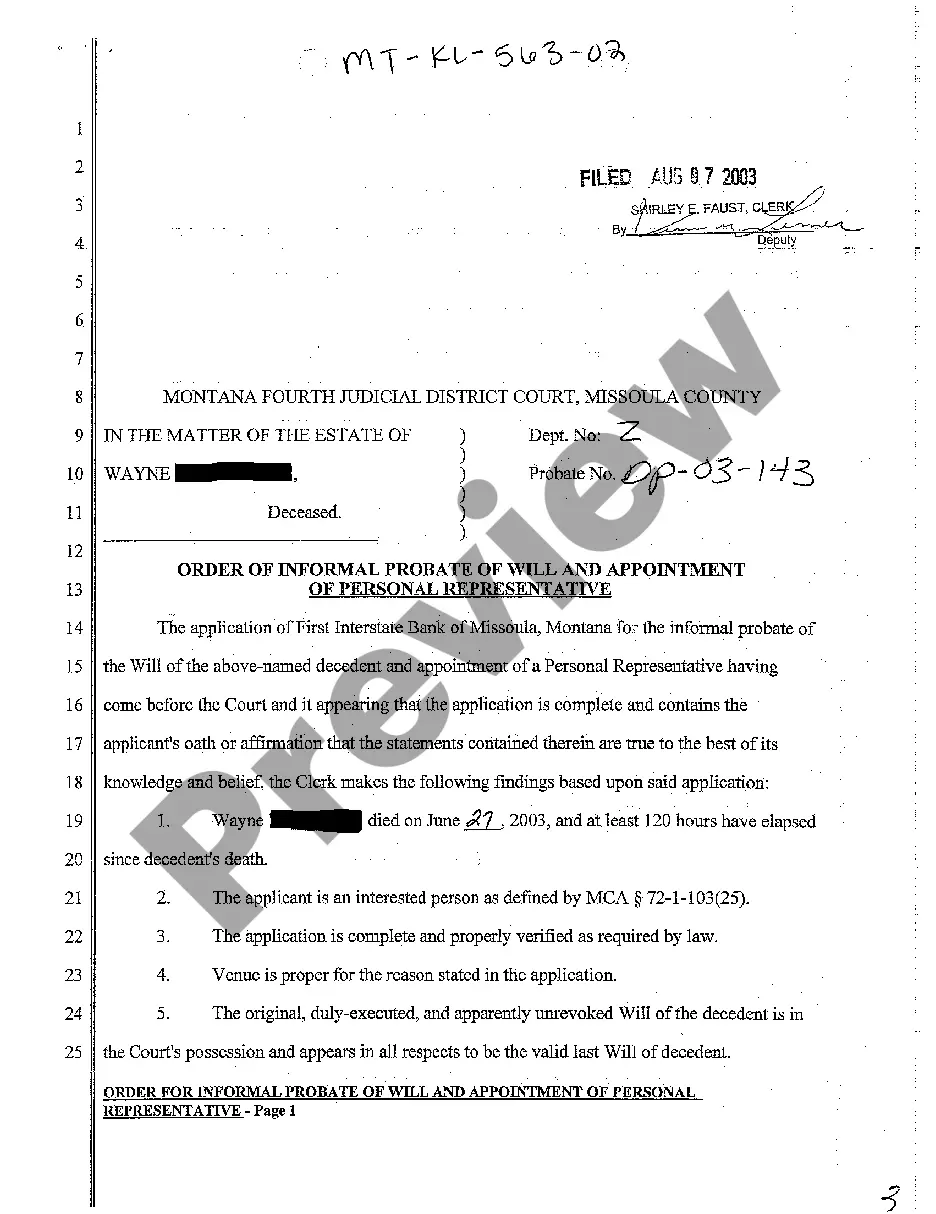

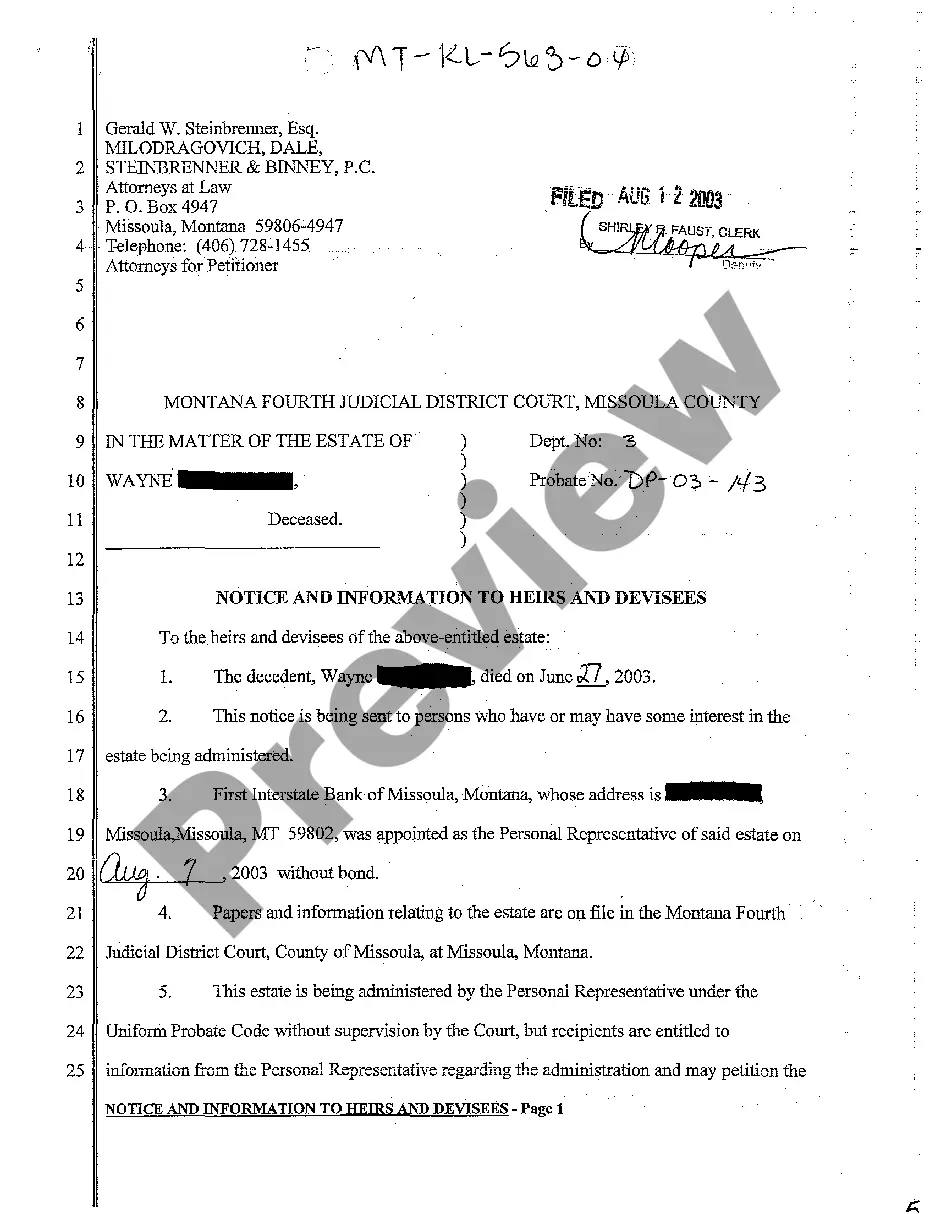

A Louisiana Administrator's Bond is a type of surety bond required by the State of Louisiana. It is required of all administrators who are appointed to handle the estate of a deceased person. The purpose of the bond is to protect the estate's beneficiaries from any mismanagement or fraud committed by the administrator. There are two types of Louisiana Administrator's Bond: the Executor Bond and the Administrator Bond. The Executor Bond is required when the deceased has a will and the administrator is appointed by the court. The Administrator Bond is required when the deceased does not have a will and the administrator is appointed by the court. The bond must be issued by a surety company licensed to do business in Louisiana and must be equal to the total value of the estate, up to a maximum of $50,000. The bond must remain in effect until the estate is closed, and the surety company is liable for any losses resulting from any mismanagement or fraud committed by the administrator.

