Sample Letter for Attempt to Collect Debt before Legal Action

Description

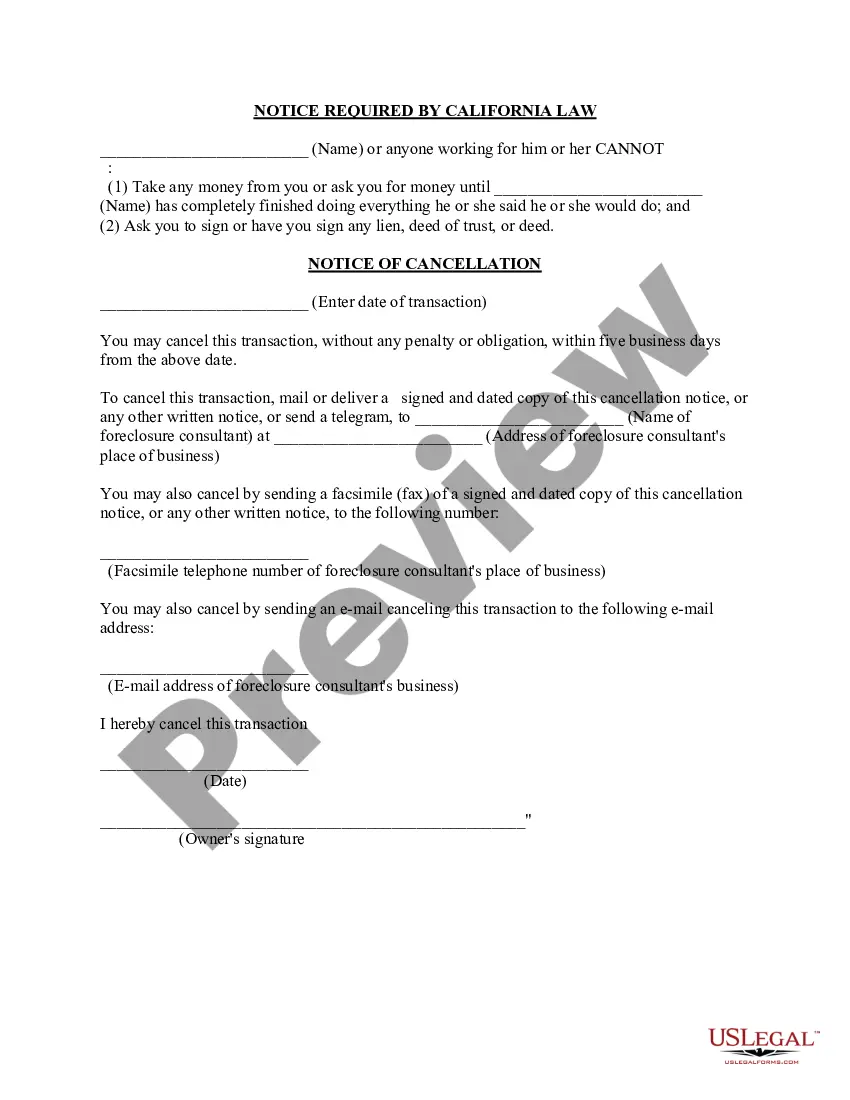

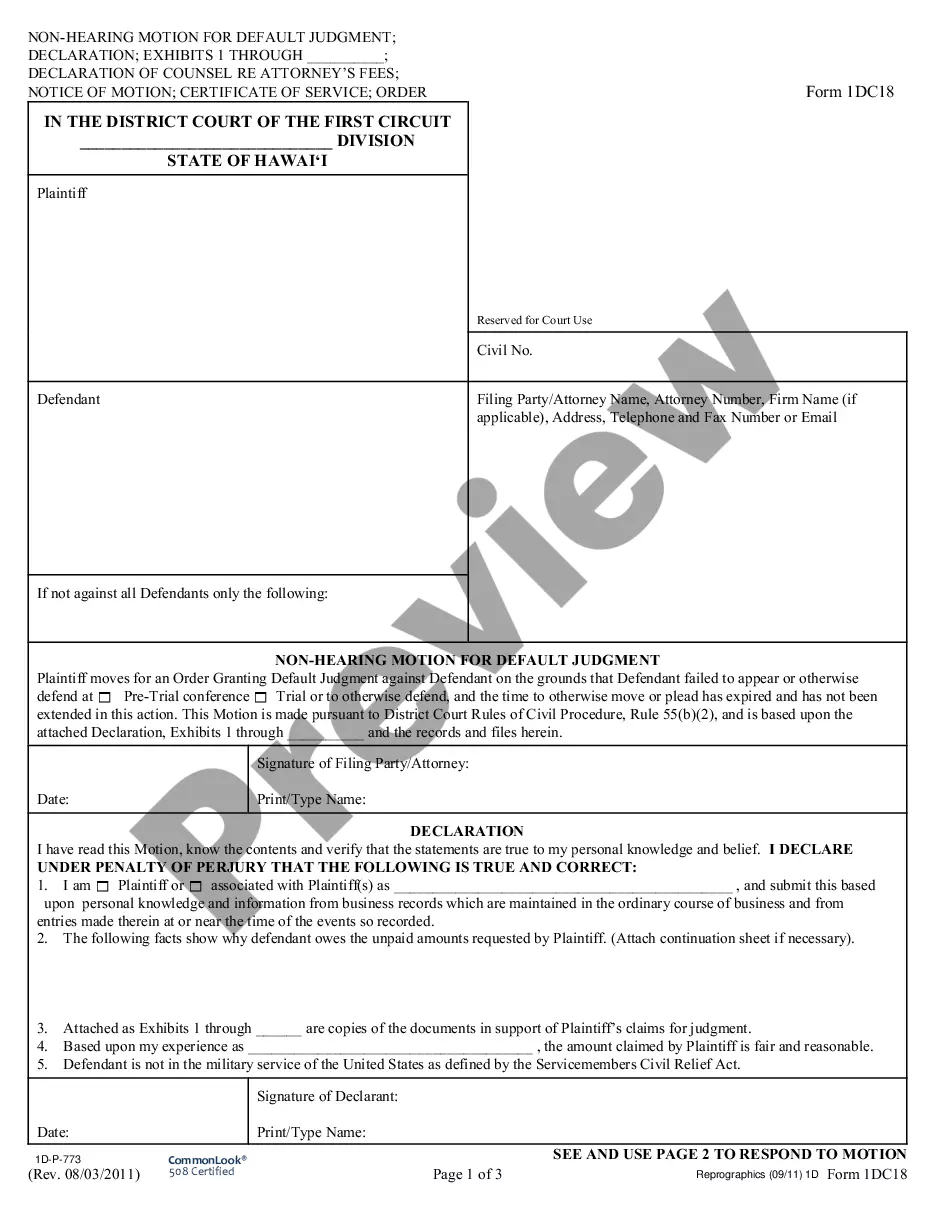

