Private Annuity Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

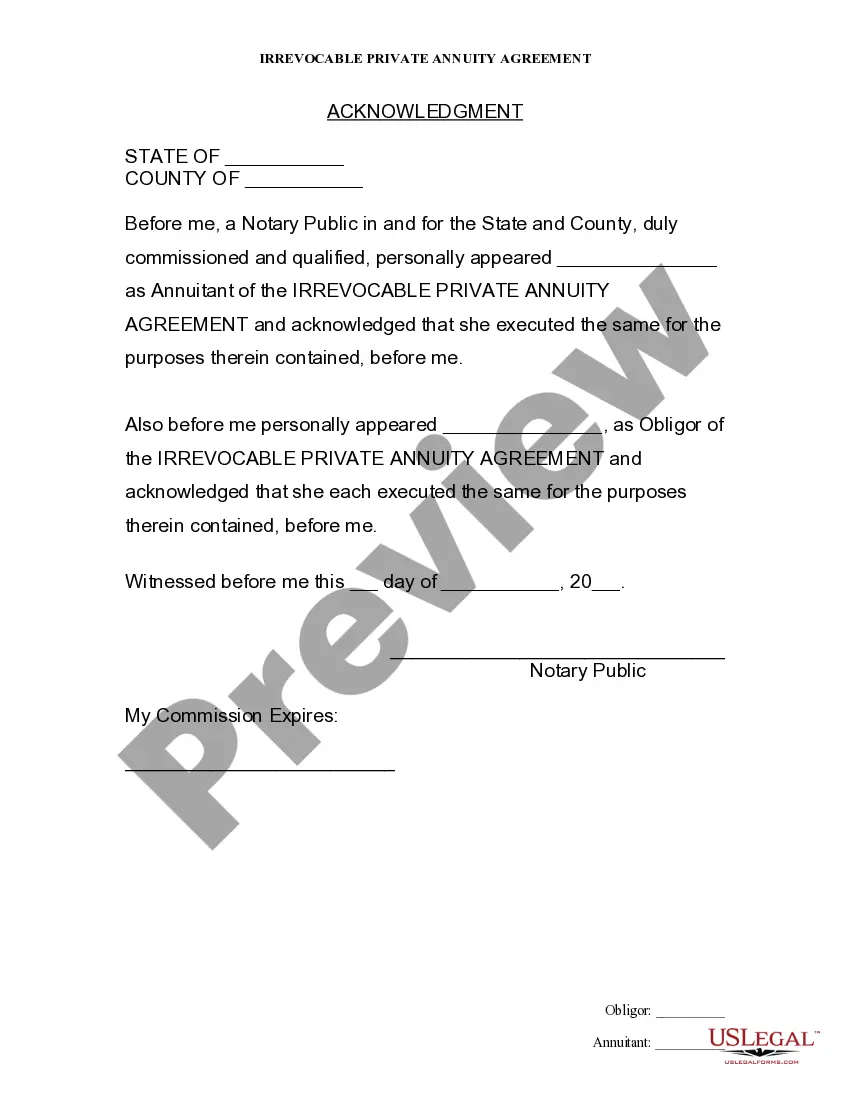

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Private Annuity Agreement?

US Legal Forms is the most simple and cost-effective way to locate appropriate legal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with national and local laws - just like your Private Annuity Agreement.

