Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral

Definition and meaning

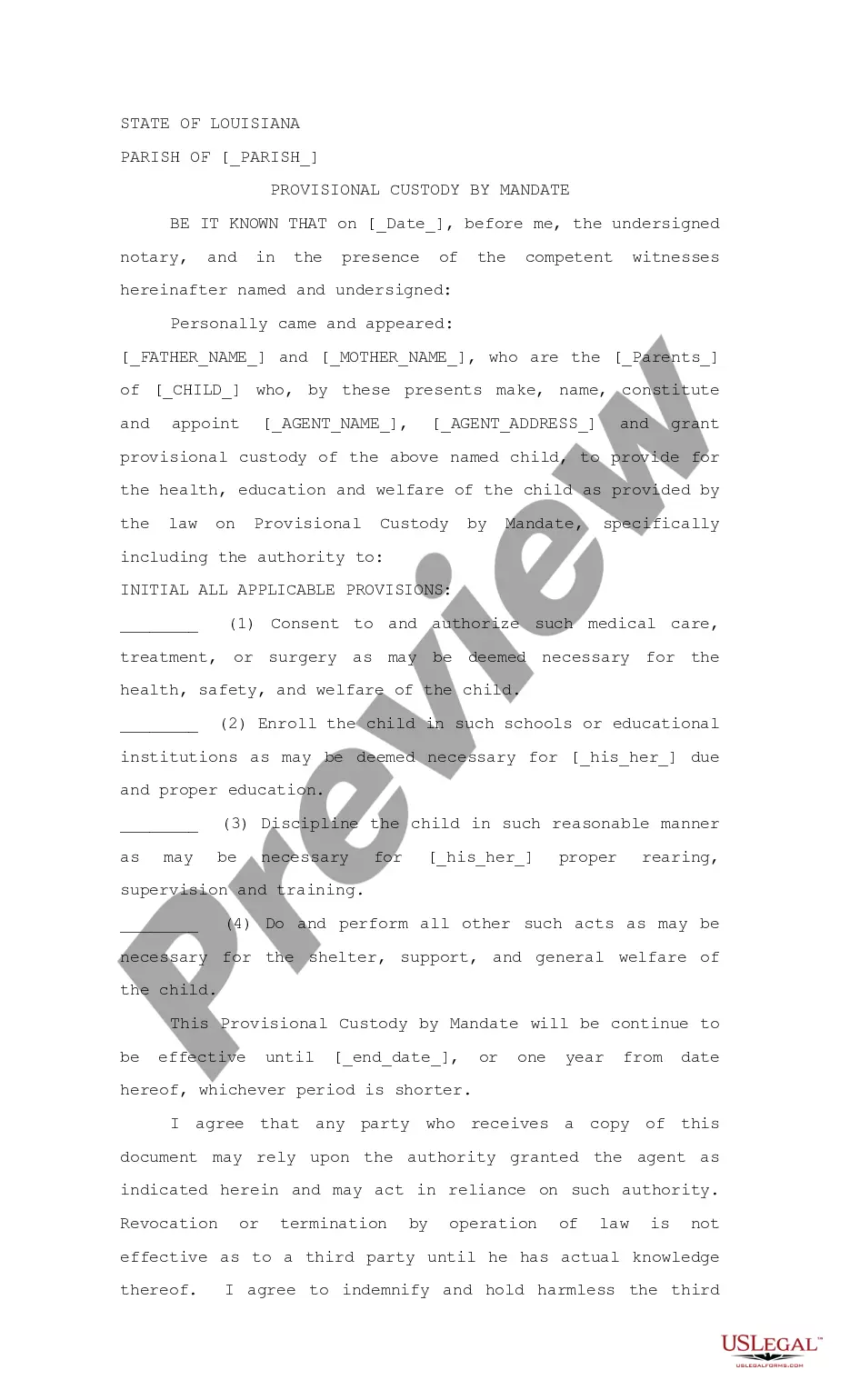

The Assignment of Life Insurance Proceeds to a Funeral Home for the Purpose of Pre-Arranging a Funeral is a legal document that allows an individual, referred to as the Assignor, to transfer the ownership rights of a life insurance policy to a funeral home. This transfer ensures that the proceeds from the policy will be used exclusively to cover funeral costs upon the death of the insured person.

