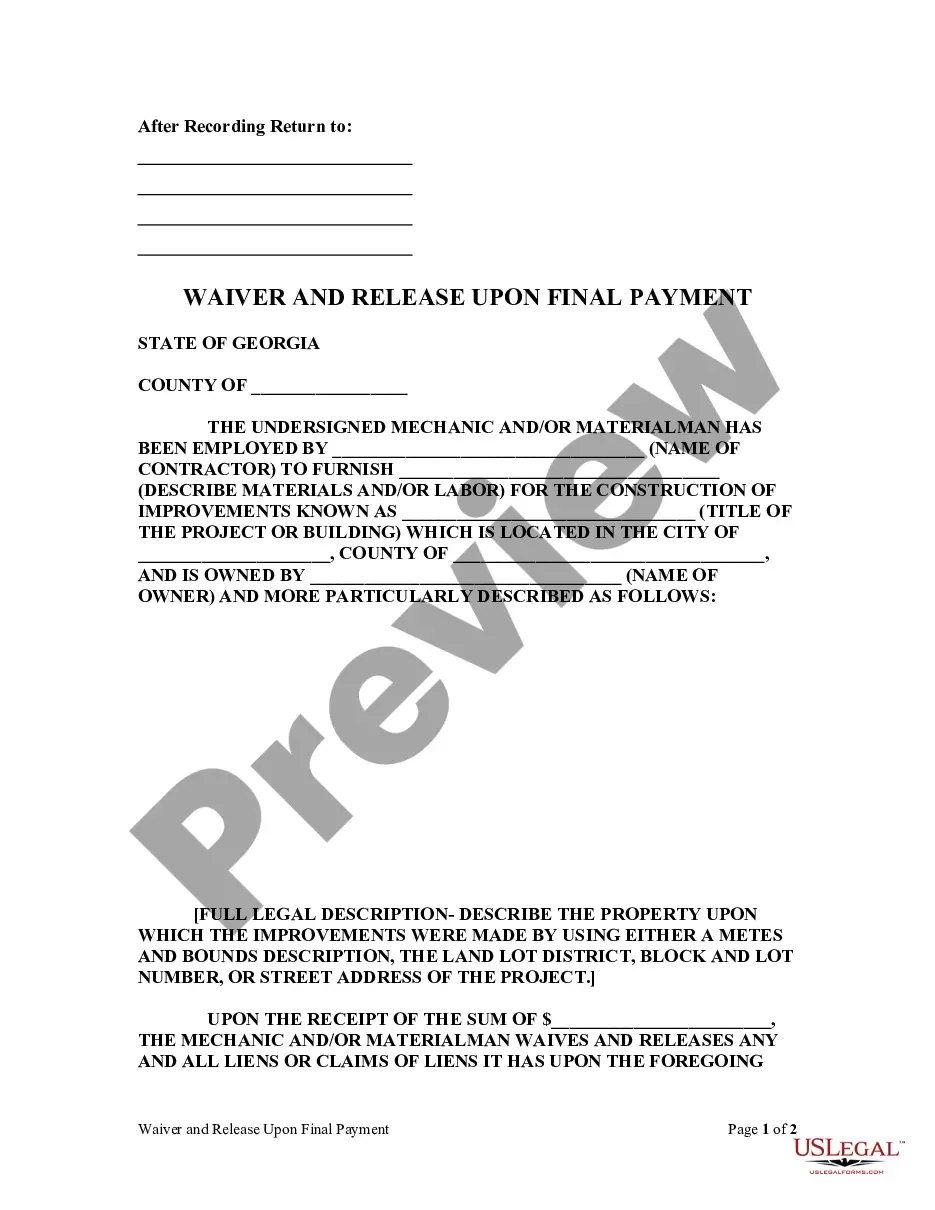

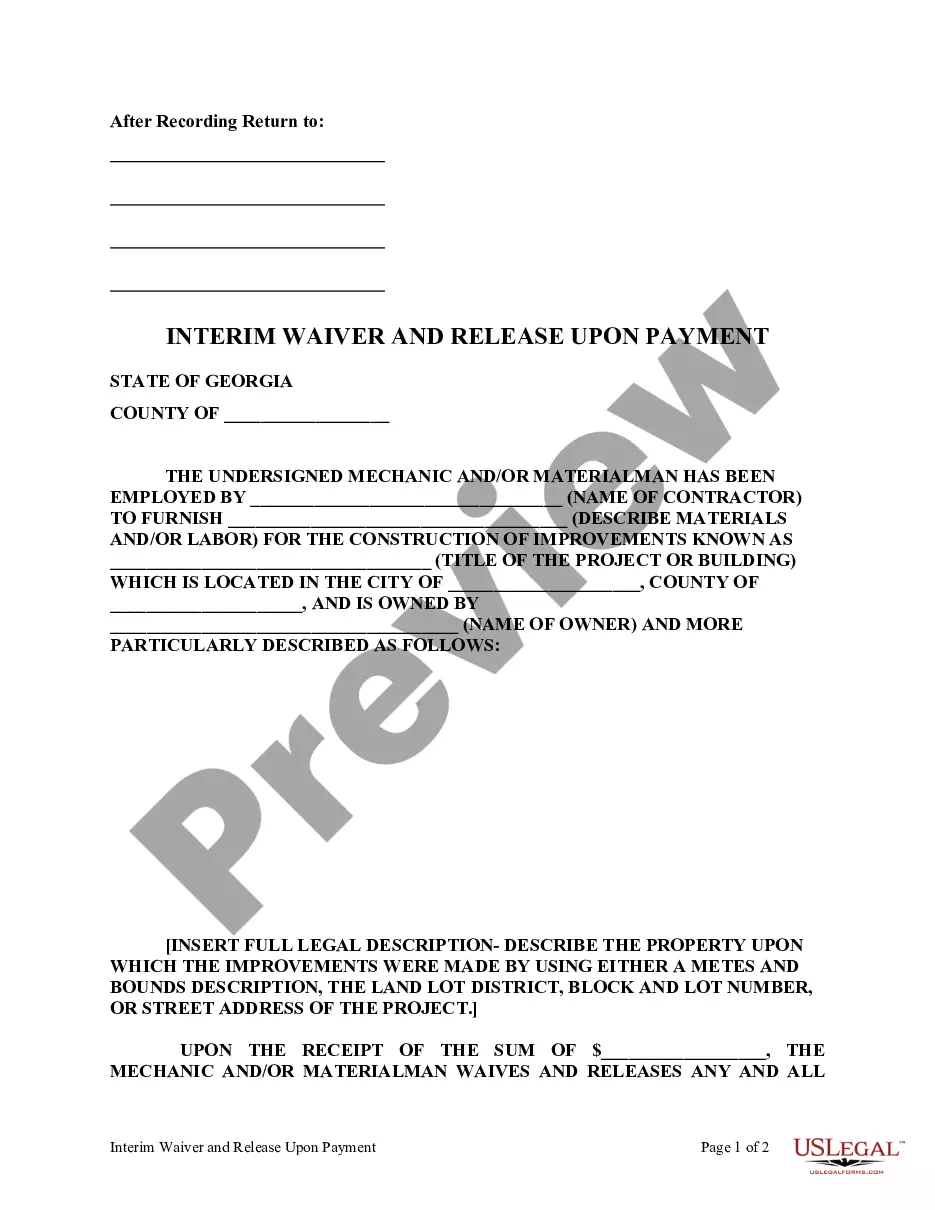

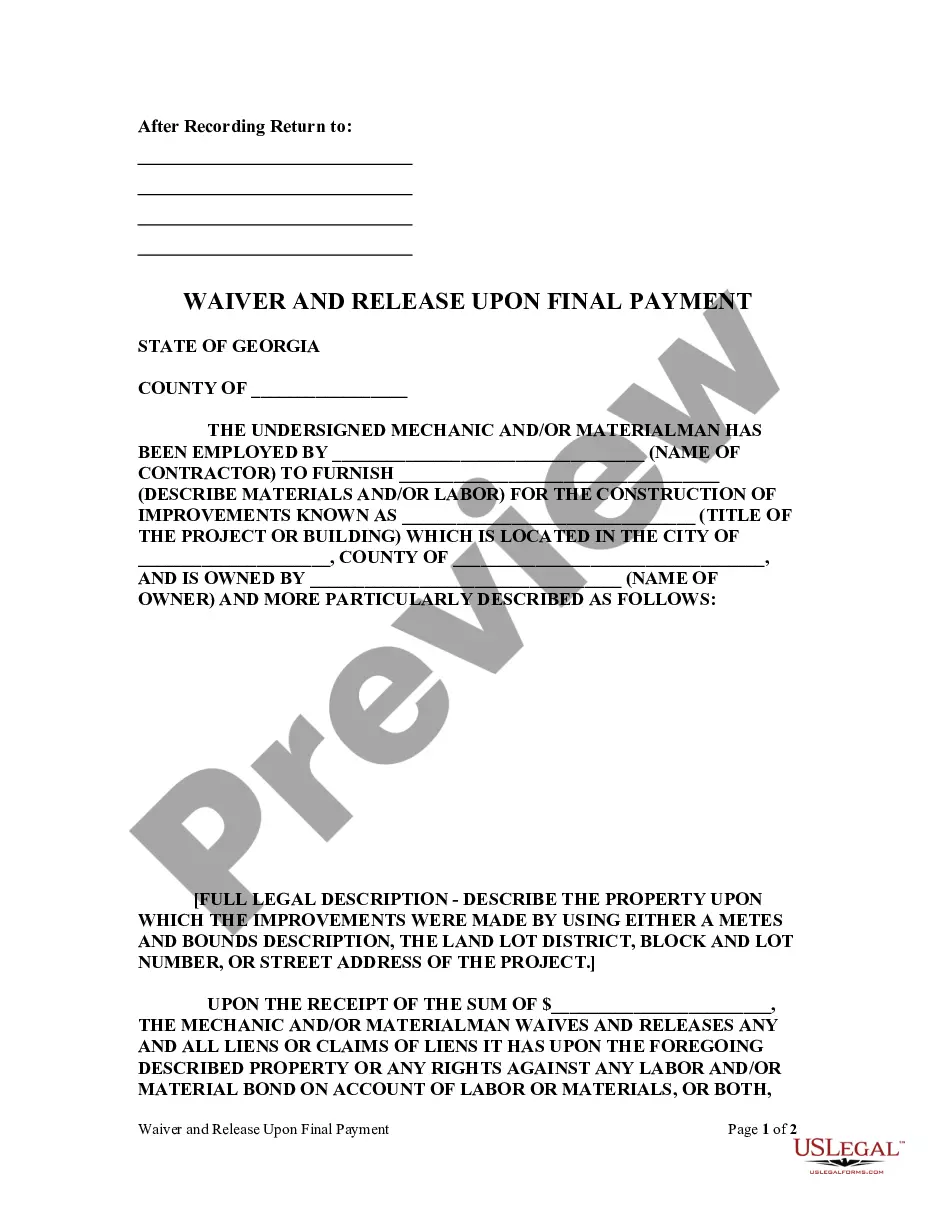

This Unconditional Waiver and Release Upon Final Payment form is for use by a corporate or LLC mechanic and/or materialman who has been employed to furnish materials and/or labor for the construction of improvements and has received final payment for such materials and/or labor to waive and release any and all liens or claims of liens or any right against any labor and/or material bond on the improved property.

Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Georgia Unconditional Waiver And Release Upon Final Payment Sect. 44-14-366 - Corporation Or LLC?

Obtain the most comprehensive collection of approved forms.

US Legal Forms is a resource where you can locate any specific state form in just a few clicks, including the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC templates.

No need to spend endless hours searching for a court-acceptable sample. Our certified experts ensure that you receive current documents all the time.

After selecting a pricing plan, set up your account. Pay via credit card or PayPal. Save the example to your device by clicking the Download button. That's it! You should submit the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC template and verify it. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and conveniently access over 85,000 helpful templates.

- To take advantage of the document library, select a subscription and create an account.

