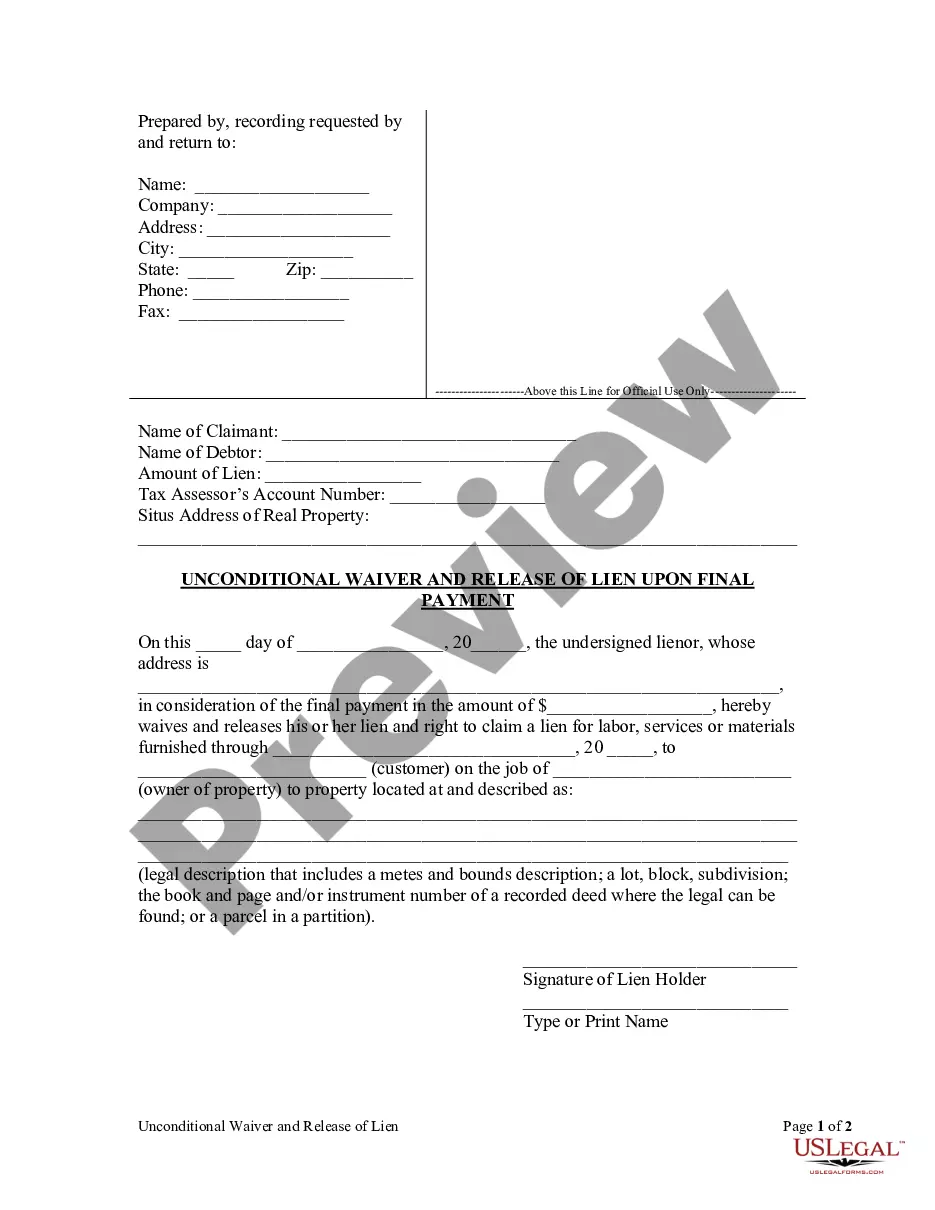

This Unconditional Waiver and Release of Claim of Lien Upon Final Payment form is for use by a lienor, in consideration of final payment, to waive and release his or her lien and right to claim a lien for labor, services or materials furnished through a particular date to a customer on the job of an owner of property.

Oregon Unconditional Waiver and Release of Claim of Lien Upon Final Payment

Description

Key Concepts & Definitions

Unconditional Waiver and Release of Claim of Lien: This legal document is used in the construction industry in the United States. When a contractor, subcontractor, or material supplier has been paid for their work or supplies and has no further claims against the property owner, they sign this document to waive and release any lien rights they may have. This document is crucial as it clears the property of claims and is often required before final payment or during refinancing and sale transactions.

