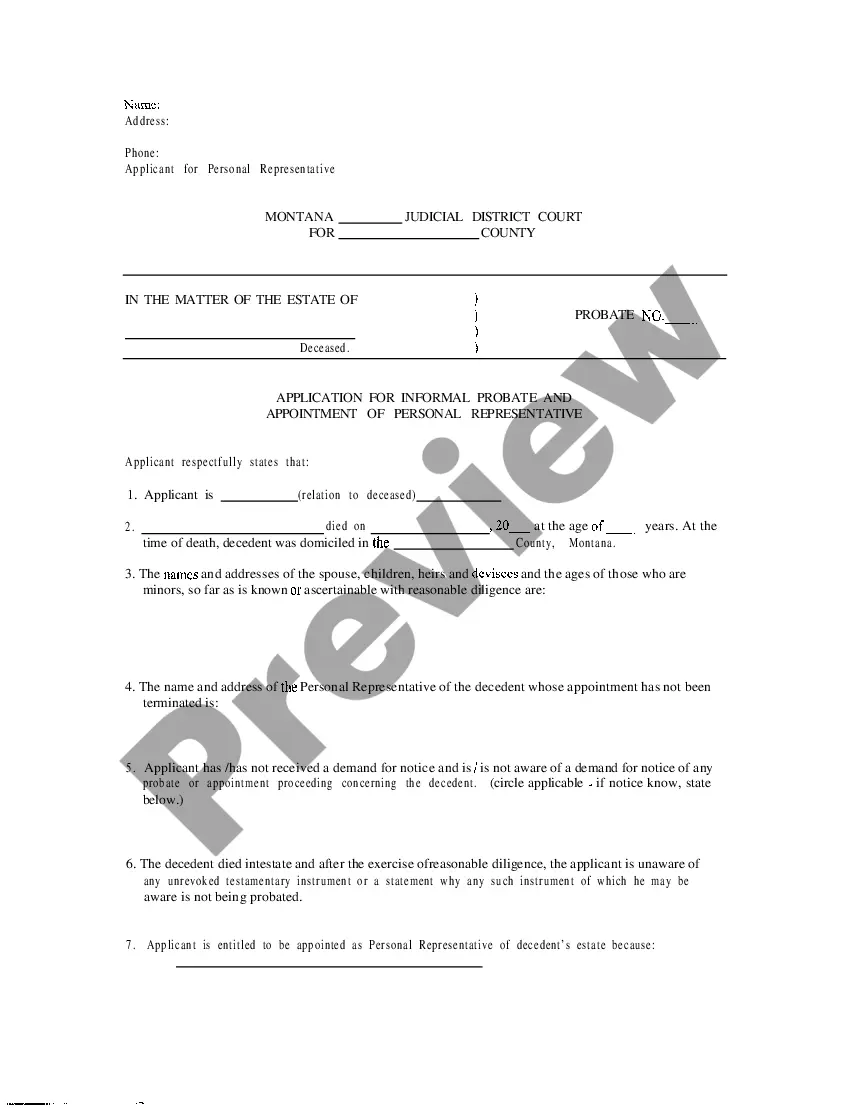

A Louisiana Administrators Bond is a type of surety bond that is required by the state of Louisiana. It is designed to protect the public from any financial loss caused by the dishonest or fraudulent acts of a person or company acting as an Administrator in the state. It is required for individuals or businesses who administer estates, trusts, guardianship, conservatorships, and other fiduciary services. Types of Louisiana Administrators Bonds include: Probate Bond, Trust Bond, Fiduciary Bond, and Court Bond. The Probate Bond is required of those appointed by the court as an Executor or Administrator of an Estate. The Trust Bond is required of those appointed by the court to manage trust property. The Fiduciary Bond is required of those appointed by the court to manage the financial affairs of a minor, disabled adult, or other person deemed legally incapacitated. The Court Bond is required of those appointed by the court to act as a Guardian Ad Item.

Louisiana Administrators Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Administrators Bond?

If you seek a method to properly draft the Louisiana Administrators Bond without employing a legal professional, then you've found the ideal source.

US Legal Forms has established itself as the most comprehensive and esteemed collection of formal templates for any individual and business situation.

Another significant benefit of US Legal Forms is that you will never lose the documents you have obtained - you can access any of your downloaded forms in the My documents section of your account whenever required.

- Ensure the document you view matches your legal context and state regulations by reviewing its text description or browsing through the Preview mode.

- Enter the form name in the Search tab at the top of the page and select your state from the dropdown list to locate an alternative template in case of discrepancies.

- Verify the content again and click Buy now when you feel confident about the document meeting all stipulations.

- Log in to your account and click Download. If you do not have an account yet, register for the service and choose a subscription plan.

- Utilize your credit card or PayPal option to purchase your US Legal Forms subscription. The blank will be ready for download immediately after.

- Choose the format in which you want to preserve your Louisiana Administrators Bond and download it by pressing the corresponding button.