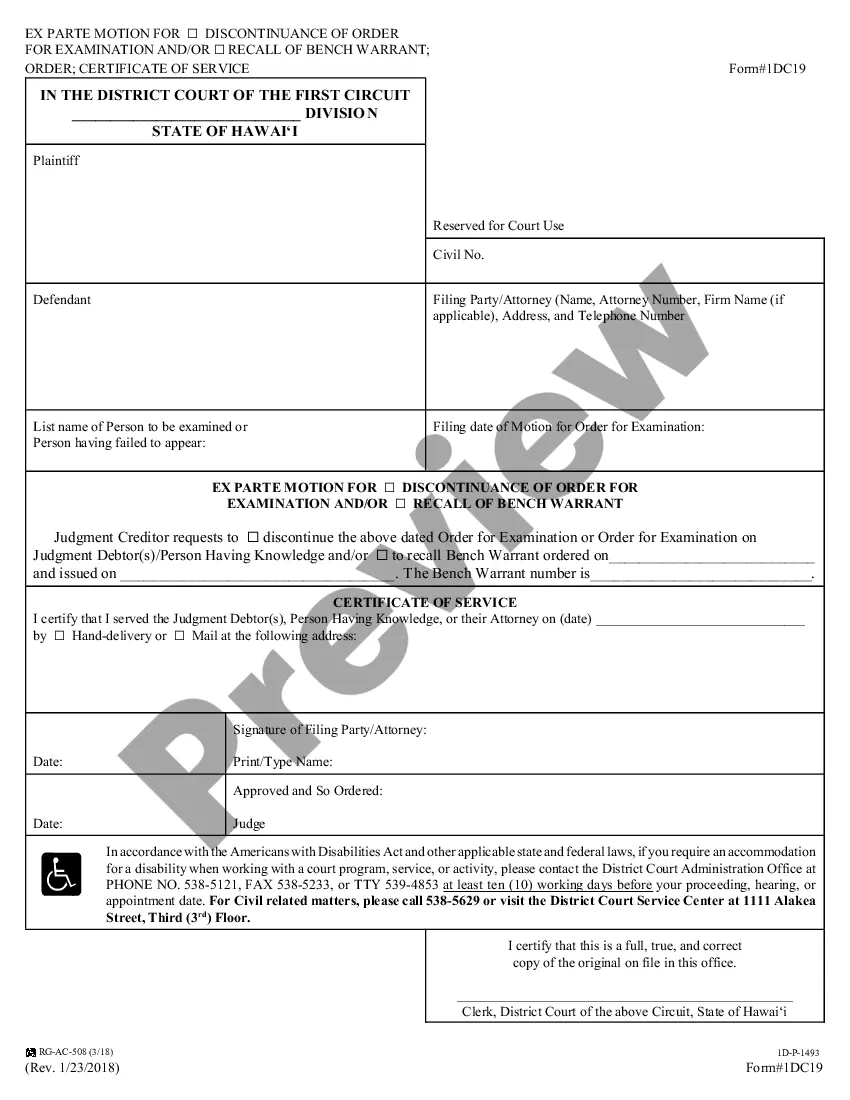

How to fill out Sample Letter For Attempt To Collect Debt Before Legal Action?

