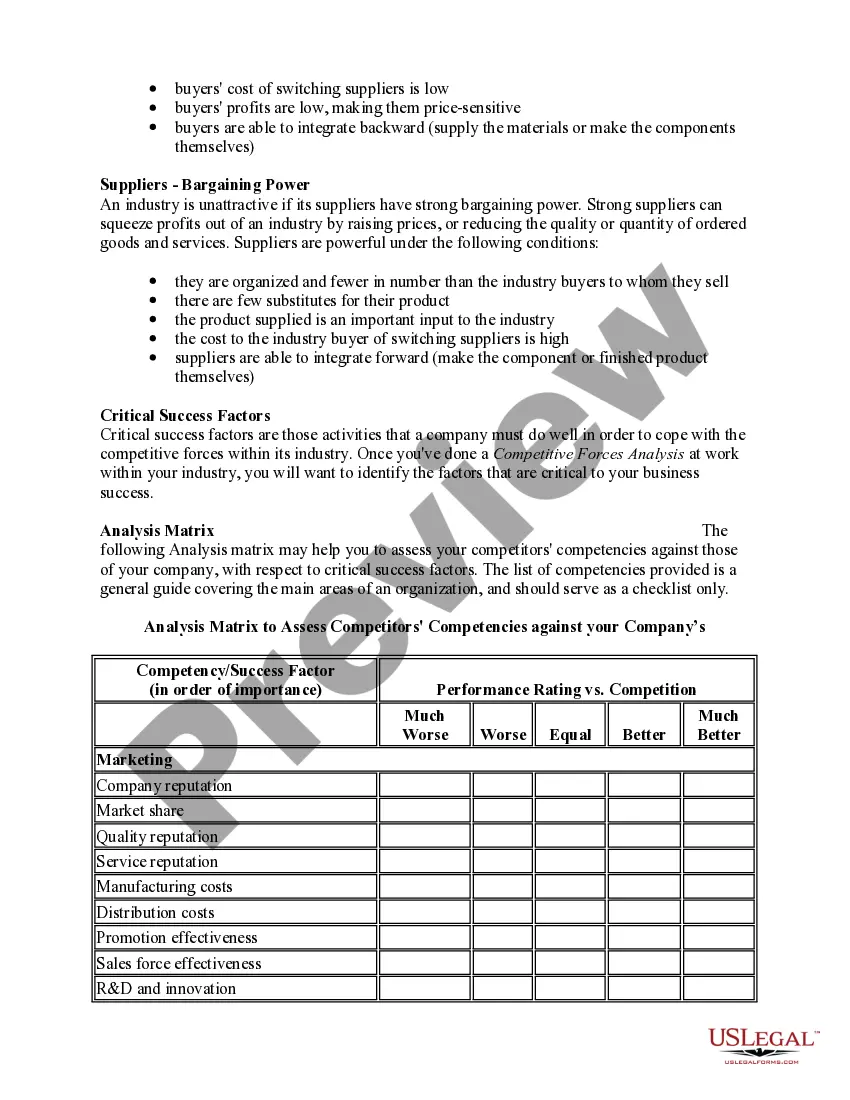

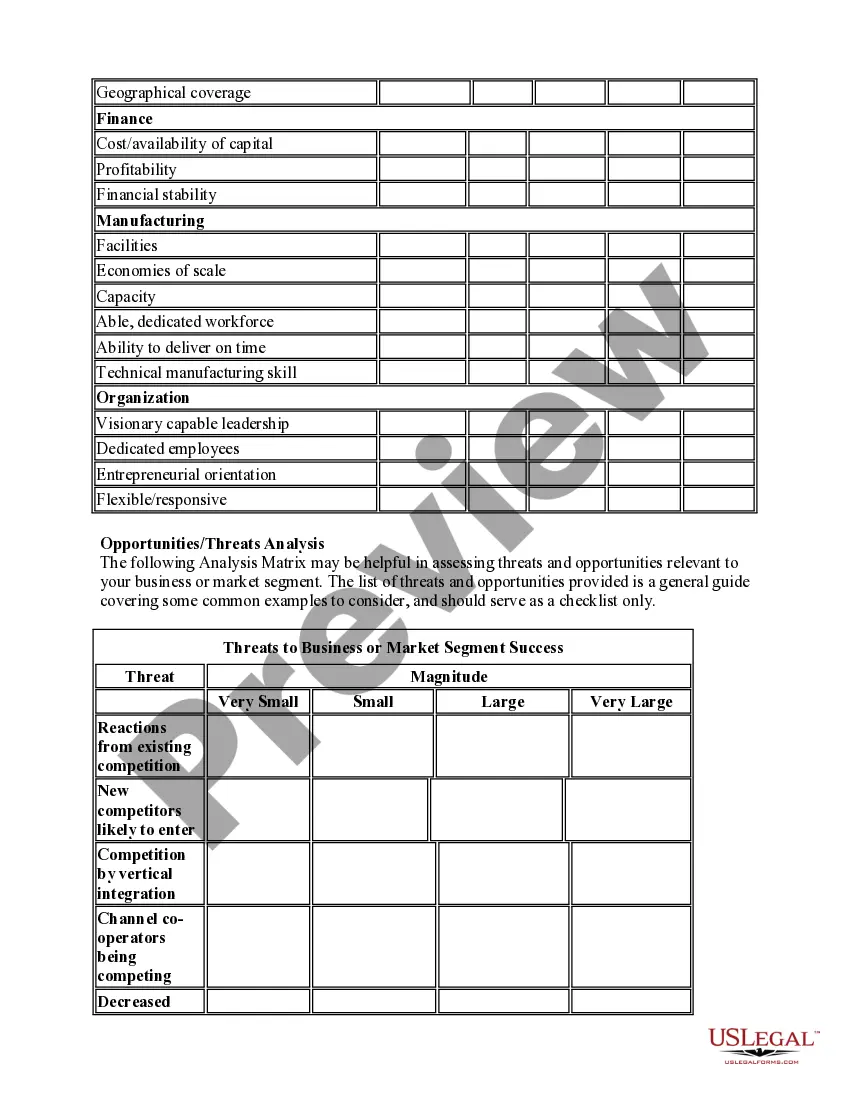

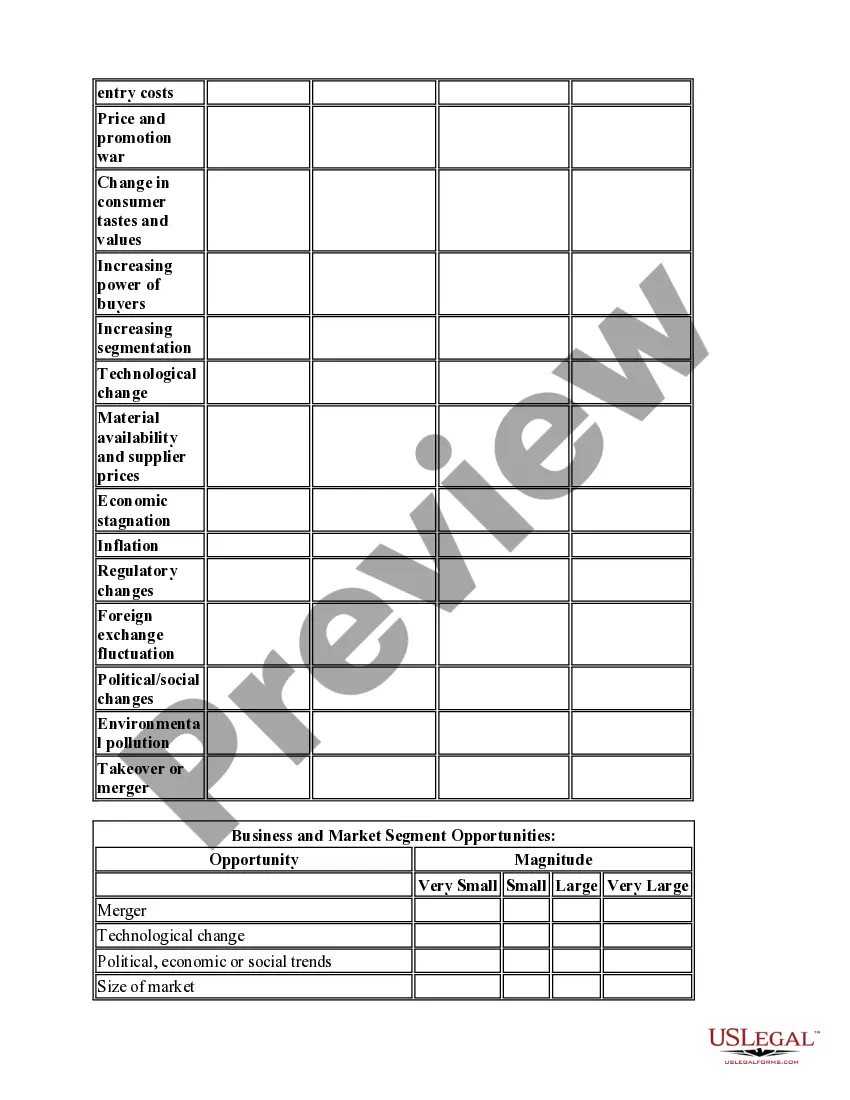

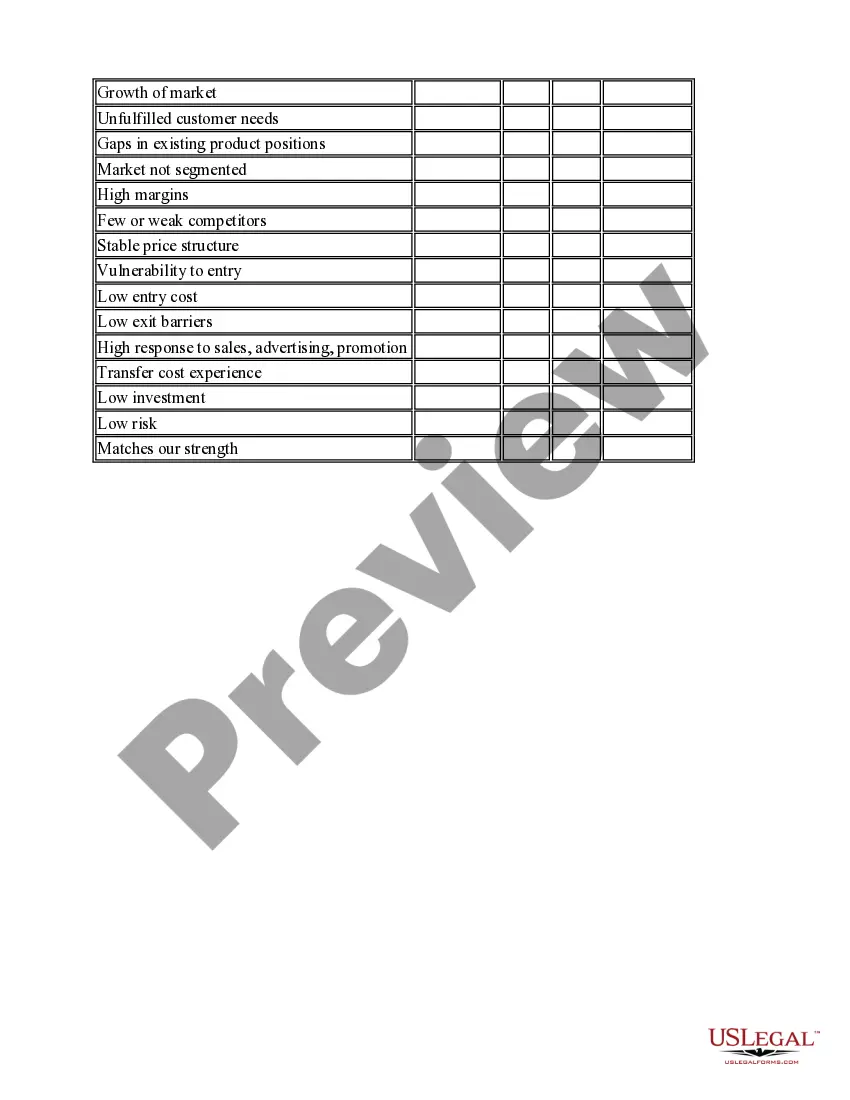

Worksheet — Industry & Competitive Forces Analysis is a tool used to evaluate the competitive environment of an industry. It helps identify key competitors, the strengths and weaknesses of each competitor, and the overall attractiveness of the industry. The analysis typically includes an assessment of the five competitive forces, which are: 1) Buyer Power: The ability of buyers to influence prices, quality, and availability of products. 2) Supplier Power: The ability of suppliers to increase prices and restrict the availability of products. 3) Threat of New Entrants: The likelihood of new competitors entering the market. 4) Threat of Substitute Products: The availability of products that may replace existing products. 5) Rivalry Among Existing Competitors: The intensity of competition between existing competitors. The analysis is done by collecting data about each of the five competitive forces, and then assessing them with a rating scale, such as a 1-5 scale. This will provide a better