Sample Letter for Debt Collection

What is this form?

The Sample Letter for Debt Collection is a legal document used to formally request payment from a debtor for money owed. This letter is distinct from other collection notices as it is drafted in a professional tone, indicating legal representation and outlining the potential consequences of non-payment. It serves as a final reminder before taking further legal action to recover the debt.

What’s included in this form

- Return address and date: Shows the sender's and recipient's information.

- Balance due description: Clearly states the amount owed for the work performed.

- Payment deadline: Informs the debtor about the time frame to respond to the demand letter.

- Legal representation notice: Indicates that an attorney is representing the creditor.

- Consequences of non-payment: Outlines the legal actions that may be taken if the debt remains unpaid.

- Federal Debt Collection Act notice: Provides details about the debtor's rights regarding debt validation.

When to use this document

This form should be used in situations where a creditor has made multiple attempts to collect a debt but has not received a satisfactory response. It is appropriate for service providers, contractors, or businesses that need to formally document their request for payment before considering legal action. This letter serves as an official communication that can help resolve the matter before it escalates further.

Who this form is for

- Businesses seeking payment from clients for overdue invoices.

- Service providers who have completed work but have not received payment.

- Individuals who wish to formally request payment from a debtor.

- Attorneys representing clients in debt collection cases.

How to prepare this document

- Identify the parties: Fill in your name and the debtor's name and address.

- Specify the debt amount: Enter the total balance due for the work completed.

- Indicate the deadline: State when the payment is required, typically within thirty days.

- Include legal representation: If applicable, mention the name of the attorney or firm handling the case.

- State potential legal actions: Detail the steps that may be taken if the debt is not paid.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

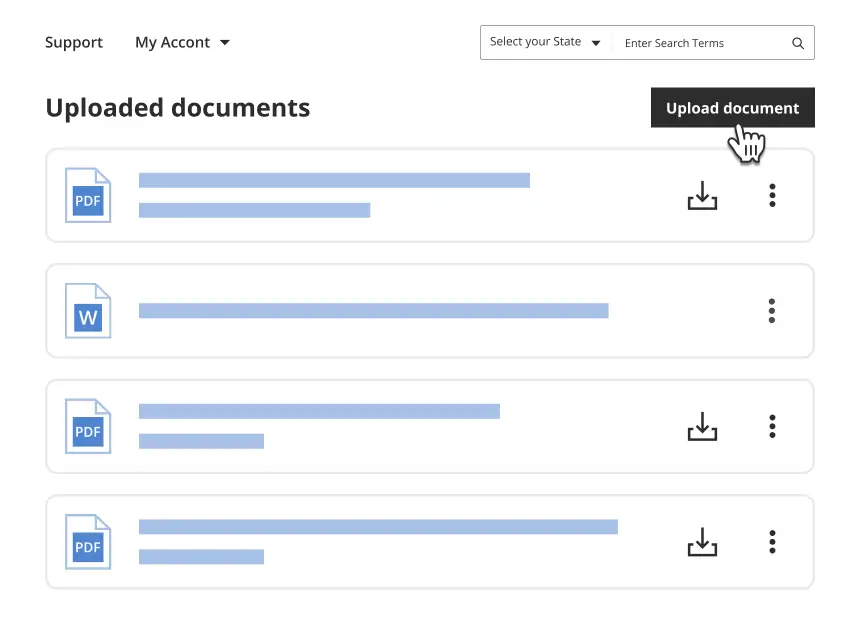

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include accurate contact information for both parties.

- Not clearly stating the amount owed, leading to confusion.

- Neglecting to set a specific deadline for payment.

- Not signing the letter or including legal representation details.

Benefits of completing this form online

- Convenience: Easily downloadable and editable to meet specific needs.

- Reliability: Created by licensed attorneys to ensure compliance with legal standards.

- Time-saving: Quick access allows for prompt sending of the letter.

- Clear template: Structured format that guides you through each necessary section.

Legal use & context

- This letter serves as a formal notice, which is essential for legal documentation of the debt.

- Failure to respond to this letter may result in legal actions for breach of contract.

- It provides the debtor with information regarding their rights under the Federal Debt Collection Act.

Main things to remember

- The Sample Letter for Debt Collection is crucial for formally requesting overdue payments.

- Its structure outlines the balance due and potential consequences of non-payment.

- This form helps protect your rights as a creditor and provides legal groundwork for further action.

Looking for another form?

Form popularity

FAQ

For the name and contact information of the original creditor. why the collector believes you own the debt in the first place. for a record of all owners of the debt. the amount and age of the debt (including an account number if you're able). under what authority the collector has to collect.

Reference the products or services that were purchased. Make it very clear what you did for your client and how much it costs. Maintain a friendly but firm tone. Remind the payee of their contract or agreement with you. Offer multiple ways the payee can take action. Add a personal touch. Give them a new deadline.

Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not in the next 7 business days as this can be vauge.

You might get sued. The debt collector may file a lawsuit against you if you ignore the calls and letters. If you then ignore the lawsuit, this could lead to a judgment and the collection agency may be able to garnish your wages or go after the funds in your bank account. (Learn more about Creditor Lawsuits.)

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.

You have the right to force the debt collector to prove you owe the money. Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.