Missouri Loan Modification Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Loan Modification Agreement?

Obtain any template from 85,000 legal documents including Missouri Loan Modification Agreement online with US Legal Forms. Each template is created and refreshed by state-authorized attorneys.

If you possess a subscription, Log In. Once you’re on the document’s page, click on the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow the steps below: Check the state-specific criteria for the Missouri Loan Modification Agreement you wish to utilize. Review the description and preview the example. When you are confident the template is what you require, simply click Buy Now. Select a subscription plan that truly fits your budget. Create a personal account. Pay in one of two convenient methods: by credit card or through PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the file to the My documents tab. After your reusable form is prepared, print it out or store it on your device.

- With US Legal Forms, you will consistently have immediate access to the correct downloadable sample.

- The platform offers you access to forms and categorizes them to streamline your search.

- Utilize US Legal Forms to acquire your Missouri Loan Modification Agreement effortlessly and swiftly.

Form popularity

FAQ

Filling out a loan agreement involves several key steps. First, you need to enter your personal information and loan details, including the amounts and terms. When drafting a Missouri Loan Modification Agreement, be sure to read each section carefully and provide accurate information. Utilizing resources from USLegalForms can guide you through the process, ensuring that your agreement meets all legal requirements.

To initiate a loan modification, you'll typically need to provide several documents, including your current mortgage statement, proof of income, and a hardship letter. A complete Missouri Loan Modification Agreement will also require information about your financial situation and any supporting documentation. Gathering these documents can streamline the process and improve your chances of approval. Platforms like USLegalForms offer templates to help you compile these documents correctly.

An example of a loan modification is when a borrower reduces their monthly payment due to financial hardship. In a Missouri Loan Modification Agreement, the lender may agree to lower the interest rate or extend the loan term, making the payments more manageable. This process helps borrowers avoid default while ensuring lenders maintain their investment. Understanding such modifications can be easier with resources available on USLegalForms.

The loan modification is documented through a formal agreement between the borrower and the lender. This Missouri Loan Modification Agreement outlines the new terms of the loan, including changes to interest rates, payment schedules, and loan balances. It's crucial to ensure that both parties sign this document to make the modification legally binding. Using a reliable platform like USLegalForms can help you generate the necessary paperwork efficiently.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

Generally, the simplest way to calculate a debt to income ratio for loan modification is simply to take total monthly debt obligations and divide it by total monthly gross household income. Anything over about 60-70% is pretty good for loan modification purposes.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

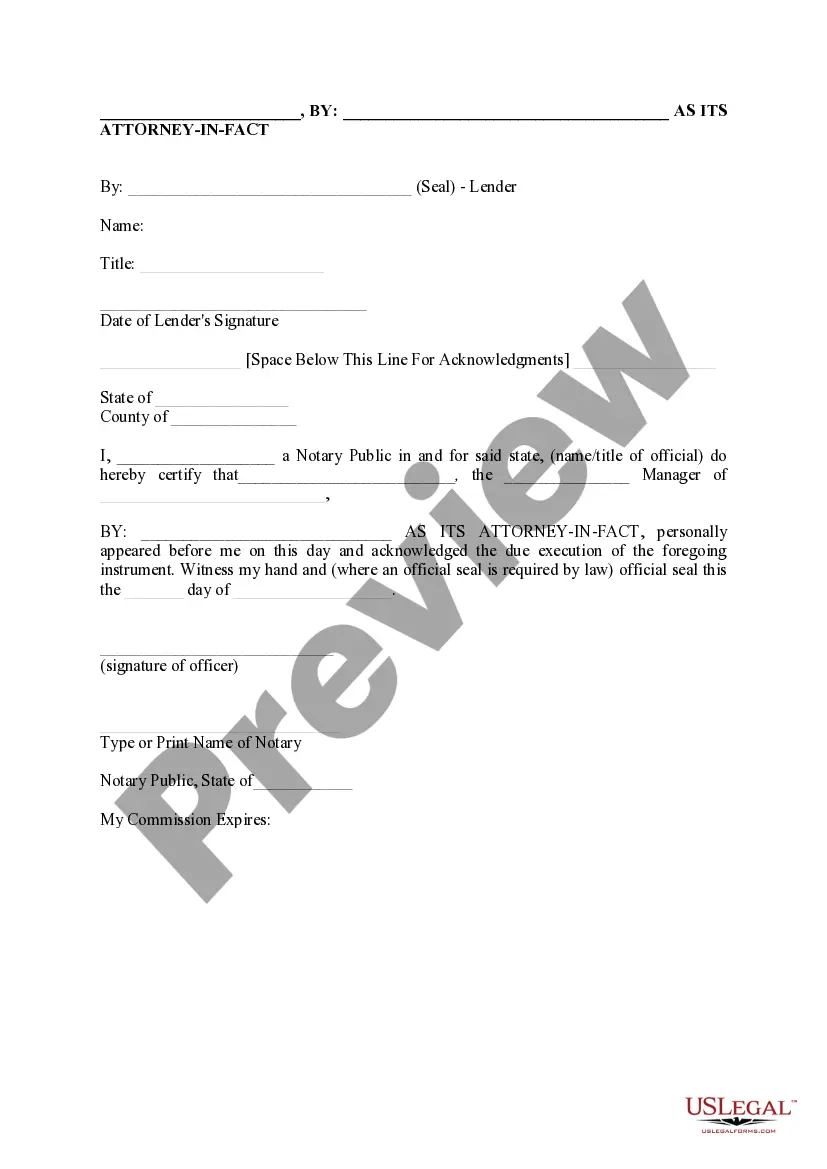

When you've successfully completed your trial modification payments, your mortgage loan servicer will send you a loan modification agreement. That agreement needs to be signed by you, stamped and signed by a notary, and sent back to your servicer.Some banks even offer a notary who will come to your home.