Private Annuity Agreement with Payments to Last for Life of Annuitant

Definition and meaning

A Private Annuity Agreement with Payments to Last for Life of Annuitant is a legal document that establishes a financial arrangement where one party, known as the Grantor, agrees to pay another party, known as the Annuitant, an annual sum of money for the duration of the Annuitant's life. This agreement is often used for estate planning purposes, enabling the Grantor to transfer property or assets while ensuring the Annuitant receives regular payments during their lifetime.

How to complete a form

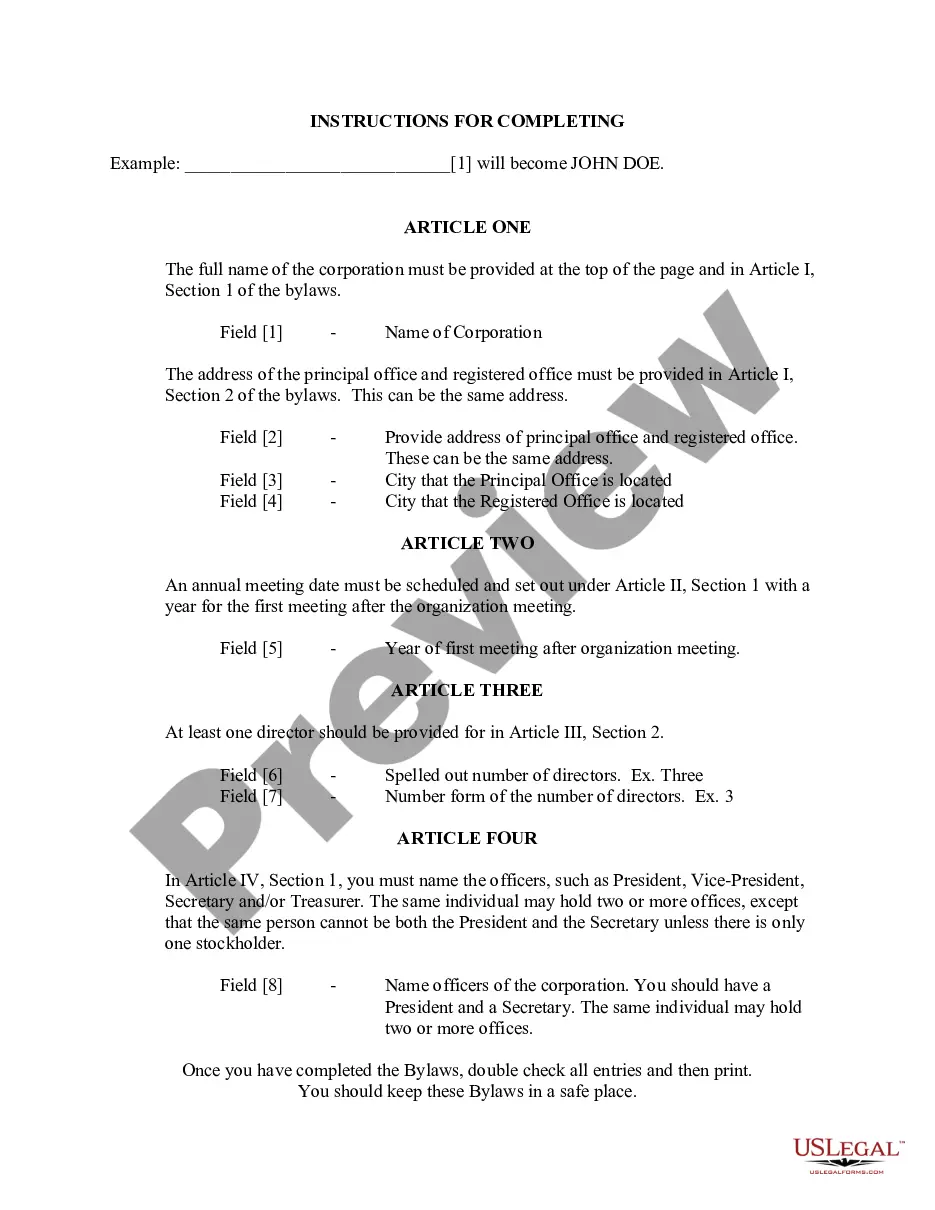

Completing a Private Annuity Agreement involves several important steps:

- Gather information: Collect the names, addresses, and relevant financial details for both the Annuitant and the Grantor.

- Fill in the details: Enter the date of the agreement, the dollar amount to be paid, and the frequency of payments (usually monthly).

- Sign the agreement: Obtain signatures from both parties and any required witnesses.

- Notarization: Depending on your state, you may need to have the document notarized for it to be legally binding.

Make sure to keep a copy for your records.

Who should use this form

This form is beneficial for individuals who wish to secure their financial future through a guaranteed income stream during retirement. It is particularly useful for:

- Individuals looking to sell property or assets while ensuring recurring payments.

- People involved in real estate transactions.

- Those engaged in estate planning who want to provide benefits to a family member or partner.

Key components of the form

The Private Annuity Agreement consists of several crucial elements:

- Parties involved: Clearly identifies the Annuitant and Grantor.

- Payment terms: Specifies the amount and frequency of payments.

- Duration of payments: Indicates that payments will continue until the death of the Annuitant.

- Signatures: Requires signatures from both parties and notarization, if necessary.

Common mistakes to avoid when using this form

When filling out a Private Annuity Agreement, it is important to avoid these common errors:

- Neglecting to provide accurate information about the parties involved.

- Not fully understanding the payment structure.

- Failing to sign and date the agreement or having it notarized when required.

- Overlooking state-specific rules that may affect the legality of the agreement.

What documents you may need alongside this one

To complete the Private Annuity Agreement, you may also require the following documents:

- Proof of identity for both the Annuitant and Grantor.

- Documentation of the asset or property being utilized for the annuity.

- Any previous agreements relevant to the transaction.

- State-specific forms related to the notarization process.

What to expect during notarization or witnessing

Notarization is an important step in validating the Private Annuity Agreement. Here's what to expect:

- The parties involved will need to present identification to the notary public.

- Each person signing will do so in the presence of the notary.

- The notary will then affix their seal and signature, confirming the authenticity of the agreement.

- It is advisable to ask the notary any questions about the process to ensure clarity.

Form popularity

FAQ

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed upon schedule in exchange for the property transfer.Agreement contract provisions are created and agreed to by both parties.

Consequently, under no circumstances can a private annuity be secured with the asset transferred, or any other collateral.Insuring the life of the transferee is an available option; however, any connection of the life insurance policy to the private annuity will be deemed as a secured transaction.

Annual payments of $4,000 10 percent of your original investment is non-taxable. You live longer than 10 years. The money you receive beyond that 10-year-life expectation will be taxed as income.

All appreciation and/or earnings from the annuity property after the sale are outside of the Annuitant's estate and not subject to estate tax. 3. Upon the Annuitant's death, the annuity obligation terminates and nothing is included in the Annuitant's gross estate.

The taxable part of your pension or annuity payments is generally subject to federal income tax withholding. You may be able to choose not to have income tax withheld from your pension or annuity payments (unless they're eligible rollover distributions) or may want to specify how much tax is withheld.

When you receive payments from a qualified annuity, those payments are fully taxable as income. That's because no taxes have been paid on that money. But annuities purchased with a Roth IRA or Roth 401(k) are completely tax free if certain requirements are met.