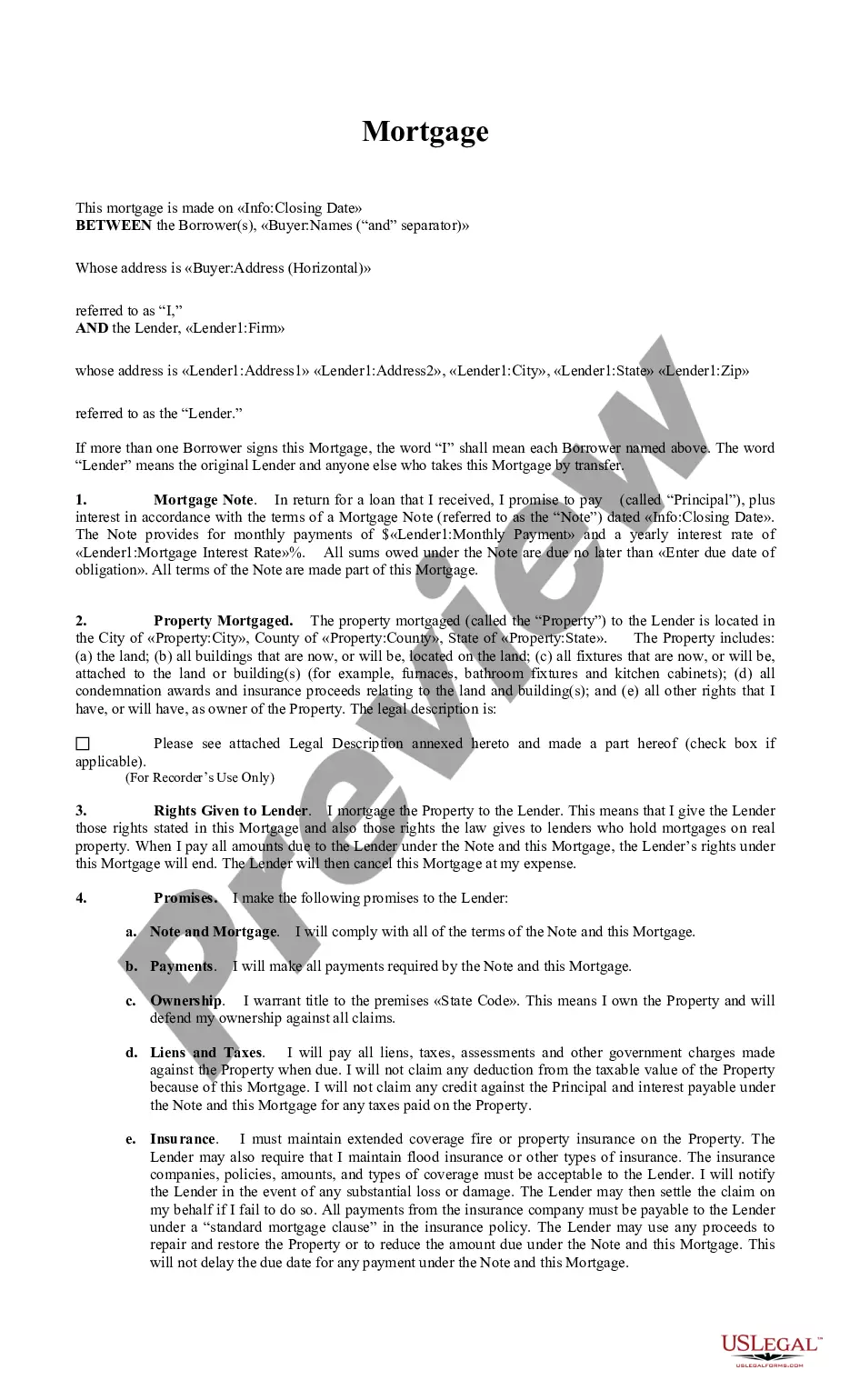

Florida Mortgage is a loan obtained to purchase or refinance real estate located in the state of Florida. It is typically secured by a lien on the property that has been purchased or refinanced. There are different types of Florida Mortgage products available, including conventional mortgages, jumbo mortgages, adjustable-rate mortgages, government-backed mortgages (FHA, VA and USDA), and reverse mortgages. Conventional mortgages are typically available in either a fixed or adjustable rate, and feature competitive interest rates and down payment requirements. Jumbo mortgages are larger loans available for more expensive properties. Adjustable-rate mortgages (ARM's) offer lower initial interest rates that can change over time. Government-backed mortgages are available for those who qualify, and feature lower interest rates and more lenient credit and income requirements. Reverse mortgages are available to homeowners aged 62 and up and allow them to access the equity in their home without having to make payments.

