Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual

Overview of this form

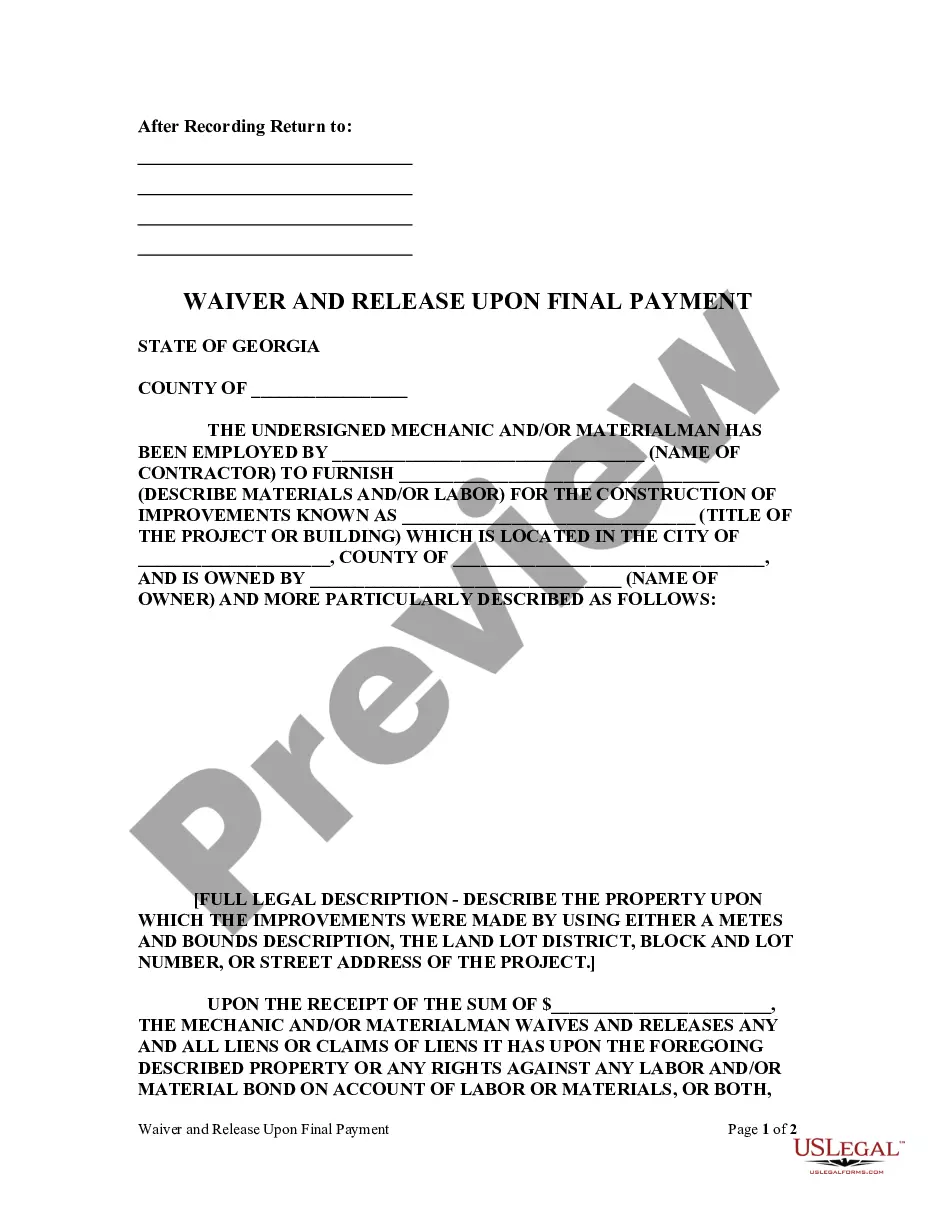

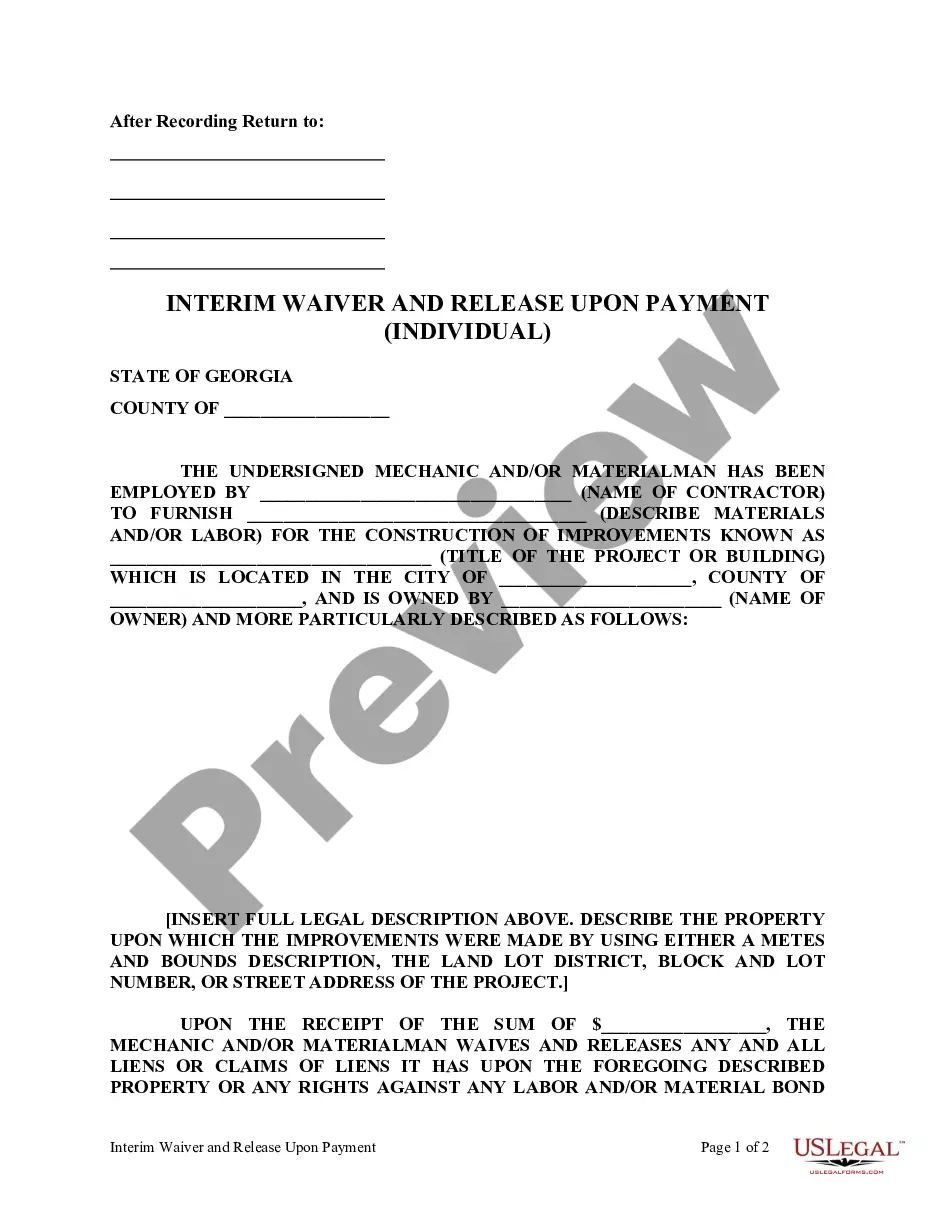

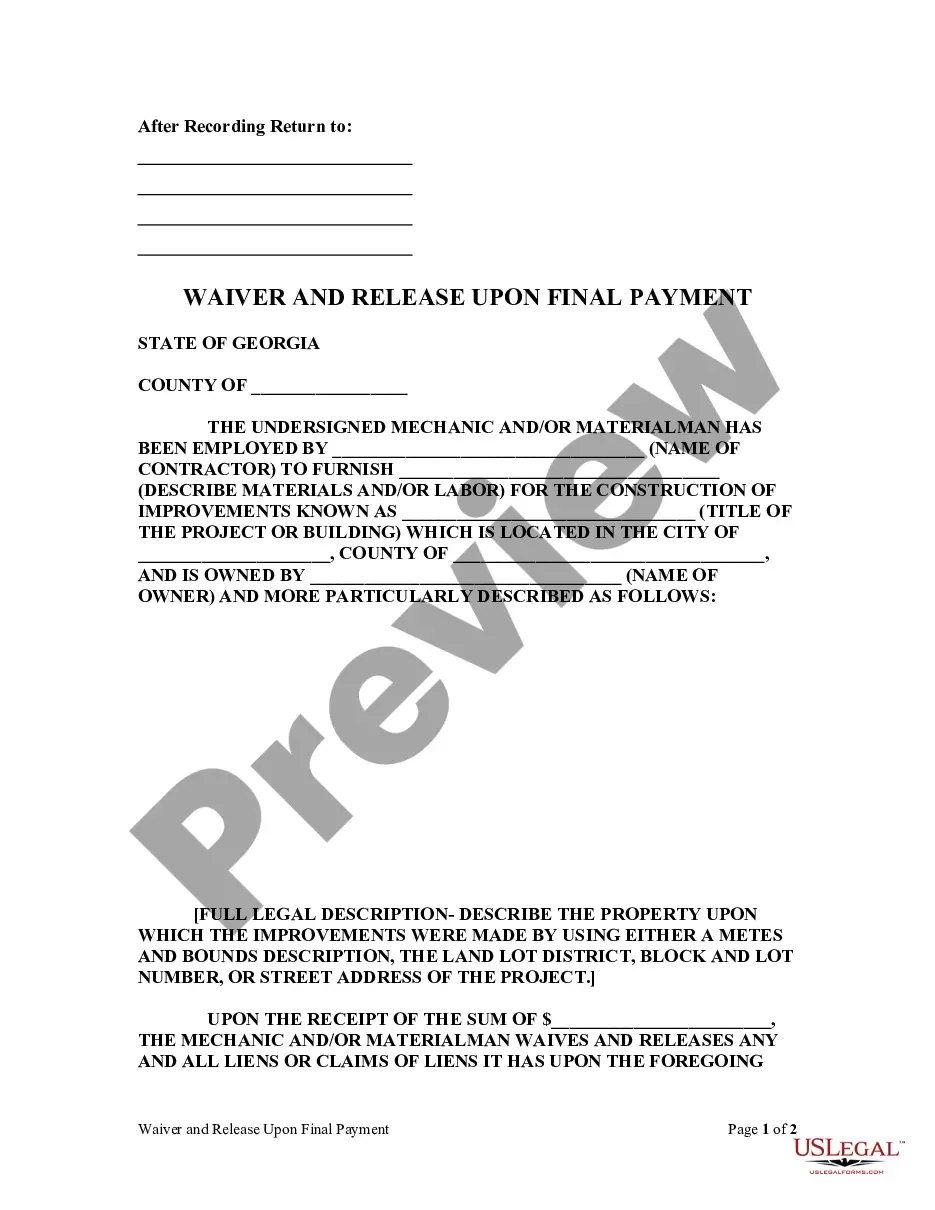

The Unconditional Waiver and Release Upon Final Payment is a legal document used by individuals to formally waive any claims or liens against property after receiving final payment for services provided. This form is most commonly utilized in construction and repair contexts to confirm that all due payments have been made, ensuring the contractor or supplier no longer has any claims on the property related to the contract. Unlike other waiver forms, this document specifically addresses the final payment and asserts that the claimant has been paid in full.

What’s included in this form

- Identification of the parties involved, including the mechanic or materialman and the property owner.

- The specific amount of final payment received.

- A clear statement releasing all liens and claims upon the specified property.

- Declaration of services or materials provided under the contract.

