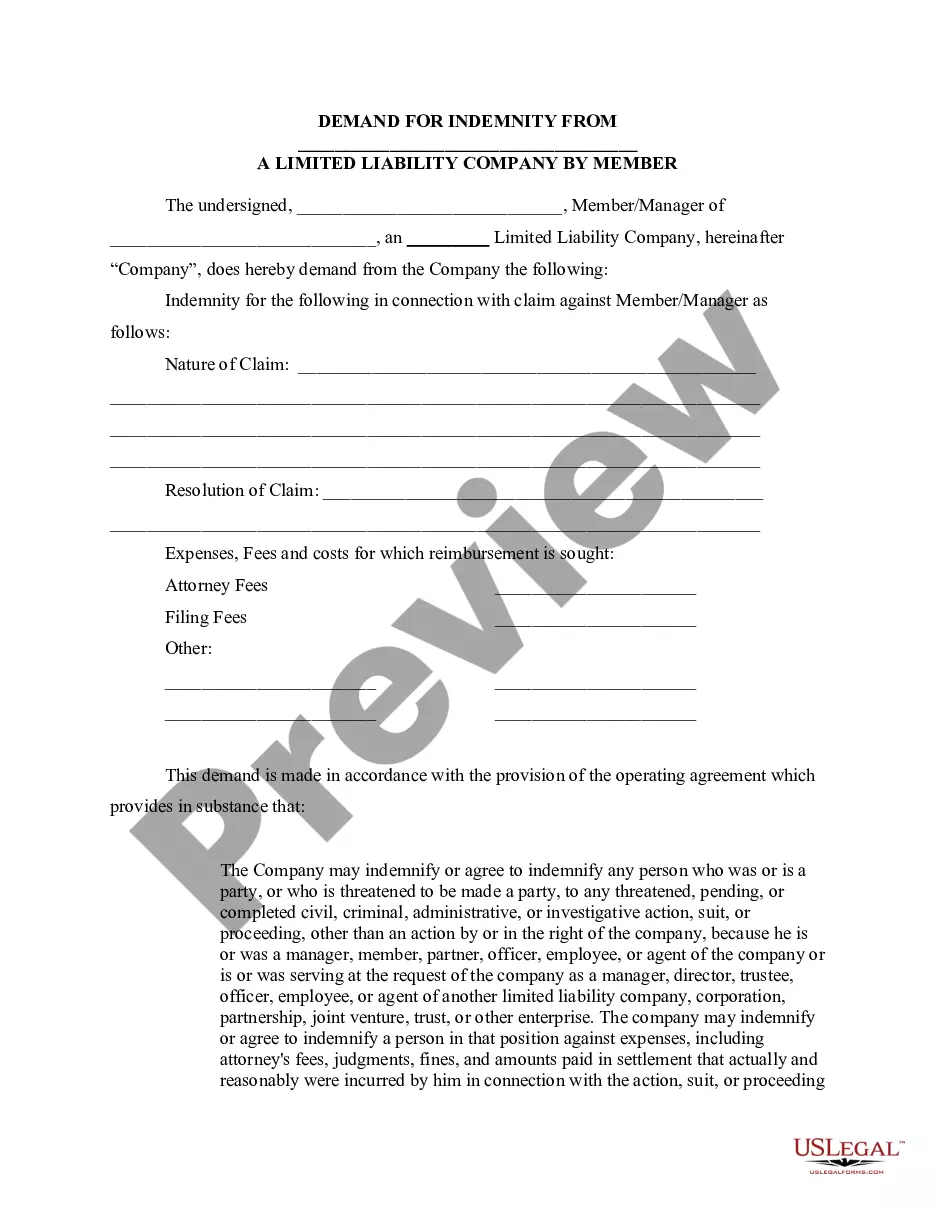

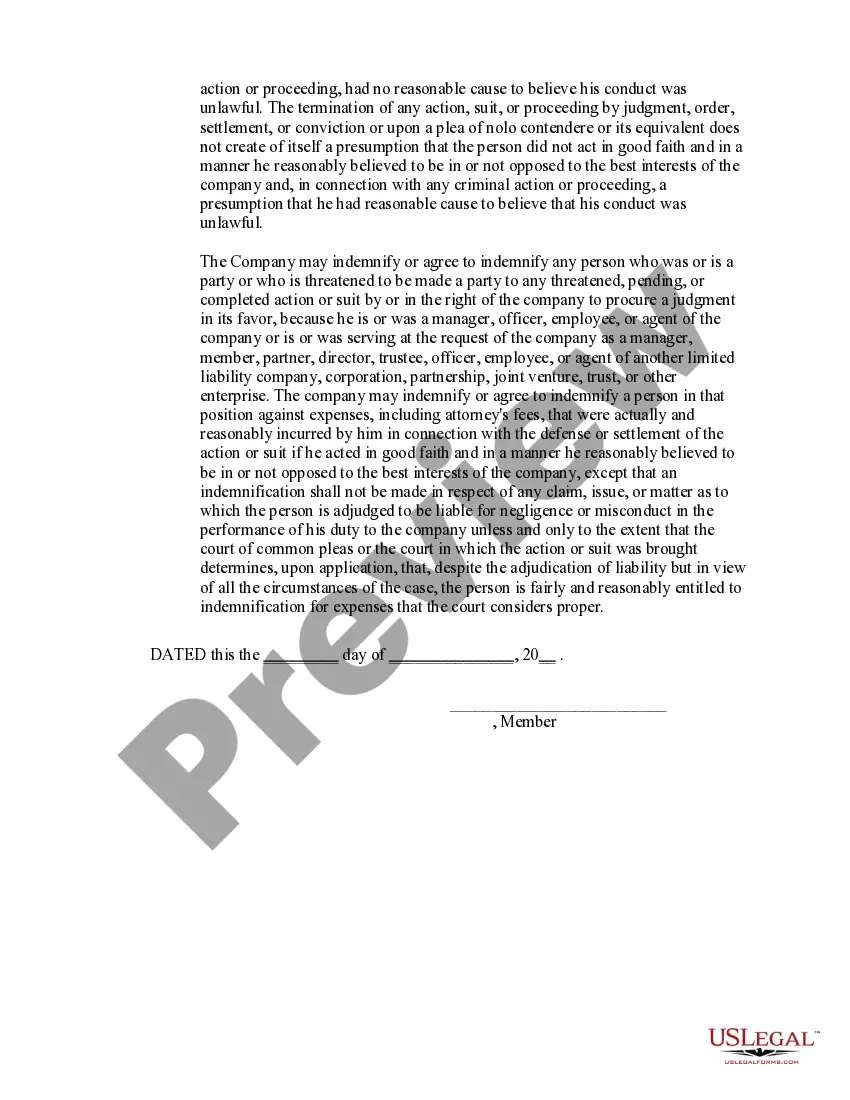

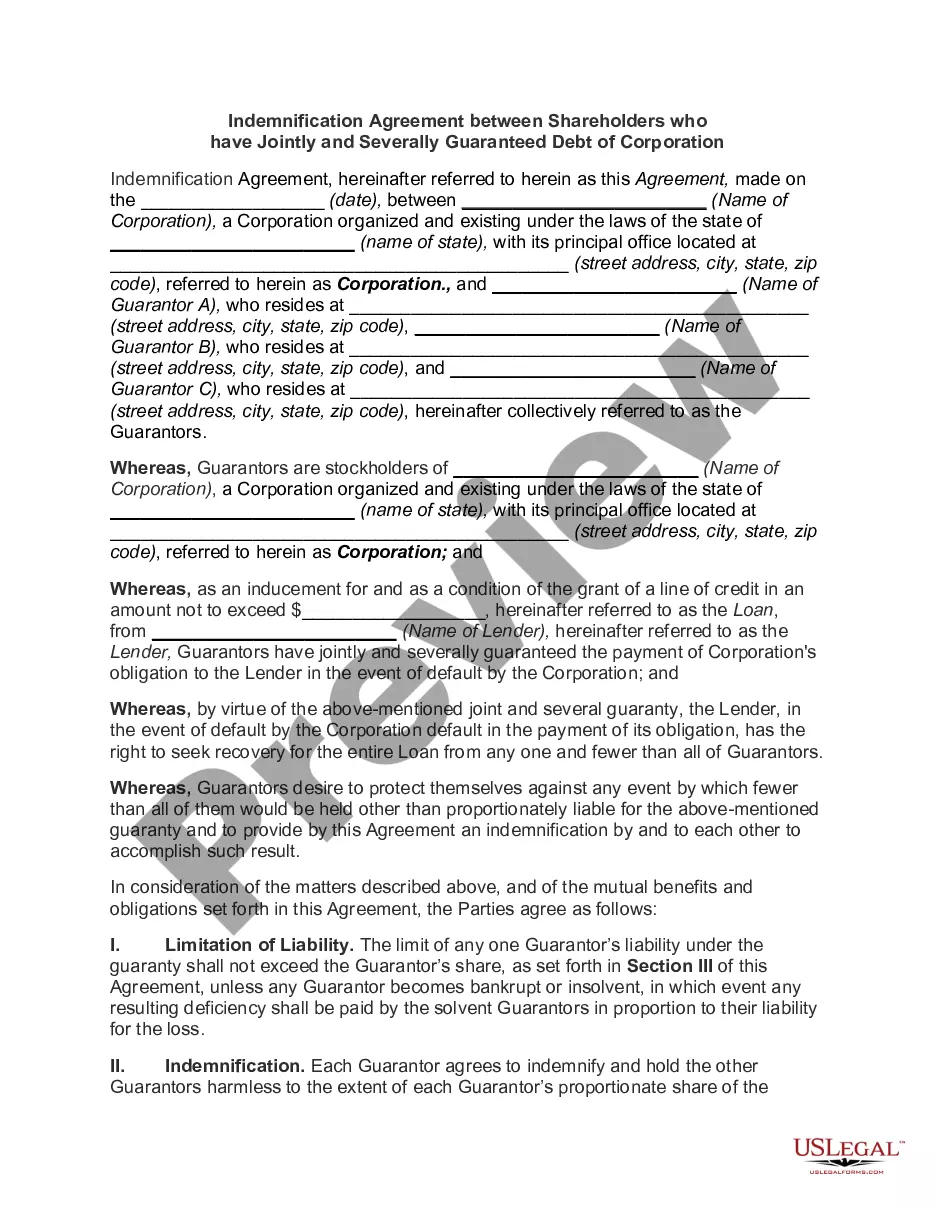

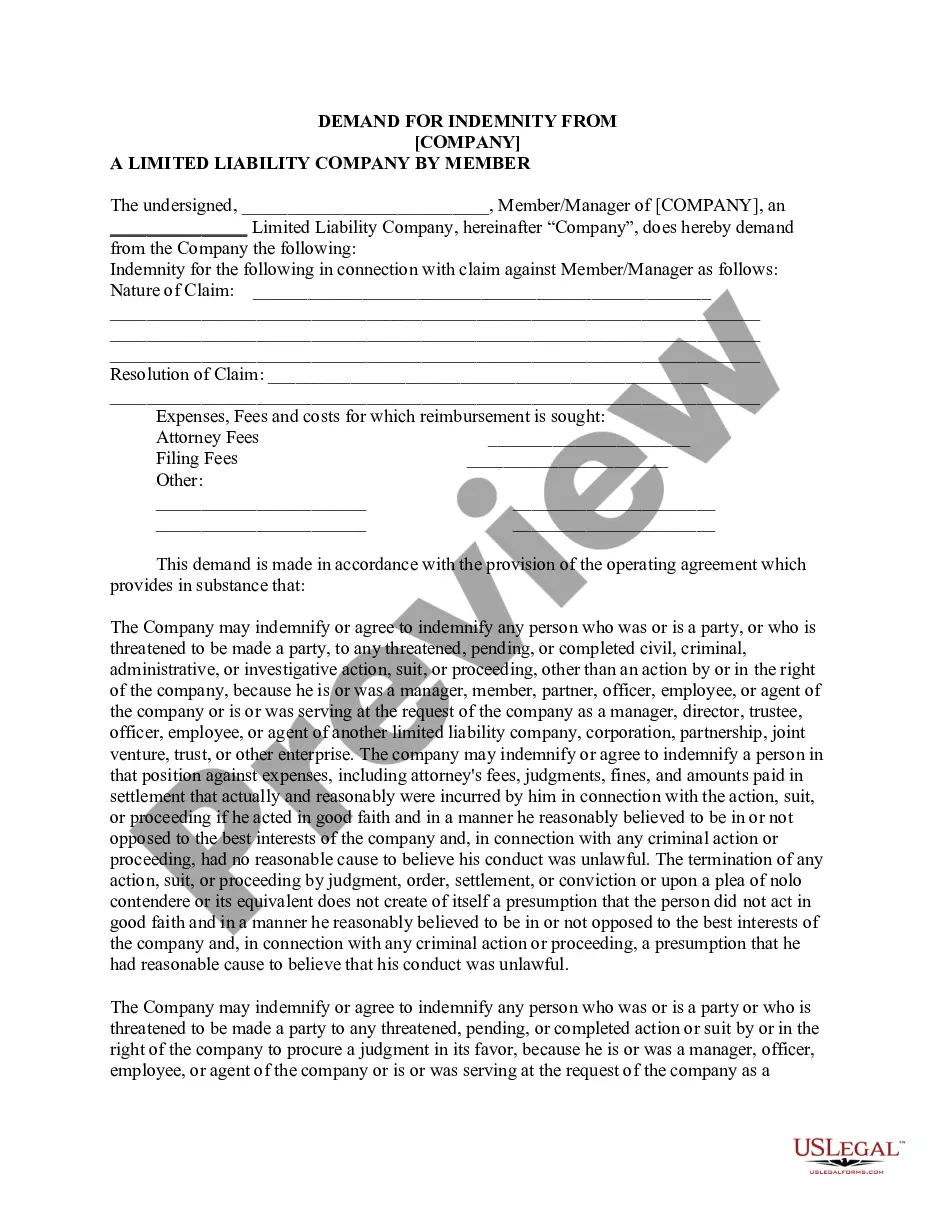

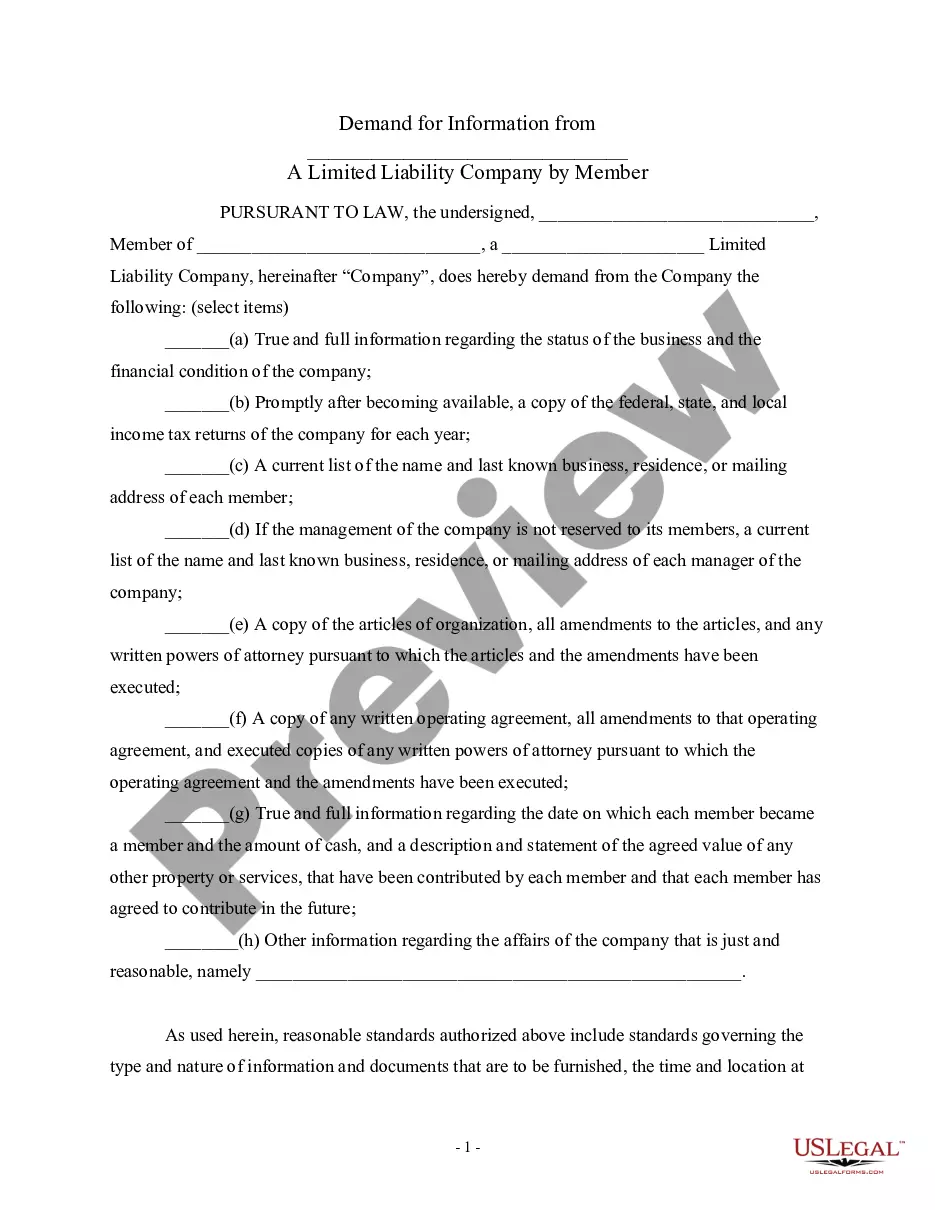

Demand for Indemnity from a Limited Liability Company LLC by Member

Description

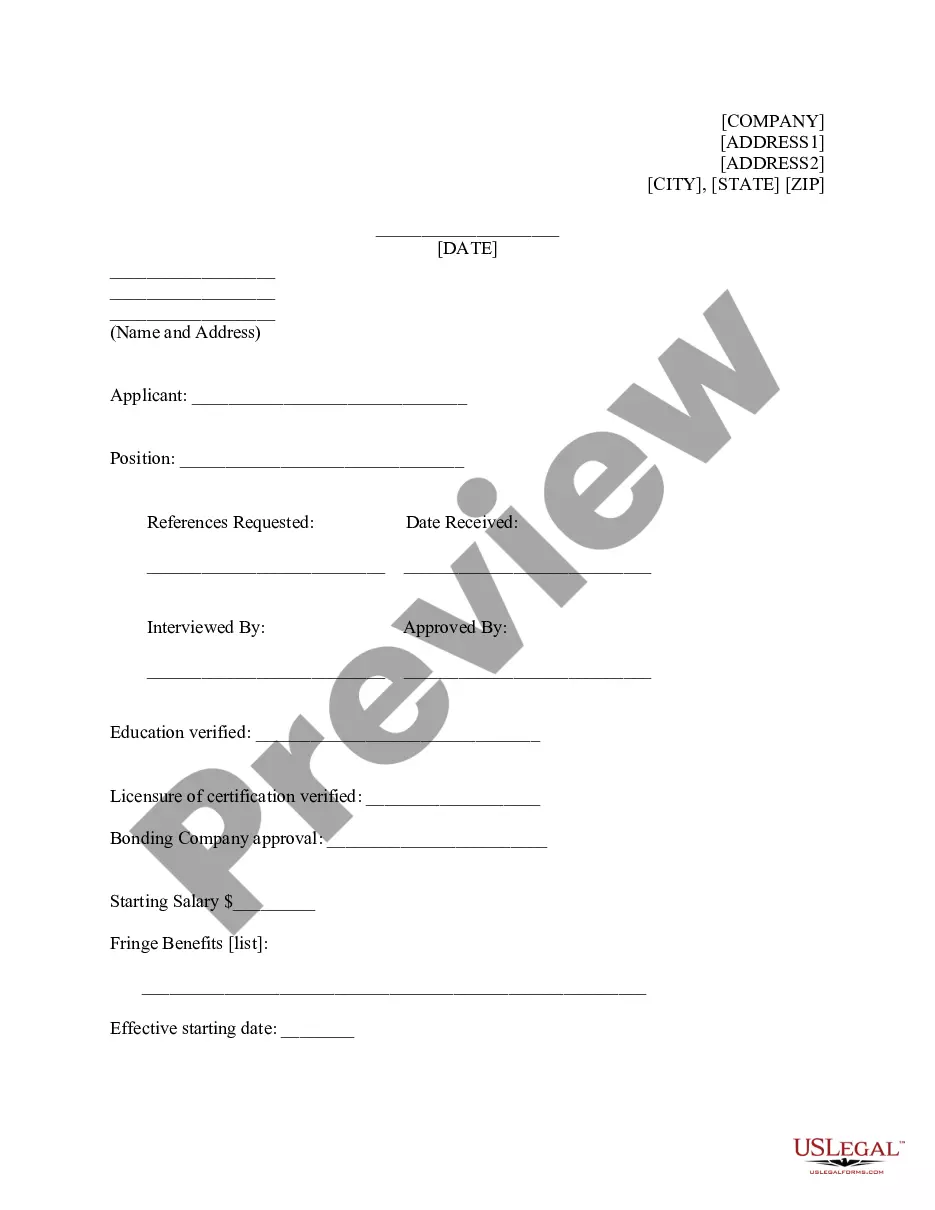

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Demand for indemnity from a limited