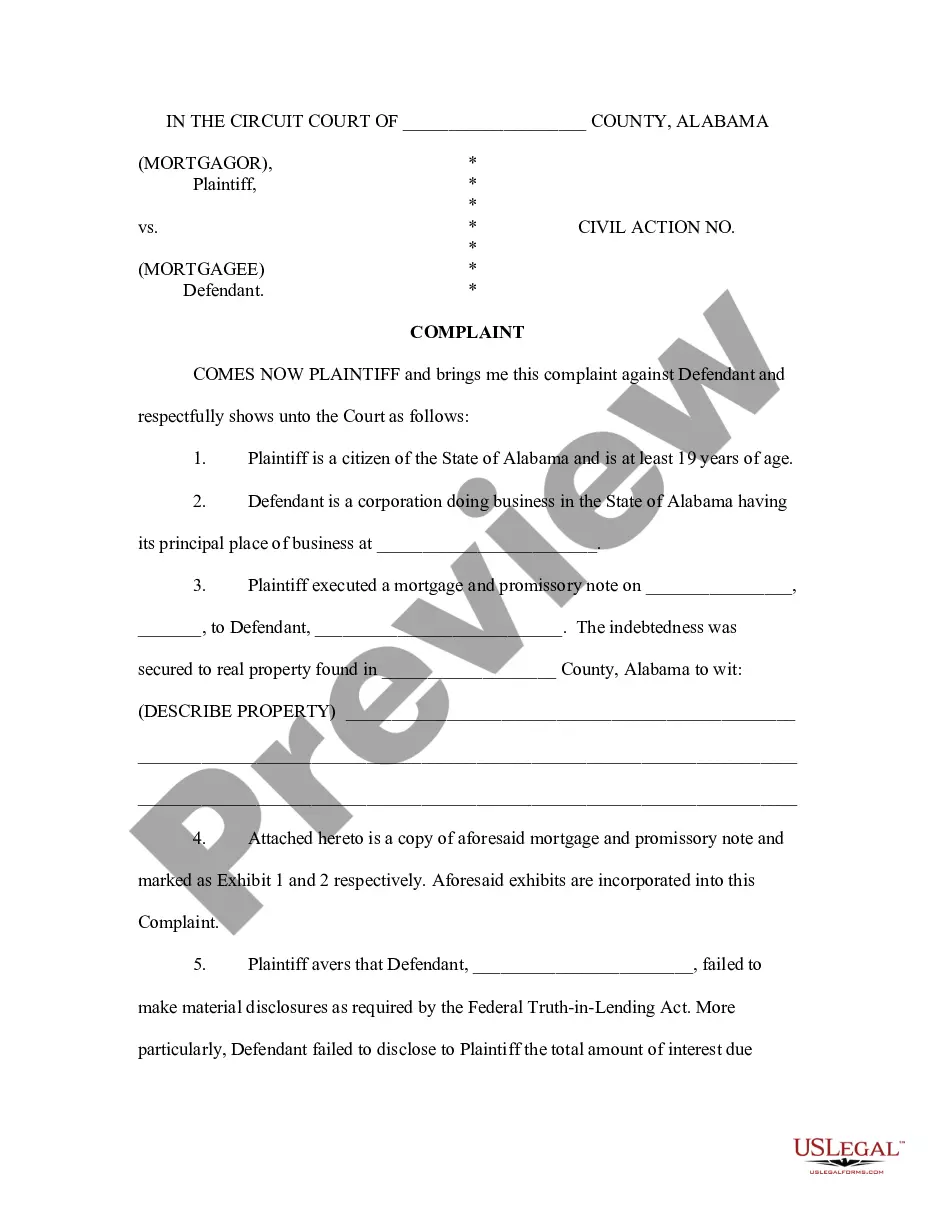

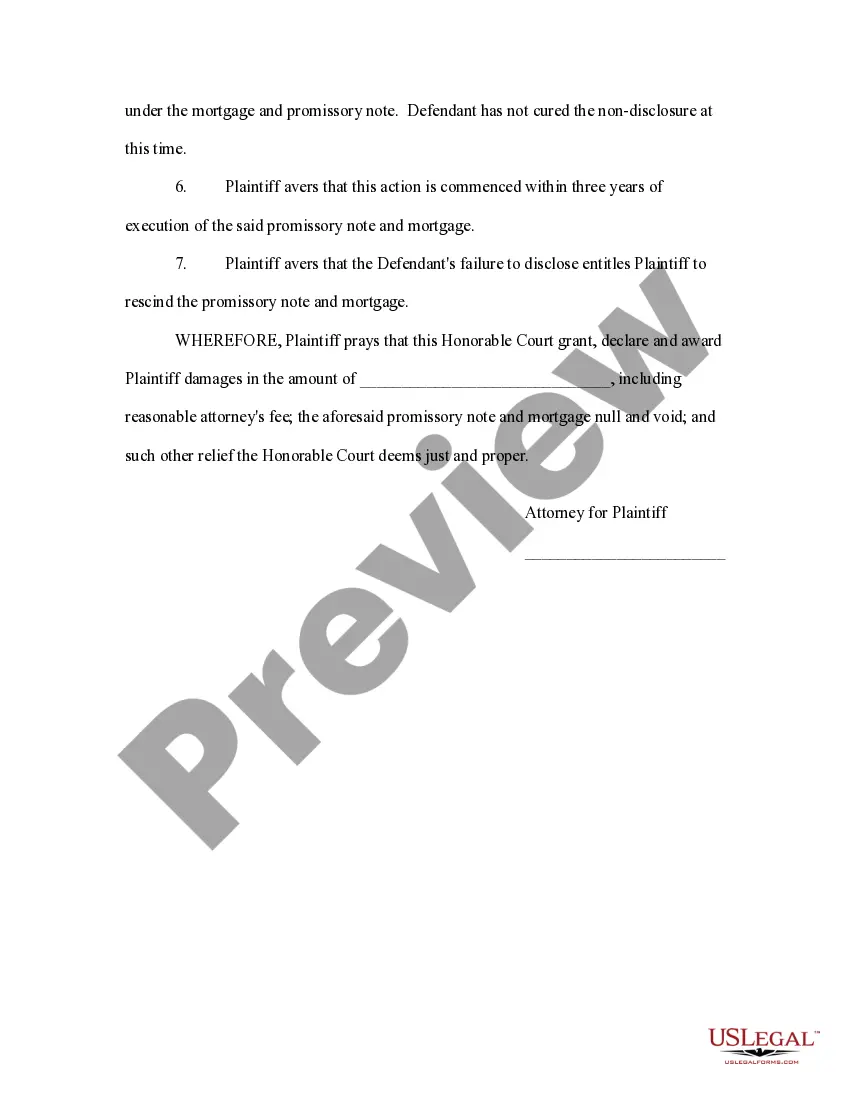

This sample complaint filed in the Circuit Court alleges violations of the Federal Truth-in-Lending Act. Specifically it alleges that certain material disclosures were not made to the plaintiff and seeks to have the promissory note declared null and void.

Alabama Complaint - Federal Truth-in-Lending Act

Description

How to fill out Alabama Complaint - Federal Truth-in-Lending Act?

Utilizing Alabama Complaint - Federal Truth-in-Lending Act instances created by expert lawyers enables you to avoid hassles when preparing paperwork.

Simply obtain the template from our site, complete it, and request a lawyer to review it.

Doing so can spare you considerably more time and expenses than seeking legal advice to develop a document from scratch to fulfill your requirements would.

Utilize the Preview option and read the description (if available) to determine if you need this particular template, and if so, click Buy Now. Search for another template using the Search field if necessary. Choose a subscription that fits your requirements. Begin using your credit card or PayPal. Select a file type and download your document. Once you have completed all of the steps above, you will be able to fill out, print, and sign the Alabama Complaint - Federal Truth-in-Lending Act sample. Remember to verify all entered information for accuracy before submitting or mailing it out. Save time on document preparation with US Legal Forms!

- If you have previously purchased a US Legal Forms subscription, just Log In to your account and return to the forms page.

- Locate the Download button near the template you are examining.

- After downloading a template, you will find all your saved documents in the My documents section.

- If you lack a subscription, that's not an issue.

- Simply adhere to the steps below to register for an account online, acquire, and fill out your Alabama Complaint - Federal Truth-in-Lending Act template.

- Double-check and confirm that you are downloading the correct state-specific form.

Form popularity

FAQ

The Alabama Complaint - Federal Truth-in-Lending Act does not address every possible lending issue. Specifically, it does not cover home mortgages in most cases, nor does it include loans with an established repayment period of less than a year. Understanding these limitations can empower consumers to navigate their financial agreements more effectively.

If you believe you are a victim of predatory lending, it is crucial to take immediate action. You can file a complaint through the Alabama Complaint - Federal Truth-in-Lending Act or consult with legal professionals specializing in consumer rights. Platforms like USLegalForms provide valuable resources to help you report such offenses and seek justice.

