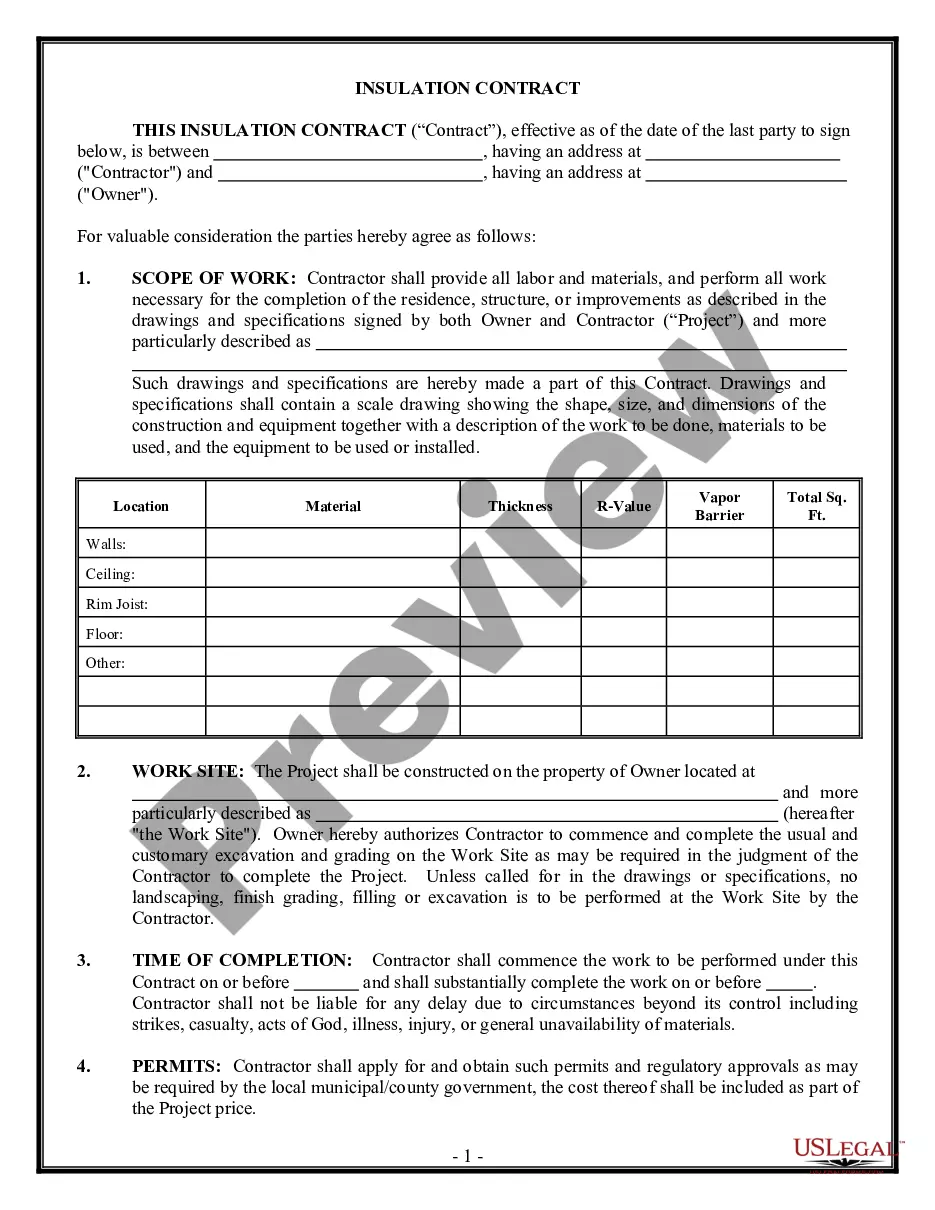

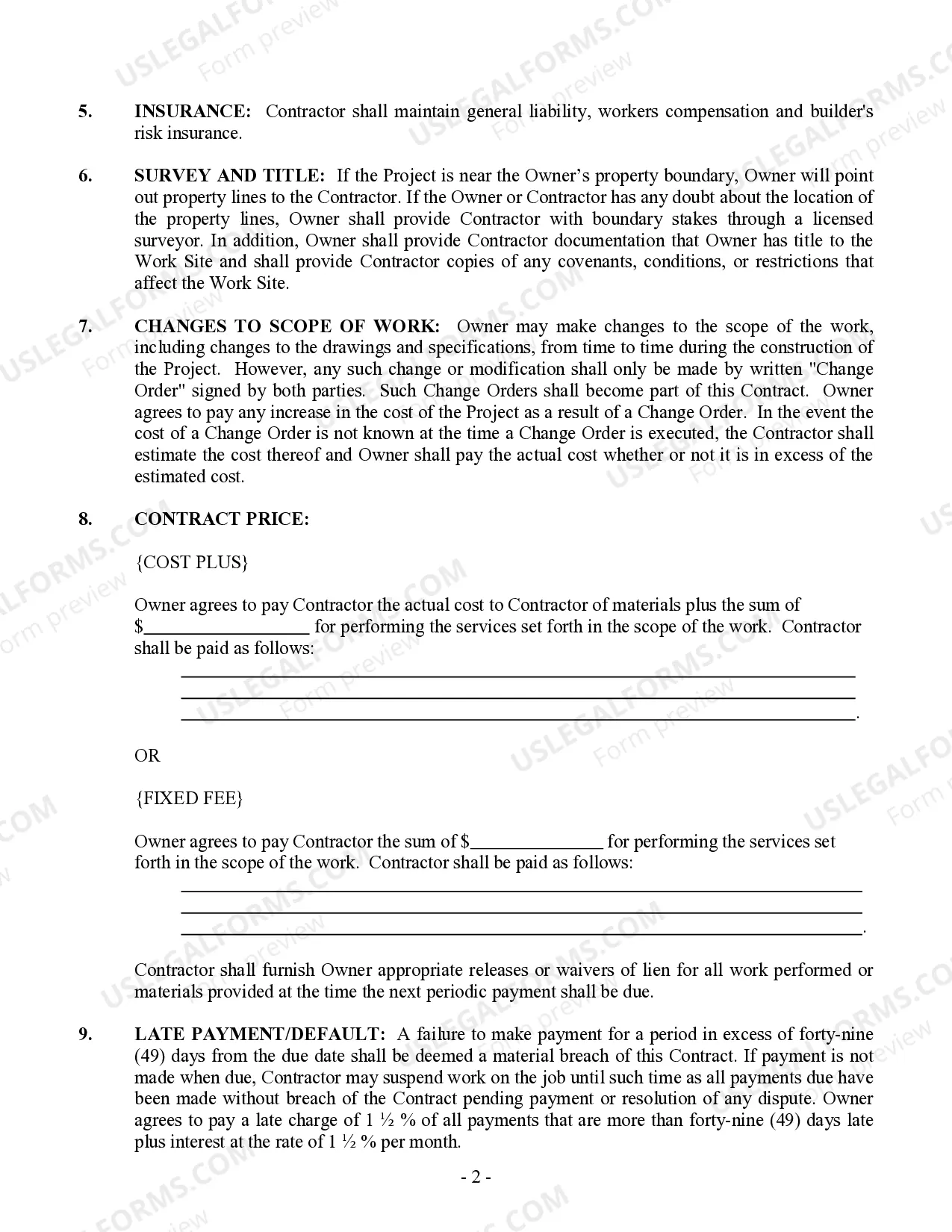

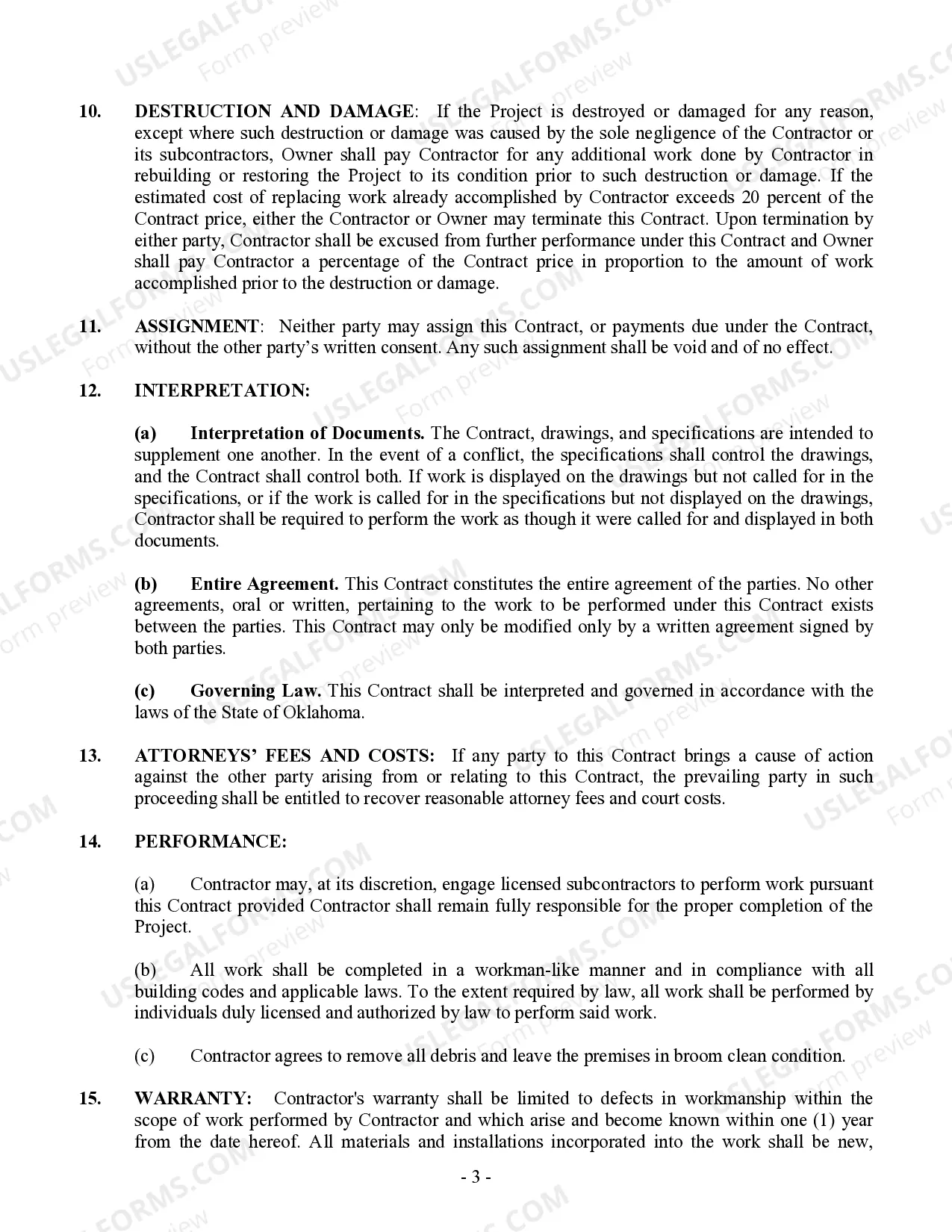

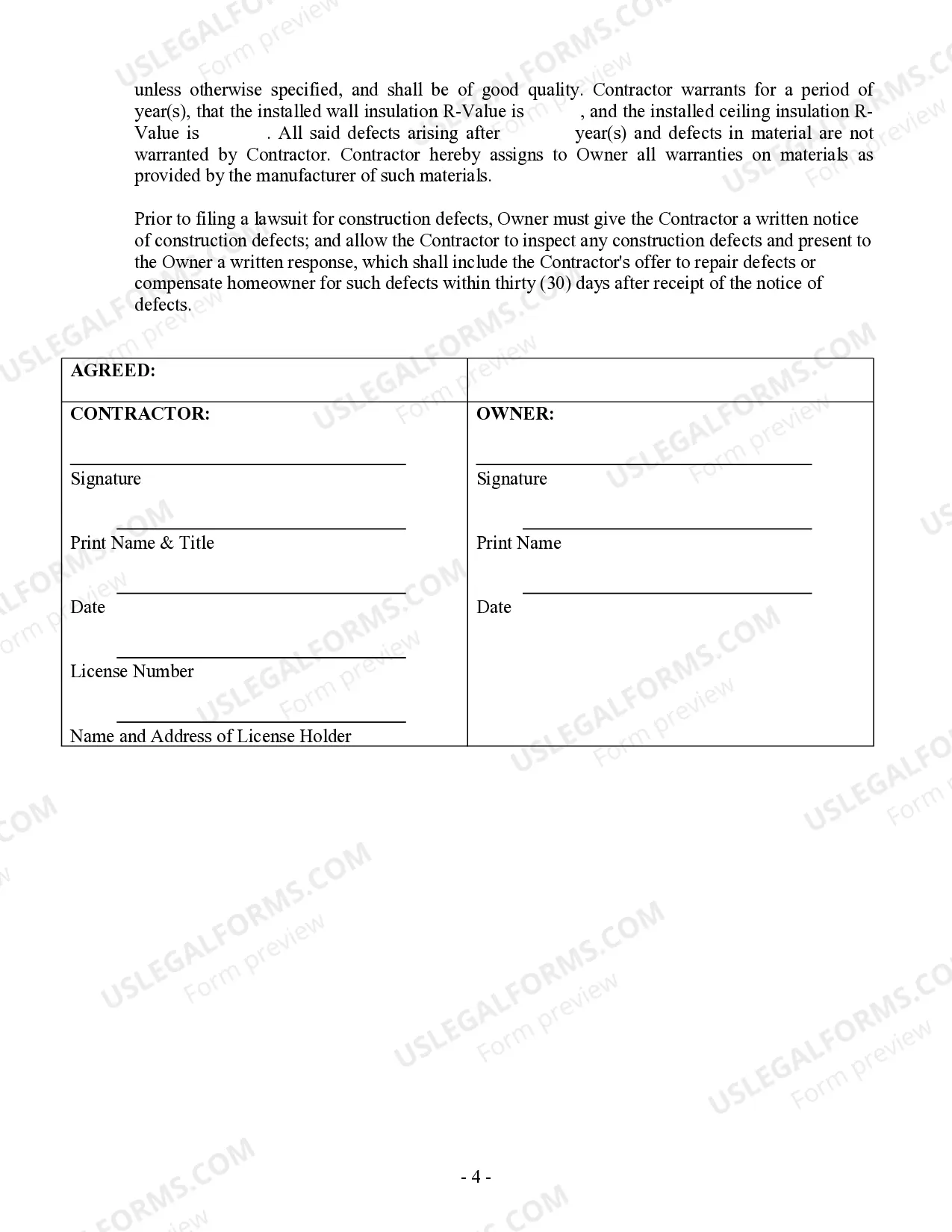

This form is designed for use between Insulation Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Oklahoma.

Oklahoma Insulation Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oklahoma Insulation Contract For Contractor?

When it comes to submitting Oklahoma Insulation Contract for Contractor, you probably imagine a long procedure that consists of getting a appropriate sample among countless similar ones then needing to pay out legal counsel to fill it out to suit your needs. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific document in a matter of clicks.

In case you have a subscription, just log in and click Download to find the Oklahoma Insulation Contract for Contractor template.

In the event you don’t have an account yet but need one, stick to the step-by-step manual listed below:

