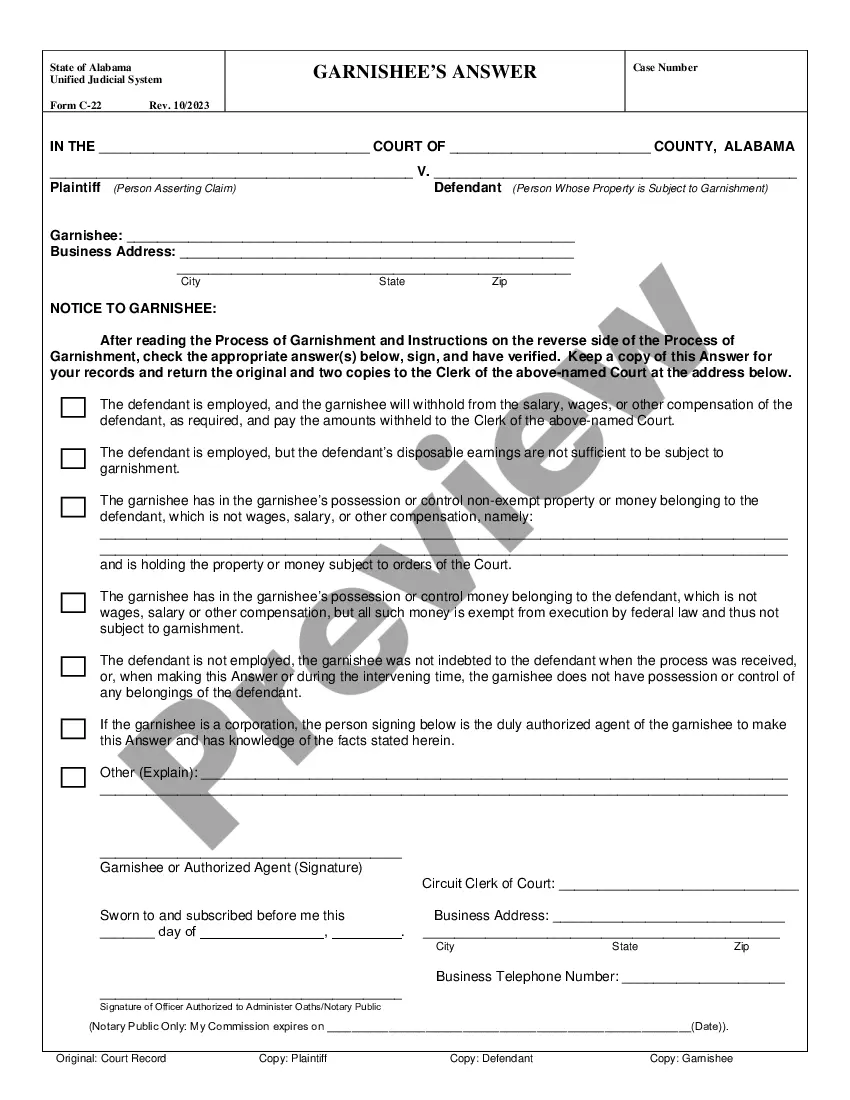

Alabama Answer To Garnishee is a form used when served with a garnishment. It is a legal document used to respond to a wage garnishment in the state of Alabama. The form allows the recipient to dispute the garnishment or to provide information about their wages and financial resources. There are two types of Alabama Answer To Garnishee forms. The first is the basic version which allows the garnishee to respond to the garnishment and provide the court with information about their wages and financial resources. The second version is the advanced version which provides more detailed information about the garnishee’s wages and financial resources. Both versions must be completed in their entirety in order for the garnishee to be able to dispute the garnishment.

Alabama Answer To Garnishee

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Answer To Garnishee?

How many hours and resources do you typically allocate for creating formal documents.

There’s a better method to obtain such forms than engaging legal professionals or spending countless hours searching online for an appropriate template. US Legal Forms is the foremost online repository that offers expertly drafted and verified state-specific legal documents for any purpose, such as the Alabama Answer To Garnishee.

