South Dakota Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can purchase or create.

By utilizing the website, you can obtain numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest templates such as the South Dakota Contract for Part-Time Assistance from Independent Contractor in moments.

If you possess an account, Log In and download the South Dakota Contract for Part-Time Assistance from Independent Contractor from the US Legal Forms repository. The Download button will appear on every form you view. You have access to all previously saved forms from the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the saved South Dakota Contract for Part-Time Assistance from Independent Contractor.

Each template saved in your account has no expiration date and is your property indefinitely. Therefore, if you wish to acquire or print another copy, simply navigate to the My documents section and click on the form you need. Access the South Dakota Contract for Part-Time Assistance from Independent Contractor with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and demands.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the correct form for your locality. Click the Review button to examine the content of the form. Read the description of the form to ensure that it is the right one for you.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are pleased with the form, confirm your choice by clicking the Purchase now button. Then, choose your preferred payment plan and provide your credentials to register for the account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Yes, as an independent contractor, you typically have the freedom to set your own hours. This flexibility is one of the primary advantages of contracting work. However, it is essential to specify your availability in the South Dakota Contract for Part-Time Assistance from Independent Contractor to ensure both parties have a clear understanding.

A 1099 employee, often referred to as an independent contractor, follows specific guidelines that differentiate them from traditional employees. Key rules include having control over how to complete tasks and being responsible for their taxes. Always ensure that your South Dakota Contract for Part-Time Assistance from Independent Contractor addresses these aspects to maintain compliance.

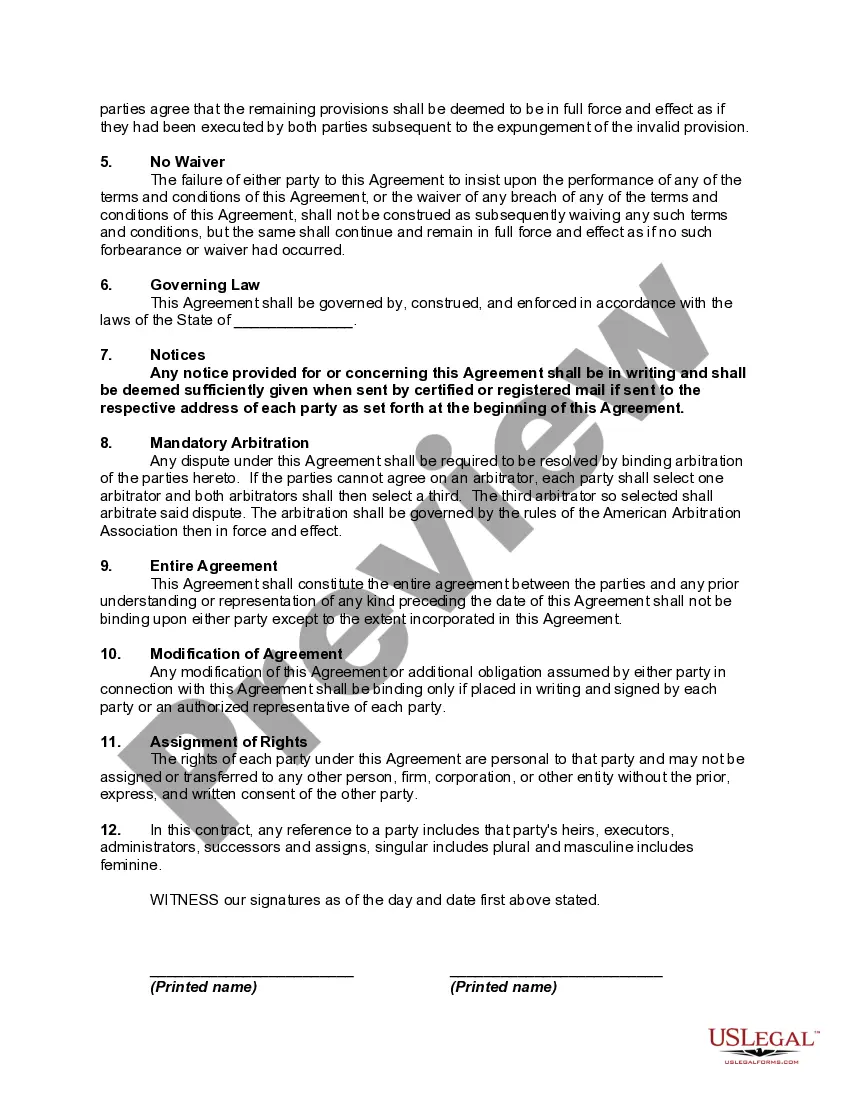

Writing a contract as an independent contractor involves clearly outlining the scope of work, payment terms, and deadlines. It's crucial to be specific about what services you will provide and under what conditions. Utilizing resources like a South Dakota Contract for Part-Time Assistance from Independent Contractor can guide you in creating a comprehensive and legally sound agreement.

