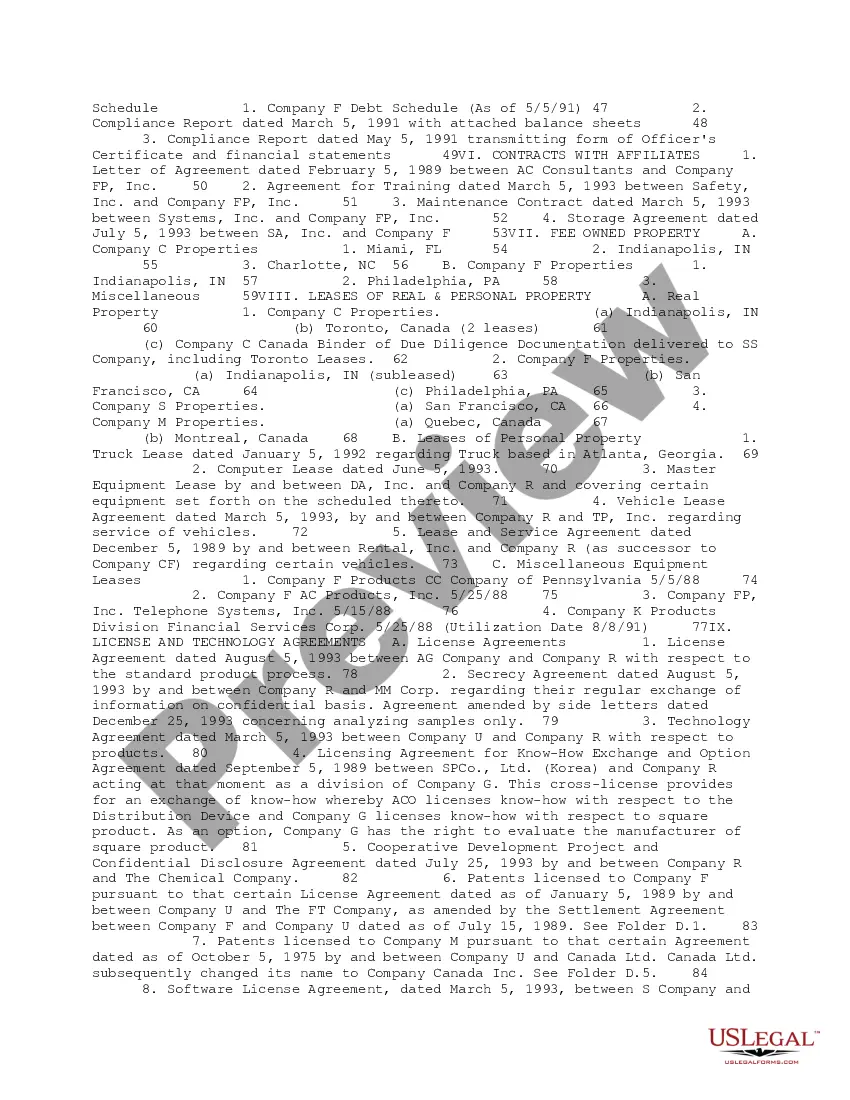

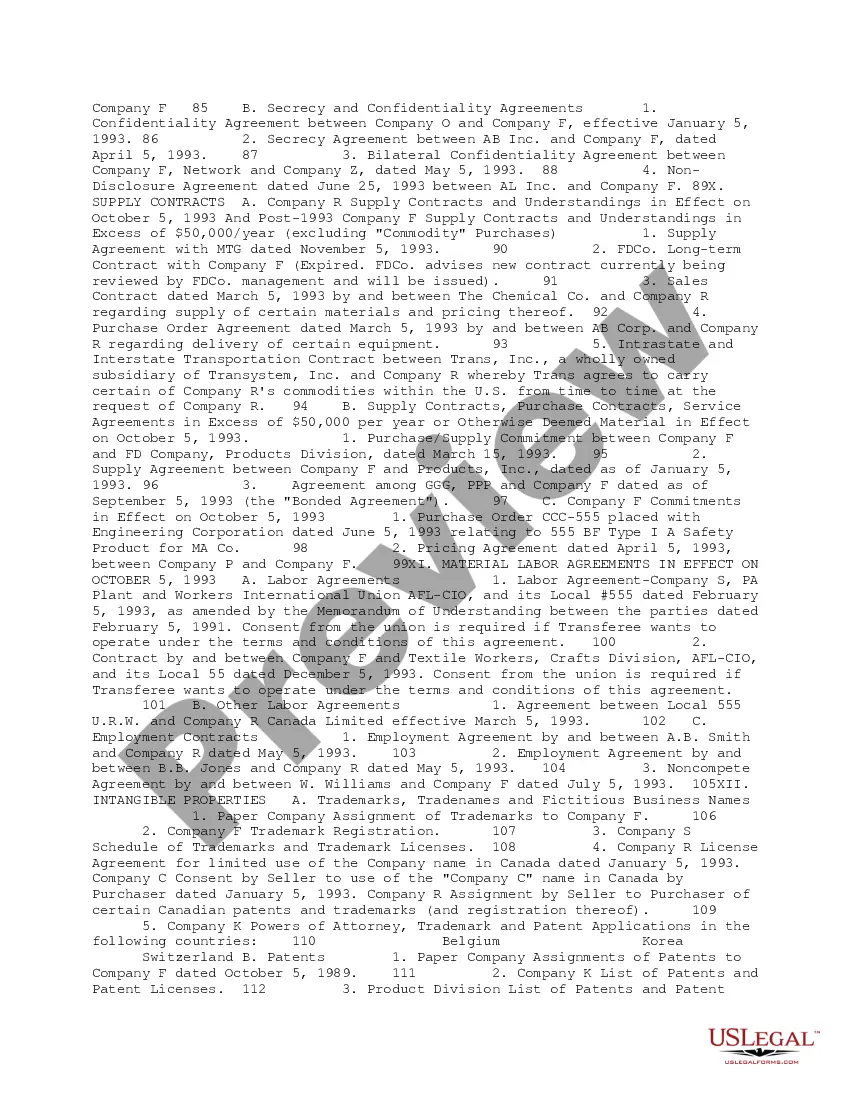

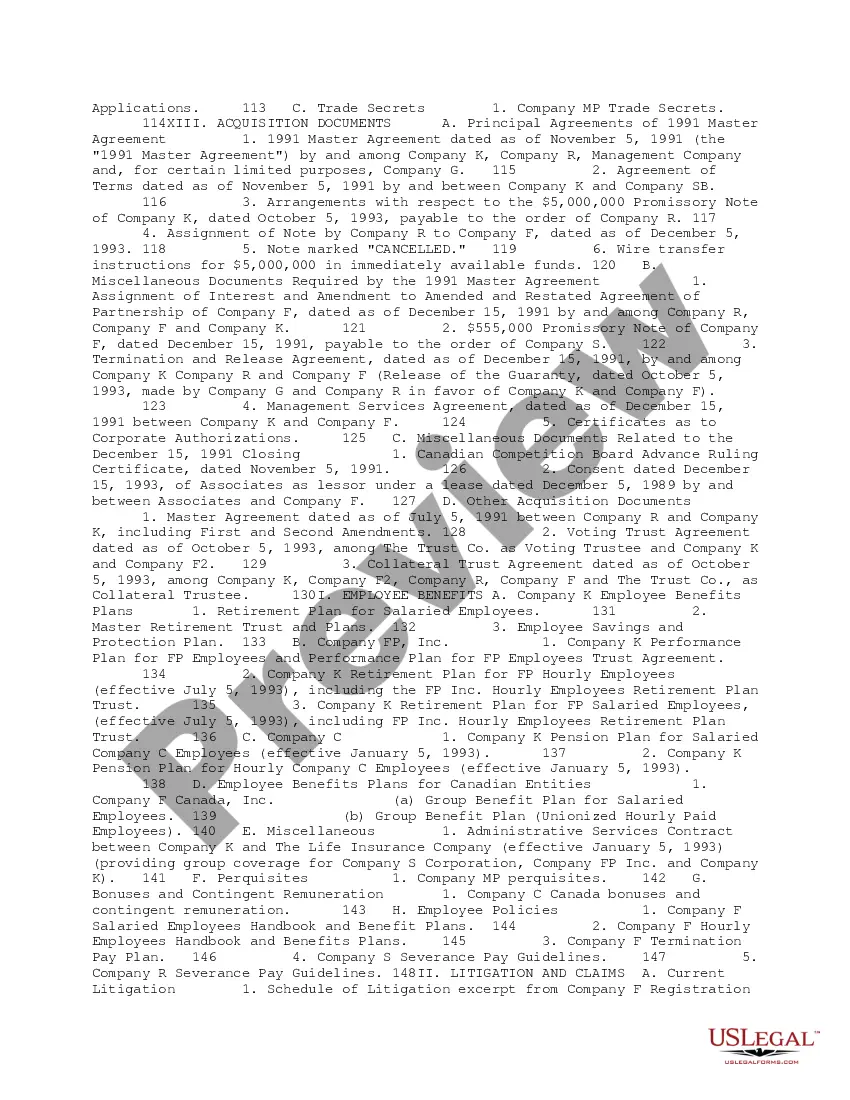

This form is the master data room index of documents and information for a company regarding business transactions.

Data Room Index

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Data Room Index?

When it comes to drafting a legal document, it’s easier to delegate it to the experts. However, that doesn't mean you yourself cannot find a sample to utilize. That doesn't mean you yourself can not find a sample to use, nevertheless. Download Data Room Index straight from the US Legal Forms web site. It provides numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. Once you’re registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Data Room Index quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Data Room Index is downloaded you may fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

An electronic due diligence data room, often referred to as a virtual data room, is essentially online cloud storage. They house a safe place for important data, such as documents and files, to be uploaded, shared, and stored. Data rooms used to be physical rooms where paper files were stored.

Use a Specific Document Naming System. This may seem like such simple, common sense advice, but plenty of company personnel are guilty of saving documents without paying much attention to how they name the file. Create Folders and Subfolders. Keep Things Updated in Real Time. Conduct Searches to Confirm Organization.

Because the primary purpose of the data room is to present a company's potential for future profit to a group of investors, the following documents should be considered for inclusion:Records of previous capital raises and liquidity events. Board of Directors' meeting minutes or previous actions. Business plans.

Data room. It is a physical location that is established by the seller to store essential documents that are required during an M&A transaction. The data room is part of the due diligence process; buyers and attorneys representing the buyer can access it before closing the transaction.

Legal structure and articles of incorporation. Records of previous capital raises and liquidity events. Board of Directors' meeting minutes or previous actions. Business plans. Company financials, including profit and loss statements and projections.

A data room is a space used for storing information such as contracts or corporate documents typically with the intent to share that information in a secure and/or confidential fashion with others (such as with a potential acquiror).

A data room index is an index of documents or data room table of contents. It lists all of the documents inside the VDR made available by the parties involved. Much like an index inside a book, this virtual data room index is used to locate information and can be an incredibly useful tool.

Use a Specific Document Naming System. This may seem like such simple, common sense advice, but plenty of company personnel are guilty of saving documents without paying much attention to how they name the file. Create Folders and Subfolders. Keep Things Updated in Real Time. Conduct Searches to Confirm Organization.