Sample Letter for Cardholder's Report of Lost Credit Card

Description

How to fill out Sample Letter For Cardholder's Report Of Lost Credit Card?

Among lots of free and paid examples that you can find on the web, you can't be sure about their accuracy and reliability. For example, who made them or if they’re skilled enough to deal with what you require those to. Keep calm and utilize US Legal Forms! Locate Sample Letter for Cardholder's Report of Lost Credit Card samples made by skilled attorneys and prevent the high-priced and time-consuming process of looking for an attorney and then having to pay them to draft a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re looking for. You'll also be able to access all your earlier downloaded samples in the My Forms menu.

If you are utilizing our platform for the first time, follow the guidelines listed below to get your Sample Letter for Cardholder's Report of Lost Credit Card with ease:

- Make certain that the file you see applies in your state.

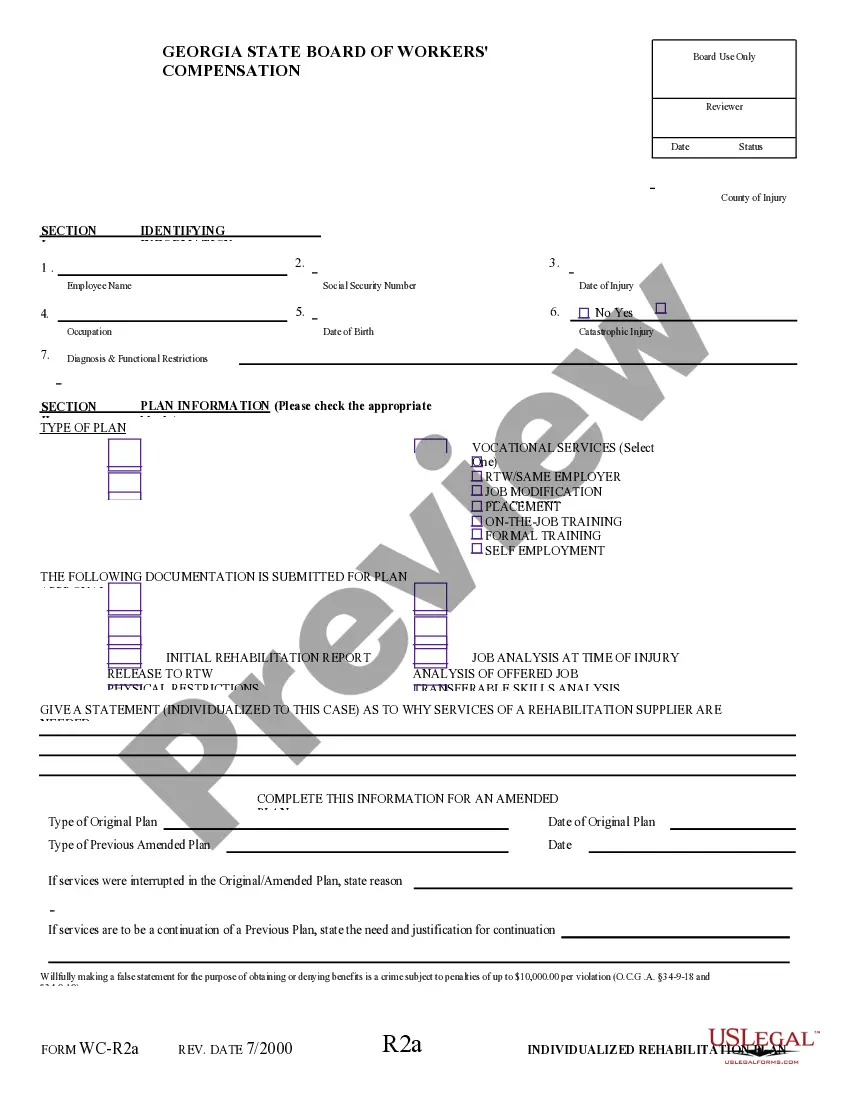

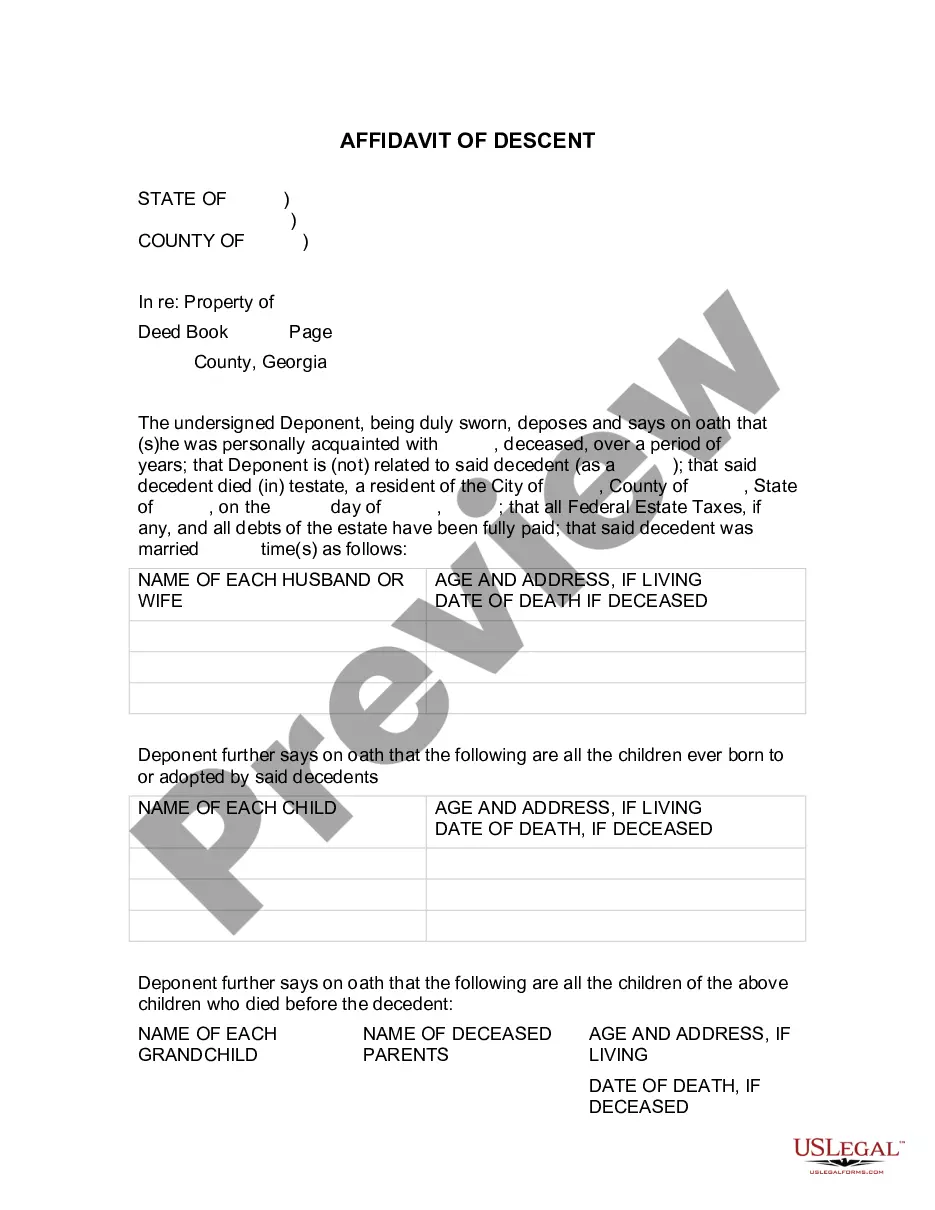

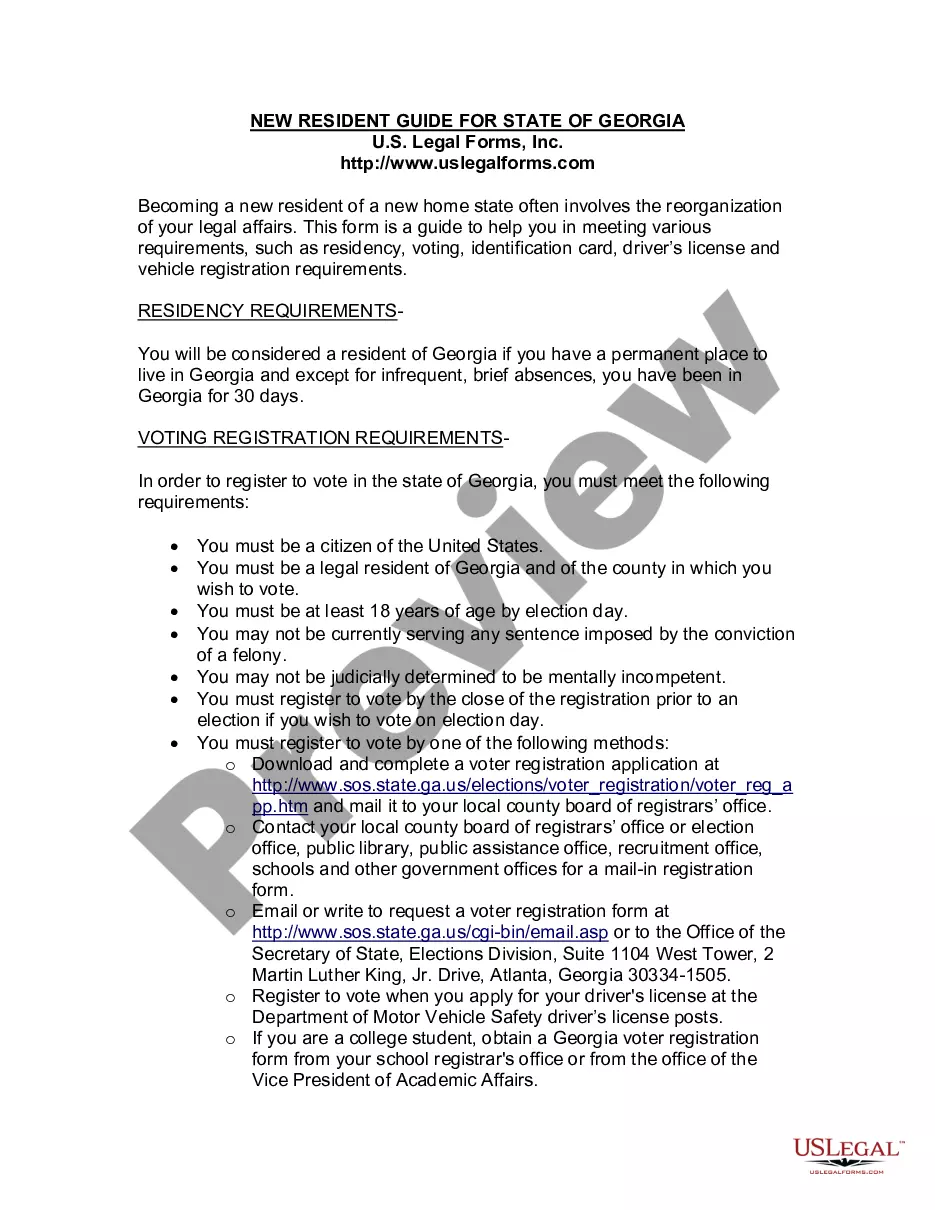