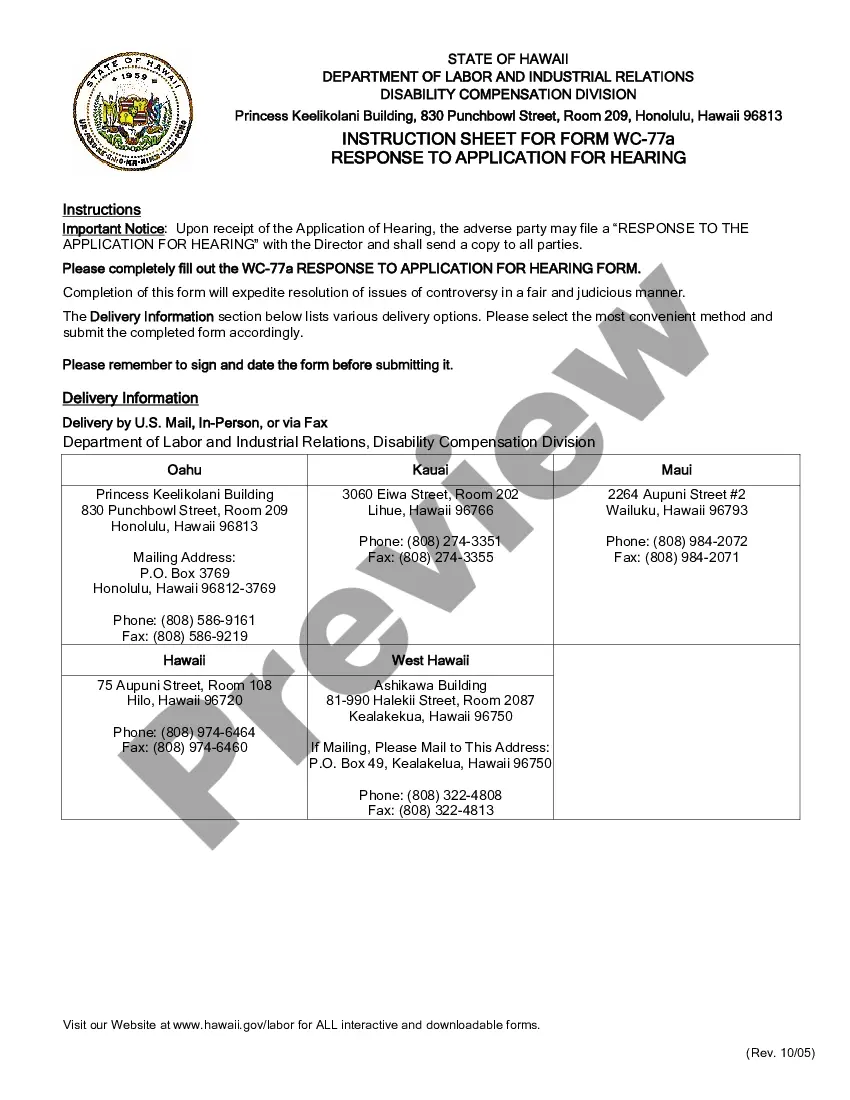

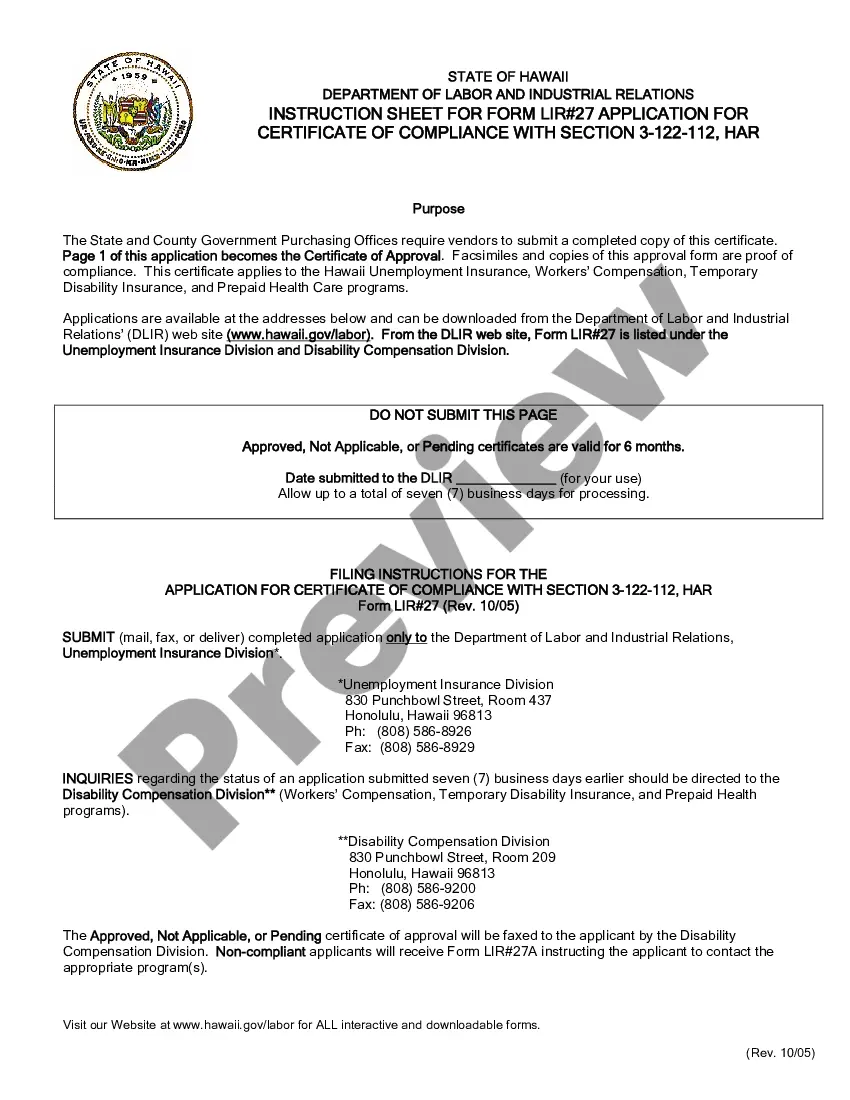

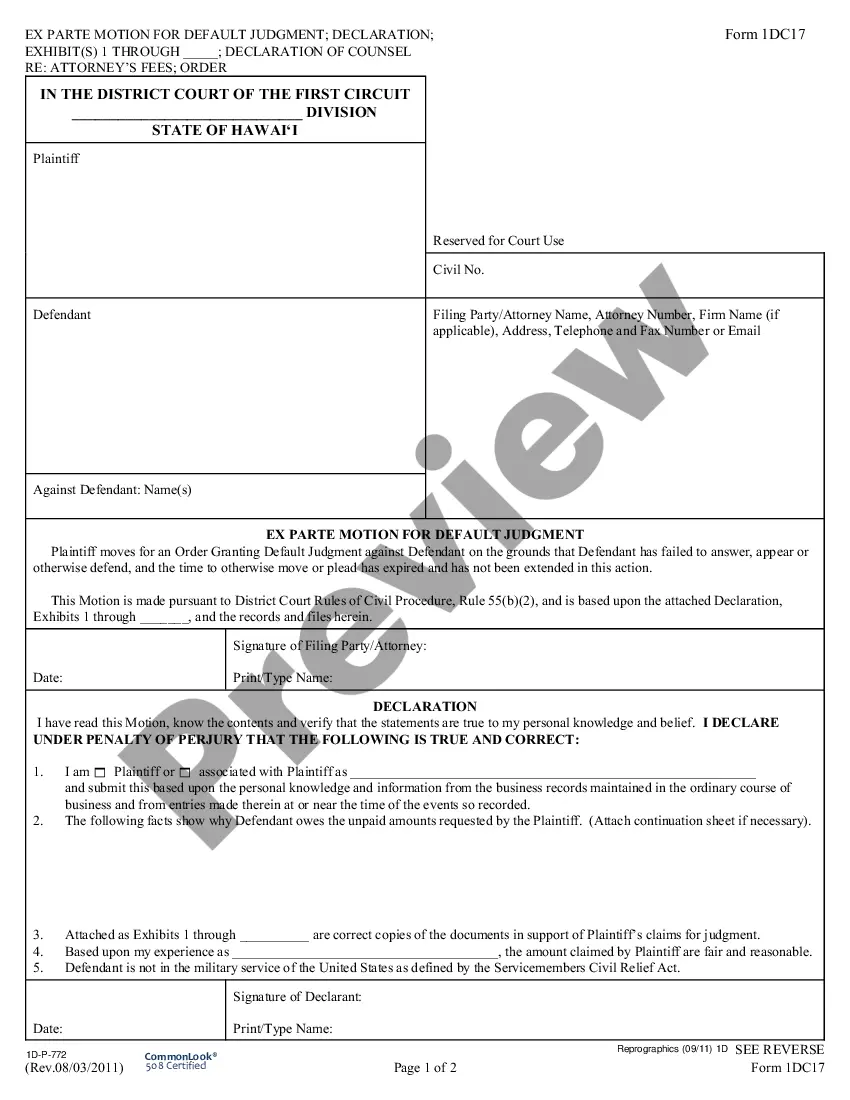

Use US Legal Forms to get a printable Sample Letter for Attempt to Collect Debt before Legal Action. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms catalogue online and provides cost-effective and accurate samples for consumers and legal professionals, and SMBs. The templates are categorized into state-based categories and some of them can be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For people who don’t have a subscription, follow the tips below to easily find and download Sample Letter for Attempt to Collect Debt before Legal Action:

- Check out to make sure you get the proper template with regards to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Click Buy Now if it’s the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Make use of the Search field if you want to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Sample Letter for Attempt to Collect Debt before Legal Action. Above three million users have already used our service successfully. Select your subscription plan and obtain high-quality forms in just a few clicks.

Form popularity

FAQ

The FDCPA gives you a set period of time to dispute debts with collection agencies, but you can still request a debt validation after 30 days.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

Here's some basic information you should write down anytime you speak with a debt collector: date and time of the phone call, the name of the collector you spoke to, name and address of collection agency, the amount you allegedly owe, the name of the original creditor, and everything discussed in the phone call.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

Reference the products or services that were purchased. Make it very clear what you did for your client and how much it costs. Maintain a friendly but firm tone. Remind the payee of their contract or agreement with you. Offer multiple ways the payee can take action. Add a personal touch. Give them a new deadline.

Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.

A debt validation letter can be an effective tool for dealing with debt collectors.