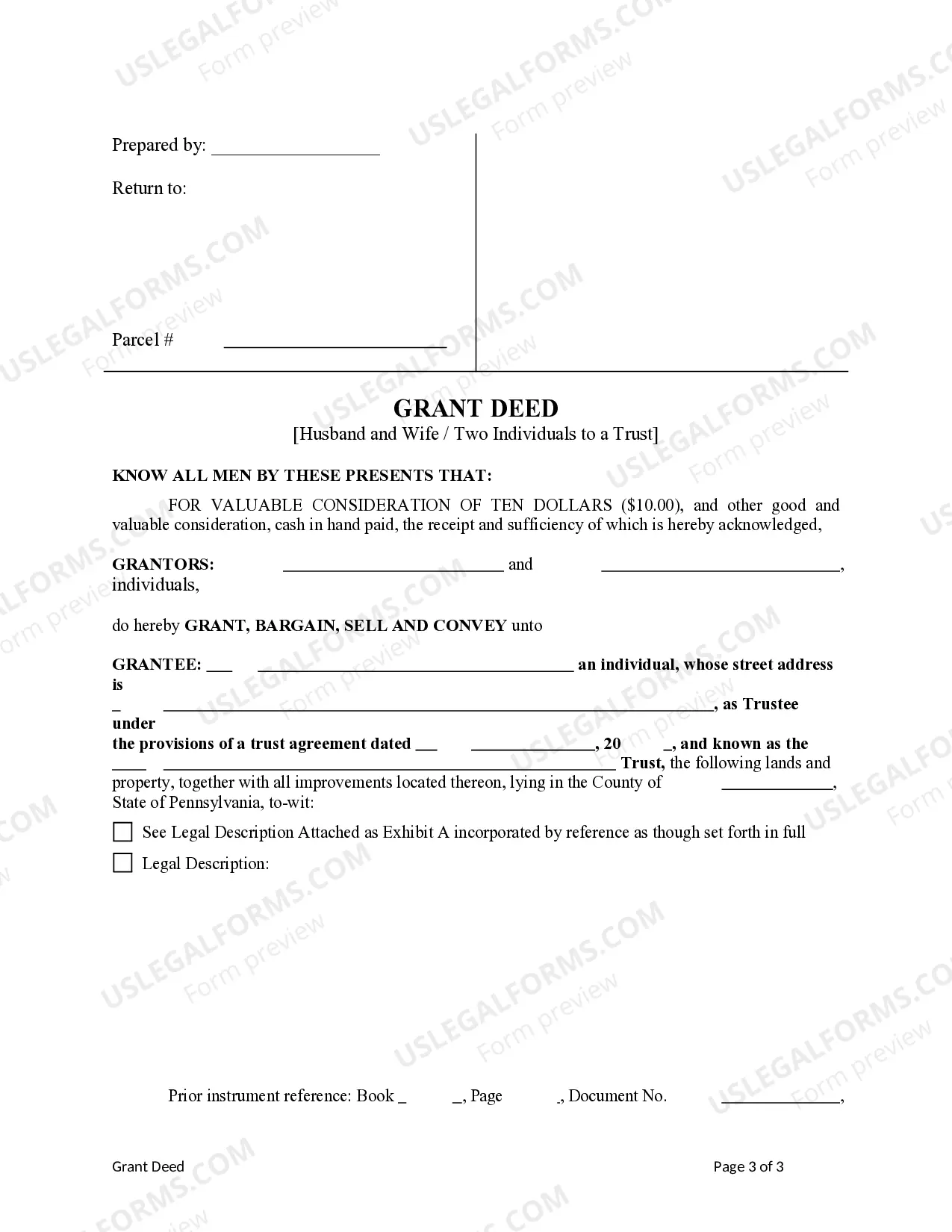

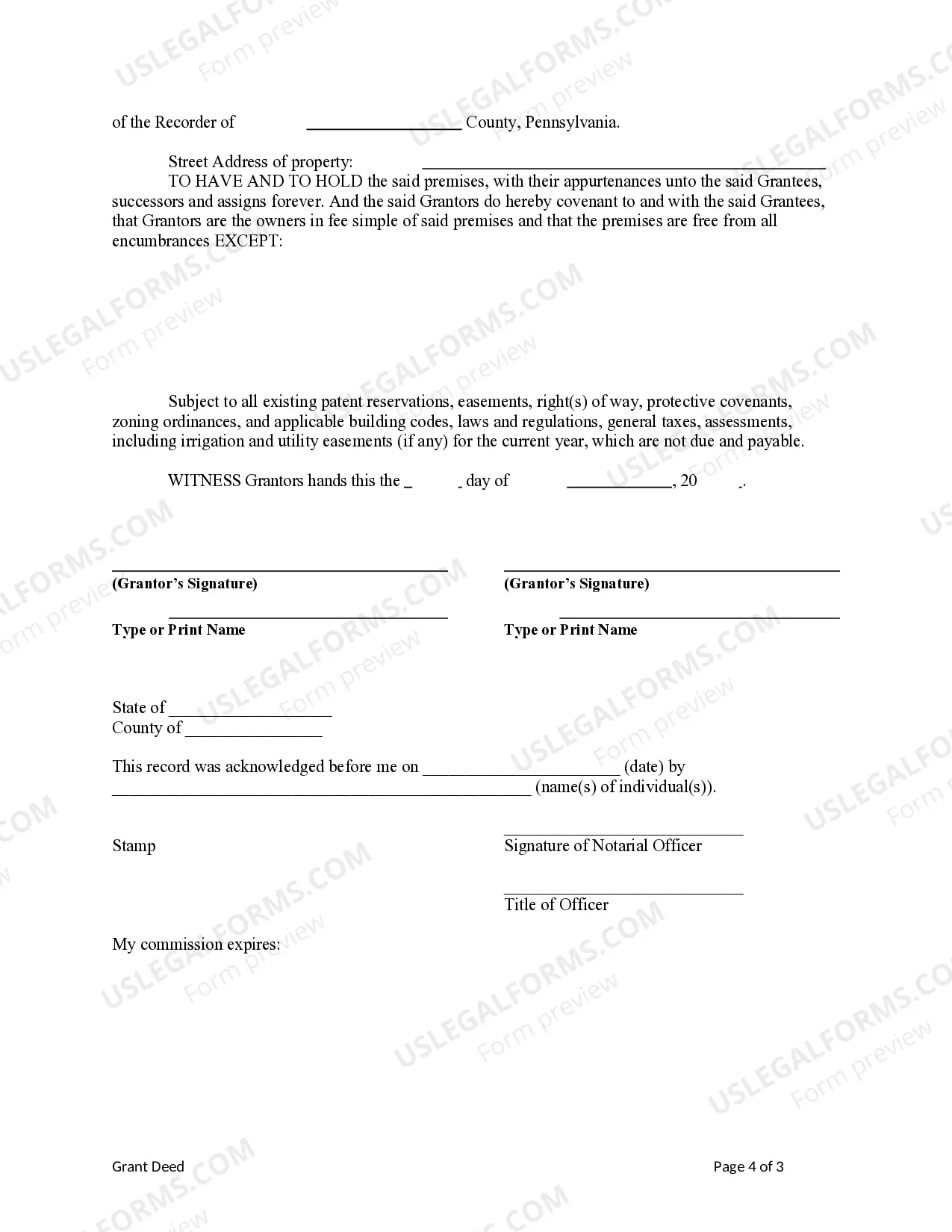

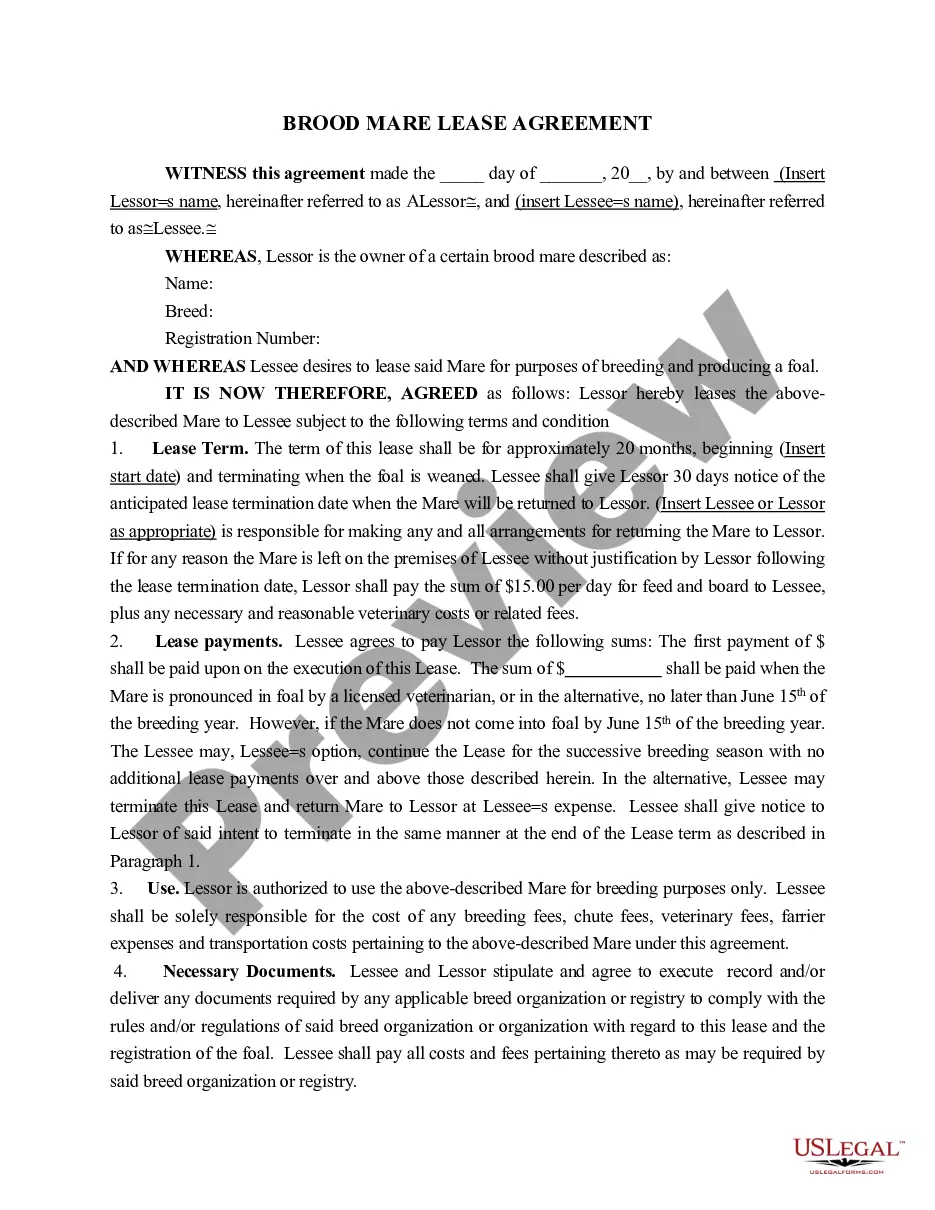

This form is a Grant Deed where the Grantors are husband and wife, or two individuals, and the Grantee is a trust. Grantors convey and grant the described property to the Grantee. This grant simply transfers the title of a property to the grantee. Included in the deed are statements verifying the property is not sold to other parties, and all encumbrances on the property are known to the grantee.

Grantors affirm that (1) Grantors have the right to sell and convey the property; (2) the property has not been sold by Grantors to any party; and (3) any encumbrances or liens are noted herein. This deed complies with all state statutory laws.

Pennsylvania Grant Deed from Husband and Wife, or two Individuals, to a Trust

Description

How to fill out Pennsylvania Grant Deed From Husband And Wife, Or Two Individuals, To A Trust?

Creating papers isn't the most straightforward job, especially for people who rarely work with legal papers. That's why we advise making use of correct Pennsylvania Grant Deed from Husband and Wife, or two Individuals, to a Trust templates