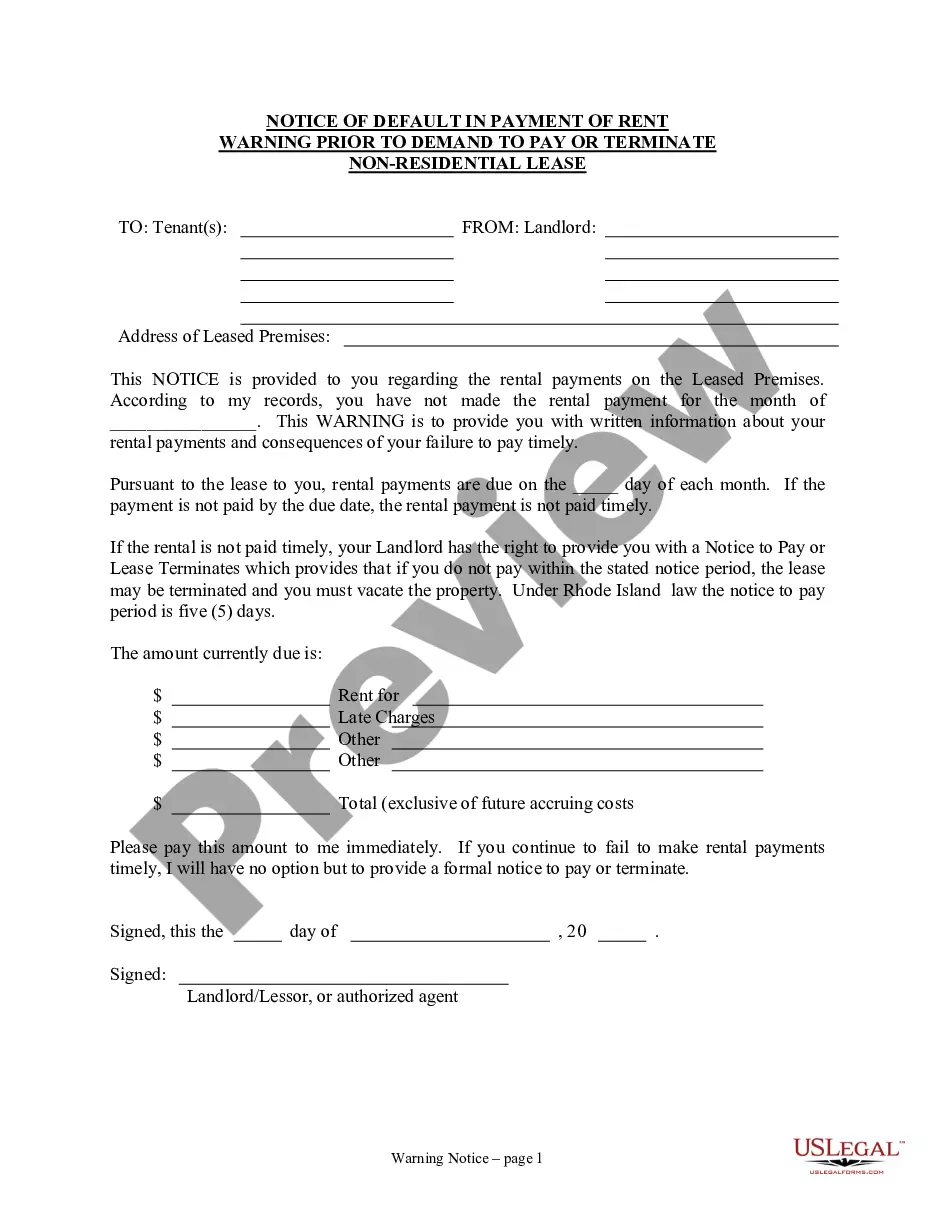

Rhode Island Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Nonresidential or Commercial Property

Description

How to fill out Rhode Island Notice Of Default In Payment Of Rent As Warning Prior To Demand To Pay Or Terminate For Nonresidential Or Commercial Property?

The work with documents isn't the most simple process, especially for people who rarely work with legal papers. That's why we advise utilizing correct Rhode Island Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Nonresidential or Commercial Property samples created by skilled lawyers. It gives you the ability to eliminate problems when in court or working with formal institutions. Find the templates you need on our site for top-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. When you’re in, the Download button will immediately appear on the template webpage. Right after downloading the sample, it’ll be stored in the My Forms menu.

Customers with no an activated subscription can quickly get an account. Use this simple step-by-step help guide to get the Rhode Island Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Nonresidential or Commercial Property:

- Make sure that the sample you found is eligible for use in the state it’s required in.

- Verify the document. Make use of the Preview feature or read its description (if readily available).

- Buy Now if this form is the thing you need or use the Search field to get a different one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these easy steps, it is possible to fill out the sample in an appropriate editor. Recheck filled in details and consider asking a legal representative to examine your Rhode Island Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Nonresidential or Commercial Property for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

TurboTax Online includes federal and state e-filing. About 75% of our customers choose this version.

The W-4 is a federal document, and several states but not all accept the federal W-4. Below is a chart of states and what they accept. If the state has their own withholding form, then the federal W-4 is not allowed for state calculation of withholdings.

The State of Rhode Island Division of Taxation accepts online payments made by credit card. Alternatively, you can pay by mailed check or money order. In this case, send your payment with your return and Form 1040V to Rhode Island Division of Taxation, Dept #85, PO Box 9703, Providence, RI 02940-9703.

No, they aren't exactly the same. Most state tax laws are similar to federal tax law, but each state usually differs from the federal rules in some way.In addition, states often apply different rules than the Internal Revenue Service (IRS) for other types of income and have differing tax rates.

Yes. You can file them separately. Although state returns can be e-filed with your federal return (or after your federal return has already been accepted), it's no longer possible to e-file state returns before the federal. They are taking this measure to add an extra layer of security to all e-filed state returns.

If you are a part year Rhode Island resident and are required to file a federal return, you must file a Rhode Island return. If you are a Rhode Island nonresident who has to file a federal return and has income from Rhode Island sources, you must file a Rhode Island return.

Introduction. In addition to federal income taxes, U.S. citizens are liable for various state taxes as well. While some states do not levy a state income tax, all states assess some form of tax, such as sales or use taxes. And some of these taxes will require you to submit a separate state tax form each year.

Every part-year individual who was a resident for a period of less than 12 months is required to file a Rhode Island return if he or she is required to file a federal return.