- Integrate your template into an online editor for swift completion and signing or print it to prepare your physical copy manually.

Form popularity

FAQ

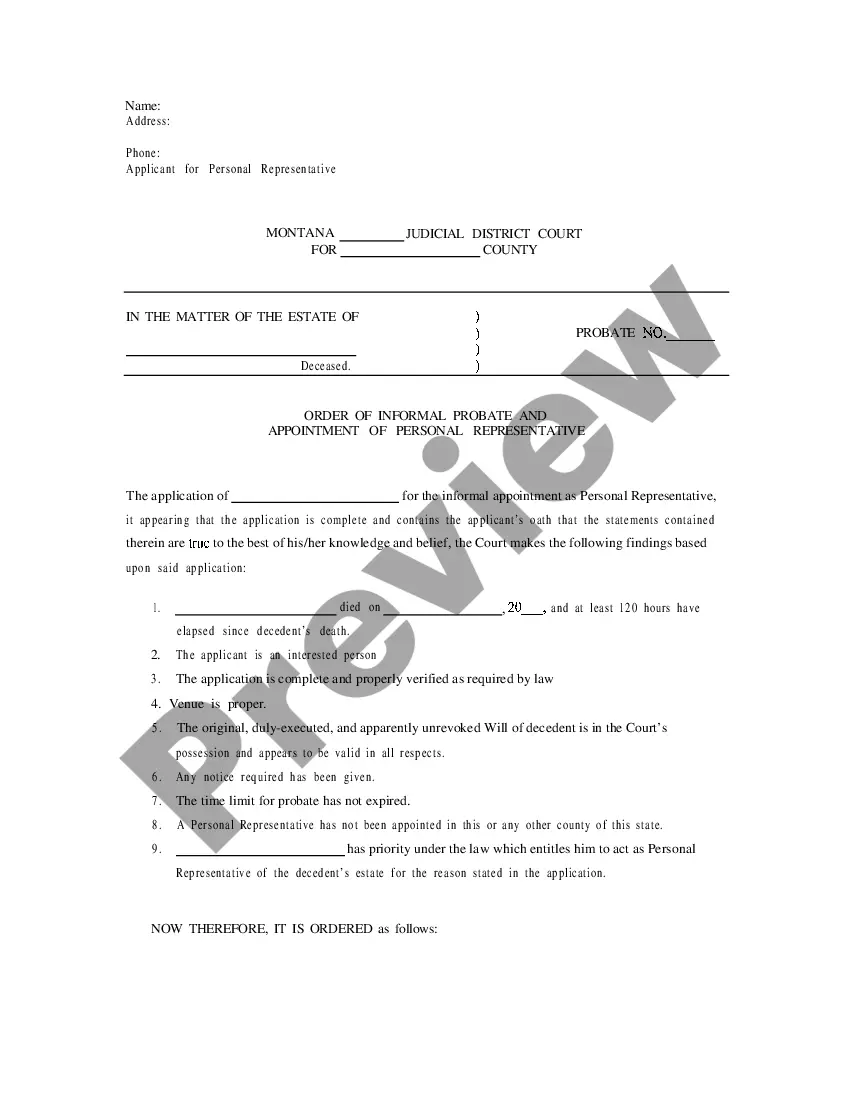

An administrator bond guarantees the performance of specific fiduciary duties. The administrator or administratrix must identify all heirs and creditors, collect the deceased's assets and appraise them, pay all debts of the deceased, then distribute the remaining assets to the heirs.

Surety bonds are one of the most common legal documents that are used to protect consumers against damages that they can incur from negligent businesses. Louisiana surety bonds are issued across many different industries to protect consumers against damages, and businesses against costly claims from their customers.

Who pays for a probate bond in California? the person appointed as the personal representative of the estate, such as the Administrator or Executor, is responsible for paying the premium for the probate bond.

If a financial institution is appointed as the administrator of an estate, then an administration bond is not required. Also, if there is a valid will or other estate planning document in place which states to not have a bond, an administration bond will not be requested.

Probate Courts often require any person fulfilling a fiduciary role on behalf of another person or party to post a fiduciary bond. If a fiduciary fails to fulfill their duties, they become financially liable for any claims filed against the bond.

What Do Louisiana Surety Bonds Cost? Surety bonds generally cost 1-15% of the required bond amount. Costs vary significantly depending on the bond amount you need and your rate (which is the percentage of the full bond amount you must pay).

A probate bond is a type of court bond issued on the performance of an executor of the estate of a recently deceased person. It essentially acts as a guarantee that the executor of an estate will act ing to state laws and the terms of the trust or will of the deceased.

Surety Bond Requirements The bond must be issued by an insurer admitted to write surety business in Louisiana. Each bond must be executed on the form provided by the LDI. The original bond must be filed with the LDI. Each bond must provide for a cancellation notice of not less than thirty day.