Mississippi Settlement Statement and Receipt

What is this form?

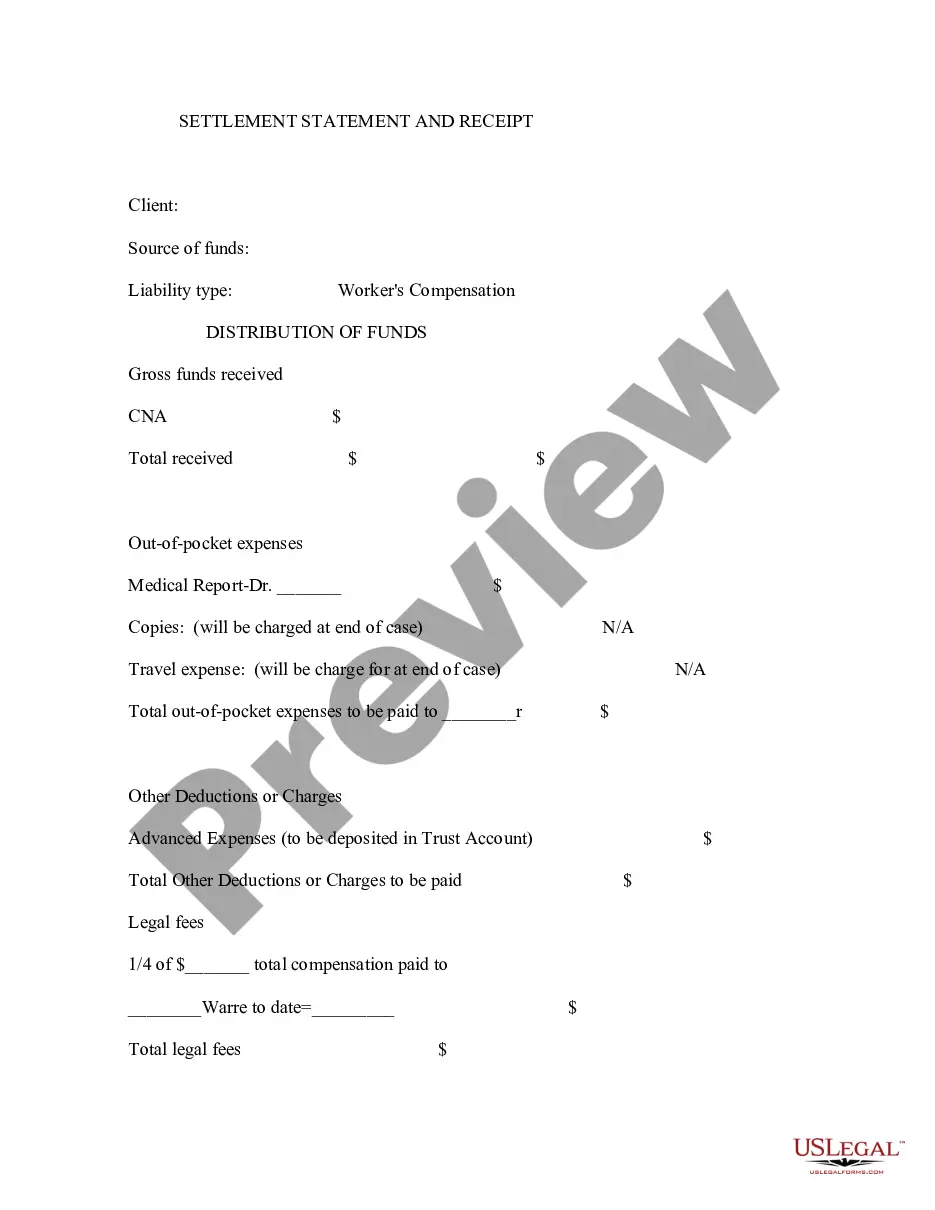

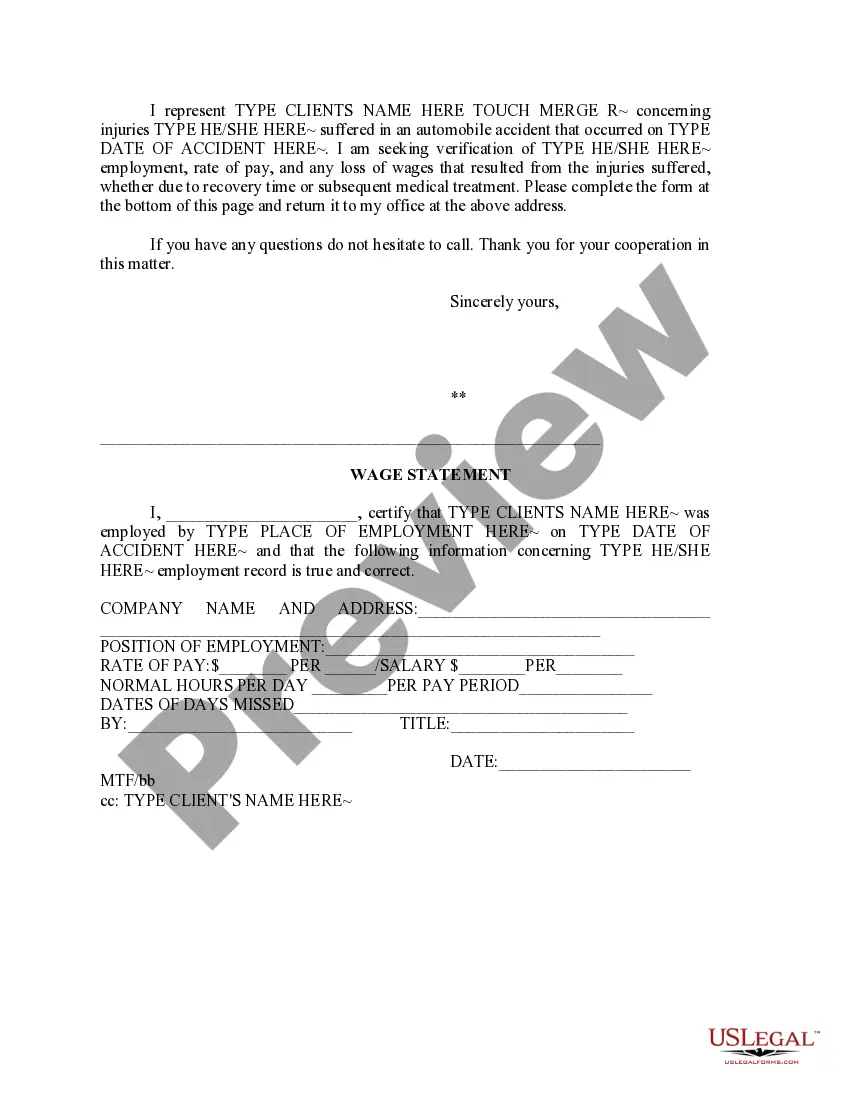

The Settlement Statement and Receipt is a legal document used in Mississippi to outline the terms of a settlement agreement between two parties. This form serves to confirm the details of the settlement, including the distribution of funds and acknowledgment of receipt by both parties. It differs from similar forms by providing a comprehensive breakdown of financial aspects, making it essential in resolving disputes efficiently and transparently.

Main sections of this form

- Client information: Basic details about the parties involved.

- Source of funds: Identification of the funds being disbursed.

- Liability type: Specification of the nature of the claim, such as workersâ compensation.

- Distribution of funds: Detailed outline of gross funds, out-of-pocket expenses, and deductions.