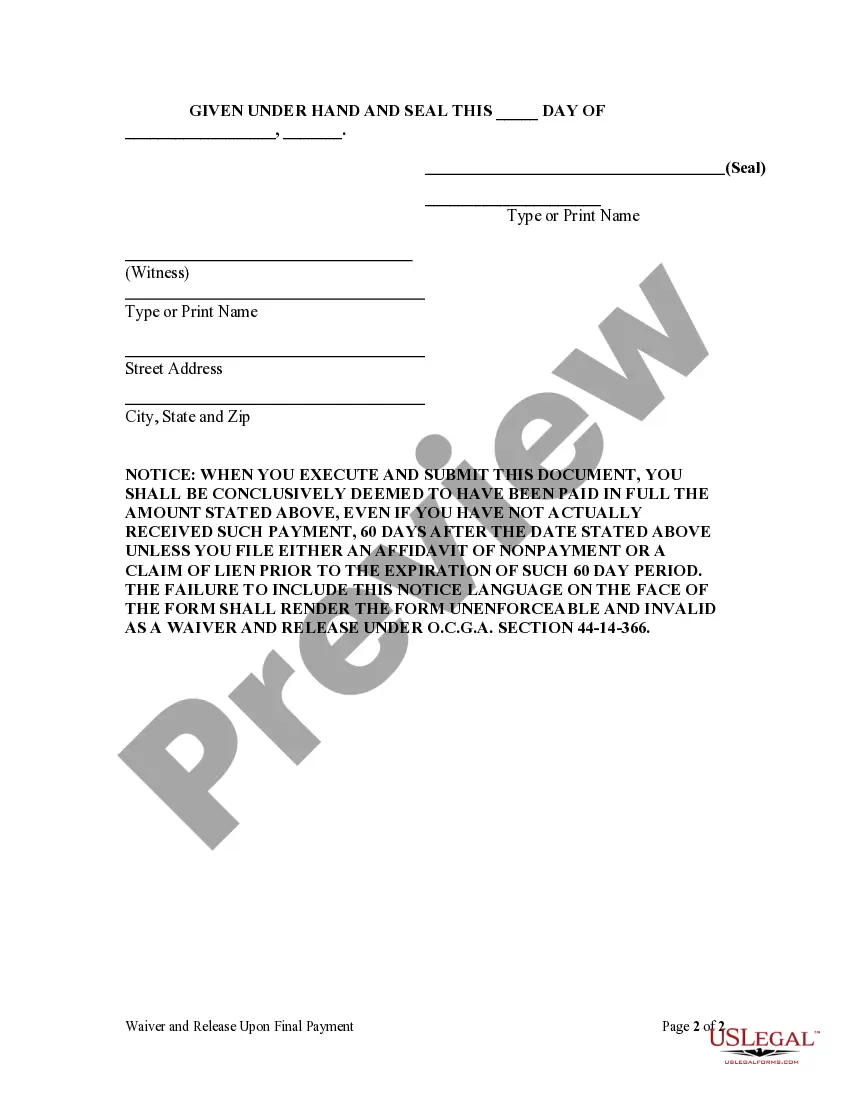

- Signature and date fields for the individual waiving their claims.

Situations where this form applies

This form should be used when an individual contractor or supplier has completed their work on a property and received the final payment for their services. It is crucial in circumstances where the contractor wants to prevent future claims or disputes regarding payment. This form helps to protect both the property owner and the contractor by clearly documenting that final payment has been made and all claims have been released.

Intended users of this form

This form is intended for:

- Independent contractors who have completed work on a property.

- Material suppliers who have provided materials for construction or repair projects.

- Property owners seeking formal confirmation that all claims have been released after payment.

- Individuals involved in contractual agreements where lien rights may be relevant.

Instructions for completing this form

- Identify the parties involved by providing the names of the contractor and property owner.

- Enter the final payment amount received in the designated space.

- Clearly describe the property related to the contract.

- Affirmatively state the waiver of any liens upon the property.

- Sign and date the form to validate the release.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately state the final payment amount.

- Not identifying all parties involved in the contract.

- Omitting necessary signatures or dates.

- Using a waiver form that does not fit the specific contractual obligations.

Why complete this form online

- Convenience of downloading the form anytime, anywhere.

- Editable templates that allow for customization to meet specific needs.

- Access to forms drafted by licensed attorneys, ensuring legal compliance.

- Easy-to-use format that guides users through the completion process.

Looking for another form?

Form popularity

FAQ

In Georgia, the statute of limitations for a tax lien is typically three years from the date of assessment. This timeframe is critical for anyone dealing with tax liabilities and related liens. To navigate these complexities and understand the implications on your financial obligations, consider turning to uslegalforms for comprehensive support and information.

Section 44 14 361 in Georgia outlines the rights and obligations related to the filing of lien waivers. This section provides clarity on how and when conditional and unconditional waivers should be executed. Understanding this section is crucial when utilizing the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual, as it frames the parameters of your documentation.

In Georgia, lien waivers, including the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual, do not require notarization to be legally binding. However, while notarization is not mandatory, it can add an extra layer of verification. It is recommended to consult legal guidelines or resources available through uslegalforms to ensure compliance.

In Georgia, the time limit for a demand statute is essential for enforcing your rights. Under the law, you typically have 90 days to assert a claim following final payment. This timeframe emphasizes the importance of promptly filing your Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual to protect your interests in any project.

To fill out a Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual, begin by clearly stating your name and the correct property address. Next, provide the payment details, including the date and amount received. Ensure you sign and date the document, and remember to keep a copy for your records to confirm that the release was granted.

An unconditional waiver and release is a specific legal agreement that confirms that a contractor or supplier has received payment and waives any future claims against that payment. Under Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual, this document protects both parties by ensuring a clear understanding that all obligations related to the payment are fulfilled. Utilizing platforms like USLegalForms can help streamline the process of creating and managing these important documents.

An unconditional release is a legal document that confirms a party has received full payment for work or services rendered. In the context of the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual, it serves to protect both the payer and the service provider. Once signed, the provider cannot later claim any unpaid amounts for that specific project. This clarity helps maintain trust in business transactions.

A conditional final waiver stipulates that the waiver will only take effect upon the receipt of final payment for work completed. This protects contractors by ensuring that they will only release their rights once they have received full payment. Utilizing this form can be especially beneficial when dealing with projects governed by the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual.

Final unconditional refers to the status when payment has been fully made for a project, and no further claims can be made regarding that project. By signing a final unconditional waiver, you acknowledge receipt of the payment and relinquish any rights to future claims. This concept is crucial to grasp when dealing with the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual.

Statute 44-14-366 in Georgia outlines the requirements for releasing claims regarding payment for construction-related work. This law emphasizes both conditional and unconditional waivers and their implications for contractors and property owners. Understanding this statute is essential for anyone involved in construction in Georgia, particularly when dealing with the Georgia Unconditional Waiver and Release Upon Final Payment Sect. 44-14-366 - Individual.