liability refers to a request often made within the scope of business operations where a party seeks compensation for losses or damages from a party with limited liability coverage. This can often be seen in commercial partnership agreements and involves indemnity clause insurance to manage potential liabilities tied to contracts and operations.

Step-by-Step Guide on Managing Indemnity Demands

- Review the commercial partnership agreement to understand the specific terms of indemnity and the responsibilities assigned to the indemnifying party.

- Assess the claim presented by the indemnified party to ensure it falls within the scope of the agreement's indemnity clauses.

- Engage contract management services to handle disputes or clarifications in indemnity claims, ensuring compliance with business and legal standards.

- Coordinate with your insurance provider to activate any necessary indemnity clause insurance coverage.

- Document all communications and actions taken to manage the indemnity claim as part of ongoing business compliance regulations.

Risk Analysis: Online Tools and Contracts

- Website security solutions mitigate risks of online fraud which could impact business operations and lead to indemnity claims.

- Online fraud risks need to be evaluated regularly, with updates to security protocols to protect both business assets and client information from unauthorized access.

Common Mistakes & How to Avoid Them

- Failing to update indemnity clauses: Regular updates are essential to cater to changing legal and business environments.

- Inadequate communication: Ensure transparency with all parties about the terms and conditions of indemnity to prevent misunderstandings.

Practical Law Insights on General Partner Duties

General partners have specific duties and obligations under a commercial partnership, which include managing indemnifying party obligations and ensuring that the partnership adheres to predefined business compliance regulations. Staying informed through continuous learning and adapting to new regulations are vital for maintaining these standards.