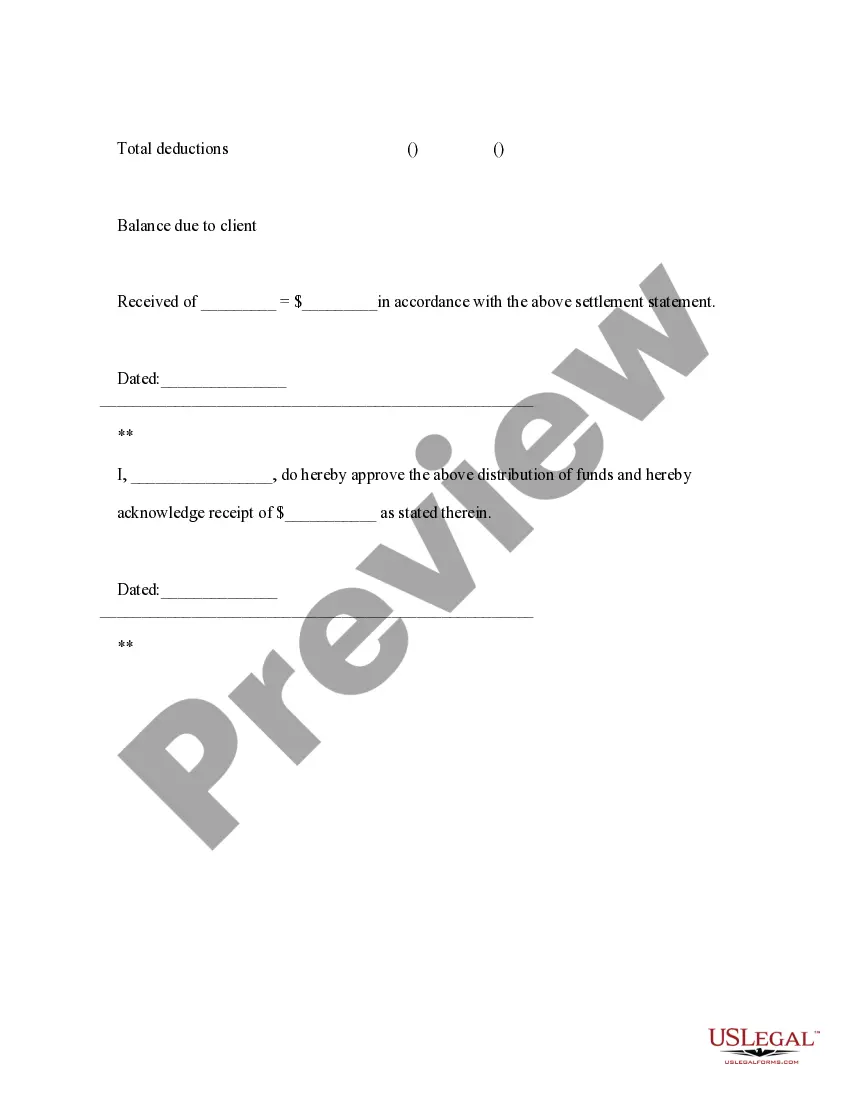

- Balance due to client: The final amount that the client will receive after deductions.

- Signature and date fields: Spaces for both parties to acknowledge receipt and agreement.

When to use this form

This form should be used when a settlement has been reached in a legal dispute, particularly in cases involving workersâ compensation claims in Mississippi. It is essential when there is a need to formally document the financial distribution of the settlement to ensure both parties are in agreement and have a clear record of the transactions involved.

Intended users of this form

- Clients involved in a legal settlement, specifically regarding workersâ compensation.

- Attorneys representing clients in settlement negotiations.

- Insurance companies that are processing settlement payments.

- Individuals seeking clarity and documentation on fund distribution post-settlement.

How to prepare this document

- Identify the parties involved, including the client and the source of funds.

- Specify the type of liability associated with the settlement.

- Fill in the sections detailing the gross funds received and any out-of-pocket expenses.

- Calculate legal fees and other deductions, providing totals as necessary.

- Both parties should sign and date the form to acknowledge receipt and agreement to the terms laid out.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all necessary client and source information.

- Inaccurate calculations of total fees and deductions.

- Not obtaining signatures from both parties.

- Leaving out the date fields, which can lead to disputes about the timeline.

Why use this form online

- Convenient access to the form at any time, making it easier to complete on your schedule.

- Editability allows customization to fit specific settlement agreements.

- Online platforms ensure that the form is compliant and up to date with legal standards.

- Secure storage options help keep records organized and easily retrievable.

Looking for another form?

Form popularity

FAQ

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1.

In mortgage lending, there are two main types of settlement statements a borrower may encounter: closing disclosures and HUD-1 settlement statements. A mortgage closing disclosure is a type of standard settlement statement that is formulated and regulated for the mortgage lending market.

In your case, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your settlement documents.

Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

The HUD-1 form is used in purchase transactions, and it includes lines for both borrower charges/fees and seller charges/fees.The HUD-1A is an option, instead of using the HUD-1, for loan transactions that do not include a seller (refinance). The HUD-1 is three pages, while the HUD-1A is only two pages.

Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, as appropriate, must be used for all mortgage transactions that are subject to the Real Estate Settlement Procedures Act.

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exceptionreverse mortgages.