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another template using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

When you’ve signed up and bought your subscription, you can use your Sample Letter for Cardholder's Report of Lost Credit Card as many times as you need or for as long as it continues to be active in your state. Edit it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

To get a new card in place of an existing damaged card, you can contact our 24-Hour CitiPhone Banking helpline.To get a new card in place of lost/stolen card you can: STEP 1: Login to www.citibank.com/India and access your account using the IPIN. STEP 2: Click on "Credit card" tab on the left side of screen.

If the card has been lost or stolen, you can request a new card at the Replacement Card Page. If you prefer, you can reach Citi Customer Service at 1-800-950-5114 (TTY: 1-800-325-2865 for hearing and speech impaired services only).

Sign in to your Chase mobile app (for either Android or iOS). Select the credit card you want to replace. Swipe up to Account Services and tap Replace a lost or damaged card. Select the card you want to replace and tap Next.

Contact Us immediately on 1800 267 2425 (India toll free) or +91 22 4955 2425 (local dialing) to log a complaint or block your card in any of the following scenarios: You have lost your Citibank Bank Debit / Credit Card. Your Citibank Bank ATM / Debit Card is stuck in the card slot of an ATM.

Your letter should clearly identify each item in your report you dispute, state the facts and explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your report with the items in question circled.

Credit Card: If your card has been lost, stolen or damaged, call us immediately at 1-800-432-3117. Go to chase.com/customerservice for call center hours. Personal Banking: If your card has been lost, stolen or damaged, call us immediately at 1-800-935-9935.

To cancel online, sign in to Citi® Online, go to the Account Management. To cancel by phone, please call the number on the back of your card to speak to a customer service representative.

Call your credit card issuer. Call your credit card issuer immediately to report the loss or theft of your missing card. Get prepped with information. Your credit card issuer will need to verify your identity. Follow up and keep records. Check your credit card statement. Check your insurance coverage.