How to complete a form

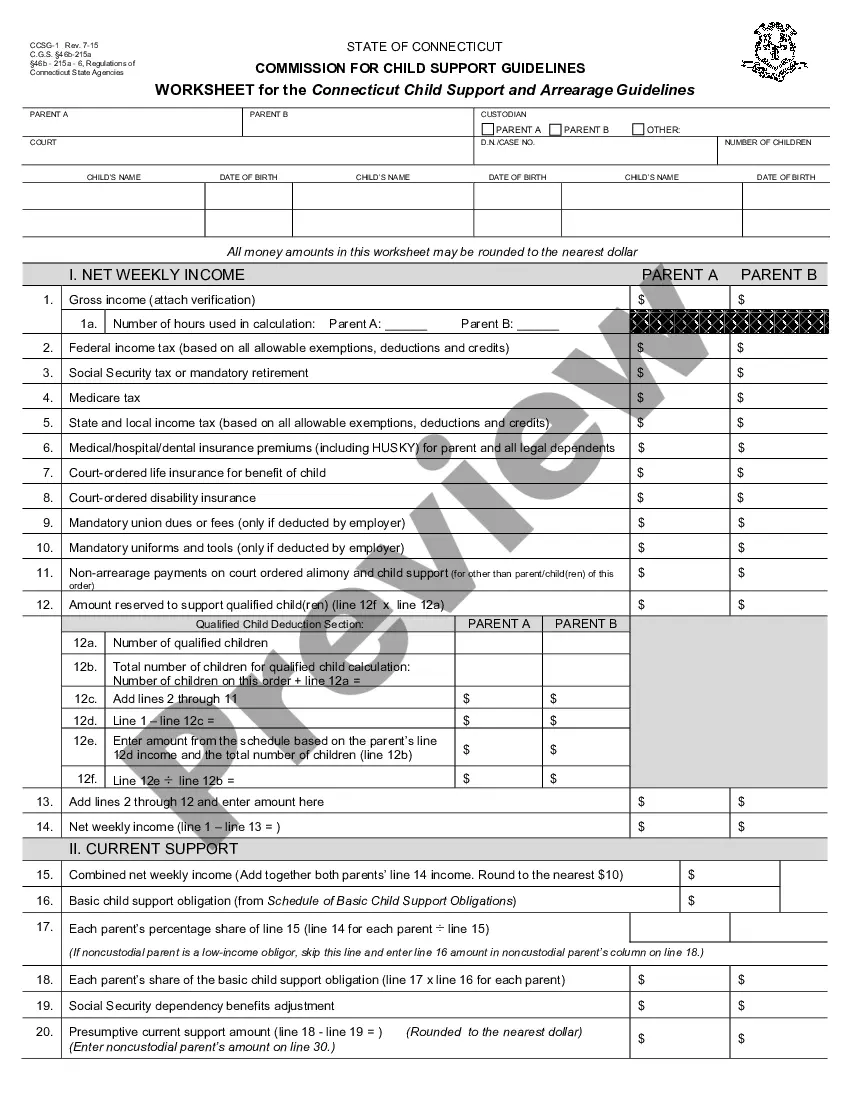

Completing the Assignment of Life Insurance Proceeds form requires attention to detail. Follow these simple steps:

- Gather necessary information: Collect all relevant details about the Assignor, the Funeral Home, and the life insurance policy.

- Fill in the form: Clearly enter the date of assignment, names, and addresses as specified in the form sections.

- Sign and date: Ensure that both the Assignor and an authorized representative of the funeral home sign the document.

Make sure to retain copies of the completed form for your records.

Who should use this form

This form is intended for individuals who wish to pre-arrange their funeral services or those of a loved one through a designated funeral home. It is especially useful when the person who owns the life insurance wishes to ensure that the policy proceeds are directly applied to cover their funeral expenses. This can provide peace of mind by easing the financial burden on family members during a difficult time.