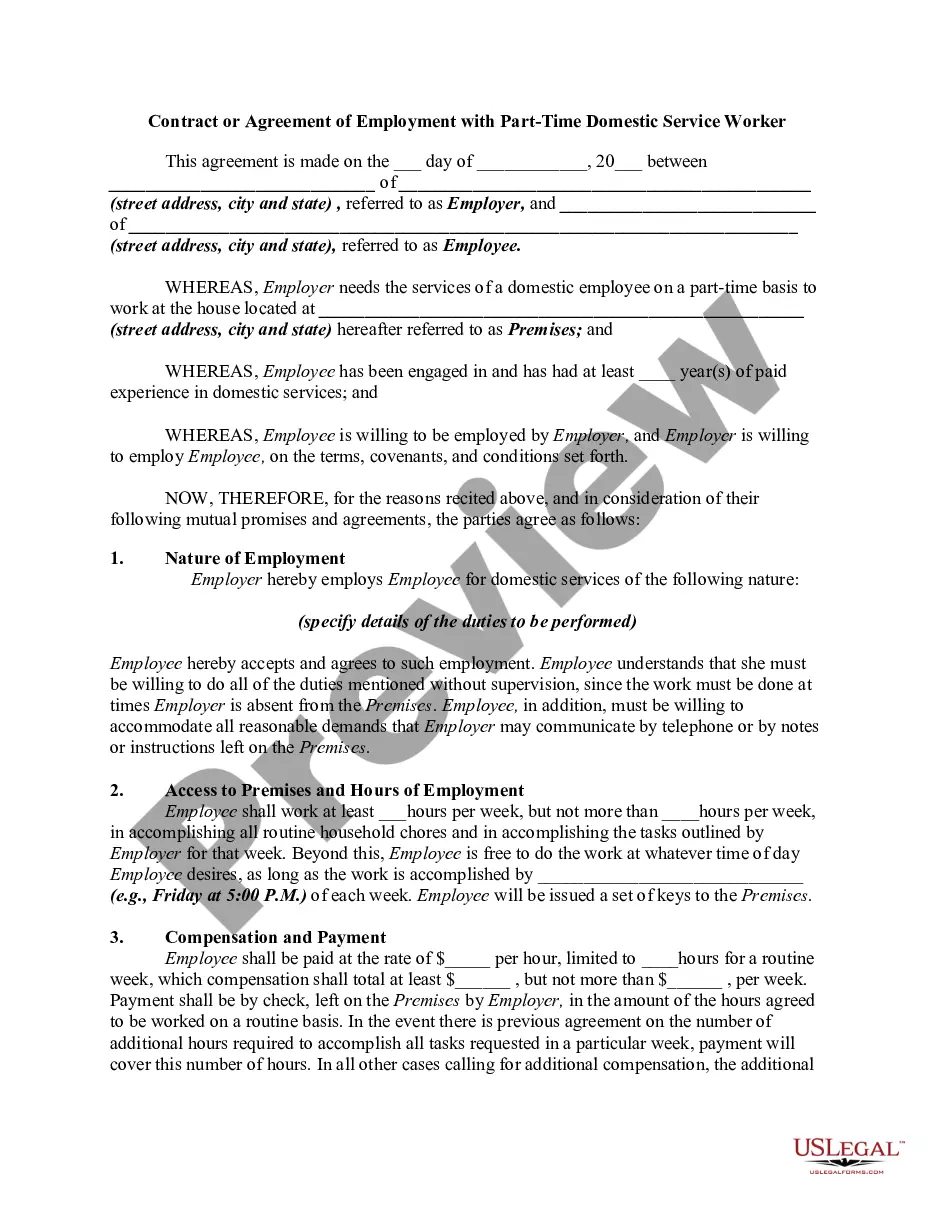

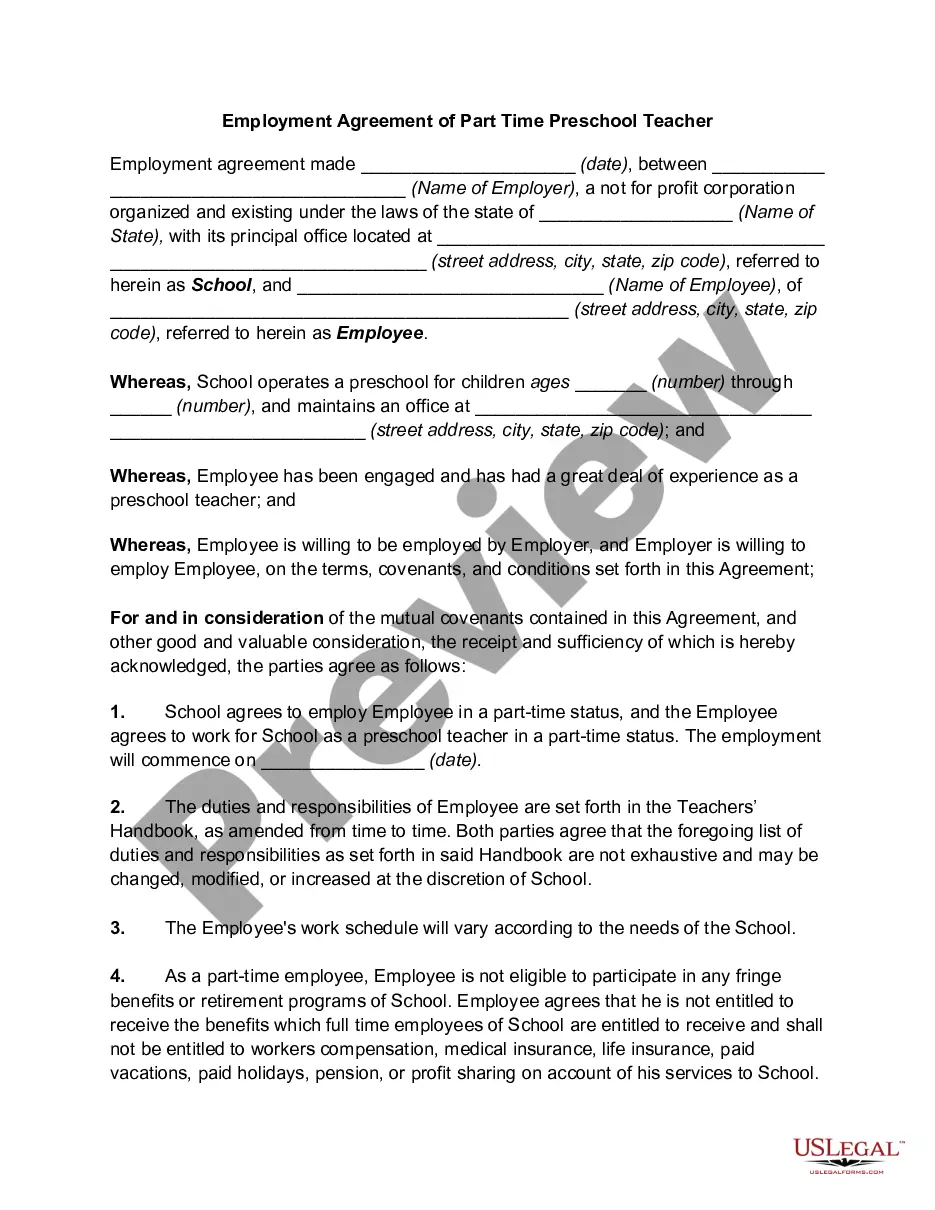

Absolutely, you can work part-time as an independent contractor. Many individuals choose this arrangement for flexibility and autonomy. A South Dakota Contract for Part-Time Assistance from Independent Contractor helps outline expectations, duties, and payment terms, ensuring a clear working relationship.

Yes, a part-time employee can be classified as a 1099 contractor, provided they meet specific criteria. It is essential to ensure that the nature of the work complies with IRS standards. By utilizing a South Dakota Contract for Part-Time Assistance from Independent Contractor, you can clarify your classification and avoid potential misclassification issues.

Typically, independent contractors do not receive time and a half for overtime. Instead, their payment structure is outlined in the South Dakota Contract for Part-Time Assistance from Independent Contractor. This contract specifies the agreed-upon rates and hours. If you need clarification on your rights and obligations, exploring our services can be beneficial.

Filling out an independent contractor agreement requires attention to detail. Begin by entering the names of the parties, followed by a comprehensive description of the work to be done. Make sure to specify payment details and the duration of the agreement. Resources like uslegalforms offer user-friendly templates to help you create a precise South Dakota Contract for Part-Time Assistance from Independent Contractor.

Writing a simple contract agreement involves clearly stating the agreement's purpose, the parties involved, and the terms of the transaction. It's crucial to include specifics on deliverables, timelines, and payment arrangements. By using resources such as uslegalforms, you can easily draft a South Dakota Contract for Part-Time Assistance from Independent Contractor that meets all legal standards.

To create an independent contractor agreement, start by outlining the scope of work, payment terms, and duration of the contract. Include relevant details such as confidentiality provisions and dispute resolution methods. Using a clear template can streamline this process, like those offered through uslegalforms, which provide guidance for a valid South Dakota Contract for Part-Time Assistance from Independent Contractor.

In the United States, an independent contractor must earn at least $600 in a given tax year to receive a 1099 form. This 1099 form reports their income to the IRS. For your South Dakota Contract for Part-Time Assistance from Independent Contractor, it's important to keep good records of your earnings and ensure compliance with tax obligations.