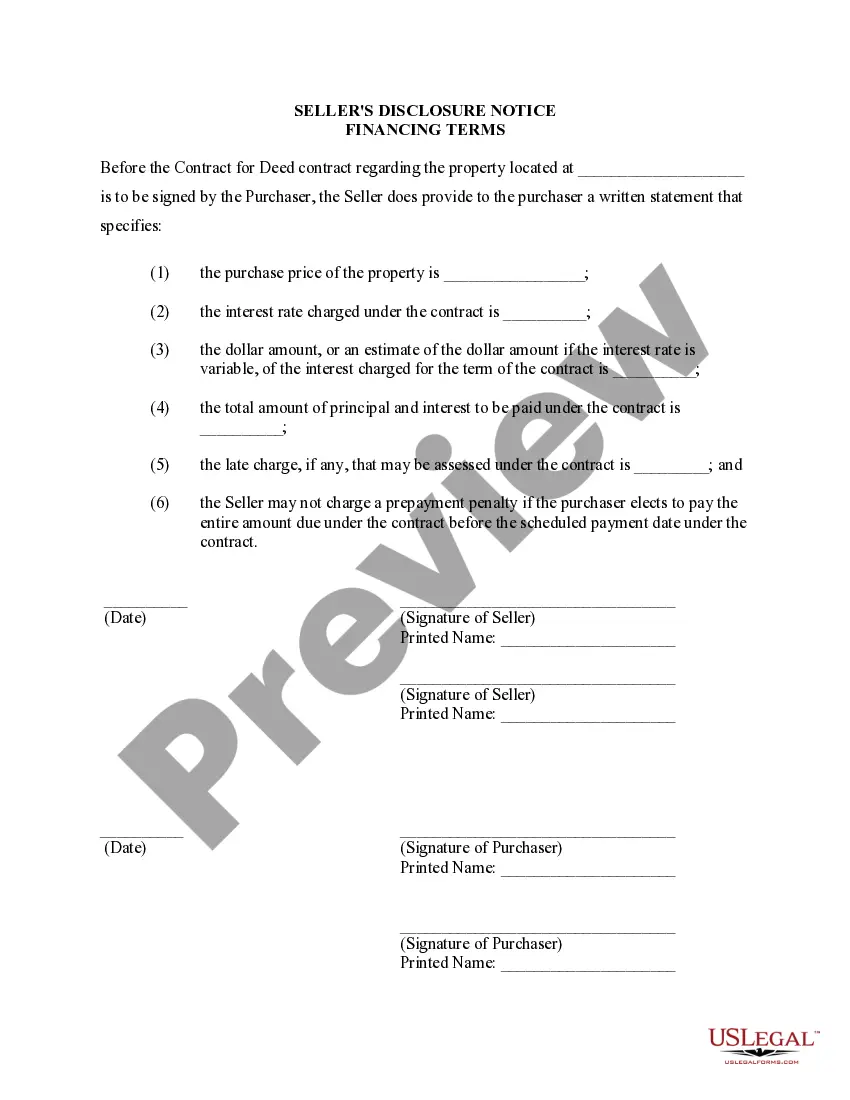

Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Pennsylvania Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Use US Legal Forms to obtain a printable Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms library on the web and offers affordable and accurate templates for customers and attorneys, and SMBs. The documents are grouped into state-based categories and many of them might be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For those who do not have a subscription, follow the tips below to quickly find and download Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract:

- Check out to make sure you have the proper template in relation to the state it is needed in.

- Review the form by reading the description and using the Preview feature.

- Hit Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Make use of the Search field if you want to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Pennsylvania Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Above three million users already have used our platform successfully. Choose your subscription plan and obtain high-quality documents within a few clicks.

Form popularity

FAQ

In Pennsylvania, the sellers of a house are usually required by law to disclose the condition of that home.Where applicable, the law requires a seller to disclose to a buyer all known material defects about the property being sold that are not readily observable.

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

One such alternative is the contract for deed. In a contract for deed, the purchase of property is financed by the seller rather than a third-party lender such as a commercial bank or credit union.

A Contract for Deed is a tool that can allow buyers who either don't qualify for traditional lending options or who want a faster financing option to purchase property.The seller retains legal title to the property until the balance is paid; the buyer gets legal title to the property once the final payment is made.

As the property is mortgaged, you can not sell part of the land without first getting your lender's consent.You may find that the lender wants to have a professional valuation carried out, for which you will have to pay and if there is still sufficient equity to support your mortgage you should get consent.

Once both buyer and seller sign the purchase agreement, the contract is legally binding. In many cases, however, the contract has contingencies or certain conditions that must be met in order for the sale to go through.

You can sell your house on a land contract with an outstanding loan balance if your lender agrees and if the contract doesn't have a due-on-sale clause.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.