Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc.

Description

How to fill out Nonemployee Directors Stock Option Plan Of National Surgery Centers, Inc.?

When it comes to drafting a legal form, it’s easier to leave it to the professionals. Nevertheless, that doesn't mean you yourself can not get a sample to utilize. That doesn't mean you yourself can not get a sample to use, nevertheless. Download Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. After you’re signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. promptly:

- Make sure the form meets all the necessary state requirements.

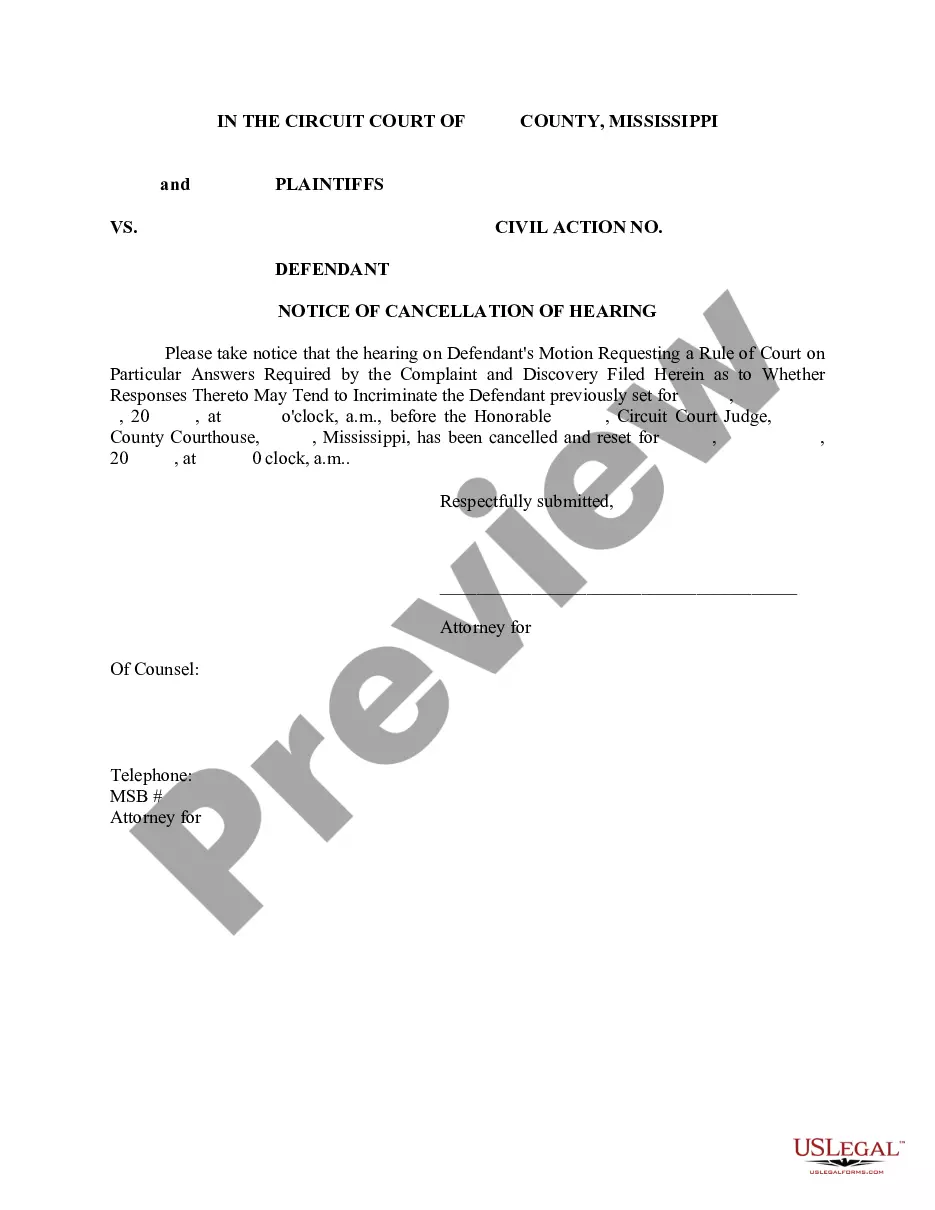

- If possible preview it and read the description prior to buying it.

- Click Buy Now.

- Choose the suitable subscription for your requirements.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

Once the Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. is downloaded it is possible to fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.

In a private company setting, after the founders have been issued fully vested or restricted stock under their stock purchase agreements, the employees, consultants, advisors and directors who are subsequently hired commonly receive equity compensation through stock options.

Q: Can a member of the board of directors receiving a stock option as compensation for board member service receive an incentive or statutory stock option (an ISO)? A: No. A board member who is just a board member, and not otherwise an employee of the company cannot receive an ISO. Only employees can receive ISOs.

Stock options are often issued as a part of a company's incentive program to the company's and its subsidiaries' key persons who are working on the company's projects. The purpose of the stock options is to give personnel a financial incentive to work hard to increase the company's shareholder value.

A share option is the right to buy a certain number of shares at a fixed price, some period of time in the future, within a company.They can then keep the shares or, if the market price is higher, sell them at a profit.