South Carolina Incorporation Questionnaire

Description

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews."

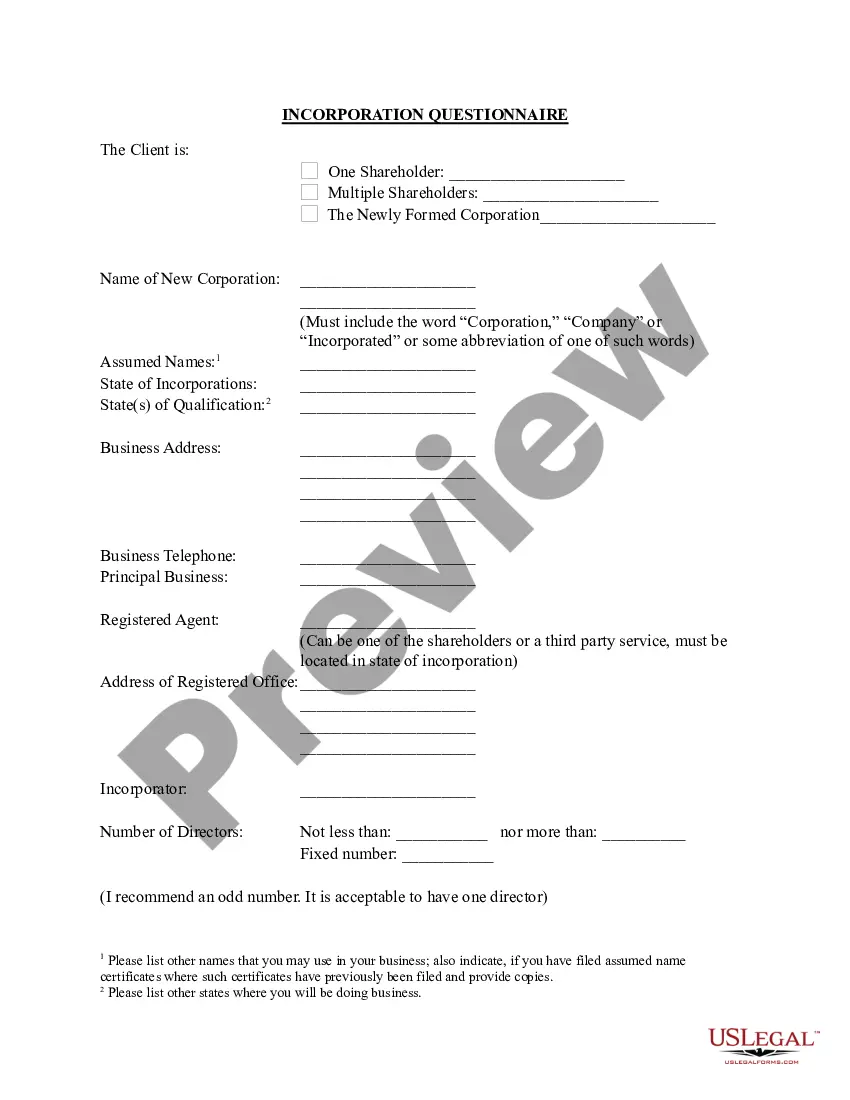

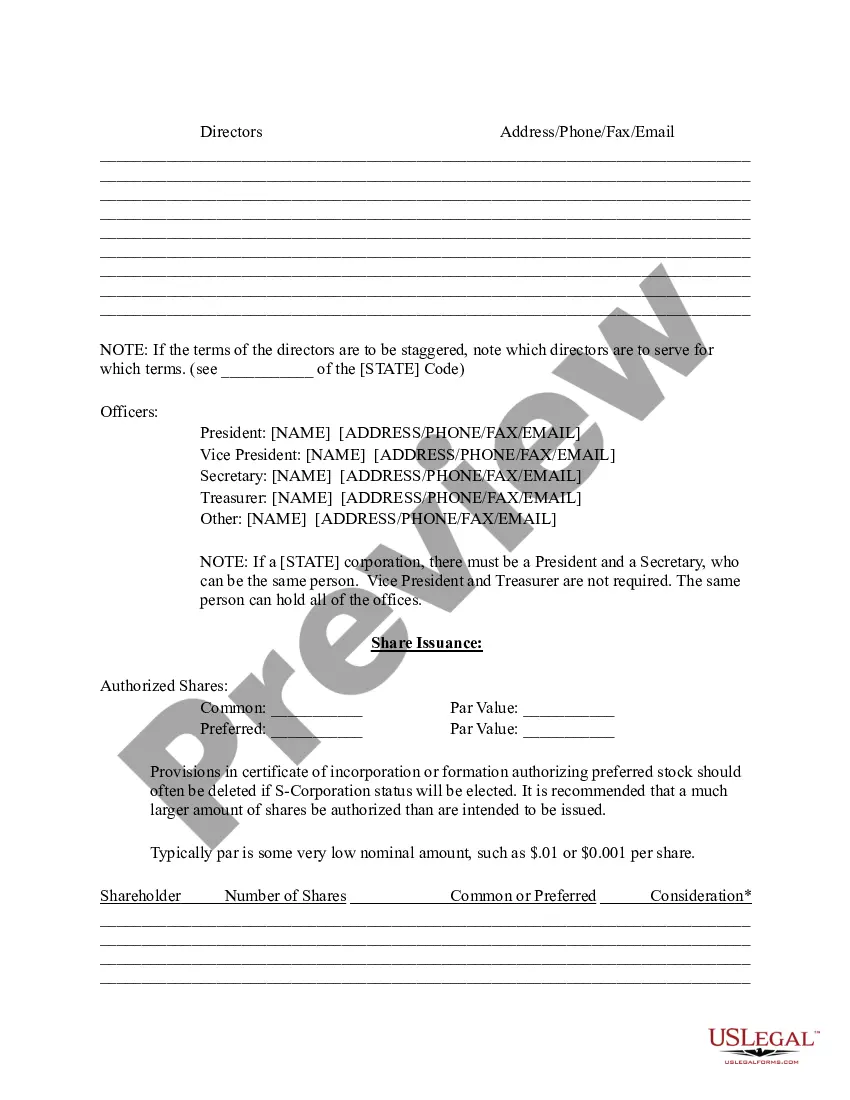