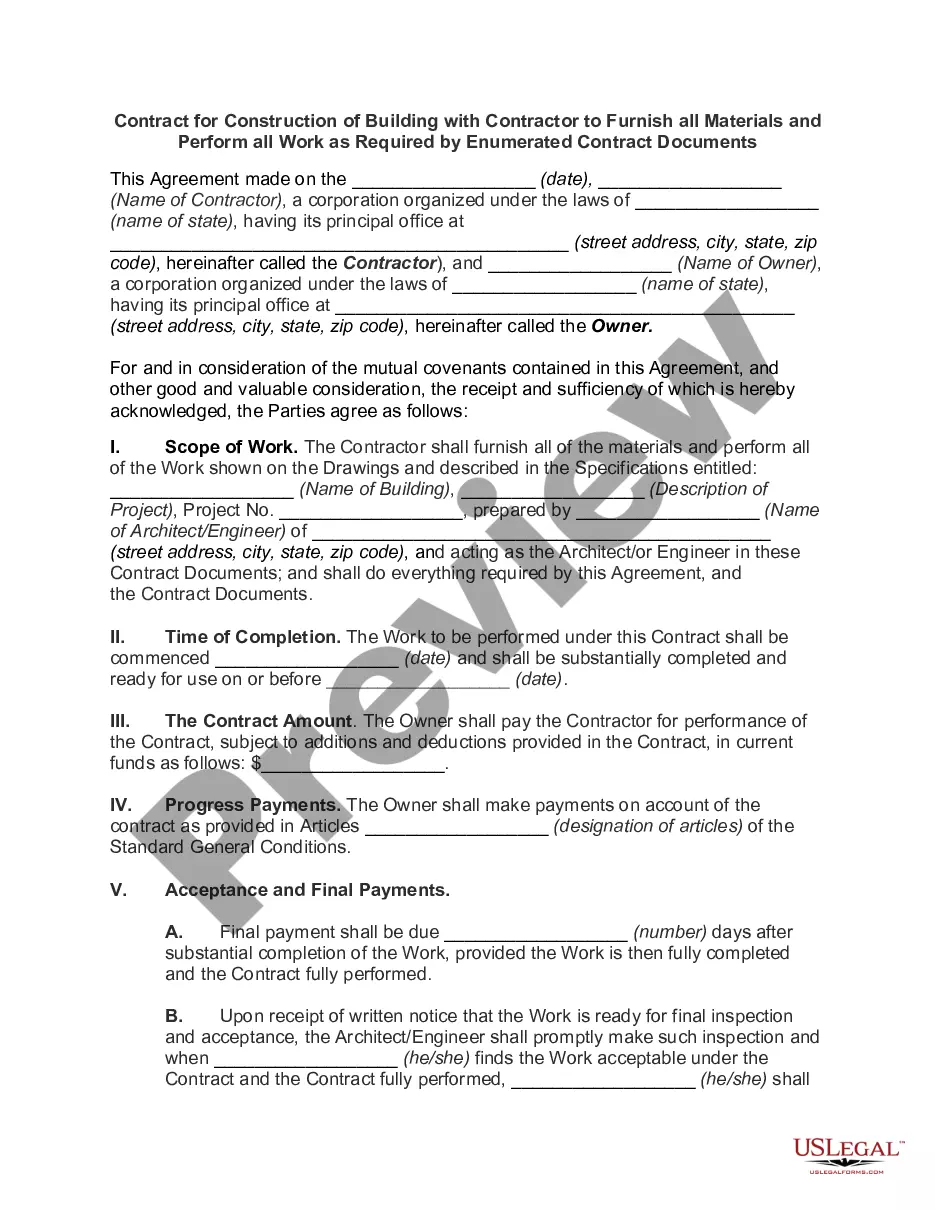

Best Practices for Contract Management in Business

- Implement robust contract management services to oversee all contract-related activities and ensure legal compliance.

- Use advanced analytics to monitor the performance and enforceability of contracts including indemnity clauses.

- Ensure that contract management systems are aligned with the latest business compliance regulations.

How to fill out Demand For Indemnity From A Limited Liability Company LLC By Member?

Employ the most comprehensive legal catalogue of forms. US Legal Forms is the perfect place for getting up-to-date Demand for Indemnity from a Limited Liability Company LLC by Member templates. Our service offers thousands of legal documents drafted by certified legal professionals and grouped by state.

To get a template from US Legal Forms, users simply need to sign up for a free account first. If you are already registered on our platform, log in and choose the template you need and buy it. Right after purchasing templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your needs.

- When the form features a Preview function, utilize it to check the sample.

- If the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template meets your expections.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr credit/bank card.

- Choose a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and fill out the Form name. Join thousands of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

