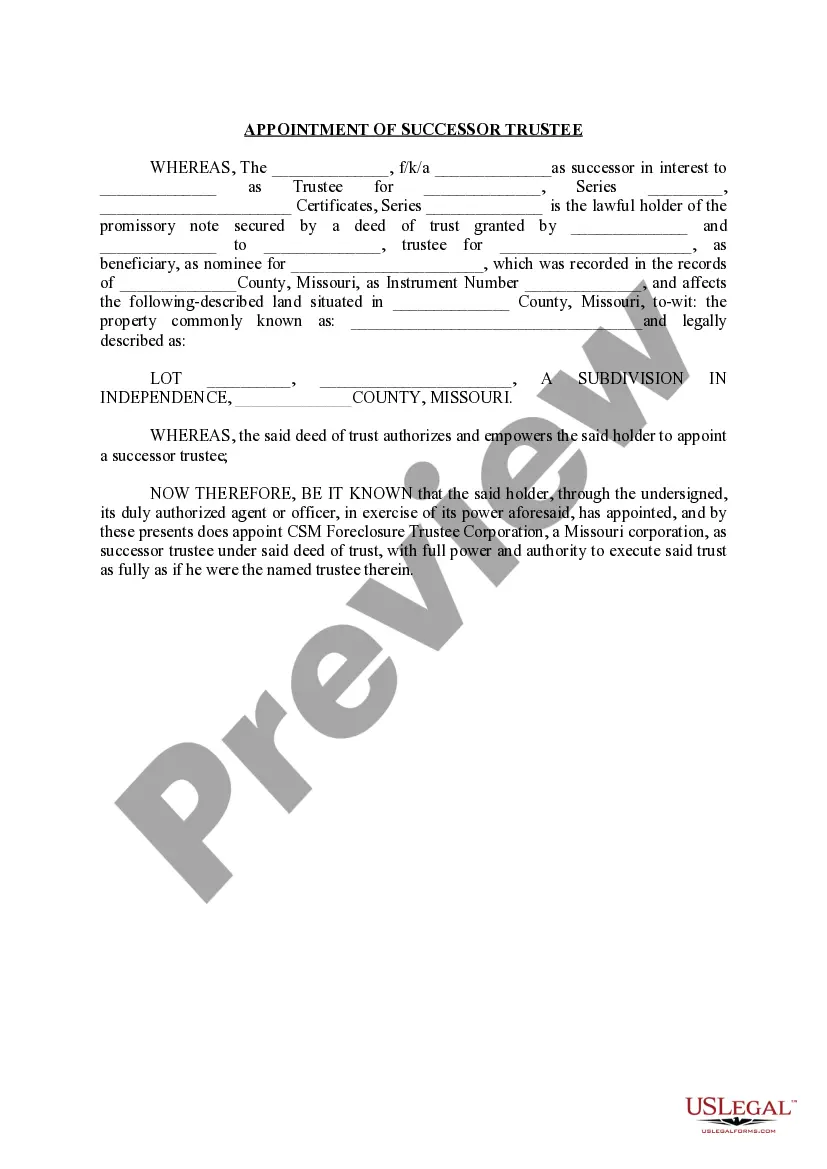

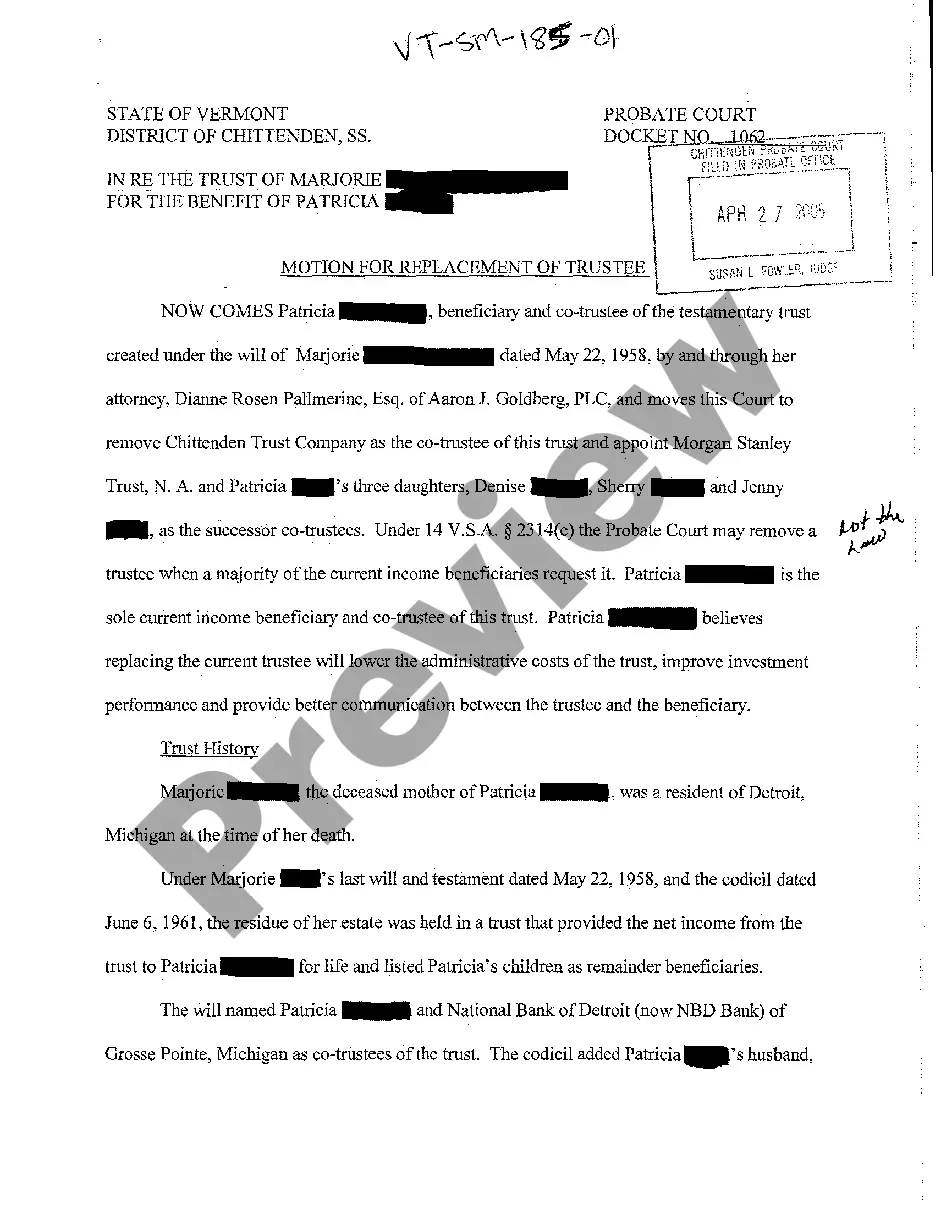

Appointment of Successor Trustee: This refers to the process in which a new trustee is designated to manage the trust upon the incapacity, death, or resignation of the original trustee. Trust Administration: This involves managing and executing the terms of a trust according to the legal requirements and for the benefit of the beneficiaries. Estate Planning: The preparation of tasks that serve to manage an individual's asset base in the event of their incapacitation or death.

Step-by-Step Guide on Appointing a Successor Trustee

- Review the Trust Document: Identify the provisions for appointing a successor trustee mentioned in the original trust document.

- Selecting a Successor: Choose a competent individual, financial institution, or a combination of both that aligns with the trust's goals and objectives.

- Notify All Parties: Inform all beneficiaries and related parties about the appointment of the new trustee.

- Transfer Authority: Officially transfer authority over trust assets and financial accounts to the new trustee.

