Rabbi Engagement Agreement

Overview of this form

The Rabbi Engagement Agreement is a formal document that outlines the terms of engagement between a Rabbi and a synagogue. This agreement specifies the duties, responsibilities, and conditions of employment for the Rabbi, distinguishing it from other clergy contracts by focusing specifically on the unique requirements of a Jewish spiritual leader. It assures clarity in the relationship between the Rabbi and the synagogue, which is crucial in light of recent legal classifications regarding clergy employment status.

Key components of this form

- Appointment: Details the Rabbi's appointment as spiritual leader.

- Power, Duties, and Conditions: Outlines the Rabbi's responsibilities and rights.

- Honoraria: Specifies how the Rabbi may retain honoraria for services rendered.

- Term: Defines the duration of the contract.

- Termination: Conditions under which either party may terminate the agreement.

- Responsibilities on Termination: Instructions for vacating residence after termination.

Situations where this form applies

This form should be used when a Rabbi is appointed to serve as the spiritual leader of a synagogue. It formalizes the relationship and expectations between the Rabbi and the synagogue, making it essential for both parties to understand their rights and obligations during and after the term of service. This agreement is particularly important to avoid misclassification of clergy members under IRS guidelines.

Intended users of this form

- Synagogues seeking to hire a Rabbi.

- Rabbis who are being engaged by a synagogue.

- Boards of Directors of synagogues responsible for clergy appointments.

How to complete this form

- Identify the Rabbi and the synagogue, including their addresses and contact information.

- Specify the appointment date and the term length of the agreement.

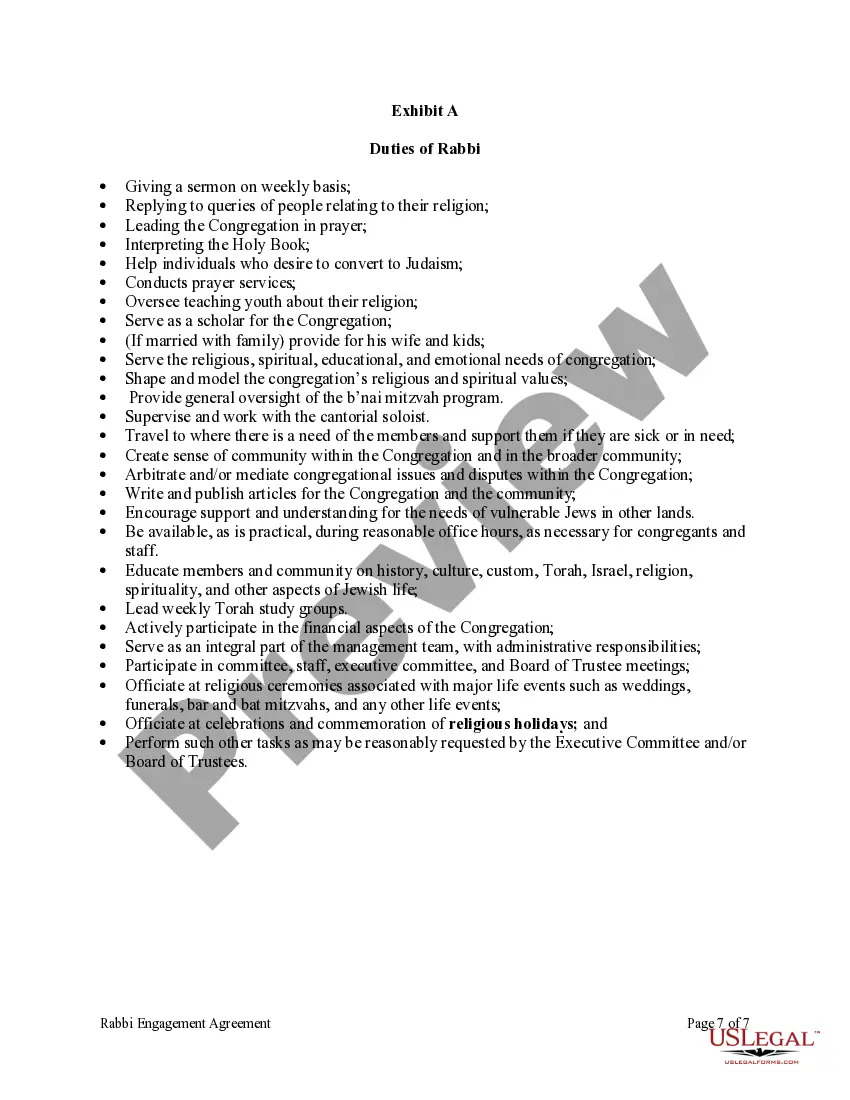

- Detail the Rabbi's specific duties and expectations within the document.

- Include provisions regarding honoraria and outside activities as negotiated.

- Ensure that both parties sign and date the agreement to finalize it.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to specify the term length can lead to misunderstandings.

- Not detailing the Rabbi's duties may create ambiguity in expectations.

- Overlooking the section on termination could complicate future exits.

Why use this form online

- Convenience of accessing the form anytime and anywhere.

- Ability to edit and customize the agreement to fit specific needs.

- Reliable templates drafted by licensed attorneys ensure legal compliance.

Looking for another form?

Form popularity

FAQ

Rabbi, (Hebrew: my teacher or my master) in Judaism, a person qualified by academic studies of the Hebrew Bible and the Talmud to act as spiritual leader and religious teacher of a Jewish community or congregation.

Emeritus (/025902c8m025br026at0259s/; female: Emerita), in its current usage, is an adjective used to designate a retired chair, professor, pastor, bishop, pope, director, president, prime minister, rabbi, emperor, or other person who has been "permitted to retain as an honorary title the rank of the last office held".

Acts of the Apostles, 5 speaks of Gamaliel as a man held in great esteem by all Jews and as the Jewish law teacher of Paul the Apostle in Acts 22:3. Gamaliel encouraged his fellow Pharisees to show leniency to the apostles of Jesus Christ in Acts .

But do not be called Rabbi; for One is your Teacher, and you are all brothers. Do not call anyone on earth your father; for One is your Father, He who is in heaven.Consider This: The word Rabbi comes from the Hebrew word rab or rav, meaning great as in numerous or much.

The title of a Jewish expounder of the Law. The word is Greek for My Master, through the Hebrew rabi, from the root rab, lord, chief.

The primary role of a rabbi is to teach Torah. In addition, rabbis often act as the religious leader of a Jewish community. In contrast to many other religions, a rabbi is not required to be present at life cycle events in Judaism. Nevertheless, rabbis still normally preside over life cycle events.

At the present time, an ordained graduate of a rabbinical seminary that is affiliated with one of the modern branches of Judaism, Reform, Conservative, Reconstructionist, or modern Orthodox, will find employmentwhether as a congregational rabbi, teacher, chaplain, Hillel director, camp director, social worker or

In this page you can discover 28 synonyms, antonyms, idiomatic expressions, and related words for rabbi, like: Jewish teacher, Jewish minister, master, teacher, Hebrew doctor of laws, religious functionary, Hebrew theologian, eliezer, , shlomo and Yaakov.