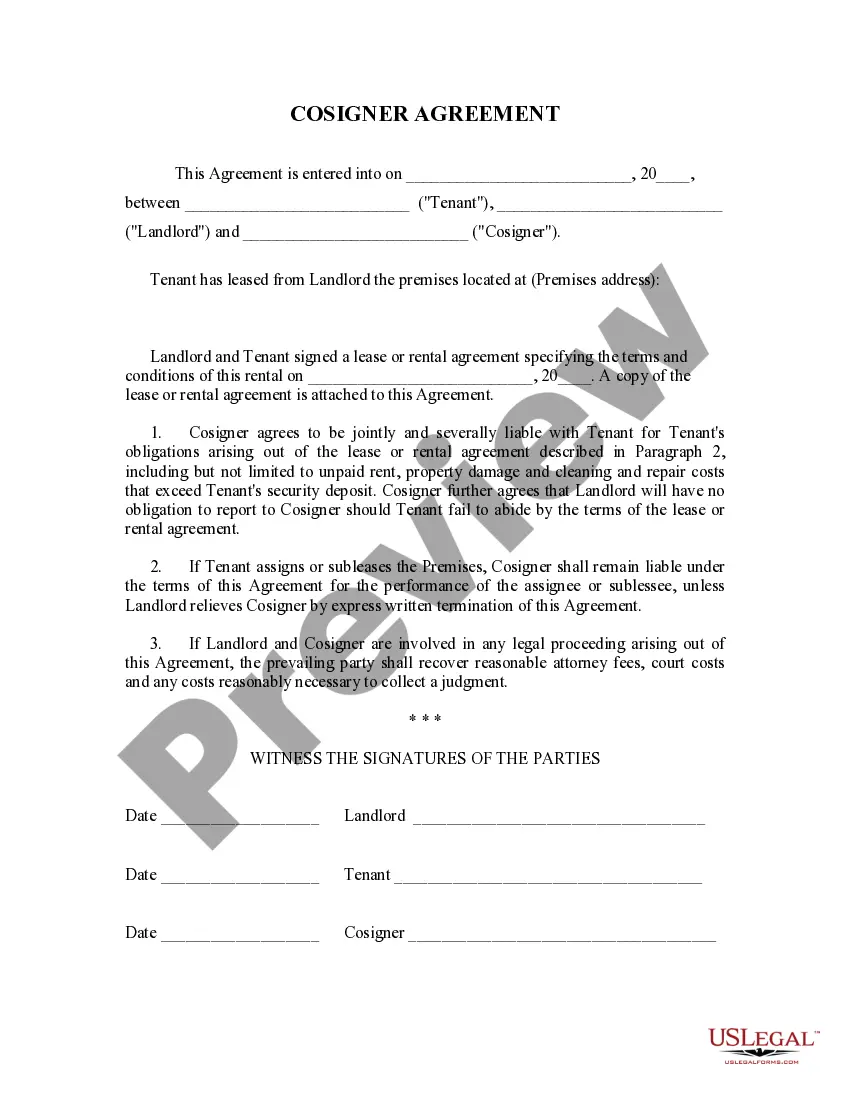

The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property. They may or may not manage the business and affairs. Initial members are admitted at the time of formation.

Under state LLC laws, an LLC is a legal entity, in effect a legal person. An LLC can sue and be sued, own property, enter into contracts, and do many of the things that an individual human being can do.A member has no interest in specific property of the limited liability company. N.Y.

Limited liability companies (LLCs) are legally considered separate from their owners. In terms of debt, this means that company owners, also known as members, are not responsible for paying LLC debts. Creditors can only pursue assets that belong to the LLC, not those that personally belong to members.

Members will have interests that are associated with various rights. These include the right to share in the profits and losses, to receive distributions, and to participate in the management of the company. The company's Operating Agreement defines nature of these rights. An LLC must have at least one member.

If you form an LLC, you will remain personally liable for any wrongdoing you commit during the course of your LLC business. For example, LLC owners can be held personally liable if they: personally and directly injure someone during the course of business due to their negligence.

Unless the articles of organization state otherwise, when a member leaves a LLC, her former ownership interest is divided equally between the remaining members or is transferred to a new member, according to "Your Limited Liability Company: An Operating Manual."

As a general rule, if the LLC can't pay its debts, the LLC's creditors can go after the LLC's bank account and other assets. The owners' personal assets such as cars, homes and bank accounts are safe. An LLC owner only risks the amount of money he or she has invested in the business.

When Can LLC Members Sue Each Other? When first forming an LLC, the members should draft an operating agreement.If the operating agreement states that members can be held liable to one another for wrongdoing, then one member is able to bring suit against another.

Unlike a limited partnership, no LLC owner (member) need be personally liable for the company's obligations, and each member is permitted to manage the company and to take part in the ·control of its business without losing the member's limited liability (Corp C A§A§17101, 17150).