Step-by-Step Guide

- Verify Payment: Ensure that the payments detailed in the lien claim have been fully received and cleared through the bank.

- Consult Legal Advice: Discuss with a legal advisor to ensure that signing an unconditional waiver fits your situation, as once signed, rights to further liens for past work are forfeited.

- Prepare the Waiver Form: Use the correct form that complies with state laws. Many states have specific forms that must be used.

- Complete the Form: Fill in all necessary details in the form, including the correct legal description of the property and the date of through which the waiver is effective.

- Sign and Notarize: Have the waiver signed by the claimant in front of a notary to authenticate the identity of the signer.

- Distribute Copies: Provide copies to all relevant parties, including the property owner, the general contractor, and keep a copy for your records.

Risk Analysis

- Premature Signing: Signing the waiver before funds have fully cleared can result in unpaid work if the payment fails.

- Incorrect Details: Errors in the waiver form, such as incorrect property descriptions, can invalidate the waiver.

- State Specific Laws: Each state has unique laws and forms. Using an incorrect form or not adhering to specific statutes can make the waiver unenforceable.

- Forgery and Fraud: Improperly signed or unauthorized waivers can lead to legal disputes or questioning of authenticity.

Best Practices

- Double-Check Payment Status: Confirm all payments have cleared before signing any waiver.

- Accurate Documentation: Make sure all the details on the waiver are correct and reflect the true facts of the transaction.

- State Compliance: Use state-specific forms and adhere to local laws to ensure the validity of the waiver.

- Record Keeping: Maintain copies of all waivers and related payment documents for at least the duration of the statute of limitations in your state.

Common Mistakes & How to Avoid Them

- Rushing the Process: Avoid signing the waiver in haste without full payment verification and proper review of the form.

- Using Generic Forms: Do not use generic forms. Ensure that the form is specific to your state and meets all the legal requirements.

- Neglecting Legal Advice: Consult with a legal expert, especially in complex cases, to understand the implications of signing the waiver.

How to fill out Oregon Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

In terms of filling out Oregon Unconditional Waiver and Release of Claim of Lien Upon Final Payment, you most likely think about a long process that requires getting a perfect sample among hundreds of very similar ones after which needing to pay out a lawyer to fill it out for you. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific document in just clicks.

For those who have a subscription, just log in and click on Download button to get the Oregon Unconditional Waiver and Release of Claim of Lien Upon Final Payment template.

If you don’t have an account yet but need one, follow the step-by-step guideline listed below:

- Make sure the document you’re saving is valid in your state (or the state it’s required in).

- Do so by looking at the form’s description and by clicking on the Preview option (if accessible) to see the form’s content.

- Click on Buy Now button.

- Select the suitable plan for your budget.

- Sign up to an account and select how you would like to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Professional legal professionals work on drawing up our samples to ensure after downloading, you don't have to bother about editing content material outside of your personal information or your business’s details. Join US Legal Forms and receive your Oregon Unconditional Waiver and Release of Claim of Lien Upon Final Payment example now.

Form popularity

FAQ

An "Unconditional Waiver and Release Upon Final Payment" extinguishes all claimant rights upon receipt of the payment. A "Conditional Waiver and Release Upon Final Payment" extinguishes all claimant rights upon receipt of the final payment with certain provisions.

The undersigned makes this Waiver specifically for the benefit of the Owner and the Owner's lender, and any other person or entity with a legal or equitable interest in the Property.

Name of Claimant. This is the name the party to be paid, and the party who will be signing the lien waiver document. Name of Customer. Job Location. Owner. Exceptions. Claimant's Signature. Claimant's Title. Date of Signature.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

Signing an unconditional lien waiver is enforceable even before you get paid. This means that if you sign an unconditional lien waiver before receiving the money and the property owner ends up not paying up, you have already waived your lien rights because you signed the unconditional lien waiver.

A lien waiver is quite common in the construction business. Essentially, it is a document from a contractor, subcontractor, supplier, or another party who holds a mechanic's lien that states they have been paid in full and waive future lien rights to the disputed property.

An unconditional release means that there are no restrictions on the release of the lien. This type of lien release is often used in final project documents to confirm that the project is complete, payment has occurred, and you release all future rights to file liens on the project.

An "Unconditional Waiver and Release Upon Progress Payment" discharges all claimant rights through a specific date with no stipulations. A "Conditional Waiver and Release Upon Progress Payment" discharges all claimant rights through a specific date, provided the payments have actually been received and processed.