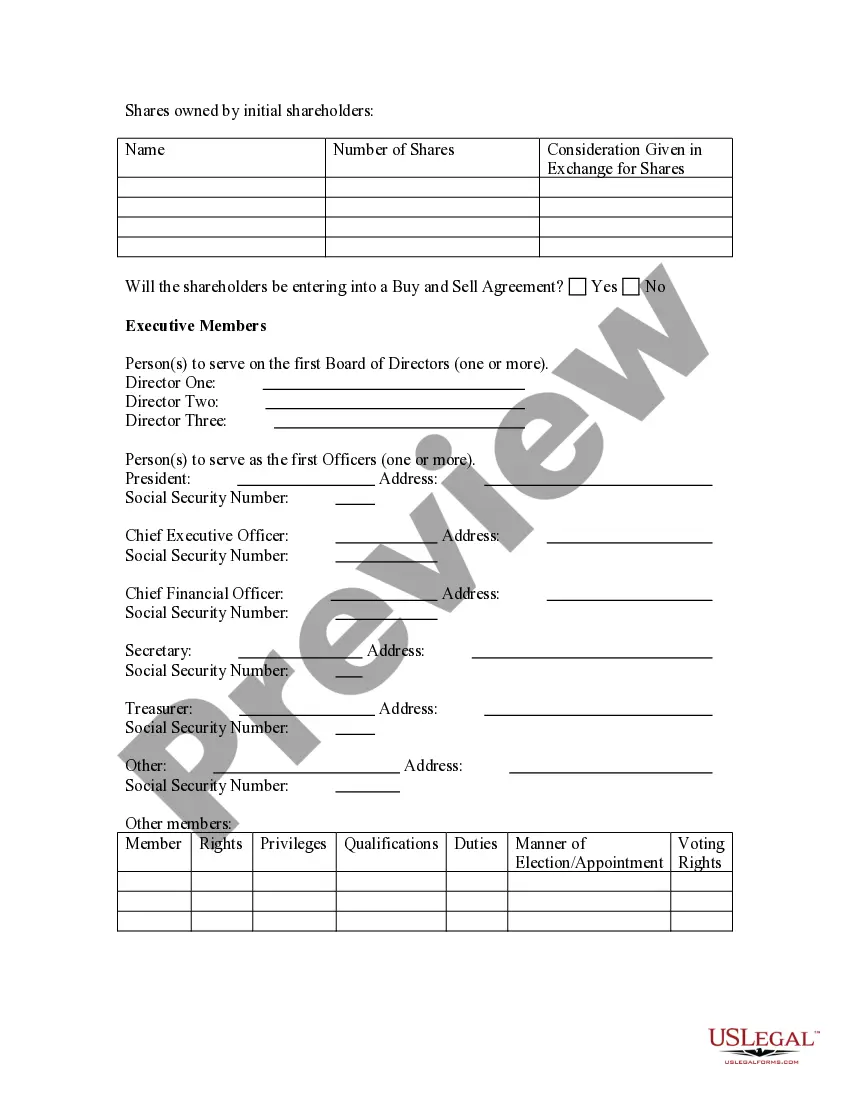

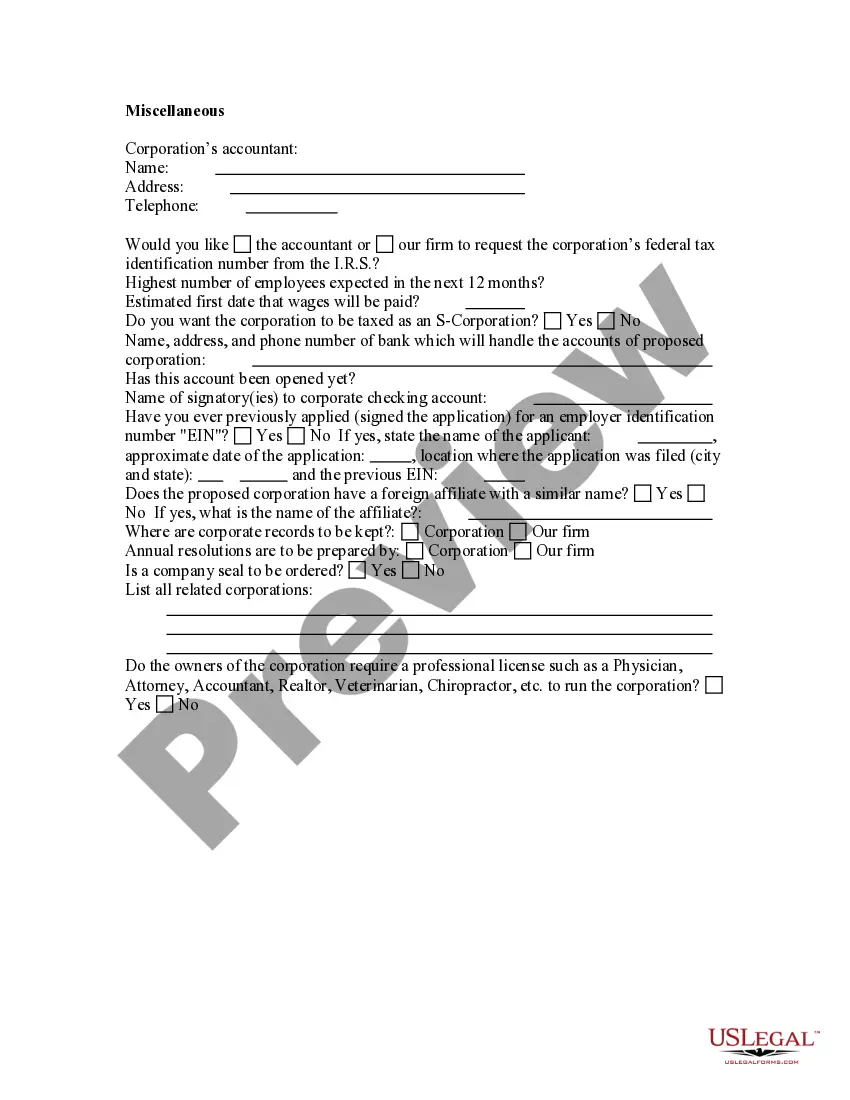

US Legal Forms - one of many greatest libraries of authorized varieties in the States - offers a wide array of authorized papers layouts you can download or print. Utilizing the website, you will get a huge number of varieties for company and specific uses, categorized by types, claims, or search phrases.You will discover the newest versions of varieties much like the South Carolina Business Incorporation Questionnaire in seconds.

If you currently have a membership, log in and download South Carolina Business Incorporation Questionnaire through the US Legal Forms local library. The Obtain switch will appear on each type you view. You have accessibility to all formerly acquired varieties within the My Forms tab of the account.

In order to use US Legal Forms the very first time, allow me to share straightforward recommendations to help you get started off:

- Be sure you have picked the proper type to your area/area. Click the Preview switch to analyze the form`s content. See the type description to ensure that you have chosen the correct type.

- If the type does not match your requirements, make use of the Look for field on top of the screen to find the one that does.

- When you are pleased with the form, confirm your selection by clicking on the Buy now switch. Then, opt for the pricing prepare you want and offer your qualifications to register on an account.

- Process the financial transaction. Use your charge card or PayPal account to perform the financial transaction.

- Pick the file format and download the form on your own product.

- Make modifications. Fill out, revise and print and indication the acquired South Carolina Business Incorporation Questionnaire.

Each template you included in your money does not have an expiration day and it is your own property permanently. So, in order to download or print an additional backup, just proceed to the My Forms area and then click in the type you need.

Get access to the South Carolina Business Incorporation Questionnaire with US Legal Forms, the most considerable local library of authorized papers layouts. Use a huge number of professional and condition-certain layouts that fulfill your business or specific needs and requirements.