Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims

Description

Key Concepts & Definitions

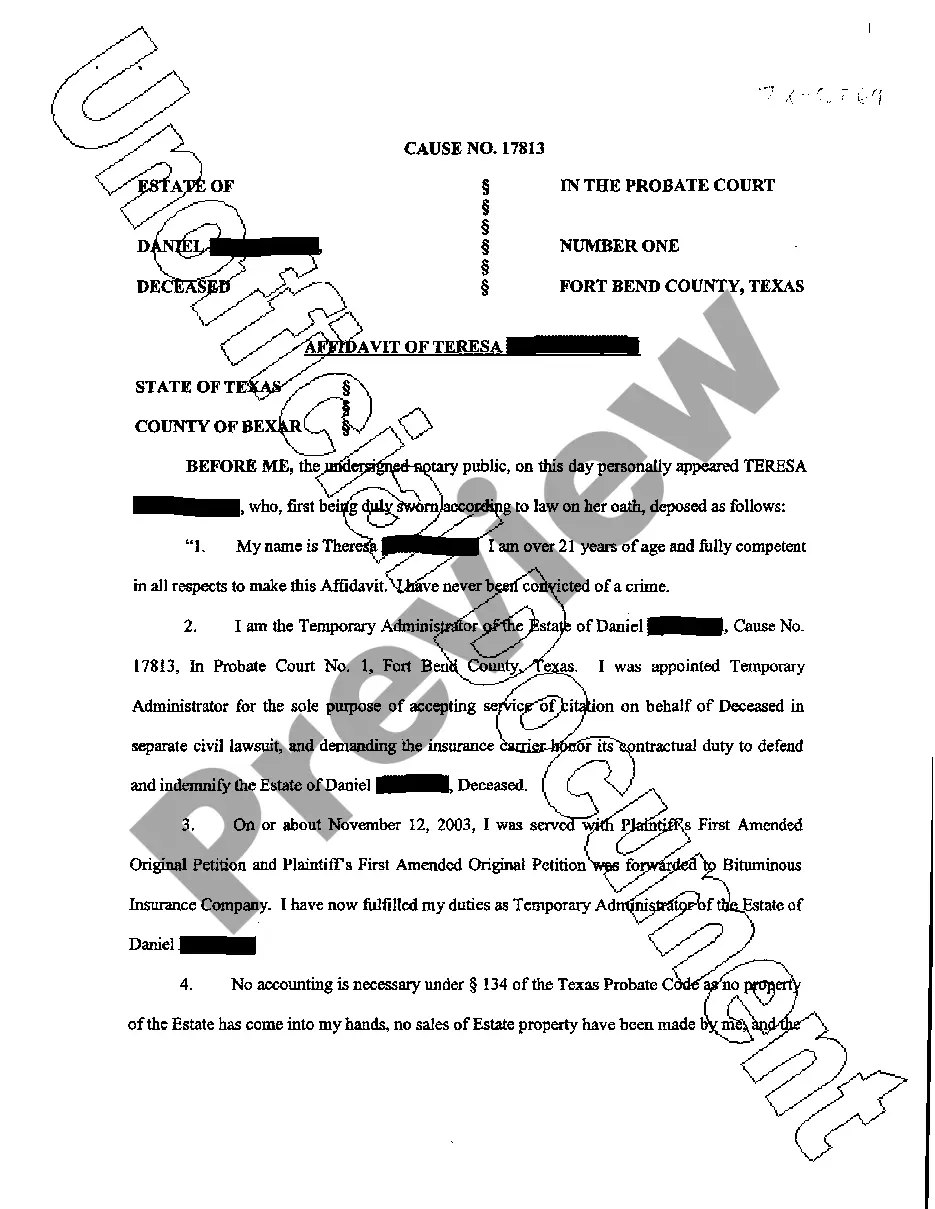

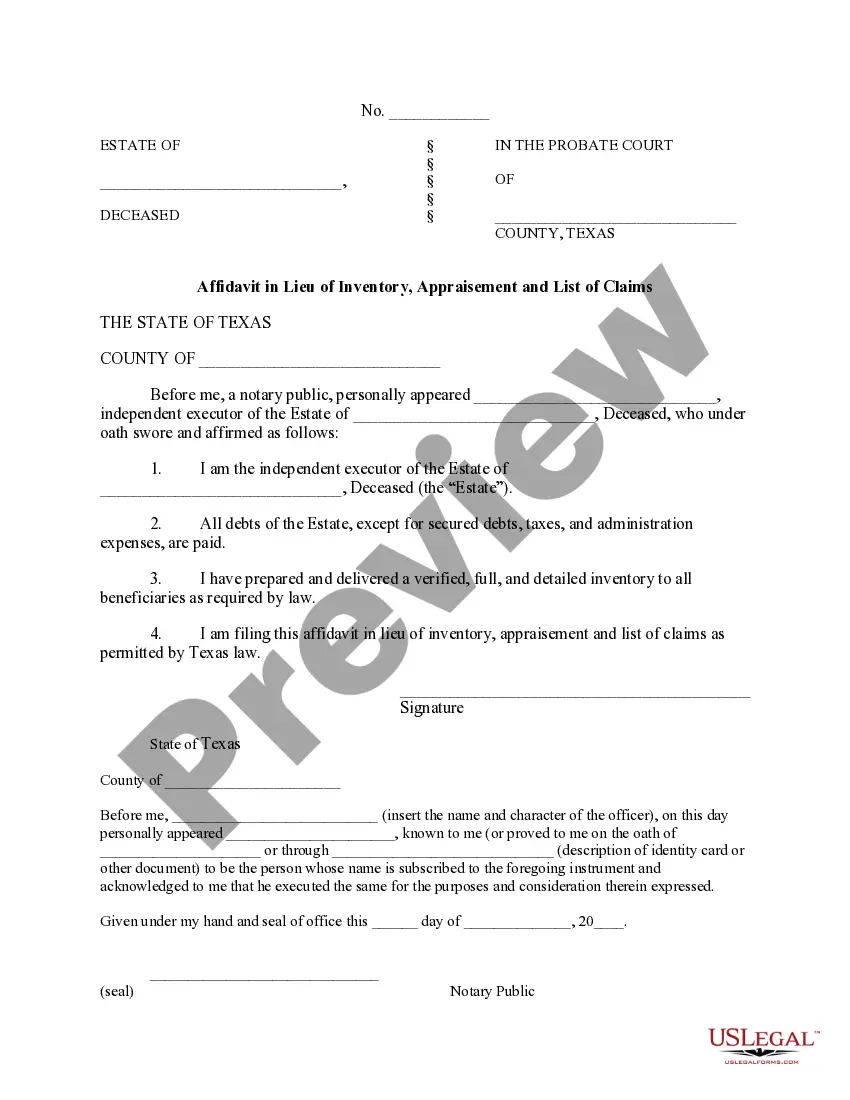

Affidavit In Lieu of Inventory Appraisement and is a legal document typically used in probate proceedings. This affidavit is filed by an executor or administrator of an estate to assert that a detailed inventory of the estate's assets has been provided to all interested parties, such as heirs and creditors, thereby sometimes waiving the need for a formal inventory filing with the court.

Step-by-Step Guide to Preparing an Affidavit In Lieu of Inventory Appraisement

- Gather Necessary Documents: Compile all relevant documents related to the estate assets, including bank statements, property deeds, and investment records.

- Consult With Legal Counsel: Before proceeding, it's advisable to seek guidance from an attorney who is experienced in estate planning and probate laws in your specific state.

- Prepare the Affidavit: Fill out the affidavit form, stating that all heirs and creditors have been presented with a detailed inventory and appraisement of the estate.

- Get Signatures: All relevant parties, particularly the administrator or executor, must sign the affidavit.

- File the Affidavit: Submit the completed affidavit to the appropriate probate court, alongside any other necessary paperwork.

Risk Analysis

- Legal Risks: Incorrectly filing an affidavit or failing to adequately notify heirs and creditors can result in legal challenges or delays in the probate process.

- Financial Risks: Errors in the inventory list or appraisal could potentially lead to financial discrepancies, affecting the distribution of assets.

- Compliance Risks: Different states have varying requirements for the filing of such affidavits. Non-compliance with these regulations can incur penalties.

Best Practices

- Thorough Documentation: Keep detailed records and document all steps taken during the inventory and appraisal process.

- Transparency: Maintain open communication with all interested parties to avoid disputes and misunderstandings.

- Legal Consultation: Regular consultations with legal experts can help in navigating the complex probate laws and ensure compliance with state-specific requirements.

Common Mistakes & How to Avoid Them

- Misunderstanding State Laws: Ensure you are familiar with your states specific probate and estate laws to avoid legal issues.

- Inadequate Notification: All interested parties must be adequately informed about the estate proceedings, including the filing of an affidavit in lieu of inventory appraisement.