- If you have already done so, simply Log In and click Download.

- The Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC template will be swiftly saved in the My documents tab (a section for all forms you download from US Legal Forms).

- To establish a new account, follow the straightforward instructions below.

- If you are about to use a state-specific sample, be sure to select the correct state.

- If available, read the description to understand all the details of the form.

- Utilize the Preview option if it is provided to view the document's information.

- If everything seems correct, click on the Buy Now button.

Form popularity

FAQ

Filling out a Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC involves several clear steps. First, gather all necessary information such as the project details, your business name, and payment specifics. Next, fill in the document accurately, ensuring that you state the release language clearly. Finally, remember to sign and date the waiver, and consider using platforms like US Legal Forms to access templates and get guidance throughout the process.

An unconditional final waiver releases a contractor or subcontractor's rights to assert claims for additional payments after receiving the final payment. This legal document plays a crucial role in the construction industry by providing a clear closure on financial obligations. Specifically, the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC ensures that all parties involved can proceed with confidence, knowing that all financial matters are settled. Using platforms like uslegalforms can help streamline this process, ensuring you have the correct documentation to protect your interests.

Section 44-14-361 in Georgia pertains to the requirements for conditional waivers and releases. It explains the documentation required from contractors and subcontractors when a conditional waiver is utilized. Being informed about this section allows you to fully understand your rights under the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC. Consulting with tools available on uslegalforms can equip you with the necessary forms and guidance for compliance.

The time limit for demand statute in Georgia is generally within six years. This period begins when the debt remains unpaid. Being aware of this time frame is essential for both creditors and debtors, as it dictates the enforceability of claims. Engaging with the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC not only helps in managing payments but also clarifies your rights and obligations.

In Georgia, the statute of limitations on a tax lien typically lasts for seven years. This time frame means that the state can enforce the lien for that period; after which, the lien may become unenforceable. Understanding the implications can be crucial if you find yourself dealing with tax-related issues. Referencing the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC can also prepare you for any financial transactions involving taxation.

