Tennessee Due Diligence Field Review and Checklist

Description

How to fill out Due Diligence Field Review And Checklist?

You can devote hours on-line attempting to find the legal document design which fits the federal and state demands you require. US Legal Forms supplies a huge number of legal types that happen to be reviewed by specialists. You can actually acquire or printing the Tennessee Due Diligence Field Review and Checklist from our services.

If you already possess a US Legal Forms account, you can log in and then click the Download switch. After that, you can comprehensive, modify, printing, or indication the Tennessee Due Diligence Field Review and Checklist. Each legal document design you buy is yours forever. To acquire yet another duplicate of the acquired develop, go to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site for the first time, follow the straightforward recommendations listed below:

- Initially, ensure that you have chosen the correct document design to the county/town of your liking. Look at the develop information to ensure you have chosen the appropriate develop. If readily available, utilize the Preview switch to check through the document design at the same time.

- In order to find yet another version from the develop, utilize the Look for industry to obtain the design that meets your requirements and demands.

- When you have located the design you need, just click Buy now to carry on.

- Choose the prices program you need, enter your accreditations, and sign up for an account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal account to cover the legal develop.

- Choose the formatting from the document and acquire it in your system.

- Make modifications in your document if needed. You can comprehensive, modify and indication and printing Tennessee Due Diligence Field Review and Checklist.

Download and printing a huge number of document themes making use of the US Legal Forms site, that provides the biggest selection of legal types. Use professional and status-particular themes to handle your company or person needs.

Form popularity

FAQ

Due Diligence Checklist General Company Information- includes company articles of incorporations, business plans, lists of all the entities where the organization has equity interests, etc. Independent Industry Reports ? These reports help improve the acquirer's understanding of a target company's industry.

The due diligence guidelines for third parties involve gathering information about the third party's background, financial stability, legal and compliance history, business practices, and overall reputation.

Due diligence consists of mailing a first class letter to the owner. The purpose of the letter is to give the owner the opportunity to collect the funds from you and relieve you of the liability to have to report and remit the funds to the Unclaimed Property Division.

Financial information to be reviewed includes: Audited financial statements. Balance sheets. Assets and liabilities. Cash flows. Capital expenditures. Projections.

How to Perform Due Diligence for Stocks Step 1: Analyze the Capitalization of the Company. ... Step 2: Revenue, Profit, and Margin Trends. ... Step 3: Competitors and Industries. ... Step 4: Valuation Multiples. ... Step 5: Management and Share Ownership. ... Step 6: Balance Sheet. ... Step 7: Stock Price History. ... Step 8: Stock Dilution Possibilities.

The process of due diligence ensures that potential acquirers gain an accurate and complete understanding of a company. It helps evaluate a company's strengths, weaknesses, risks, and opportunities. The creation of a due diligence checklist provides the detailed roadmap required to guide such an extensive analysis.

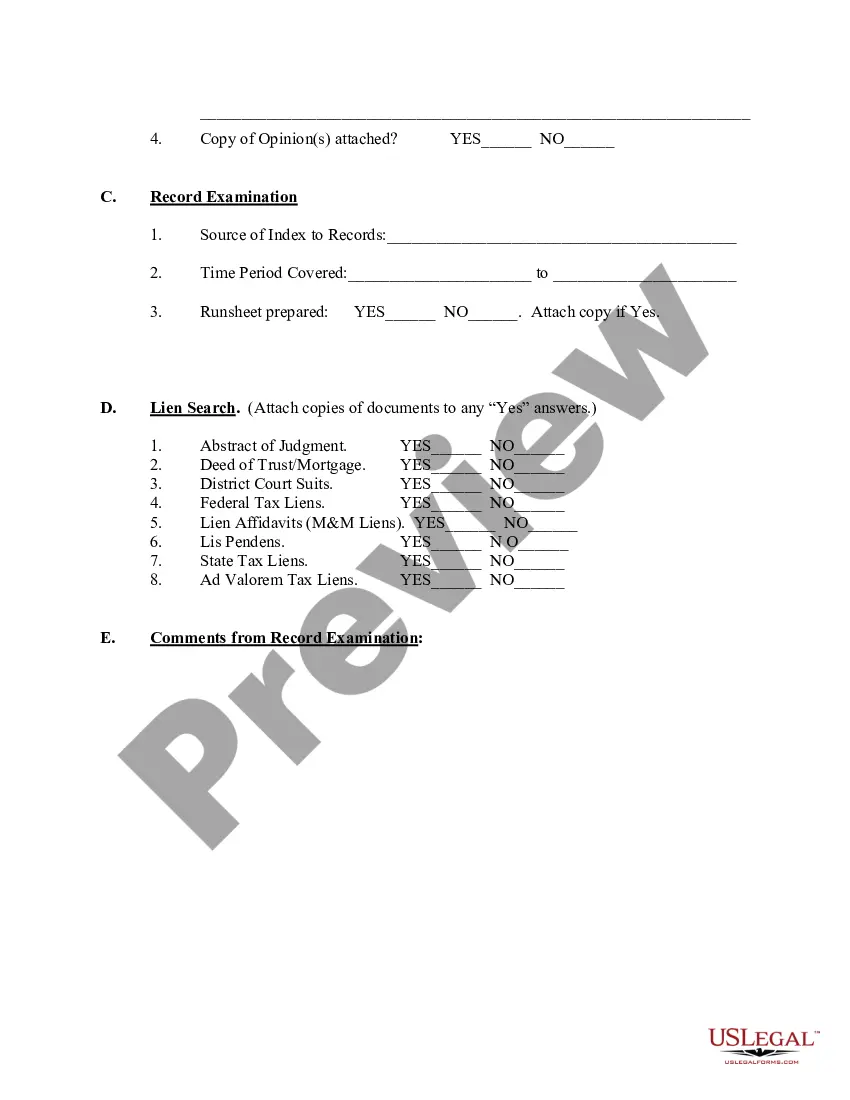

Due diligence in M&A should also include a review of all property, including deeds, leases, deeds of trusts and mortgages, title reports, other interests in real property, operating leases, conditional sale agreements, financing leases, and sale and leaseback agreements.

Due diligence For all property with a value of $50 or more. By first-class mail 60?180 days before filing the report.