A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Check Disbursements Journal

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

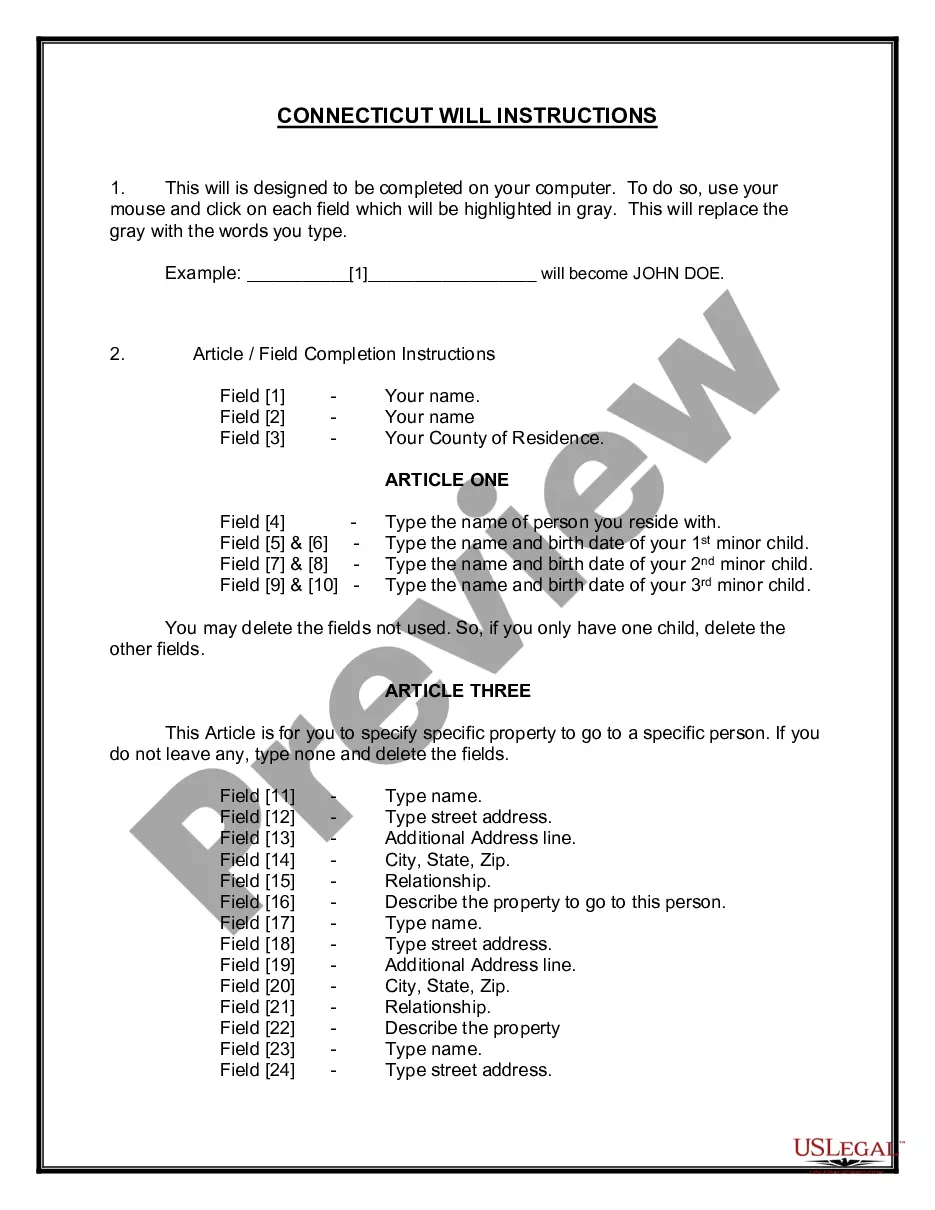

How to fill out Check Disbursements Journal?

Utilize the most comprehensive legal library of forms. US Legal Forms is the best place for finding updated Check Disbursements Journal templates. Our platform provides 1000s of legal forms drafted by certified lawyers and categorized by state.