made by professional lawyers. It allows you to avoid troubles when in court or working with formal institutions. Find the documents you require on our site for high-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file webpage. Soon after downloading the sample, it’ll be stored in the My Forms menu.

Users without a subscription can quickly create an account. Use this short step-by-step help guide to get your Pennsylvania Grant Deed from Husband and Wife, or two Individuals, to a Trust:

- Be sure that file you found is eligible for use in the state it’s necessary in.

- Confirm the document. Use the Preview option or read its description (if readily available).

- Buy Now if this template is what you need or go back to the Search field to get another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After completing these easy actions, you are able to fill out the sample in a preferred editor. Recheck filled in information and consider requesting a legal professional to review your Pennsylvania Grant Deed from Husband and Wife, or two Individuals, to a Trust for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Form popularity

FAQ

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

The names on the mortgage show who's responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

In cases where a couple shares a home but only one spouse's name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title.

To add a name to a house deed in Pennsylvania, a new deed is prepared. The owner can prepare his own deed or contact an attorney or document service to provide one. Using an attorney is the best route because the attorney ensures that the deed is prepared per the requirements of the state.

To add a name to a house deed in Pennsylvania, a new deed is prepared. The owner can prepare his own deed or contact an attorney or document service to provide one. Using an attorney is the best route because the attorney ensures that the deed is prepared per the requirements of the state.

The simplest way to add a spouse to a deed is through a quitclaim deed. This type of deed transfers whatever ownership rights you have so that you and your spouse now become joint owners. No title search or complex transaction is necessary. The deed will list you as the grantor and you and your spouse as grantees.

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.