Florida Mortgage

Description

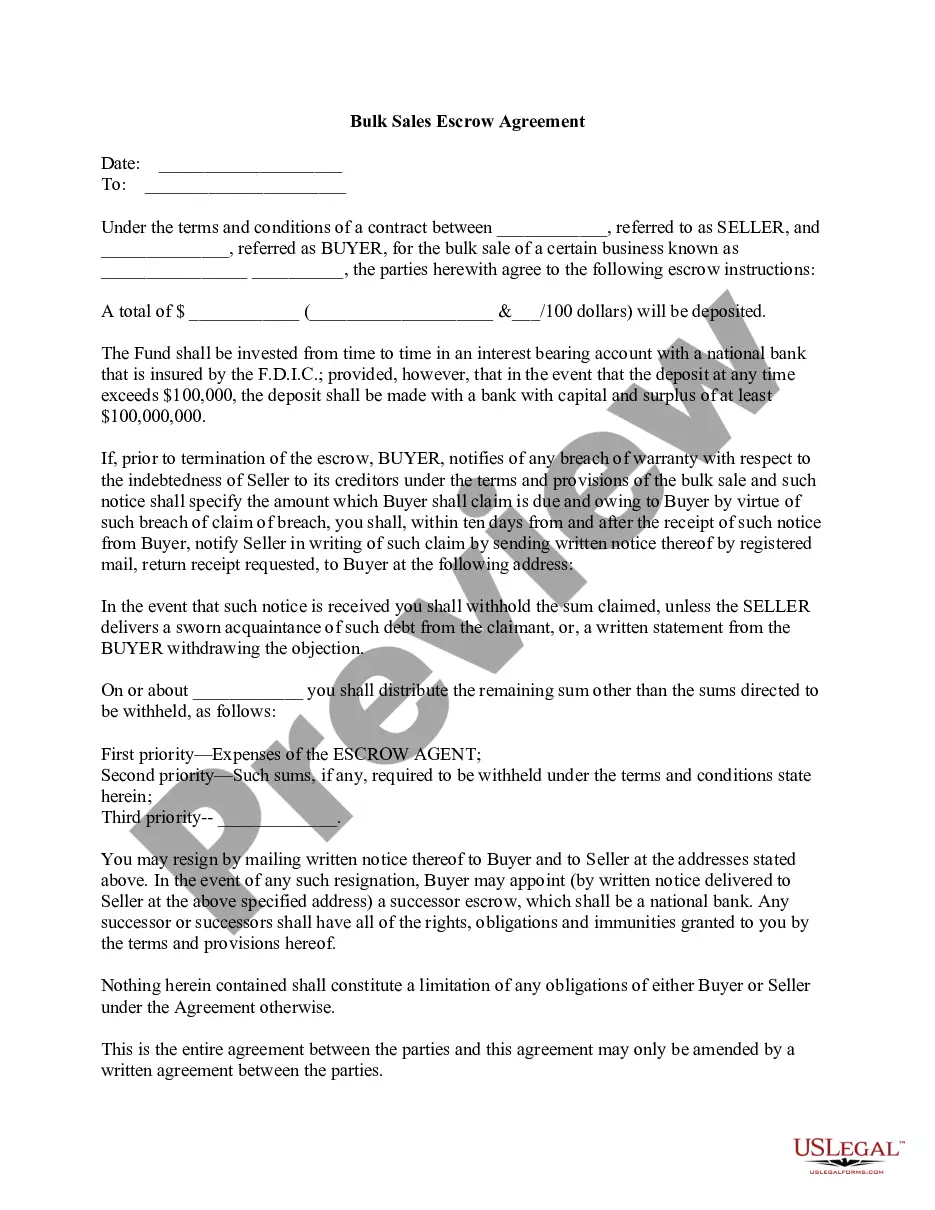

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