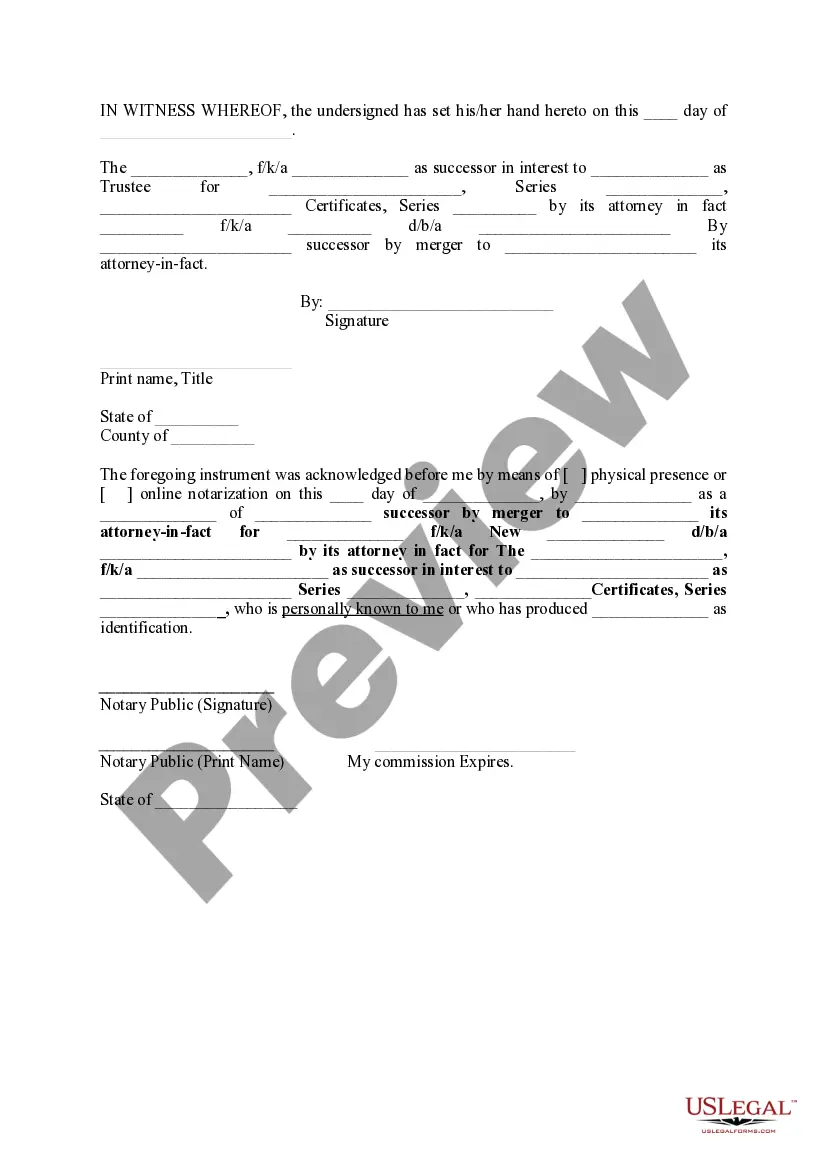

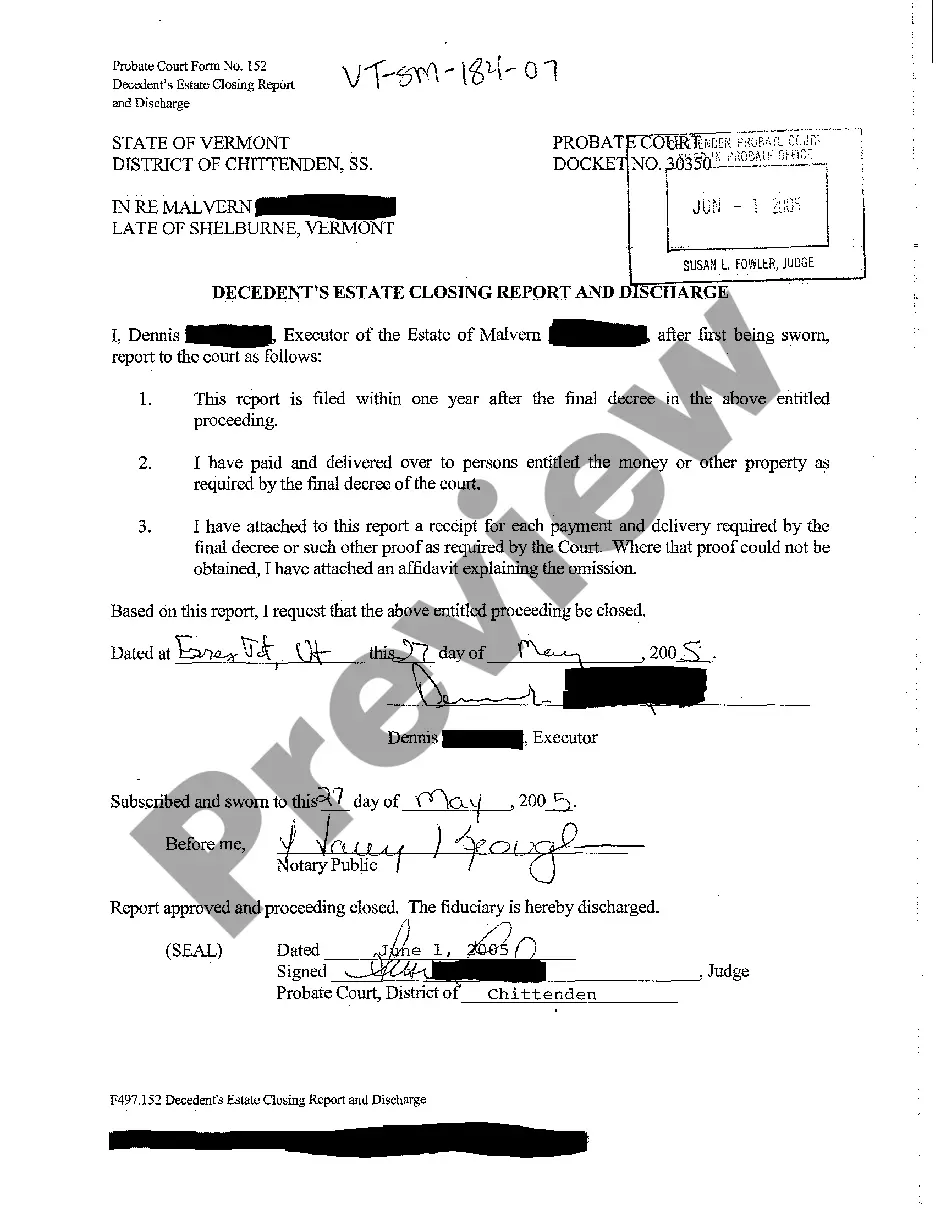

- Documentation: Update all related documents and records to reflect the change in trusteeship.