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

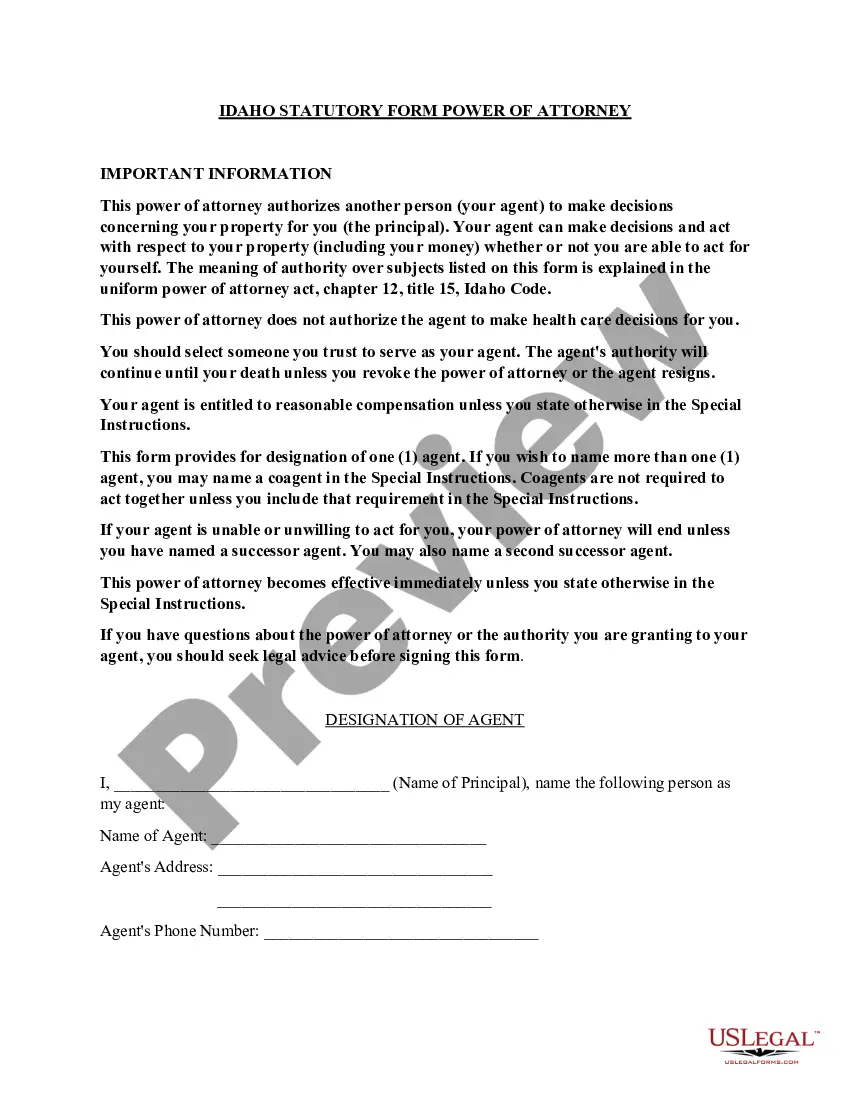

And here’s how you can obtain a professionally drafted Private Annuity Agreement if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one corresponding to your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you like most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Private Annuity Agreement and save it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your reputable assistant in obtaining the corresponding official documentation. Try it out!

Form popularity

FAQ

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

There are three ways to avoid paying taxes on annuities, purchasing a Roth Annuity or Charitable Gift Annuity for retirement income and a long-term care annuity to pay for qualified long-term care facilities and services. Finally, most structured settlements are income-tax-free.

A $50,000 annuity would pay you approximately $260 each month for the rest of your life if you purchased the annuity at age 70 and began taking payments immediately. This guide will answer the following questions: What is the monthly payout for a $50,000 annuity?