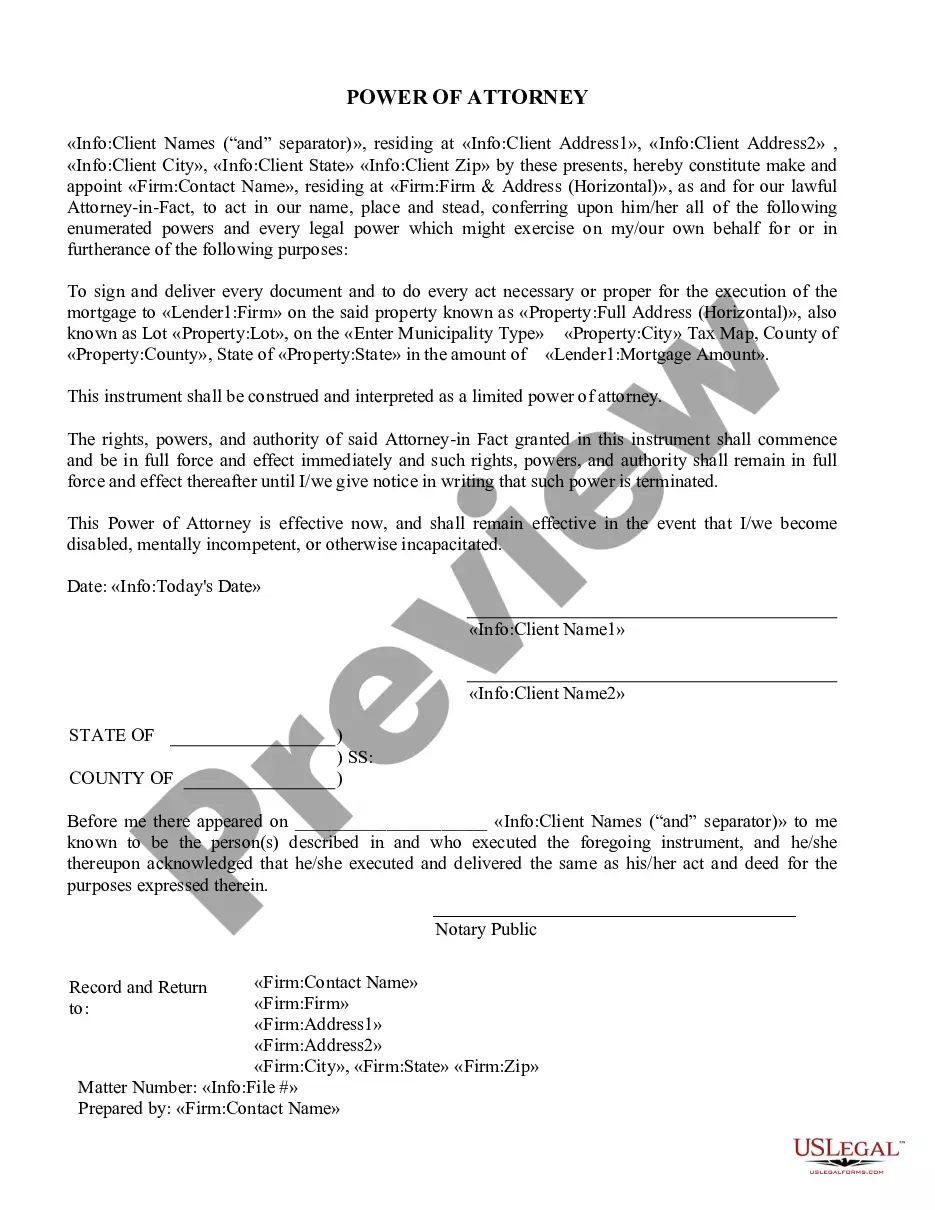

How to fill out Florida Mortgage?

How much time and resources do you frequently invest in drafting official documentation.