Risk Analysis

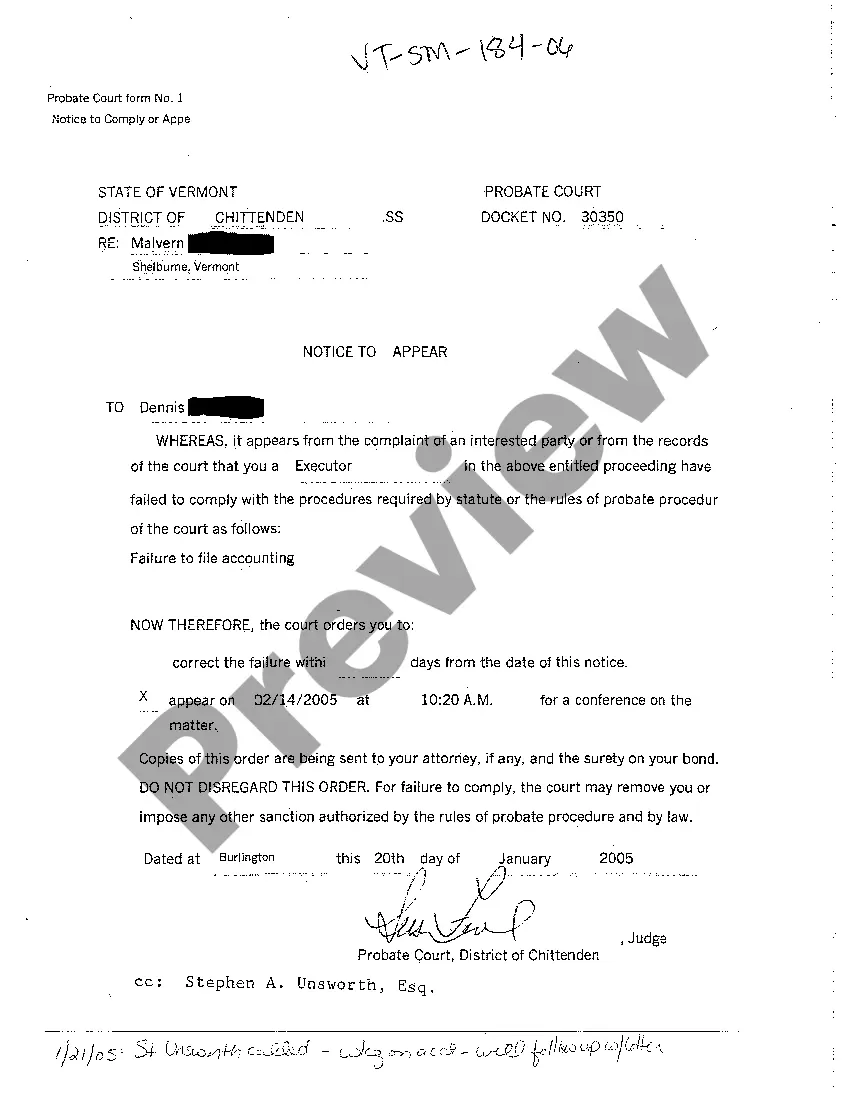

- Lack of Proper Documentation: Inadequate documentation can lead to disputes among beneficiaries and legal complications.

