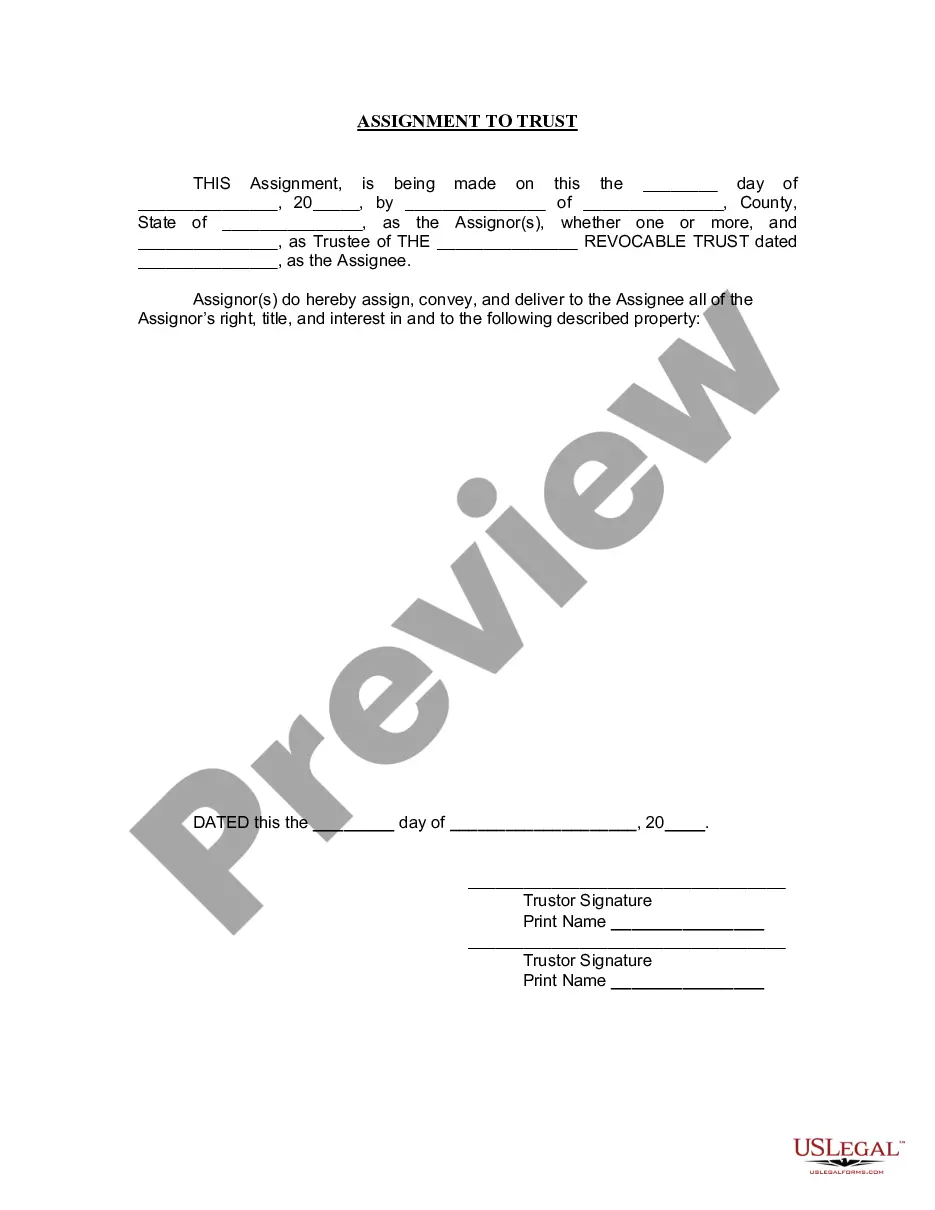

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Virginia Assignment to Living Trust

Description

How to fill out Virginia Assignment To Living Trust?

Looking for a Virginia Assignment to Living Trust online can be stressful. All too often, you find files which you think are ok to use, but discover later on they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Have any form you’re looking for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be added in to your My Forms section. If you do not have an account, you need to sign-up and select a subscription plan first.

Follow the step-by-step instructions below to download Virginia Assignment to Living Trust from the website:

- See the form description and click Preview (if available) to check whether the template suits your requirements or not.

- In case the document is not what you need, find others with the help of Search engine or the provided recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms library. Besides professionally drafted samples, users may also be supported with step-by-step instructions regarding how to find, download, and complete forms.

Form popularity

FAQ

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Charges vary from lawyer to lawyer based on their fees, as well as the complexity of your overall estate. In the end, expect to pay $1,000 or more. If you decide to go the DIY route, your costs will likely fall to around $200 to $500, depending on which online program you prefer.

Select a type of trust. Inventory your assets and property. Choose a trustee. Put together your trust document. Visit a notary public and sign your living trust in front of them. Fund your trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

A Virginia living trust is established by you, the grantor, the person setting up the trust and placing assets into it. The assets in the trust are managed for your benefit during your life.A living trust Virginia allows you to keep your trust assets out of probate, a court process required for approving a will.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

In this article: A living trust is a type of estate planning tool that allows you to transfer ownership of your assets to a separate fund while you're still alive.In some circumstances, you can use a living trust to protect money you owe to creditors.