Demand for Indemnity from a Limited Liability Company by Member

Overview of this form

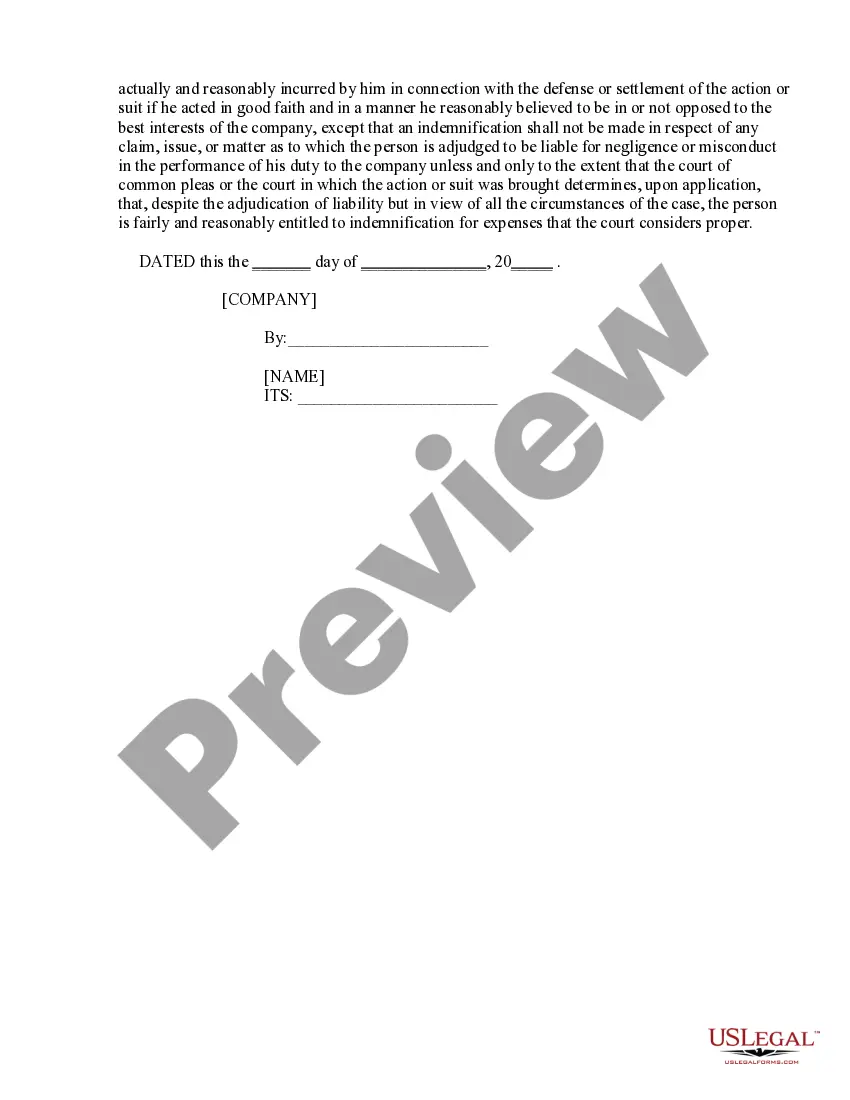

This Demand for Indemnity from a Limited Liability Company by Member is a legal document that allows a member of a limited liability company (LLC) to formally request indemnification from the LLC. This form is essential when a member incurs expenses, fees, or costs due to a legal claim related to their role in the company. It differs from other forms by ensuring the member is reimbursed for specific attorneys' fees and expenses as stipulated by the company's operating agreement.

Form components explained

- Member/Manager identification: Name of the member or manager making the demand.

- Company details: The name and designation of the limited liability company.

- Nature of claim: Description of the claim that prompted the demand for indemnity.

- Resolution of claim: Explanation of how the claim was resolved or is sought to be resolved.

- Expense breakdown: Detailed listing of expenses for which reimbursement is sought, including attorneys' fees and other related costs.

When this form is needed

This form should be utilized when a member of an LLC faces a legal claim related to their actions as a member or manager. It is particularly necessary when the LLC's operating agreement allows for indemnification, ensuring the member can recover costs associated with legal disputes or claims made against them while acting in good faith in their capacity within the company.

Who this form is for

- Members or managers of a limited liability company seeking reimbursement for legal expenses.

- Individuals involved in legal claims connected to their responsibilities within an LLC.

- Any LLC member acting in good faith who needs to formally request indemnification from the company.

Completing this form step by step

- Identify yourself as a member or manager of the LLC.

- Fill in the name of the company and indicate the nature of the claim against you.

- Explain how you resolved the claim or the intended resolution.

- Itemize the expenses, fees, and costs for which you are seeking reimbursement.

- Sign and date the form, ensuring all required fields are completed accurately.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide a detailed description of the nature of the claim.

- Not itemizing all expenses and fees accurately.

- Omitting signatures or failing to date the form properly.

- Using vague language that does not clearly outline the demand for indemnity.

Benefits of using this form online

- Convenience of downloading and filling the form at your own pace.

- Editability allows for easy adjustments before final submission.

- Access to templates drafted by licensed attorneys, ensuring legal reliability.

Legal use & context

- The form is legally binding upon proper completion and submission in accordance with the LLC's operating agreement.

- The indemnity provisions must align with applicable state laws and the company's bylaws.

- Members should act in good faith and rely on this process to protect their legal interests.

Looking for another form?

Form popularity

FAQ

A demand letter from a contract party to another party notifying it of a claim and demanding indemnity and defense under the terms of the contract.

Generally, indemnification refers to a situation in which one party (the ?indemnifying? party) agrees or is required to cover the costs, losses and/or expenses experienced by another party (the ?indemnified? party).

The supplier indemnifies the customer where the supplier breaches the contract. It also requires the customer to indemnify the supplier where the customer breaches the contract.

Indemnification usually transfers risk between the parties to the contract. Limitation of liability prevents or limits the transfer of risk between the parties. With those basic concepts in mind, think about the risks that arise out or relate to the contract.

Under a typical indemnification provision, the employer agrees to indemnify the executive against lawsuits, claims, or demands against the employee resulting from the employee's good faith performance of his or her duties and obligations.

To indemnify means that the seller will reimburse the buyer for a loss or liability. To defend means that the seller will pay the buyer's legal fees for suits that arise from specific risks articulated in the contract.

?The elements of a cause of action for indemnity are (1) a showing of fault on the part of the indemnitor and (2) resulting damages to the indemnitee for which the indemnitor is contractually or equitably responsible.? Expressions, supra, 86 Cal. App.

An indemnification clause is a legally binding agreement between two parties specifying that one party (the indemnifying party) will compensate the other party (the indemnified party) for any losses or damages that may arise from a particular event or circumstance.