- Selection of Inappropriate Trustee: Choosing an unqualified or unsuitable trustee can lead to mismanagement of assets or conflict within the trust administration.

- Legal Non-Compliance: Failure to follow legal protocols in the appointment process might invalidate the succession.

Best Practices

- Seek Professional Advice: Consult with estate planning attorneys to ensure legal and effective transition.

- Clear Communication: Maintain transparency with beneficiaries to prevent misunderstandings and disputes.

- Regular Updates: Regularly review and update the trust documents to adapt to changes in laws and personal circumstances.

Common Mistakes & How to Avoid Them

- Neglecting to Update the Trust Document: Regularly revisit and revise the trust document to reflect current wishes and legal standards.

- Failing to Clearly Define the Role of Successor Trustee: Clearly outline the responsibilities and authority of the successor trustee in the trust document to avoid ambiguity and power abuses.

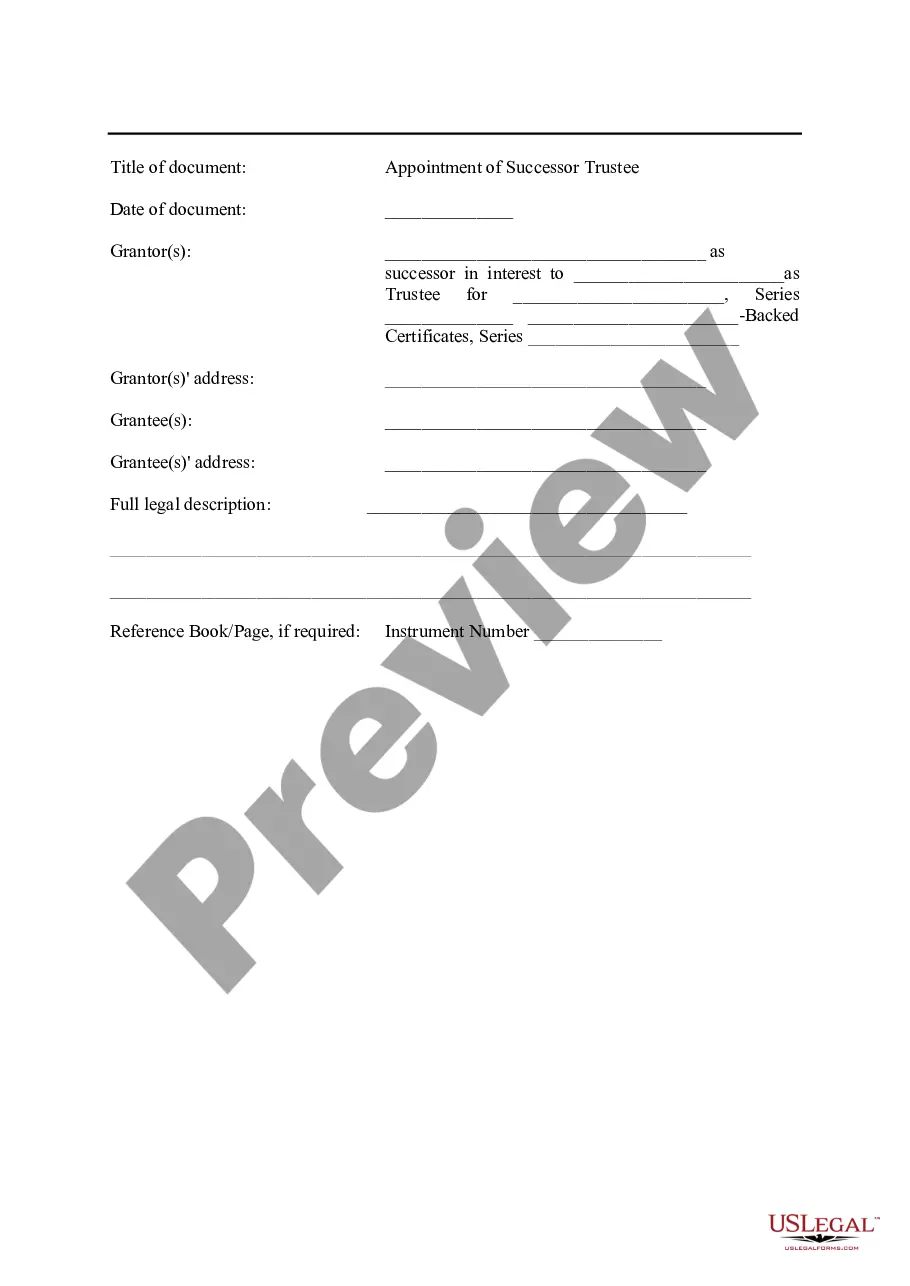

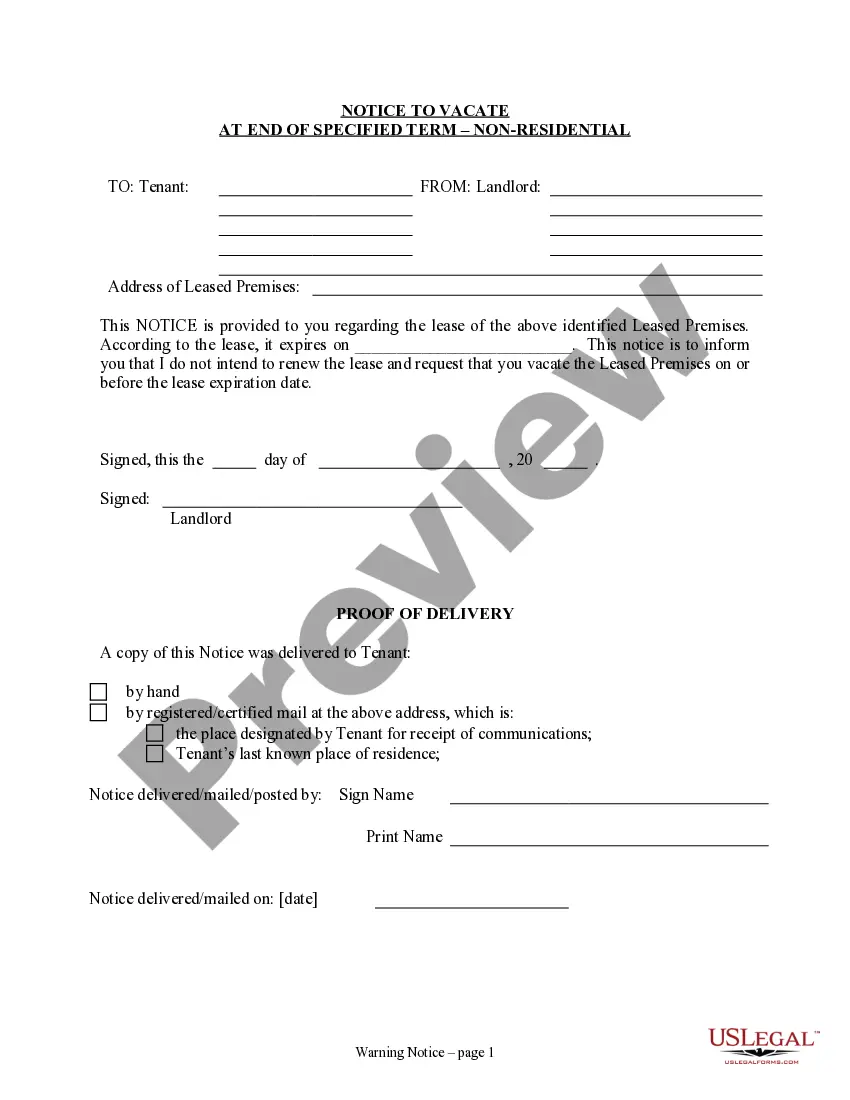

How to fill out Missouri Appointment Of Successor Trustee?

Obtain any version from 85,000 lawful documents including Missouri Appointment of Successor Trustee online with US Legal Forms. Each template is composed and revised by state-certified lawyers.

If you already possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to access it.

If you have not subscribed yet, adhere to the steps outlined below.

With US Legal Forms, you will consistently have prompt access to the suitable downloadable template. The service will provide you access to documents and organizes them into categories to facilitate your search. Utilize US Legal Forms to acquire your Missouri Appointment of Successor Trustee swiftly and effortlessly.

- Verify the state-specific criteria for the Missouri Appointment of Successor Trustee you intend to utilize.

- Browse the description and preview the example.

- When you are assured the example is what you require, simply click Buy Now.

- Select a subscription plan that fits your financial plan.

- Establish a personal account.

- Remit payment in one of two suitable methods: by card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- Once your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

In Missouri, the ability to appoint a replacement trustee often rests with the trust's creator if they are still living. If the creator is deceased or unable to make this decision, the remaining trustees or beneficiaries may have the authority to appoint a new trustee. This ensures that the management of the trust continues without interruption. For assistance with the Missouri Appointment of Successor Trustee, consider using US Legal Forms to find the necessary documents and guidance.