There’s a superior method to obtain such forms than employing legal professionals or squandering hours trying to find a suitable template on the internet. US Legal Forms is the leading online repository that offers expertly prepared and validated state-specific legal documents for any use, such as the Florida Mortgage.

Another benefit of our library is that you can access previously acquired documents that you securely keep in your profile under the My documents tab. Retrieve them at any time and redo your paperwork as often as necessary.

Conserve time and effort in completing official paperwork with US Legal Forms, one of the most reliable online services. Register with us today!

- Analyze the form content to verify its compliance with your state regulations. To do this, review the form description or utilize the Preview option.

- If your legal template does not fulfill your needs, search for another one using the search bar located at the top of the page.

- If you already possess an account with us, Log In and download the Florida Mortgage. Otherwise, continue to the following steps.

- Click Buy now after locating the appropriate document. Choose the subscription plan that fits you best to access our library’s entirety.

- Establish an account and remit payment for your subscription. You can complete a transaction using your credit card or via PayPal - our service is entirely secure for this.

- Download your Florida Mortgage to your device and finalize it either on a printed hard copy or digitally.

Form popularity

FAQ

To qualify for a Florida mortgage, first ensure your credit score meets the lender's minimum requirement. Next, prepare proof of consistent income and employment, along with a reasonable debt-to-income ratio. Additionally, having a down payment ready can significantly improve your chances of approval. Overall, being well-prepared is key, and resources like US Legal Forms can help you gather everything needed efficiently.

To get a Florida mortgage, you must meet specific requirements, including proof of income, a valid credit score, and a satisfactory debt-to-income ratio. Additionally, you’ll need to provide personal identification and details about your employment history. Gathering these documents beforehand can streamline your application process. By using platforms like US Legal Forms, you can easily find the necessary documents tailored to meet Florida mortgage standards.

To qualify for a $400,000 Florida mortgage, a general rule is that your monthly income should be around three times your expected mortgage payment. This translates to a gross monthly income of about $12,000, assuming a standard 30-year fixed mortgage at a competitive interest rate. Lenders also consider your debt-to-income ratio, which should ideally be below 43%. Understanding these numbers will help you plan better.

In Florida, the minimum credit score to secure a mortgage usually starts around 580 for FHA loans. However, conventional loans often require a score of at least 620 for approval. Each lender may have different criteria, so it’s wise to check with multiple options. Remember, a higher credit score not only increases your chances of approval but may also secure better interest rates for your Florida mortgage.

Getting approved for a Florida mortgage typically takes anywhere from a few days to several weeks. This timeline can vary based on the lender, the completeness of your application, and necessary documentation. To speed up the process, make sure you have all your financial documents ready. By being prepared, you enhance your chances of a quicker approval.

Obtaining a Florida mortgage license involves completing a pre-licensing education course, passing the national and state exams, and submitting your application with the required documentation. Additionally, keeping up with any continuing education requirements is crucial for maintaining your license. USLegalForms provides valuable resources that can simplify and clarify each step in securing your Florida mortgage license.

The difficulty of the mortgage license test in Florida can vary based on your preparation. Many find it challenging without proper study, as it covers essential financial regulations and mortgage practices. To help improve your chances of success, consider accessing study materials and practice tests available through resources like USLegalForms, specifically designed for Florida mortgages.

Yes, mortgages in Florida must be recorded to provide public notice of the lender's interest in the property. Recording the mortgage protects the lender's rights and helps avoid disputes regarding ownership. To simplify this process, consider using USLegalForms, which offers resources that guide you through the recording requirements for Florida mortgages.

The time it takes to secure a mortgage broker license in Florida can vary, typically taking from several weeks to a few months. Factors such as the completion of your pre-licensing education and the processing time of your application can influence this duration. By leveraging tools from USLegalForms, you can streamline your application, ensuring a quicker turnaround for your Florida mortgage license.

To obtain a mortgage license in Florida, you must first complete a pre-licensing course approved by the state. After completing the course, you will submit your application and required fees to the Florida Office of Financial Regulation. Resources like USLegalForms provide helpful insights and documentation to guide you through the licensing process for Florida mortgages.