To get a template from US Legal Forms, users simply need to sign up for a free account first. If you are already registered on our service, log in and select the document you are looking for and buy it. Right after purchasing templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps listed below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

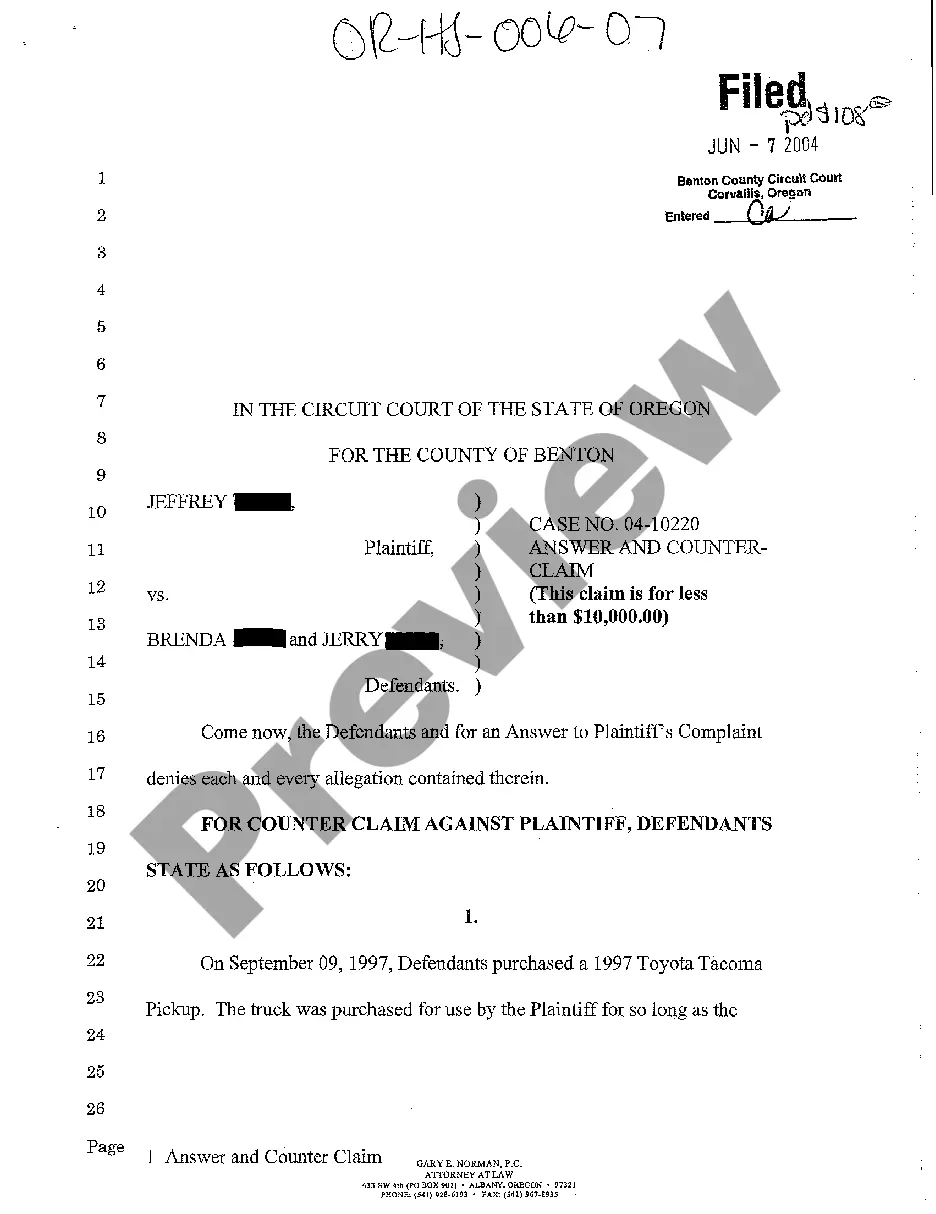

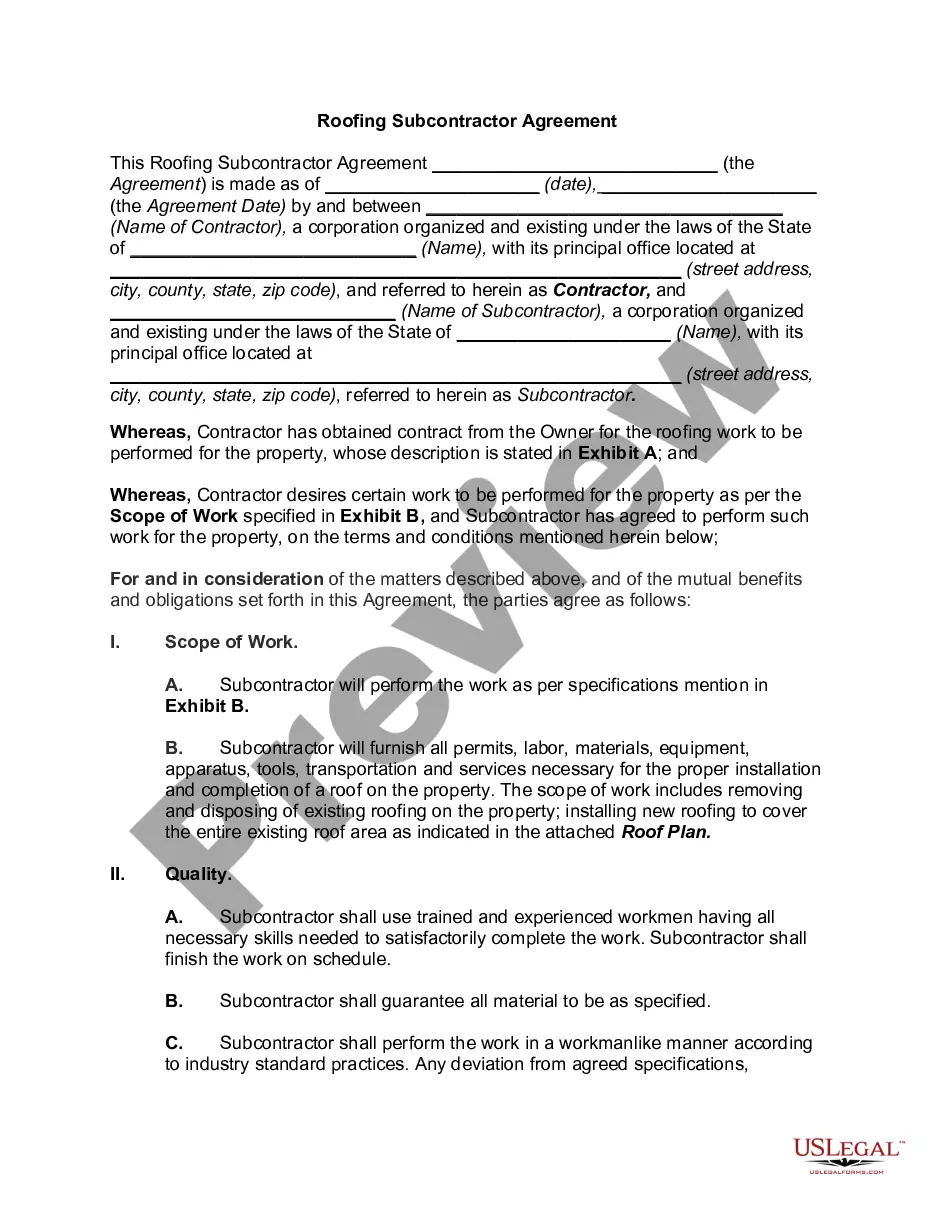

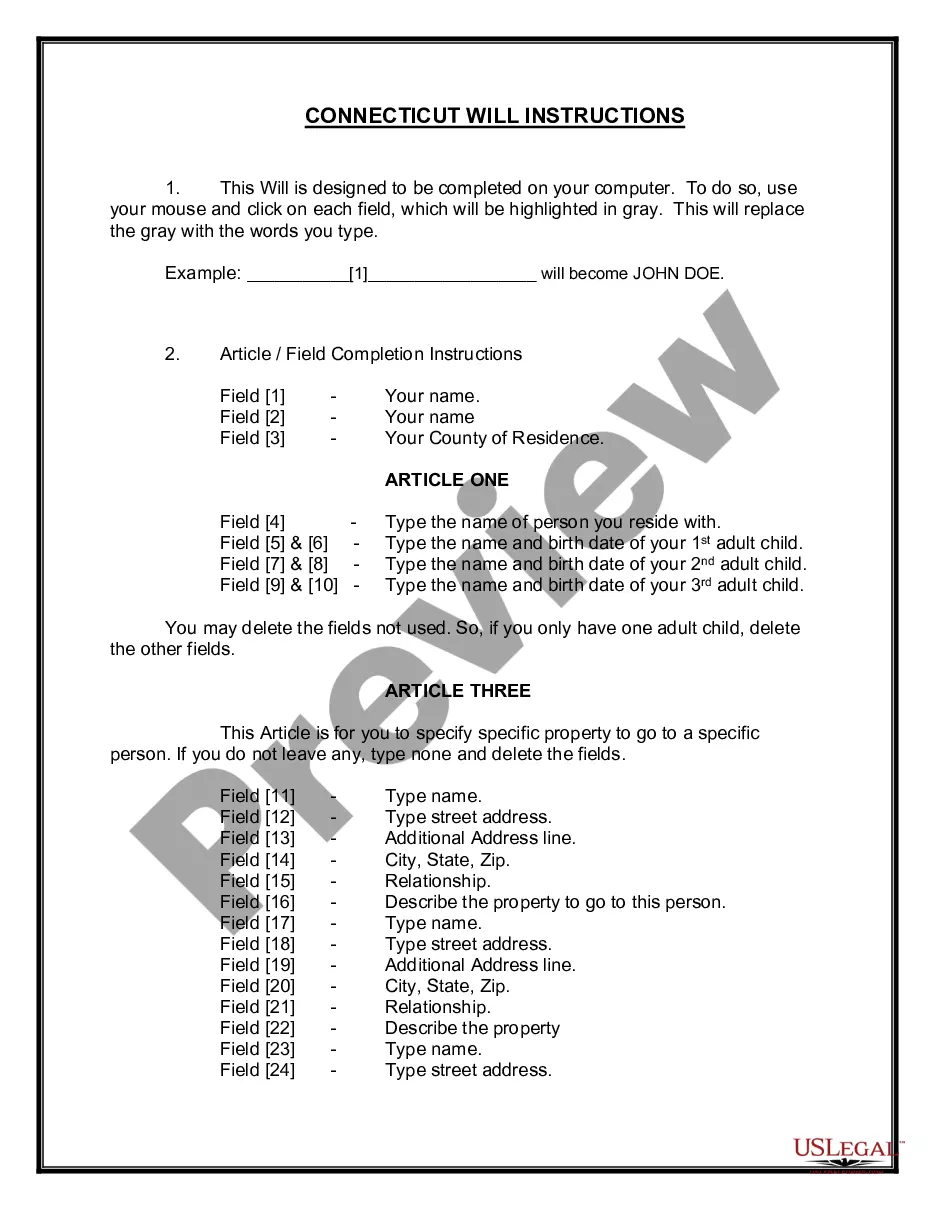

- When the form features a Preview function, utilize it to review the sample.

- In case the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template corresponds to your needs.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr credit/bank card.

- Choose a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill in the Form name. Join thousands of pleased customers who’re already using US Legal Forms!

Form popularity

FAQ

The cash disbursements journal (or cash payments journal) is an accounting form used to record all cash outflows. Some examples of outflows are accounts payable, materials payable, and operating expenses, as well as all cash purchases and disbursements to a petty cash fund.

By. Andrew Bloomenthal. Updated Apr 20, 2020. A cash disbursement journal is a record kept by a company's internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger.

A cash disbursement journal is a record kept by a company's internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger.

In other words, a cash disbursements journal is used to record any transaction that includes a credit to cash. All cash inflows are recorded in another journal known as cash receipts journal.

Create the sales entry Record your cash sales in your sales journal as a credit and in your cash receipts journal as a debit. Keep in mind that your entries will vary if you offer store credit or if customers use a combination of payment methods (e.g., part cash and credit).

When recording cash payments to suppliers it is quite common for the cash disbursement journal to include a discounts received column. By using a discounts received column, the business can use the cash disbursement journal to record the invoiced amount, the discount received, and the cash payment.

The cash disbursements journal (or cash payments journal) is an accounting form used to record all cash outflows. Some examples of outflows are accounts payable, materials payable, and operating expenses, as well as all cash purchases and disbursements to a petty cash fund.