Vermont Last Will and Testament for other Persons

What this document covers

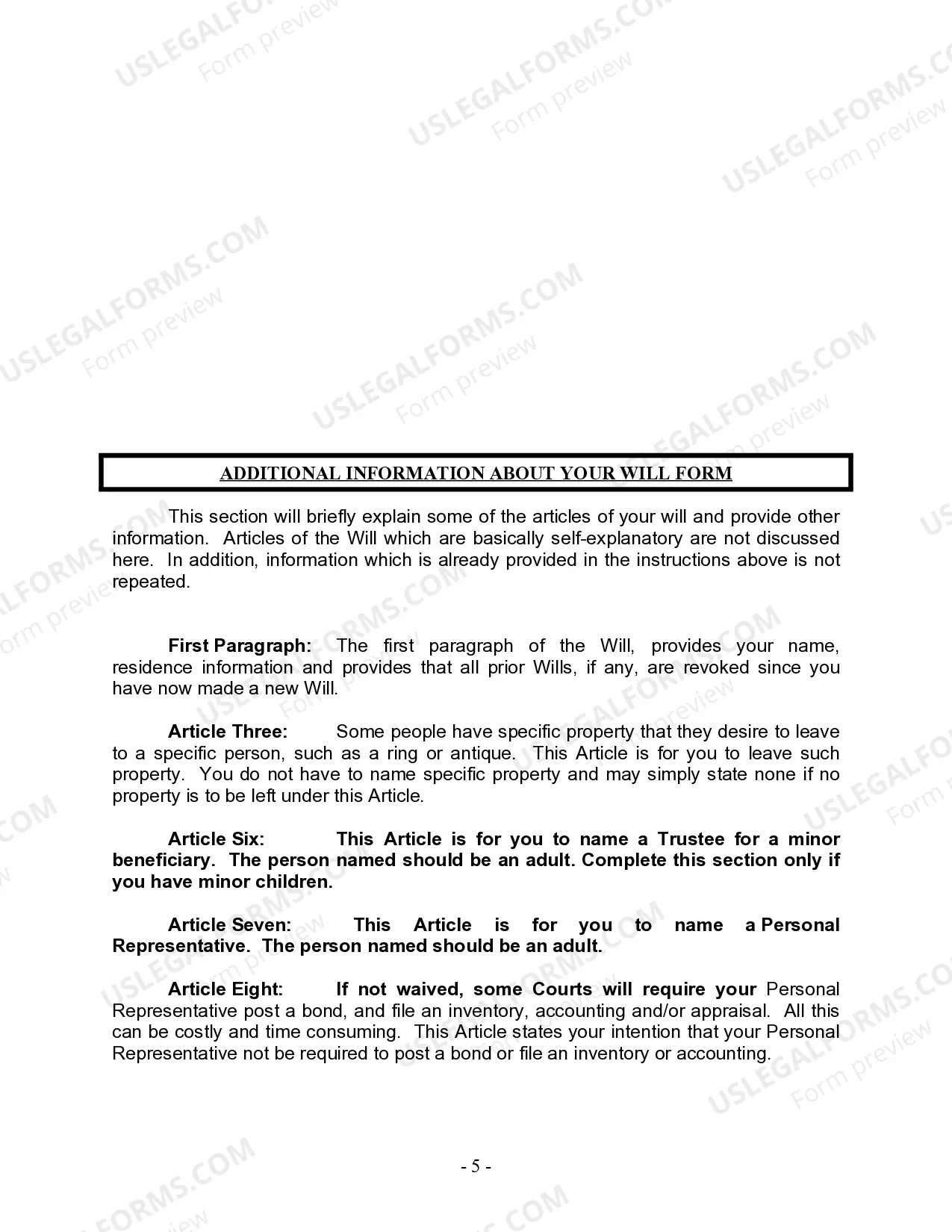

The Last Will and Testament for Other Persons is a legal document that allows individuals in Vermont to outline how their property will be distributed upon their death. This form is ideal for those who cannot find a specific will template to meet their needs. It clearly designates beneficiaries, a personal representative, and provides for guardianship of minors, offering a comprehensive solution to estate planning.

