Financial Statement Form - Universal Use

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

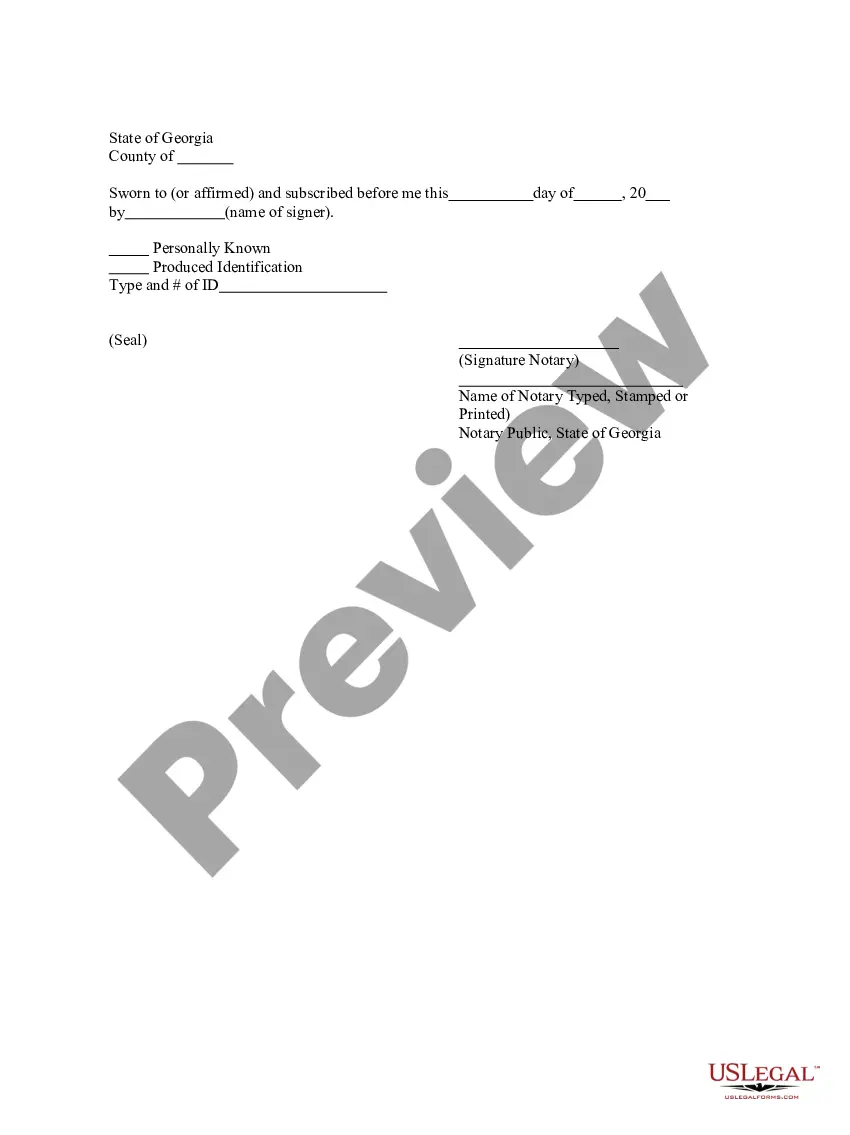

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Financial Statement Form Universal Use: A standard document used to represent an entity's financial status, including assets, liabilities, and equity, that is universally applicable across different sectors.