understanding of the competitive environment and help inform strategic decisions. Different types of Worksheet — Industry & Competitive Forces Analysis can include Porter's Five Forces Analysis, SWOT Analysis, PEST Analysis, and Industry Attractiveness Analysis.

Worksheet - Industry & Competitive Forces Analysis

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Worksheet - Industry & Competitive Forces Analysis?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state laws and are checked by our experts. So if you need to prepare Worksheet - Industry & Competitive Forces Analysis, our service is the best place to download it.

Getting your Worksheet - Industry & Competitive Forces Analysis from our service is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the correct template. Afterwards, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a quick guideline for you:

- Document compliance check. You should attentively examine the content of the form you want and check whether it suits your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Worksheet - Industry & Competitive Forces Analysis and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

If you have more than one job and are single, you can either split your allowances (claim 1 at Job A and 1 at Job B), or you can claim them all at one job (claim 2 at Job A and 0 at Job B). If you're single and have one job, claiming two allowances is also an option.

If there are only two jobs held at the same time in your household, you may check the box in Step 2 on the forms for both jobs. The standard deduction and tax brackets will be divided equally between the two jobs. You will not need to furnish a new Form W-4 to account for pay changes at either job.

When you have a second job or an additional source of income, you should claim extra withholding on your W-4 to account for the additional income. Two jobs often push you into a higher income bracket, so you must withhold more of your income using line 4(c).

If you have two jobs, you fill out two W-4 forms, one for each gig. To figure out your total income and total withheld taxes, you add the numbers on the two W-2 forms together. It's the same process as if you were adding your spouse's and your own W-2s together for a joint tax return.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.