To assign a successor trustee in Missouri, you typically need to follow the procedures outlined in the trust document. This may involve formally naming the successor trustee and ensuring they accept the role through a written acceptance. It is important to document this process properly to avoid any disputes later. Utilizing resources from US Legal Forms can help you navigate the Missouri Appointment of Successor Trustee process smoothly and effectively.

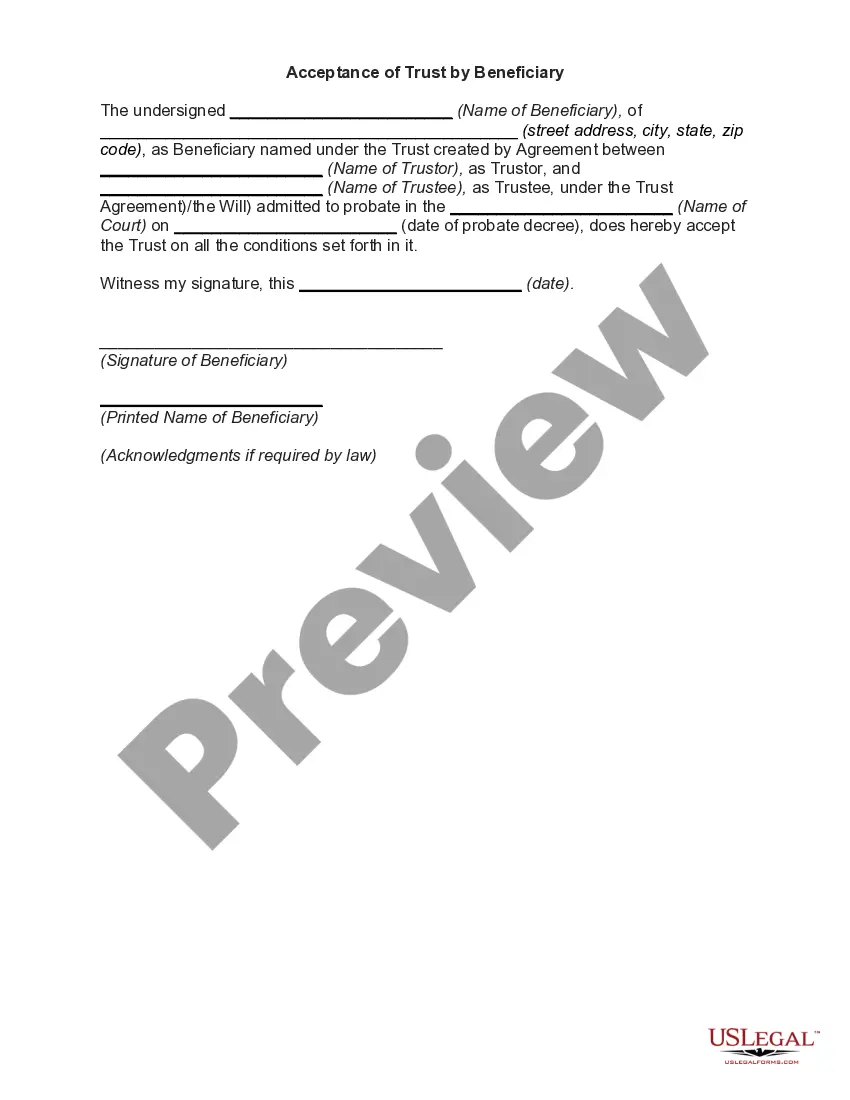

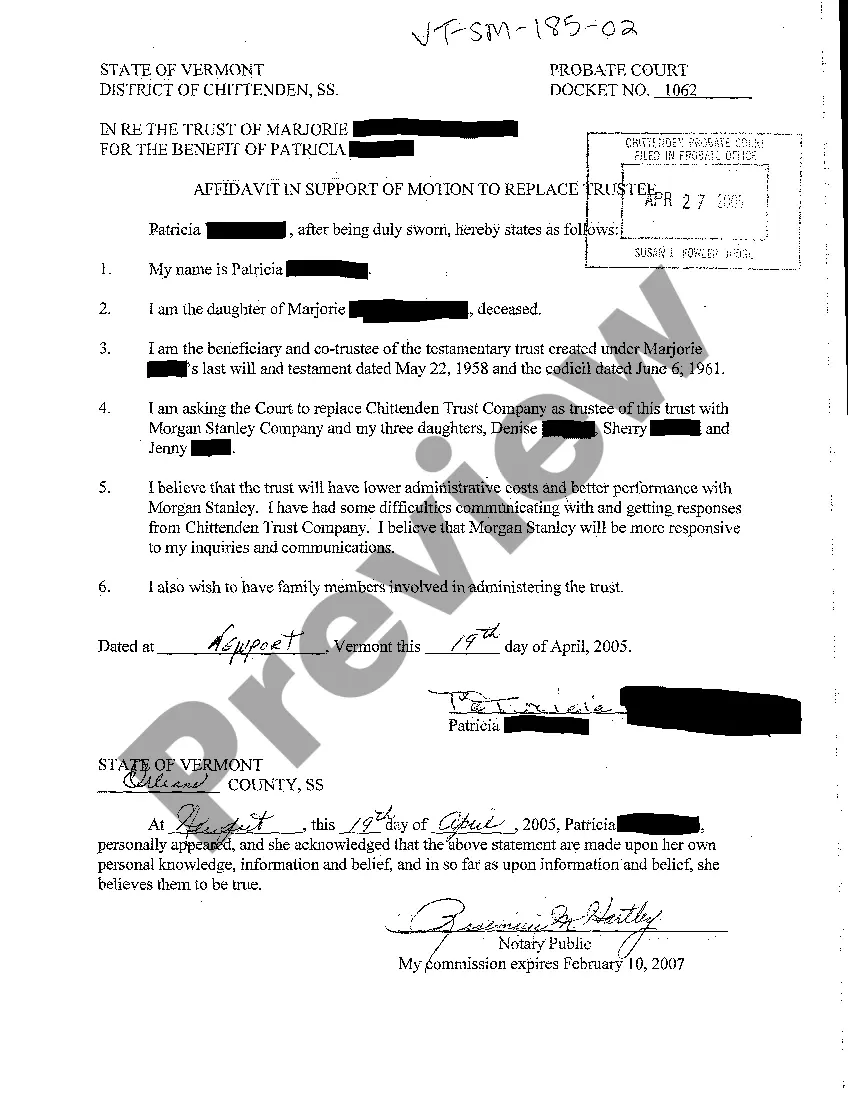

The acceptance of appointment as successor trustee form is a legal document that confirms the individual’s acceptance of their role as a successor trustee. This form ensures that the new trustee acknowledges their responsibilities and duties as outlined in the trust agreement. It is an essential step in the Missouri Appointment of Successor Trustee process, as it formalizes the transition and protects the interests of the beneficiaries. You can easily access this form through US Legal Forms to simplify your experience.

In Missouri, the power to appoint a new trustee typically lies with the trust's creator, also known as the grantor. If the grantor is no longer able to perform this task, a majority of the remaining trustees or beneficiaries may have the authority to appoint a successor trustee. This process is crucial for maintaining the trust's integrity and ensuring proper management of assets. For guidance on the Missouri Appointment of Successor Trustee, consider using resources from US Legal Forms.

To appoint a replacement trustee, you should refer to the trust agreement for specific procedures. This typically includes notifying the current trustee and obtaining approval from the beneficiaries. Utilizing resources like US Legal Forms can simplify the Missouri Appointment of Successor Trustee process, providing you with the necessary documents and guidance to ensure a smooth transition.