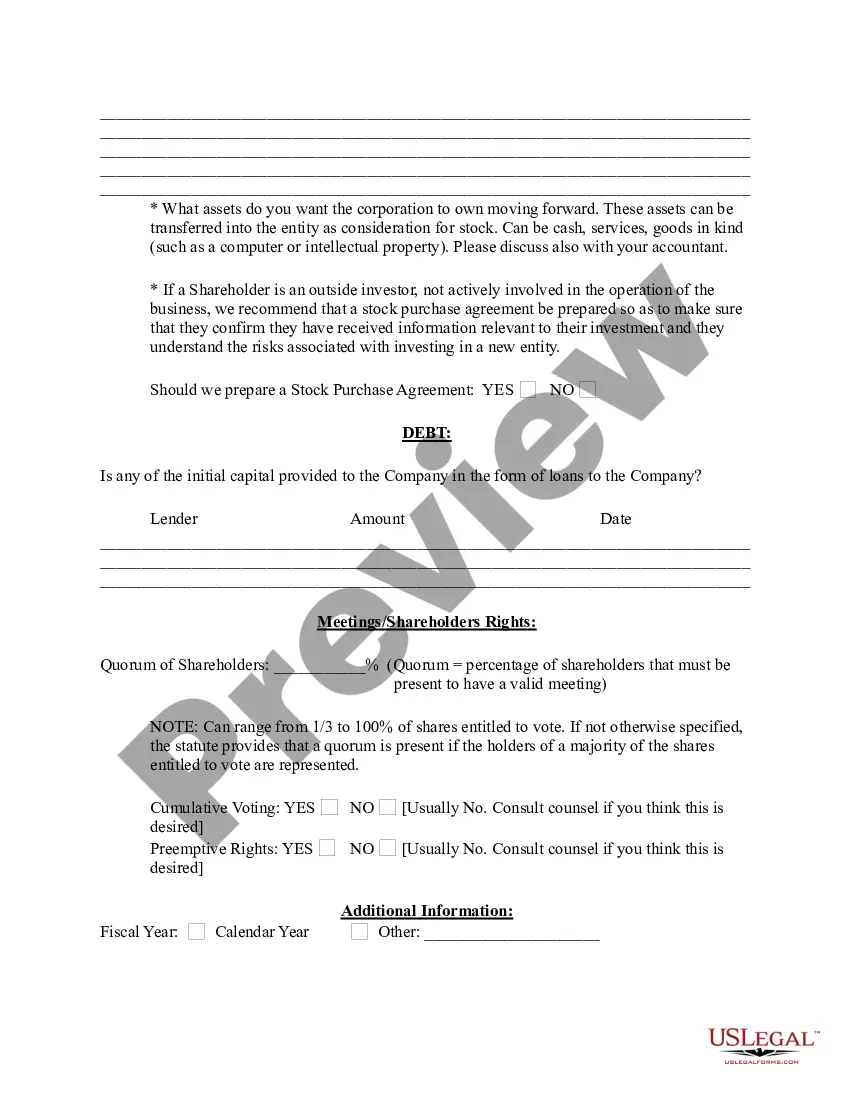

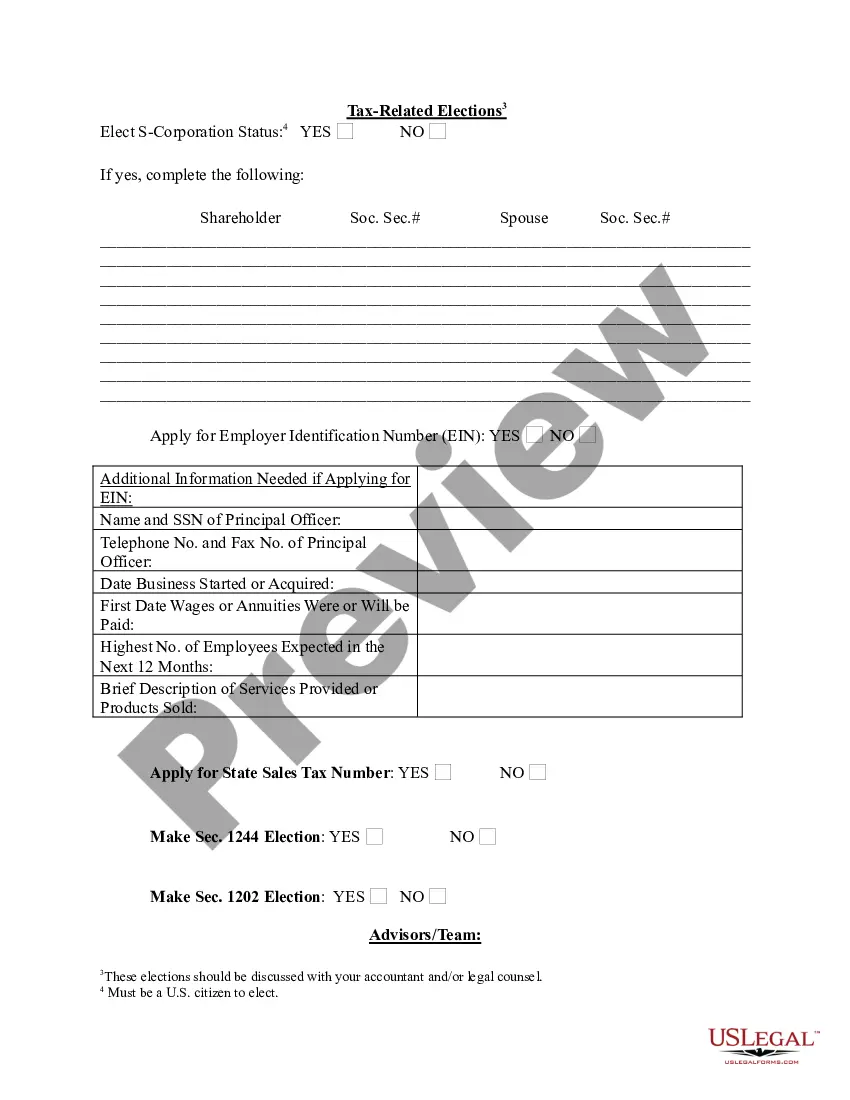