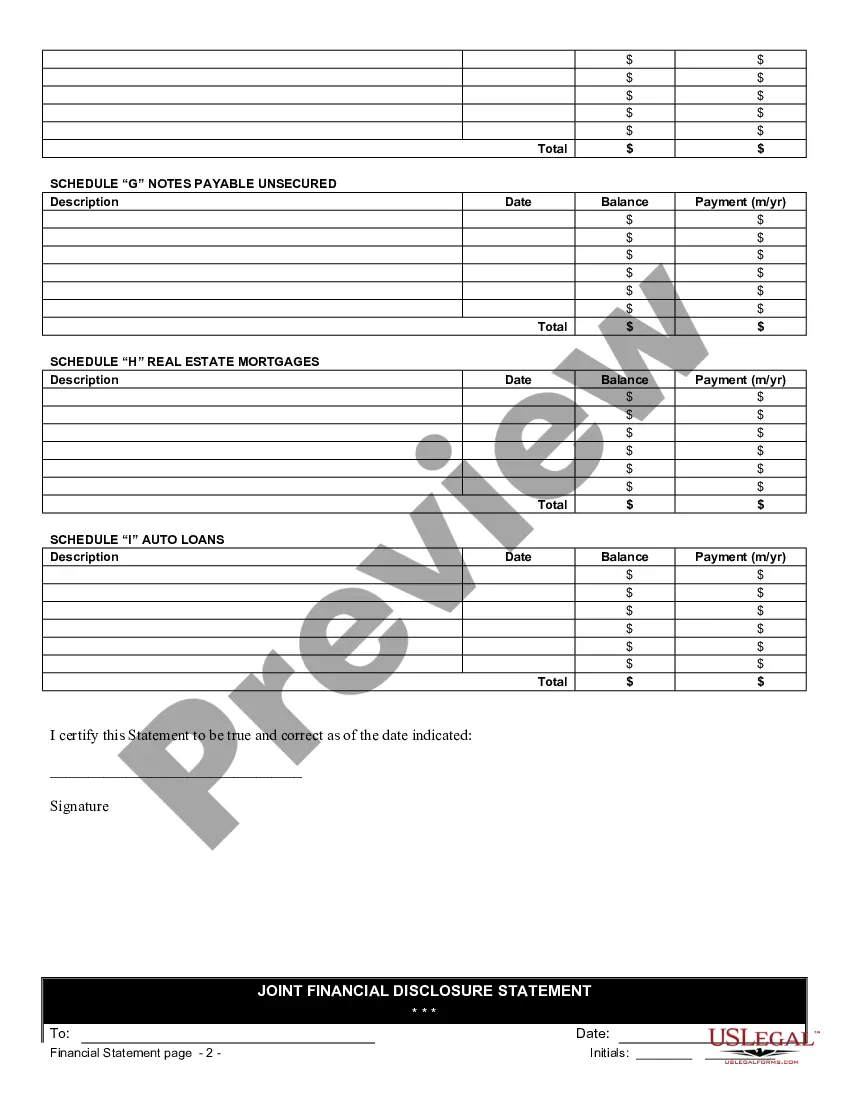

Step-by-Step Guide

Here's a detailed guide on how to properly fill out a financial statement form for universal use:

- Gather Financial Documents: Compile all necessary documents including bank statements, investment records, and proof of income.

- Complete the Asset Section: List all current and fixed assets clearly.

- Detail Your Liabilities: Include all debts and obligations.

- Record Equity: Calculate total equity by subtracting liabilities from assets.

- Review and Verify: Ensure all information is accurate and sign the form to affirm the details.

Risk Analysis

Filling out a financial statement incorrectly can lead to several risks including:

- Legal repercussions from inaccurate reporting.

- Misrepresentation during financial transactions, potentially causing financial loss.

- Mismanagement of personal or business finances due to faulty data.

Key Takeaways

- Using a universal financial statement form helps standardize financial reporting.

- Accuracy and completeness are paramount when filling out the form.

- Regular updates to the form are necessary to accommodate changing financial laws and practices.

Best Practices

- Consistency: Use consistent formats and definitions to ensure the form is universally understood.

- Consultation: Seek advice from financial professionals when in doubt.

- Verification: Regularly verify figures to maintain the form's reliability.

How to fill out Financial Statement Form - Universal Use?

Aren't you tired of choosing from hundreds of templates every time you require to create a Financial Statement Form - Universal Use? US Legal Forms eliminates the lost time numerous American people spend browsing the internet for appropriate tax and legal forms. Our skilled team of lawyers is constantly upgrading the state-specific Templates catalogue, to ensure that it always provides the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription need to complete simple steps before being able to get access to their Financial Statement Form - Universal Use:

- Use the Preview function and look at the form description (if available) to be sure that it’s the right document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate template for the state and situation.

- Make use of the Search field on top of the webpage if you want to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your template in a required format to complete, create a hard copy, and sign the document.

Once you have followed the step-by-step recommendations above, you'll always be able to log in and download whatever file you require for whatever state you need it in. With US Legal Forms, finishing Financial Statement Form - Universal Use samples or any other official documents is not hard. Get going now, and don't forget to look at the samples with certified attorneys!

Form popularity

FAQ

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time.

Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.

Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.

The basic format for an income statement states revenues first, followed by expenses. The expenses are subtracted from the revenue to calculate the net income of the business.

A personal financial statement is a snapshot of your personal financial position at a specific point in time. It lists your assets (what you own), your liabilities (what you owe) and your net worth. To get your net worth, subtract liabilities from assets.

Statement of Cash Flows. A cash flow statement is one of the most important planning tools you have available. Income Statement. Like a cash flow statement, an income statement is one of the most important and valuable financial statements at your disposal. Balance Sheet. Statement of Changes in Equity.

Step 1: Make a list of your ASSETS and where to get the most current values. Step 2: Make a list of your DEBTS and where to get the most current values. Step 3: Compile the information. Step 4: Categorize your total assets. Step 5: Categorize your total liabilities / debts. Step 6: Calculate your net worth.

For example, if you have a house and a car with a value of $100,000, and you have a mortgage and car loan for $75,000, your net worth is $25,000. Net worth for an individual is similar to owner's equity for a business. Therefore, a personal financial statement is similar to a business's balance sheet.

The balance sheet lists all assets, liabilities and owner's equity. This statement can be a one or two-column vertical format. One-column balance sheets list all assets first, liabilities second and owner's equity third. Two-column balance sheets list assets on the left in their own column.