- Poor Documentation: Maintain organized and thorough documentation to support all claims made in your affidavit and other probate documents.

How to fill out Texas Affidavit In Lieu Of Inventory, Appraisement And List Of Claims?

Get access to high quality Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims forms online with US Legal Forms. Avoid days of wasted time searching the internet and lost money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find more than 85,000 state-specific legal and tax templates that you can download and submit in clicks in the Forms library.

To find the example, log in to your account and click Download. The document will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Check if the Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims you’re looking at is suitable for your state.

- View the form using the Preview option and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Choose a favored format to save the file (.pdf or .docx).

You can now open up the Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims sample and fill it out online or print it and do it by hand. Take into account giving the file to your legal counsel to be certain everything is filled in appropriately. If you make a mistake, print and complete sample once again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and get a lot more templates.

Form popularity

FAQ

Put important documents where the executor can find them. A typical executor spends a lot of time searching for pieces of paper: the will, bank statements, insurance policies, birth and marriage certificates, divorce decrees, military discharge papers, cemetery deeds2026 you get the idea.

In short, yes. Household items do have to go through the probate process as they are considered probate assets with no explicit or individual title. These assets (items like furniture, clothing, collections, artwork, jewelry, etc.)

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

An inventory and appraisement is a list of all real and personal property as well as debts and liabilities claimed by each spouse. This list will include separate property, community property, and debts that you and your spouse have.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

The executor can sell property without getting all of the beneficiaries to approve.If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

In general, an estate inventory checklist will include financial assets that belonged to the deceased.The financial information must also include the deceased's debts, such as credit card bills, student loans, alimony, child support and medical bills.