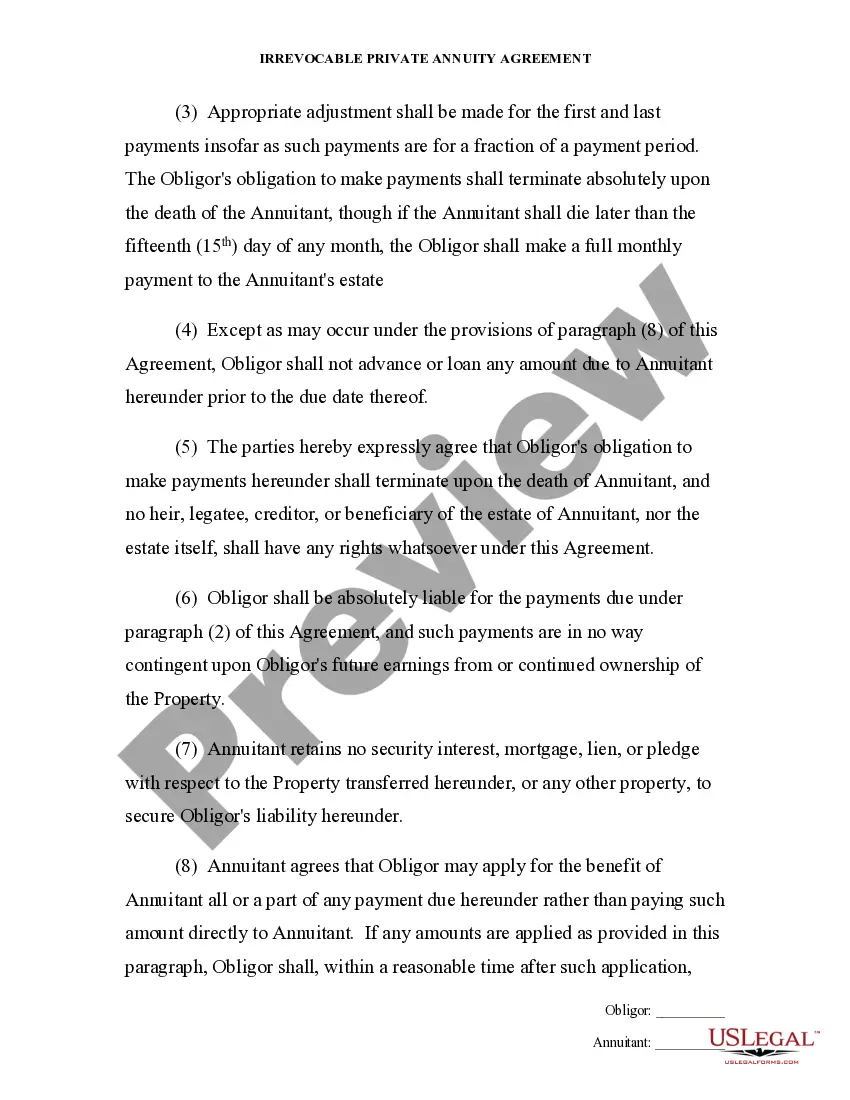

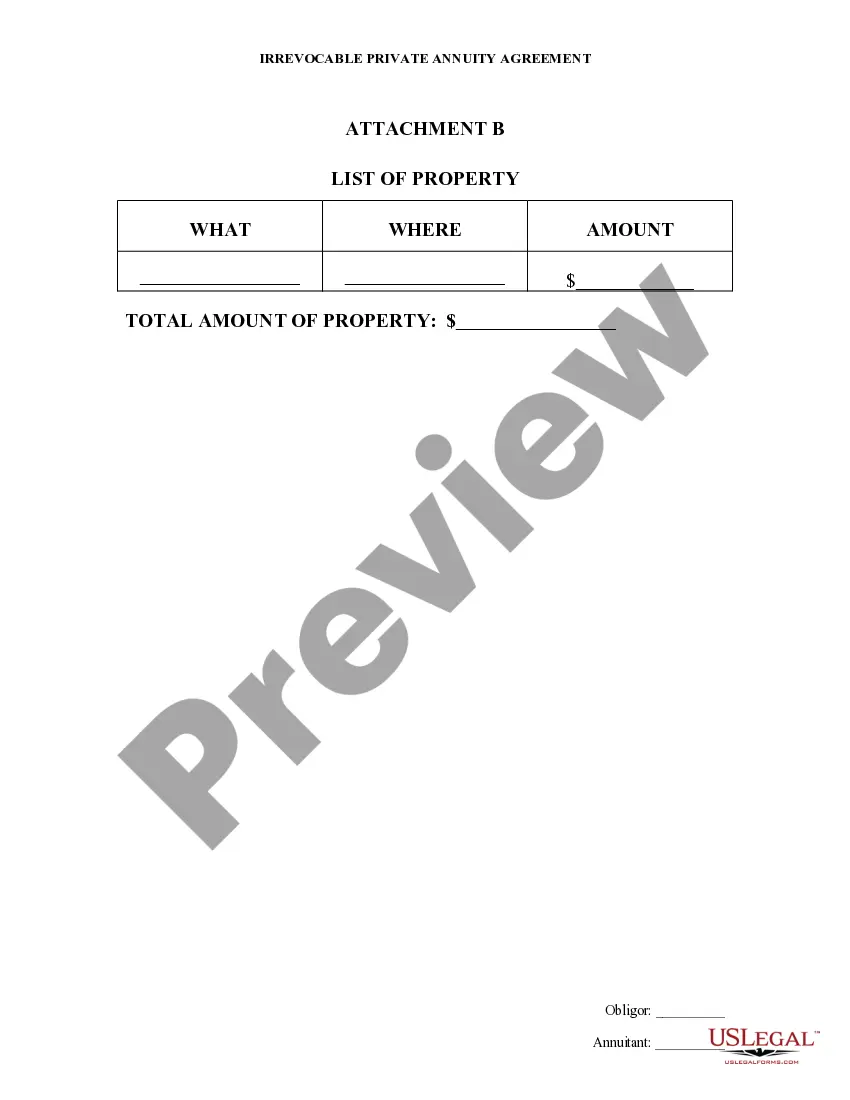

A private annuity is an arrangement where an individual (the ?annuitant?) transfers assets to another (the ?obligor?) in exchange for regular payments for the remainder of the annuitant's life (an ?annuity?).

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

Investing in a private annuity comes with the risk of inflation, which is when prices rise faster than your payments. This can drastically reduce an individual's purchasing power over time and bring financial difficulties to those who rely on their annuity income.

Disadvantages of a Private Annuity The buyer takes on 'reverse mortality risk'. If the seller lives longer than expected, the buyer could pay considerably more than the fair market value for the asset he/she bought. If the buyer stops paying, the seller generally has no collateral.

Annuity withdrawals made before you reach age 59½ are typically subject to a 10% early withdrawal penalty tax.