- Be sure the file you’re saving is valid in your state (or the state it’s required in).

- Do it by reading the form’s description and by clicking the Preview option (if available) to view the form’s content.

- Click Buy Now.

- Choose the proper plan for your financial budget.

- Join an account and choose how you want to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Get the record on the device or in your My Forms folder.

Skilled legal professionals work on drawing up our samples to ensure after saving, you don't have to bother about enhancing content outside of your personal details or your business’s information. Be a part of US Legal Forms and get your Oklahoma Insulation Contract for Contractor sample now.

Form popularity

FAQ

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying.

Most businesses operating in or selling in the state of Oklahoma are required to purchase a resale certificate annually. Even online based businesses shipping products to Oklahoma residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

In Oklahoma, general contractors are not required to have state licenses to perform their construction services.Also, state licenses are not required for small general contractors or subcontractors who do commercial or residential renovation, remodeling and repair construction projects.

As a handyman, you will not need a state license to work in Oklahoma on any renovation, remodeling, repair or construction project. Make sure to check with local governments to see if there are any regulations on the local level before you begin work.

Retail Licenses A retail license specifically authorizes your business to sell items to the public.In many cases, your resale license doubles as authorization to sell items at retail -- and, of course, to collect the tax.

The legislation declares that a homeowner has the absolute right to personally perform any construction, installation, work or repairs to his or her property including, but not limited to, fencing, landscaping, telephone, plumbing, electrical, roofing, mechanical, carpentry, concrete, masonry or painting, without

How do you register for a sales tax permit in Oklahoma? You can register for your Oklahoma sales tax permit online at the Taxpayer Access Point (TAP). Or fill out Packet A (Business Registration) and mail it in. (Packet A wasn't available on the Oklahoma Tax Commission website as of this writing.)

Are labor or services subject to sales tax? Statutes are subject to sales tax. Labor charges for installation or repair of tangible personal property if separately stated are not subject to sales tax.

Step 1 Begin by downloading the Uniform Sales Tax Exemption Certificate. Step 2 Identify the name and business address of the seller. Step 3 Identify the name and business address of the buyer.