Sample Letter for Dormant Letter

About this form

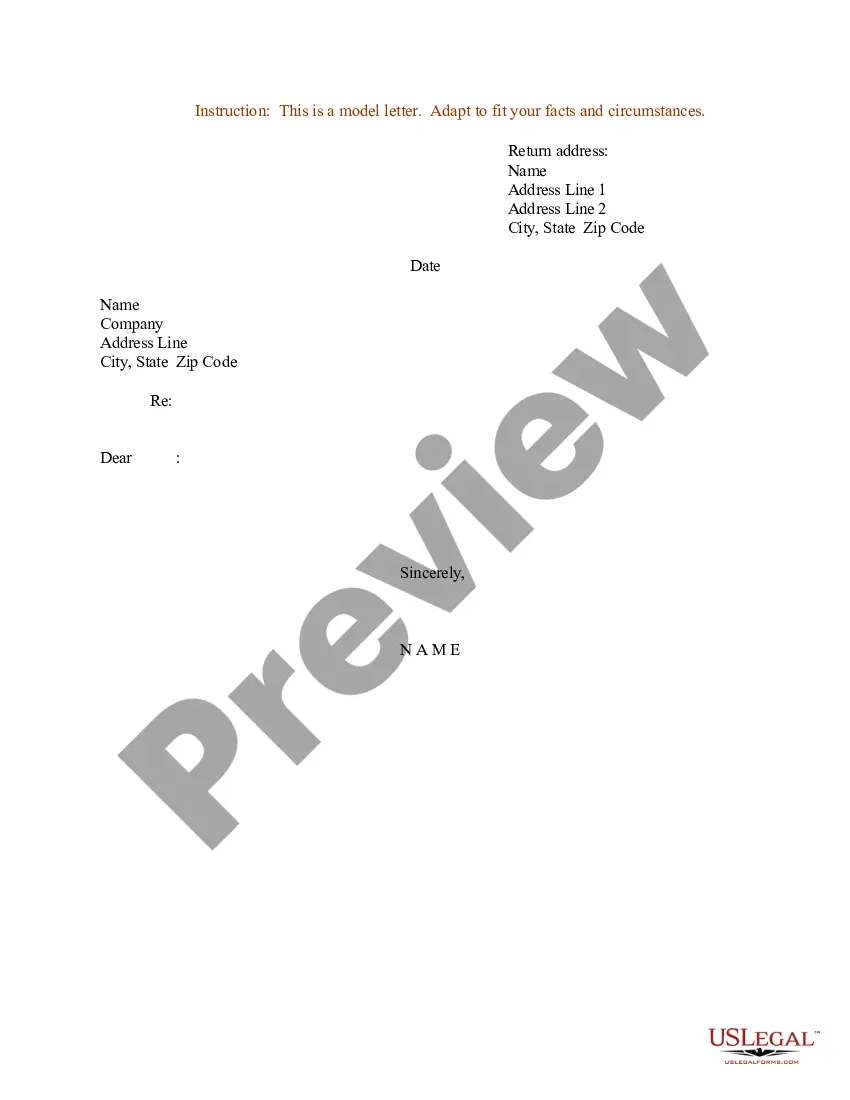

The Sample Letter for Dormant Letter is a customizable template designed to notify an individual or company about the status of an account that has been inactive or dormant. This letter serves as a formal request for the recipient to contact the sender regarding the account, ensuring clear communication about this important matter. It is particularly useful for addressing potential issues related to inactive accounts, distinguishing it from other types of correspondence that may cover different topics or account statuses.

Form components explained

- Return address: Clearly stated at the top for the recipient's reference.

- Date: Essential for tracking the timeline of the correspondence.

- Recipient's information: Includes the name and address of the individual or company being contacted.

- Subject line: Clearly labeled to indicate the purpose of the letter.

- Body of the letter: Concise message prompting the recipient to respond regarding the account.

- Closing: A professional sign-off with the sender's name for authenticity.

When to use this document

This form is useful in situations where an account has not been active for a long period. It can be used by businesses or individuals looking to re-establish communication regarding an account that may require attention. Situations may include unresponsiveness from a client or customer, or when updating account records in financial management. Sending this letter can help clarify account status and encourage action from the recipient.

Who this form is for

- Businesses needing to follow up on dormant accounts.

- Account managers responsible for client communications.

- Individuals with personal accounts that have gone inactive.

- Organizations handling customer records that require updates or follow-ups.

Steps to complete this form

- Enter your return address at the top of the letter.

- Insert the date of the letter for record-keeping.

- Add the recipient's name and address below the date.

- Fill in the subject line, indicating that it is a "Dormant Letter."

- Write a concise message requesting the recipient to contact you about the account.

- Sign the letter with your name at the bottom to personalize it.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include the date, which can confuse timelines.

- Omitting the recipient's correct address, leading to delivery issues.

- Using vague language that may not clearly convey the request.

- Not signing the letter, which can reduce its formality and effectiveness.

Benefits of using this form online

- Easy customization to fit specific account situations or recipient details.

- Instant download capability, allowing for immediate use.

- Convenience of editing and personalizing the letter at any time.

- Legally drafted content by licensed attorneys, ensuring reliability.

Looking for another form?

Form popularity

FAQ

Sir/Madam, My above mentioned savings/current account is in dormant status. The reason for dormancy of the account is give the details here. I request you to please reactivate the account.

Sir/Madam, My above mentioned savings/current account is in dormant status. The reason for dormancy of the account is give the details here. I request you to please reactivate the account.

Submit a request for activation of your account through Internet banking. By Calling the Customer Care Number of India Post Payment Bank Saving Document Required.

I am writing this letter to inform you that my account is deactivated by the bank. so I request you to Reactivate it as soon as possible. I attach a copy of the KYC duly filled in and signed and certified xerox copy of PAN Card and AAdhaar Card. Please oblige and grant my request.

To reactivate your dormant account, visit your home branch and provide a written request for reactivation of your account. Your bank may ask you for fresh KYC documentation and hence, carry along with you an identity proof, address proof and recent photograph.

Dear Sir, I am a client in your esteemed bank holding Savings Account number:2026202620262026202620262026.. Due to long-term non-operation the aforesaid account fell into dormant/inactive status. Therefore, I would request you to reactivate my account to enable me to proceed with future transactions.

To reactivate your dormant account, visit your home branch and provide a written request for reactivation of your account. Your bank may ask you for fresh KYC documentation and hence, carry along with you an identity proof, address proof and recent photograph.

Submit a written Reactivation Application. You will have to file a written application to reactive your dormant account. Submit KYC documents. You will have to submit your KYC documents alongside your reactivation application. Make a small deposit.

What Happens to Dormant Accounts? When an account officially becomes dormant, the bank doesn't get to keep it. It must try to contact the account holder over a specified period of time that varies, depending on the state. A final warning is usually issued one month before the account is turned over to the state.