What’s included in this form

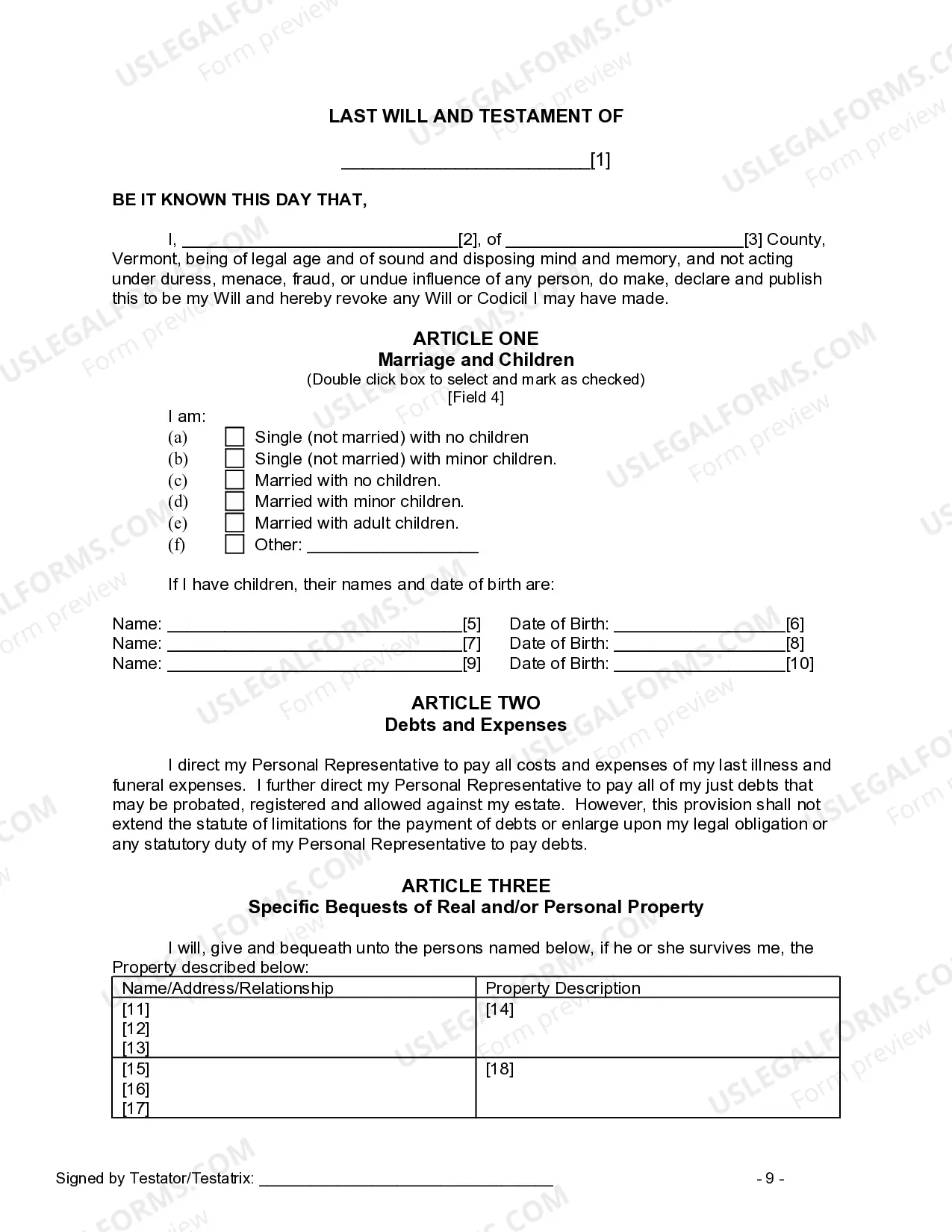

- Identification of the Testator: Name and residence details.

- Marital status and information about children, including names and birth dates.

- Specific bequests that allow the Testator to leave particular items to designated individuals.