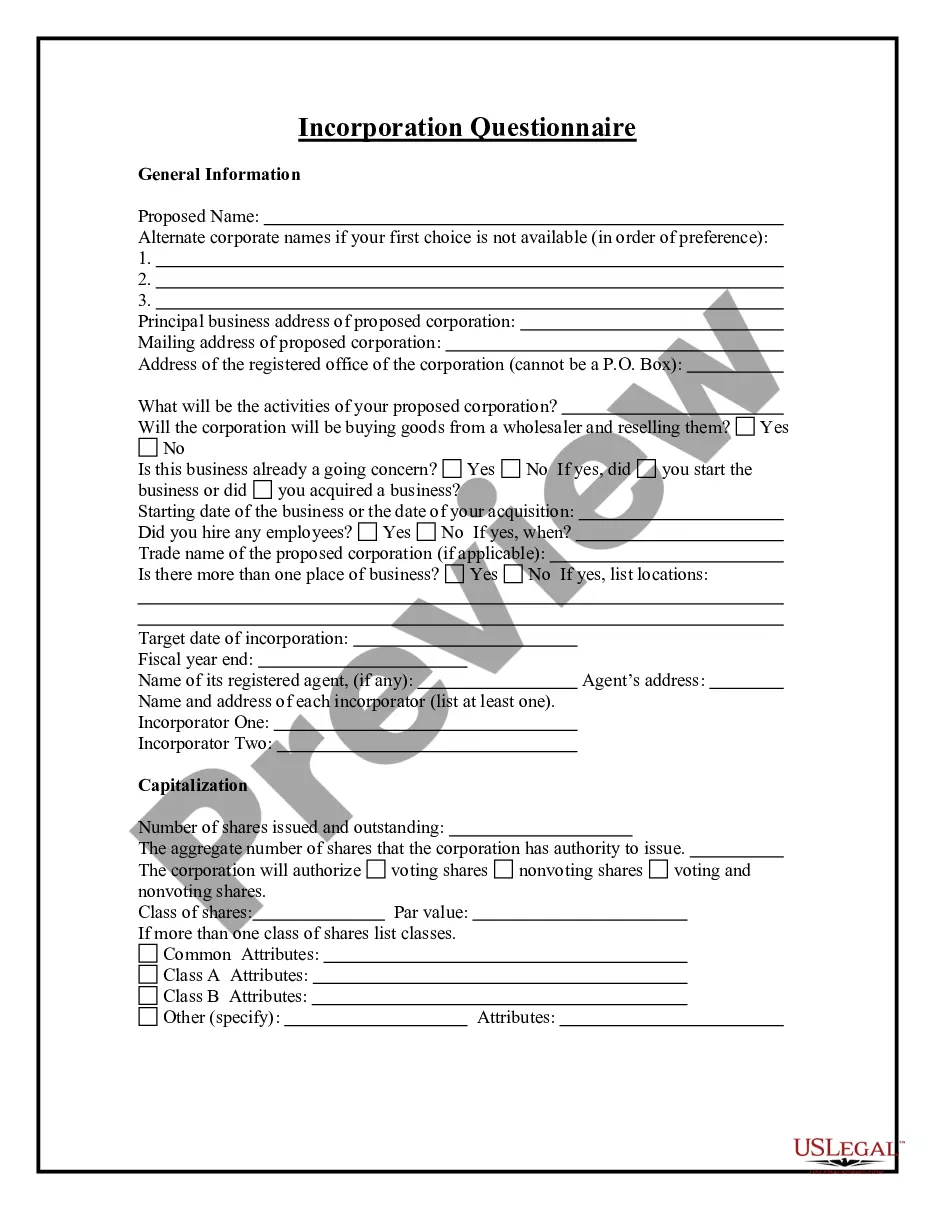

How to fill out Incorporation Questionnaire?

