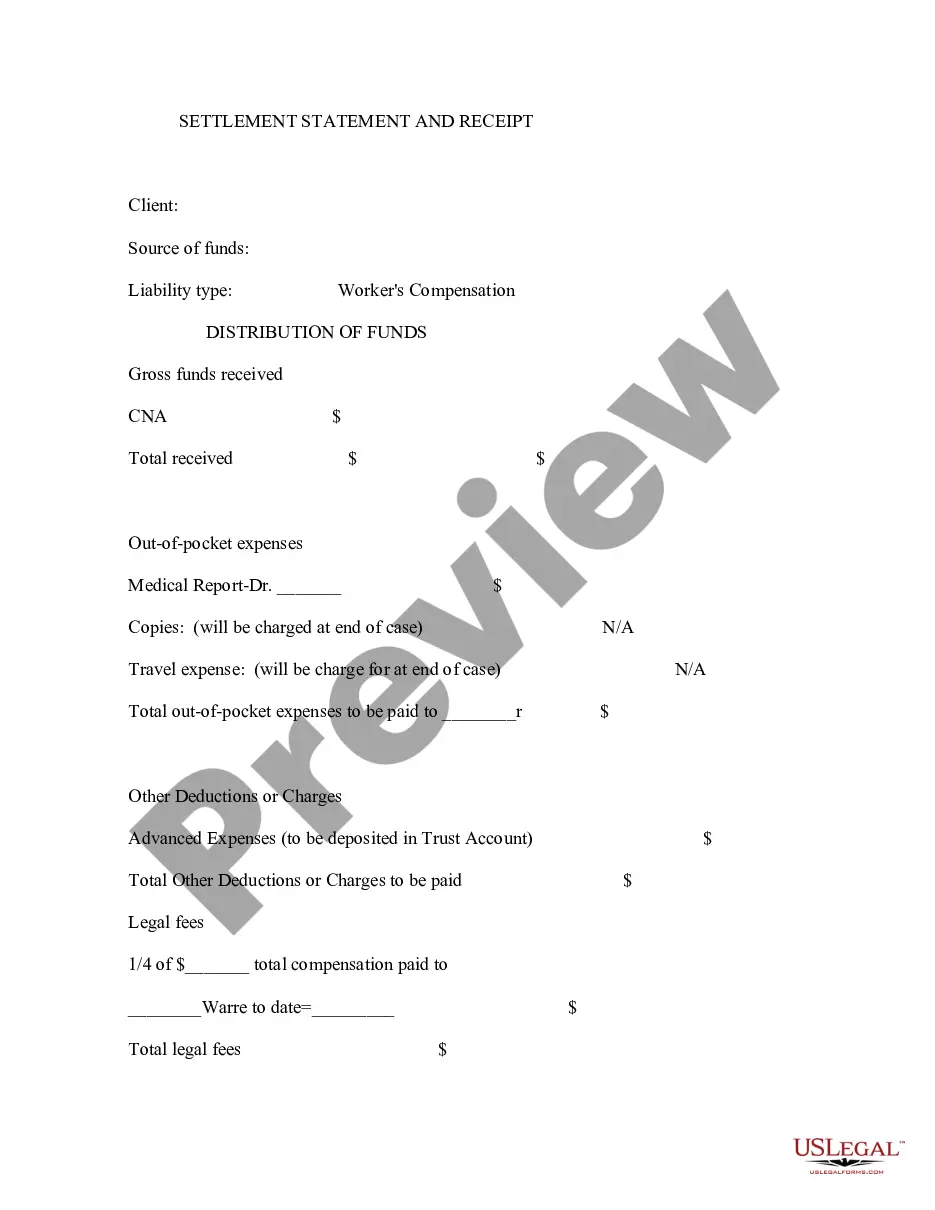

Texas Required Workers' Compensation Coverage is a form of insurance that provides financial protection to employees who are injured or become ill while on the job. It is required by the Texas Department of Insurance for employers that have five or more employees. This coverage provides medical benefits, wage replacement, and death benefits to employees in case of an accident or illness. There are two types of Texas Required Workers' Compensation Coverage: Statutory and Non-Statutory. Statutory coverage is provided to employers by the Texas Department of Insurance. It includes medical benefits, wage reimbursement, death benefits, and permanent disability benefits. Non-Statutory coverage is provided by private insurance companies and usually includes additional benefits such as rehabilitation, vocational retraining, and funeral expenses.

Texas Required Workers' Compensation Coverage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Required Workers' Compensation Coverage?

US Legal Forms is the most easy and cost-effective way to find appropriate formal templates. It’s the most extensive online library of business and individual legal paperwork drafted and verified by attorneys. Here, you can find printable and fillable blanks that comply with national and local laws - just like your Texas Required Workers' Compensation Coverage.

Getting your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Texas Required Workers' Compensation Coverage if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your demands, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Texas Required Workers' Compensation Coverage and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Try it out!

Form popularity

FAQ

The answer to this question is almost always ?yes.? Most employers are required by law to purchase workers compensation. In fact, every single U.S. state but Texas mandates that companies purchase workers compensation coverage.

Texas' State Workers' Compensation Benefits State minimum limits for workers' compensation are pretty universal. Workers' compensation state minimum limits: $100,000 per occurrence for bodily injury: This coverage is for any one employee. $100,000 per employee for bodily disease: This coverage is for any one employee.

The main downside to such a claim is that you typically get paid less than you would if you were able to take the case to trial. However, under Texas law, an employee has the right to opt out of workers' compensation coverage.

Texas is the only state which does not require coverage. However, there are exclusions to this rule for some employers listed below: Any public employer including cities, counties, state agencies and state universities. Building and construction contractors for public employers.

Texas doesn't require most private employers to have workers' compensation. But private employers who contract with government entities must provide workers' compensation coverage for the employees working on the project.

In most cases, as a single-member limited liability corporation (LLC), you may not be required by your state to have workers' compensation coverage. However, you might choose to obtain coverage once you see what workers' compensation insurance can do to protect your assets.

Do sole proprietors need workers' compensation? Though it's not required by law, sole proprietors, independent contractors, and other self-employed individuals may elect to buy workers' comp insurance for themselves. Their clients might also require them to carry this coverage.