Another benefit of our service is that you can access documents you have previously purchased, which are securely stored in your profile under the My documents tab. Retrieve them at any time and re-complete your paperwork as often as you need.

Save time and effort preparing formal documentation with US Legal Forms, one of the most reliable online solutions. Join us today!

- Review the form content to ensure it aligns with your state regulations. For this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your criteria, find another one using the search bar located at the top of the page.

- If you are already a member of our service, Log In and download the Alabama Answer To Garnishee. If not, continue to the following steps.

- Click Buy now when you identify the correct blank. Choose the subscription plan that fits you best to utilize our library’s complete service.

- Create an account and complete your subscription payment. You can pay using your credit card or via PayPal - our service is completely secure for that.

- Download your Alabama Answer To Garnishee onto your device and fill it out on a printed hard copy or digitally.

Form popularity

FAQ

Writing a hardship letter involves clearly expressing your financial difficulties and providing evidence to support your claims. Start by explaining your current situation, including your income and expenses, and how garnishment impacts your ability to make ends meet. Using templates from USLegalForms can help you draft an effective hardship letter, ensuring you include the Alabama Answer To Garnishee that outlines your case persuasively.

The maximum garnishment amount in Alabama is capped at 25% of your disposable earnings after taxes are deducted. This limit ensures that you retain enough income for essential living expenses. Knowing this percentage empowers you as a consumer, and platforms like USLegalForms can assist you in finding the Alabama Answer To Garnishee if you face garnishment.

In Alabama, garnishment laws dictate the percentage of your wages that can be withheld to repay debts. Typically, creditors can take up to 25% of your disposable income, although certain exemptions may apply. Understanding these laws is crucial; therefore, consulting with legal resources, like USLegalForms, can provide you with the Alabama Answer To Garnishee and necessary insights.

Stopping a garnishment can vary based on your situation, but generally, if you file the appropriate paperwork promptly, you can halt the process quickly. Usually, you can expect the garnishment to cease within a few days once you submit your motion to the court. Utilizing resources like USLegalForms can help you find the Alabama Answer To Garnishee needed to expedite this process.

The best way to stop wage garnishment involves understanding your legal rights and acting quickly. You can file a motion to contest the garnishment or negotiate directly with your creditor for a payment plan. Additionally, exploring all exemption options available to you can significantly help your situation. For clear guidelines, the Alabama Answer To Garnishee is an excellent tool to assist you.

Stopping a garnishment in Alabama can be achieved by filing a motion with the court to contest the garnishment. This requires presenting compelling evidence of your financial situation to justify your request. Furthermore, negotiating with your creditor for a favorable settlement may also be an effective option. Leverage the Alabama Answer To Garnishee for helpful steps and strategies.

To claim exemption and stop wage garnishment in Alabama, you need to complete the exemption claim form and submit it to the appropriate court. It is crucial to provide thorough documentation that demonstrates your eligibility for exemption. Make sure to include any information related to your income and expenses. For guidance, use the Alabama Answer To Garnishee as a valuable resource.

Claiming exemption on garnishment in Alabama involves filling out the appropriate exemption claim form and submitting it to the court. You should include reasons for your exemption, such as low income or other qualifying factors. Ensure that you provide supporting documentation to corroborate your claim. The Alabama Answer To Garnishee can provide detailed instructions on this procedure.

To stop wage garnishment in Alabama, you can file a motion in court to challenge the garnishment. It is important to provide evidence of your financial situation to strengthen your case. Additionally, you may need to negotiate a payment plan or seek a settlement with your creditor. Resources like the Alabama Answer To Garnishee can guide you through this process effectively.

Filling out a challenge to garnishment form requires you to provide specific information about your case. Start by entering your personal information, including your name and address, followed by details about the garnishment, such as the creditor's name. After that, clearly state your reasons for challenging the garnishment. Utilizing the Alabama Answer To Garnishee can help streamline this process, giving you the insights you need.