A successor trustee takes over by assuming the responsibilities outlined in the trust document once the previous trustee can no longer serve. This process involves formal acceptance of the role, followed by the transfer of relevant assets and information. The Missouri Appointment of Successor Trustee is essential in ensuring this transition is executed correctly and in accordance with the law.

Missouri law 407.675 addresses the requirements for the appointment of a successor trustee, specifically in cases involving revocable trusts. This law outlines the necessary steps and documentation needed to ensure the appointment is valid and enforceable. Understanding this law is crucial when navigating the Missouri Appointment of Successor Trustee process.

To appoint a new trustee, you typically need to follow the guidelines set forth in the trust document. This often involves notifying the current trustee and gaining consent from the beneficiaries. A Missouri Appointment of Successor Trustee can clarify this process, ensuring legal compliance and proper documentation.

The appointment of a successor trustee means designating a new individual or entity to take over the management of a trust. This is often necessary when the original trustee passes away, resigns, or becomes incapacitated. Understanding the Missouri Appointment of Successor Trustee is vital for maintaining trust operations and ensuring beneficiaries receive their entitlements.

The appointment of a successor trustee occurs when a current trustee can no longer fulfill their duties. This process ensures that the management of the trust continues smoothly and without interruption. A Missouri Appointment of Successor Trustee allows for the seamless transition of responsibilities, safeguarding the interests of the beneficiaries.