US Legal Forms - one of several biggest libraries of legitimate varieties in the USA - gives a wide range of legitimate record layouts you are able to download or printing. Utilizing the internet site, you may get 1000s of varieties for enterprise and personal purposes, categorized by classes, claims, or search phrases.You can find the newest models of varieties just like the South Carolina Incorporation Questionnaire in seconds.

If you already have a membership, log in and download South Carolina Incorporation Questionnaire in the US Legal Forms local library. The Obtain button will appear on every single form you view. You have accessibility to all previously delivered electronically varieties within the My Forms tab of your own account.

If you want to use US Legal Forms the first time, listed below are simple guidelines to get you started out:

- Be sure you have picked out the proper form to your town/county. Click on the Preview button to check the form`s information. See the form information to actually have selected the correct form.

- In the event the form does not satisfy your specifications, use the Research area towards the top of the screen to find the the one that does.

- If you are pleased with the shape, affirm your selection by clicking on the Get now button. Then, opt for the costs program you want and supply your references to sign up to have an account.

- Method the deal. Utilize your bank card or PayPal account to finish the deal.

- Find the structure and download the shape on your system.

- Make adjustments. Complete, change and printing and indicator the delivered electronically South Carolina Incorporation Questionnaire.

Every single web template you included in your account does not have an expiration date which is your own forever. So, if you wish to download or printing another duplicate, just go to the My Forms section and click on on the form you need.

Get access to the South Carolina Incorporation Questionnaire with US Legal Forms, by far the most substantial local library of legitimate record layouts. Use 1000s of specialist and state-certain layouts that satisfy your company or personal requirements and specifications.

Form popularity

FAQ

South Carolina does not require LLCs to file an annual report. Taxes. For complete details on state taxes for South Carolina LLCs, visit Business Owner's Toolkit or the State of South Carolina . Federal tax identification number (EIN).

How much does it cost to start an S-Corp? Registering an S-corp requires paying state filing fees which can range from $40 to $500, depending on the state. States also typically require annual fees to maintain a corporation's status.

There is nothing wrong with appointing yourself or another individual as your South Carolina registered agent. It is important to remember, though, that you will be listing your name and address in the public record.

CL-1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue. $25.00.

~1-2 business days online. Choose a Corporate Structure. Incorporating means starting a corporation. ... Check Name Availability. ... Appoint a Registered Agent. ... File South Carolina Articles of Incorporation. ... File Initial Report. ... Establish Bylaws & Corporate Records. ... Appoint Initial Directors. ... Hold Organizational Meeting.

Can I set up an S corp myself? While it is possible to file articles of incorporation and go through the S corporation election process alone, S corp requirements are both strict and complex. To ensure you're following the rules, we recommend consulting an attorney or tax professional.

By default, South Carolina LLCs are taxed as pass-through entities, meaning the business does not pay any sort of LLC income tax. Instead, the member or members of the LLC pays for the LLC's losses and revenue on their personal income taxes and pay the state's graduated income tax rate ranging from 0% to 7%.

S Corporations are subject to an annual License Fee of . 1% of capital and paid-in-surplus, plus $15. The License Fee cannot be less than $25. Both the Income Tax and License Fee are reported on form SC1120S.

Is There a Minimum Salary for S Corp? No, there is not a minimum salary for S Corp. The IRS can't require a minimum salary for self-employed workers.

How do I file for an S corp in South Carolina? Choose a unique business name. Appoint a registered agent. File Articles of Organization with the South Carolina Secretary of State. Draft an operating agreement. Get an Employer Identification Number (EIN).