Louisiana Administrator's Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

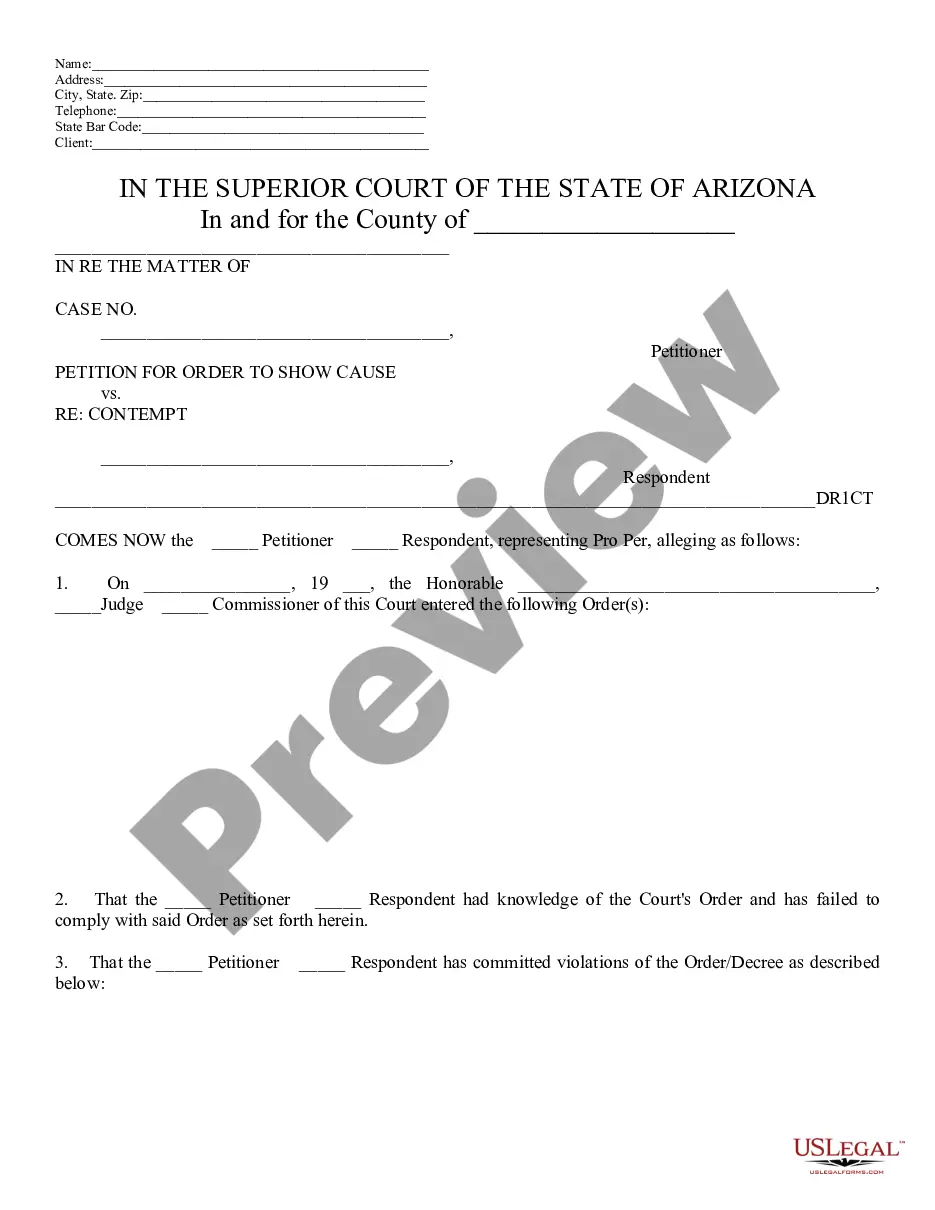

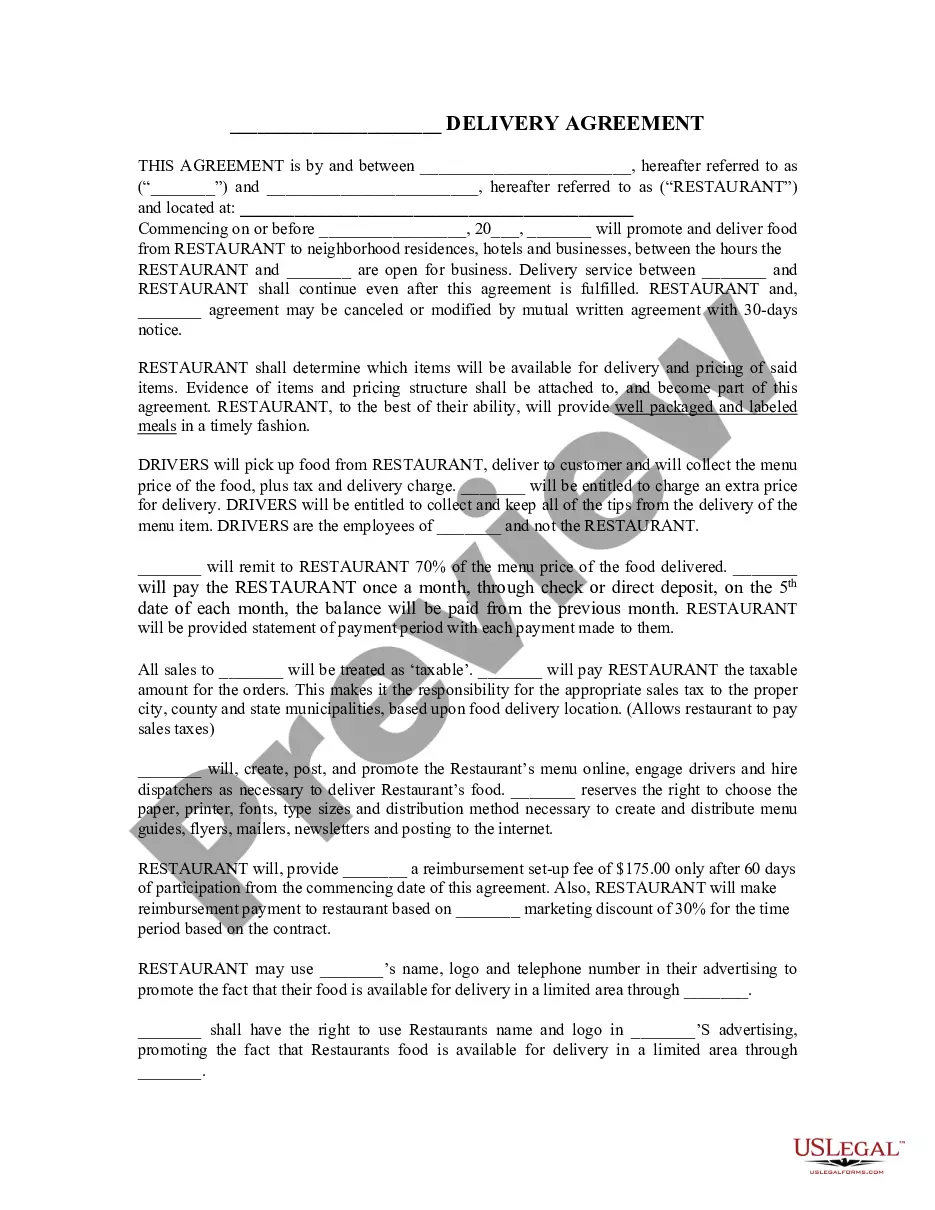

How to fill out Louisiana Administrator's Bond?

Completing official documentation can be quite a chore if you lack ready-made fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the forms you receive, as they comply with federal and state laws and are verified by our professionals.

Acquiring your Louisiana Administrator's Bond from our collection is as straightforward as pie. Previously authorized users with a current subscription simply need to Log In and click the Download button after locating the right template. Later, if necessary, users can retrieve the same document from the My documents section of their account. However, even if you are new to our service, signing up with a valid subscription will only take a few moments. Here’s a quick overview for you.

Haven’t you tried US Legal Forms yet? Register for our service today to obtain any official document swiftly and effortlessly whenever you require, and maintain your paperwork systematically!

- Document adherence verification. You should carefully inspect the details of the form you require and ensure it fulfills your criteria and aligns with your state legislation. Previewing your document and examining its overall description will assist you in this.

- Alternative search (if necessary). If there are any discrepancies, sift through the library using the Search tab above until you identify a suitable blank, and click Buy Now as soon as you find the one you want.

- Account registration and form acquisition. Create an account with US Legal Forms. After verifying your account, Log In and choose your desired subscription plan. Make a payment to continue (options available are PayPal and credit card).