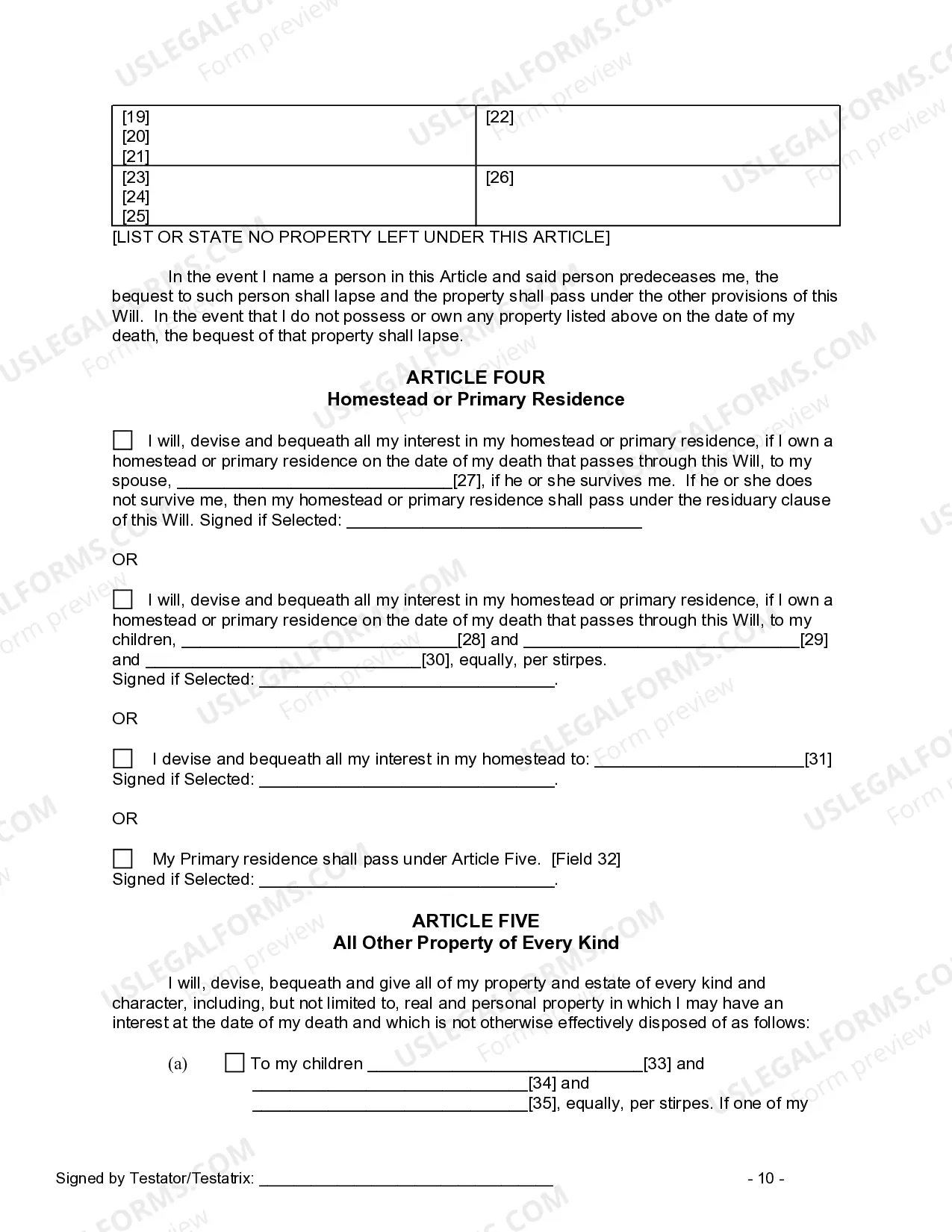

- Provisions for the homestead or primary residence, detailing how it will be allocated.

- Appointment of a personal representative to manage the estate.

- Trust stipulations for minor beneficiaries and guardianship details.

When this form is needed

This form should be used when an individual in Vermont wants to ensure that their assets are distributed according to their wishes after death. It is particularly important if the individual has minor children or specific items of value they wish to bequeath to certain people, and it helps prevent potential disputes among family members over estate distribution.

Who this form is for

- Adults aged 18 and older who are residents of Vermont.

- Individuals with children or dependents who need guardianship provisions.

- People with specific property they want to dictate to specific heirs.

- Anyone seeking to create a clear directive for their estate distribution.