Key components of the form

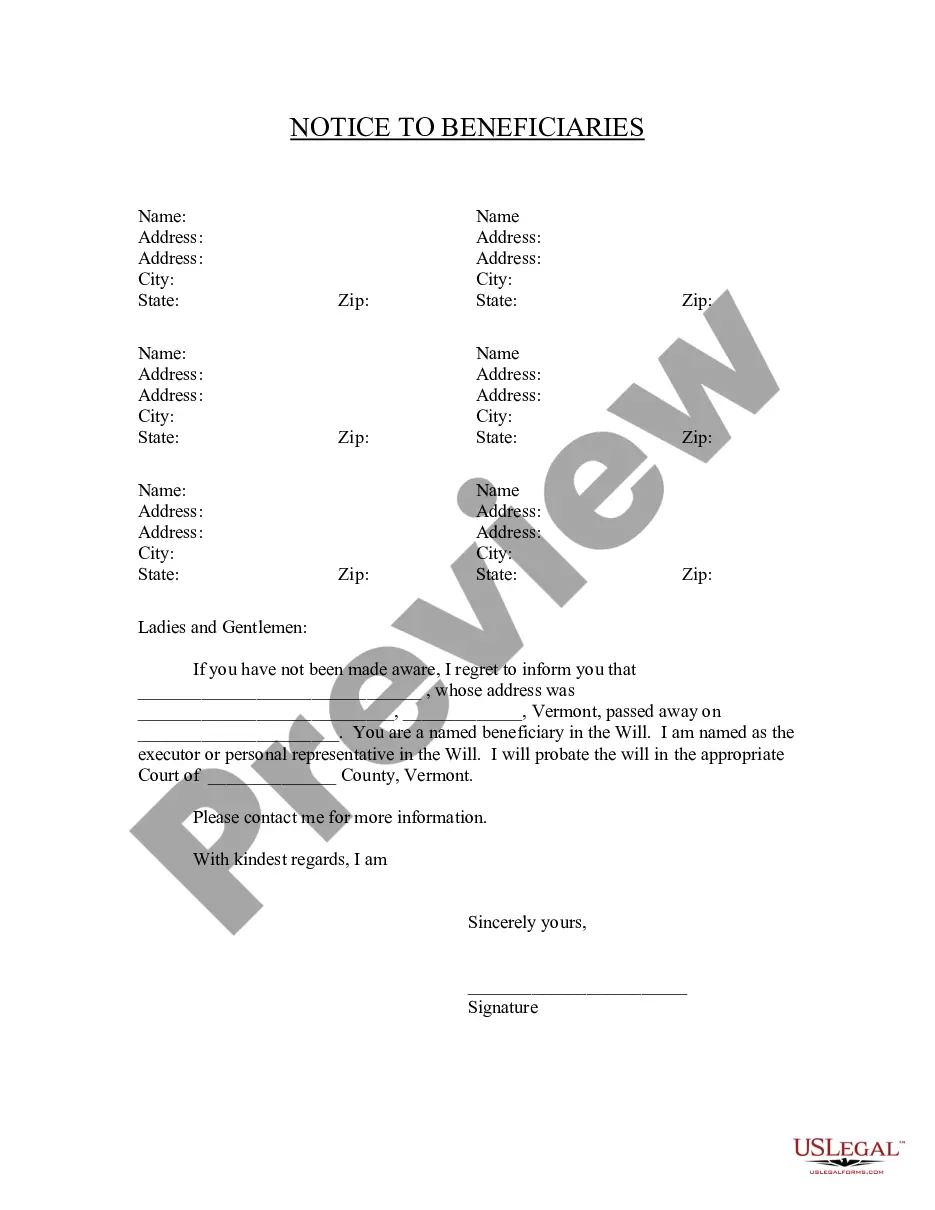

The Assignment of Life Insurance Proceeds form includes several essential components:

- Date of assignment: The date when the assignment is made.

- Name of Assignor: The individual assigning the life insurance proceeds.

- Name of Funeral Home: The entity receiving the assignment.

- Description of the Policy: Details regarding the life insurance policy being assigned.

- Trustee information: Details regarding any trust associated with the policy proceeds.

These components ensure that the assignment is legally binding and clearly outlines the responsibilities and rights of all parties involved.

Legal use and context

The Assignment of Life Insurance Proceeds is a legally recognized document that serves to clarify the distribution of policy proceeds upon death. This is particularly beneficial in situations where the insured person wishes to have specific funeral arrangements without leaving the financial burden on surviving family members. Legal professionals often recommend this assignment to avoid disputes over financial arrangements related to funeral services.

Benefits of using this form online

Utilizing an online platform to complete the Assignment of Life Insurance Proceeds form provides several advantages:

- Accessibility: Users can access the form anytime and anywhere, making it convenient to complete and submit.

- Guidance: Online templates often offer assistance and explanations for each section, reducing the likelihood of errors.

- Speed: Online completion usually expeditates the filling and submission process compared to manual methods.

This modern approach greatly improves user experience and streamlines the overall process of preparing for future funeral arrangements.

Form popularity

FAQ

The good news is that most funeral homes will wait for a payment from your life insurance policy to come through, before demanding payment for services. They are very used to dealing with this situation and will likely have policies in place for processing payments at a later date.

Beneficiary Assignment A beneficiary of a life insurance policy can fill out an assignment form at the funeral home, which will allow payment of the settlement to go directly to the funeral home. Again, any money left over is given back to the beneficiaries named once the funeral expenses are settled.

A beneficiary of a life insurance policy can fill out an assignment form at the funeral home, which will allow payment of the settlement to go directly to the funeral home. Again, any money left over is given back to the beneficiaries named once the funeral expenses are settled.

A Funeral Assignment is an agreement that is signed by a beneficiary of a life insurance policy. The beneficiary assigns all or a portion of the life insurance benefits at the Funeral Home which allows payment for funeral expenses to be made directly to the funeral home.

If the deceased person had a life insurance policy with a named beneficiary, it is not part of the estate. The proceeds pass directly to the beneficiary. The beneficiary has no obligation to pay for the funeral using the life insurance proceeds.

To take out a life insurance policy on someone else, you'll need to prove to the insurance company that you have something called insurable interest . You can roughly translate that to "financial interest, which means that you would need to prove that if the insured were to die, it would financially burden you.

Make Sure the Policy is Assignable.Funeral homes generally accept a life insurance policy in lieu of payment for a funeral, though it's best not to assume that they will. Remember, if they do accept a policy as payment, it must be assignable. Retirement benefits and 401(k) benefits are not assignable.