- Template retrieval and subsequent use. Select the file type for your Louisiana Administrator's Bond and click Download to save it on your device. Print it to finalize your paperwork manually, or utilize a multi-functional online editor to prepare an electronic version more swiftly and effectively.

Form popularity

FAQ

By the time the executor takes inventory and creditors have an opportunity to submit claims, it will be at least six months. Expect succession to take from six months to a year before the final assets may be distributed to the heirs. In complicated situations, that timeline may be extended to several years.

What Do Louisiana Surety Bonds Cost? Surety bonds generally cost 1-15% of the required bond amount. Costs vary significantly depending on the bond amount you need and your rate (which is the percentage of the full bond amount you must pay).

Surety bonds are one of the most common legal documents that are used to protect consumers against damages that they can incur from negligent businesses. Louisiana surety bonds are issued across many different industries to protect consumers against damages, and businesses against costly claims from their customers.

What Do Louisiana Surety Bonds Cost? Surety bonds generally cost 1-15% of the required bond amount. Costs vary significantly depending on the bond amount you need and your rate (which is the percentage of the full bond amount you must pay).

The main difference between a cash bond and a surety bond is the number of parties involved. Cash bonds only involve two parties, you and the owner. In a surety bond, there is a third party, the surety company. The term surety refers to any party that guarantees the payment of a debt or performance of a contract.

What Are Surety Bonds. A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

Surety Bond Requirements The bond must be issued by an insurer admitted to write surety business in Louisiana. Each bond must be executed on the form provided by the LDI. The original bond must be filed with the LDI. Each bond must provide for a cancellation notice of not less than thirty day.