To fill out a conditional waiver and release on final payment, start by providing all required information, including your name, the project address, and the amount being waived. Specify that this is a conditional waiver, meaning it only takes effect once the payment clears. Familiarity with the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC can simplify this process, ensuring you adhere to local regulations. If you prefer an easier approach, consider using platforms like uslegalforms for guidance.

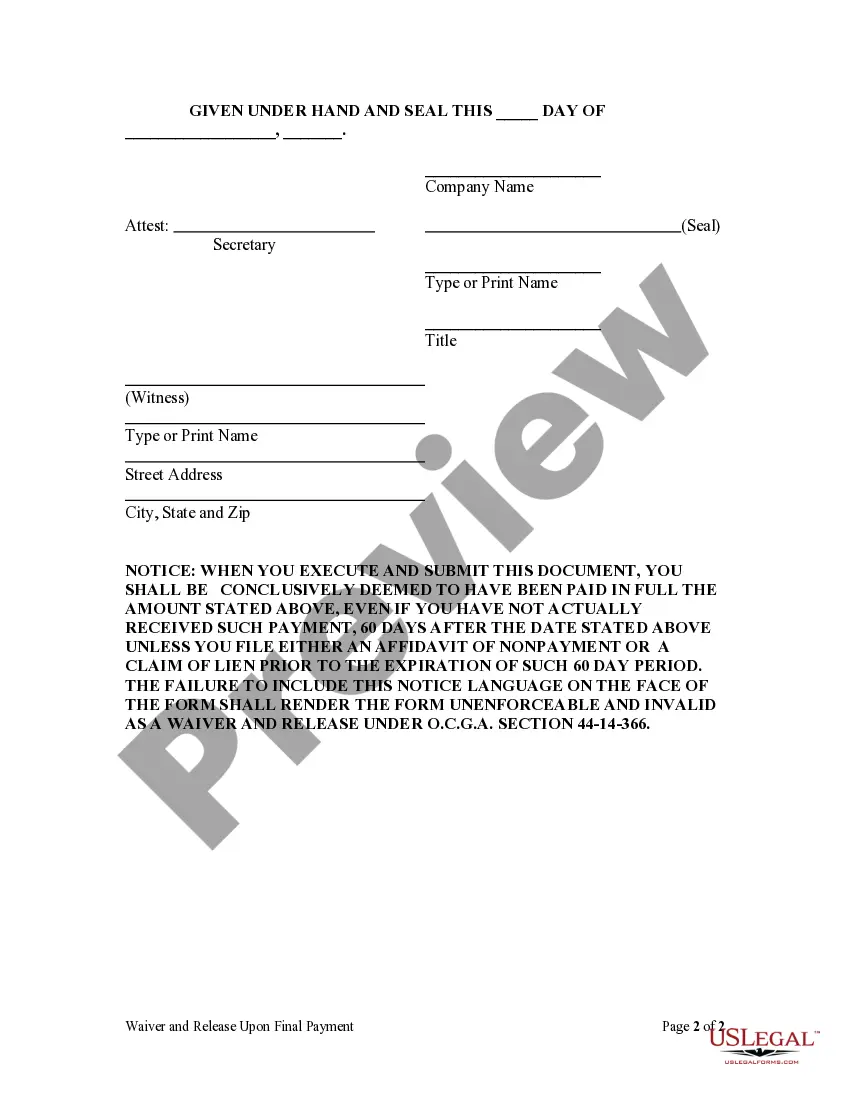

The statute 44-14-366 in Georgia outlines the conditions under which parties can use an unconditional waiver and release upon final payment. This statute protects property owners by ensuring that once payment is made, contractors and subcontractors cannot later claim a lien. Understanding the nuances of the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC can help you navigate the complexities of construction contracts successfully. Always consult with a legal professional if you have specific questions about its application.

In Georgia, lien waivers do not need to be notarized for them to be legally valid. However, it is often recommended to notarize them as a precautionary measure. The Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC provides clarity on the requirements for lien waivers. Ensuring your documents are completed correctly helps you avoid issues in future transactions.

While a waiver is the relinquishment of a right or claim, a release is a more comprehensive agreement that absolves a party from liability after a particular event or transaction. In the realm of the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC, a waiver pertains to your decision to not pursue a claim, while a release confirms that all financial obligations have been settled. Understanding these distinctions helps businesses manage their legal exposure effectively.

An unconditional release refers to the act of releasing a party from liability for a claim after payment has been made. Under the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Corporation or LLC, this release confirms that the receiving party has fully accepted the payment. Consequently, they forfeit any legal recourse regarding further payment on that project, simplifying the payment process for all involved.