Steps to complete this form

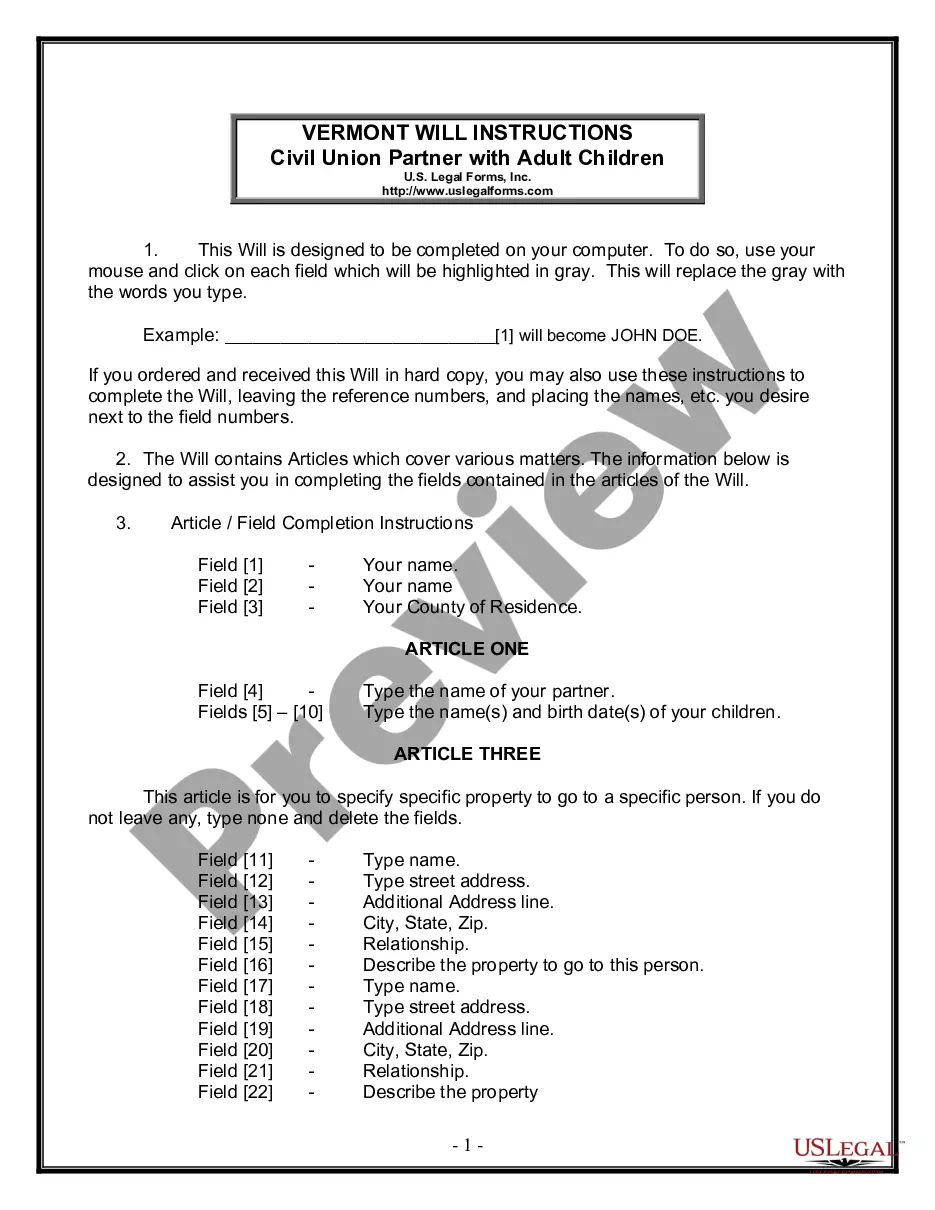

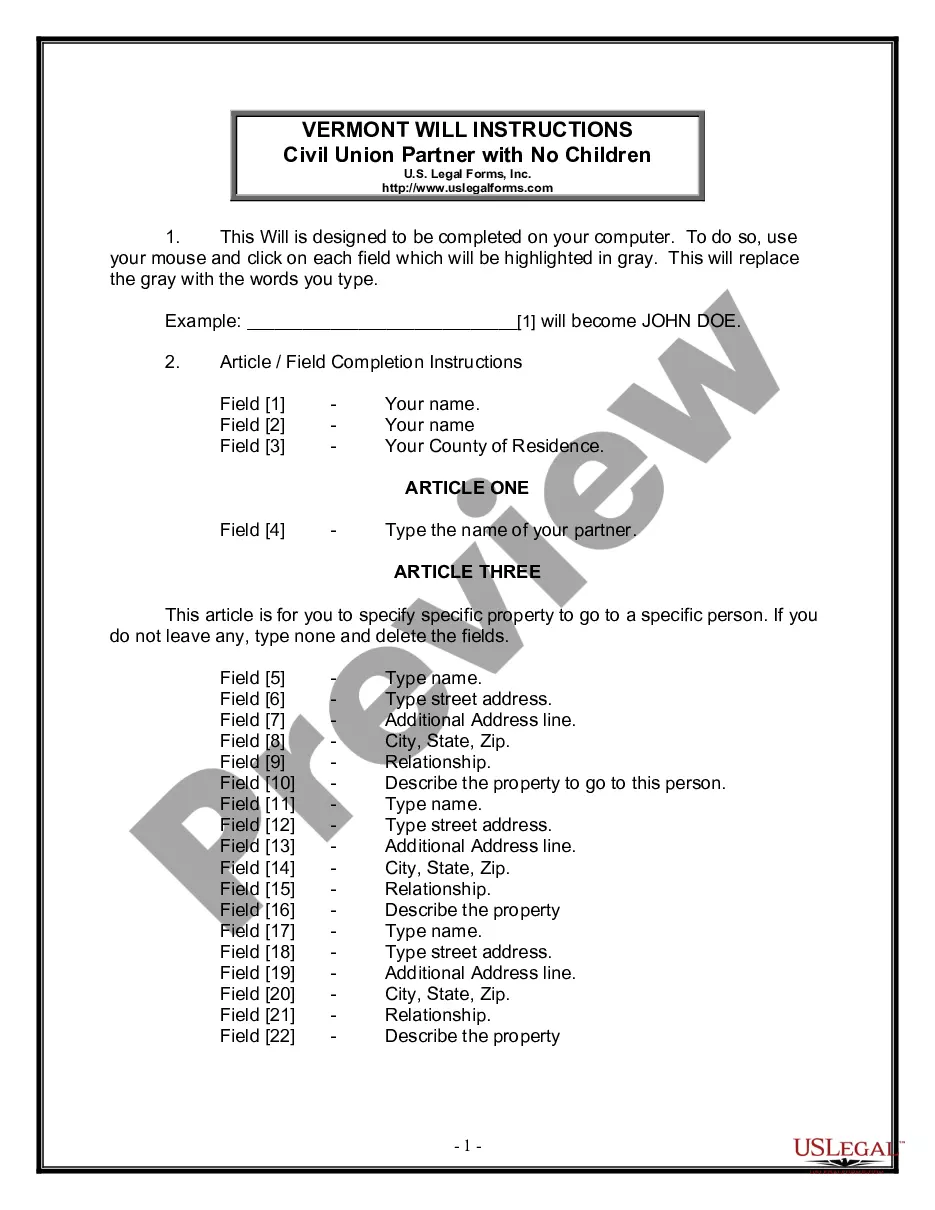

- Begin by filling in your personal details, including your name and county of residence.

- Specify your marital status and enter information regarding any children, including their names and dates of birth.

- Indicate specific items you want to bequeath by providing beneficiary names and property descriptions.

- Appoint a personal representative and any alternate representatives to manage your estate.

- Sign the completed will in the presence of two witnesses and consider notarizing it for added validity.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Common mistakes to avoid

- Failing to update the will after major life changes such as marriage, divorce, or the birth of children.

- Not witnessing the will according to state law requirements, which can invalidate the document.

- Omitting essential information about specific bequests, leaving room for ambiguity.

Key takeaways

- The Last Will and Testament for Other Persons is a crucial legal document for estate planning in Vermont.

- It provides clear instructions for asset distribution, guardianship, and the appointment of a personal representative.

- Proper completion and witnessing are vital to ensure the will is legally enforceable and valid.

Form popularity

FAQ

As an aside, Vermont Statute Title 32 § 1143 states that executors may be paid $4 per day spent in court, but this is geared towards the court paying appointed agents, and that amount was set in 1866.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

In Vermont, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The testator or person making the will must be at least 18 years of age; 2022 the testator must be of sound mind; 2022 the will must be in writing; 2022 the will must be signed by the testator or the testator's name is written by another person in the testator's presence and at the testator's express direction; 2022 the

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

No, in Vermont, you do not need to notarize your will to make it legal. However, Vermont allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.