The enforcement of the Alabama Complaint - Federal Truth-in-Lending Act falls under the authority of the Consumer Financial Protection Bureau (CFPB). This federal agency ensures compliance with the law, promoting fair lending practices. Consumers can report violations to the CFPB for thorough investigation.

The Alabama Complaint - Federal Truth-in-Lending Act does not apply to all financial transactions. For example, it generally does not cover loans secured by real estate and certain credit transactions like those made under an open-end credit plan. Knowing this can assist borrowers in identifying situations where they may lack protection under the Act.

Certain loans are specifically excluded from the Alabama Complaint - Federal Truth-in-Lending Act. These include loans made primarily for business purposes, loans with a principal amount less than $54,000, and certain student loans. Recognizing these exclusions can help borrowers understand their rights under the law.

The Alabama Complaint - Federal Truth-in-Lending Act does not cover all types of loans. For instance, it excludes business or commercial loans, loans secured by real estate, and certain types of student loans. By understanding what is not included, you can better assess your rights and seek assistance if necessary.

The enforcement of the Truth in Lending Act, or TILA, is primarily carried out by the Consumer Financial Protection Bureau (CFPB). Additionally, other federal and state agencies may also play a role in overseeing compliance. If you suspect a breach of TILA, you can initiate an Alabama Complaint - Federal Truth-in-Lending Act through platforms like uslegalforms, simplifying the process for consumers seeking justice. Awareness and action are key to protecting your rights.

Oversight of the Truth in Lending Act (TILA) is managed by the Consumer Financial Protection Bureau (CFPB) and other federal agencies. These agencies ensure that lenders provide clear and truthful information about credit terms. If you believe a lender has been non-compliant, consider filing an Alabama Complaint - Federal Truth-in-Lending Act. Speaking up helps maintain the integrity of lending practices.

The Consumer Financial Protection Bureau (CFPB) holds the primary responsibility for enforcing the truth in lending law. This agency supervises financial institutions to ensure they adhere to regulations that protect consumers. If you face issues with deceptive lending practices, an Alabama Complaint - Federal Truth-in-Lending Act is a powerful tool to seek resolution. Knowing your rights strengthens your position as a consumer.

The enforcement of TILA requirements falls under the jurisdiction of multiple federal and state regulators, with the CFPB taking the lead. They monitor compliance and investigate complaints related to lending practices. If you believe a lender has violated TILA, consider submitting an Alabama Complaint - Federal Truth-in-Lending Act. Such actions are vital in promoting transparency and fairness in lending.