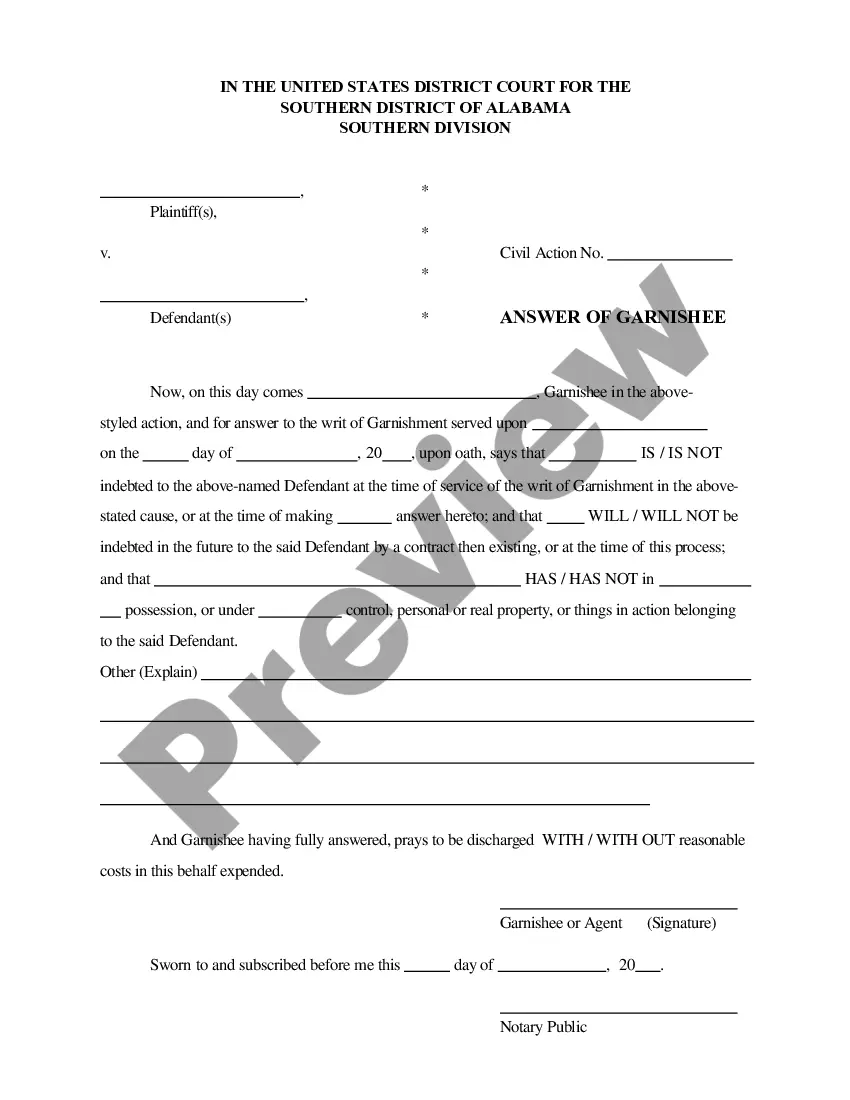

An Alabama Writ of Garnishment is a legal document issued by a court that orders a third party to turn over a debtor's assets to the creditor. This document can be used to collect unpaid debts from an individual or business. There are two types of Alabama Writ of Garnishment: Wage Garnishment and Non-wage Garnishment. Wage Garnishment orders an employer to withhold a certain amount of money from the debtor's wages to pay the debt. Non-wage Garnishment orders a third party to turn over any assets, such as bank accounts, investment accounts, and other property of the debtor, to the creditor. In both cases, the creditor must prove to the court that the debt is legitimate and that the debtor has failed to make payment.

Alabama Writ of Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Writ Of Garnishment?

Managing legal documents necessitates diligence, accuracy, and utilizing well-prepared templates.

US Legal Forms has been assisting individuals nationwide in doing just that for 25 years, so when you select your Alabama Writ of Garnishment template from our collection, you can trust it adheres to federal and state regulations.

All documents are crafted for multiple uses, such as the Alabama Writ of Garnishment you see here. If you require them again, you can complete them without repaying - just access the My documents tab in your profile and finalize your document whenever needed. Try US Legal Forms and create your business and personal documentation swiftly and in full legal compliance!

- Be sure to carefully review the document's content and its alignment with general and legal criteria by previewing it or examining its description.

- Seek an alternative formal template if the one you initially opened doesn’t align with your circumstances or state laws (the tab for that is located at the top page corner).

- Log In to your account and save the Alabama Writ of Garnishment in your preferred format. If it’s your first time on our site, click Buy now to proceed.

- Establish an account, choose your subscription level, and make a payment using your credit card or PayPal account.

- Select the format in which you wish to save your form and click Download. Print the blank or incorporate it into a professional PDF editor to prepare it electronically.

Form popularity

FAQ

Alabama has specific rules regarding garnishments that protect consumers. For instance, creditors must provide a court order to start the garnishment process, and there are restrictions on the exemption amounts based on your income and family size. Familiarizing yourself with the rules surrounding the Alabama writ of garnishment can help you navigate this challenging situation more effectively. Resources like US Legal Forms offer insights and templates that can be beneficial.

Under federal law, the maximum amount that can be garnished from your paycheck is the lesser of 25% of your disposable earnings or the amount by which your earnings exceed 30 times the federal minimum wage. Similarly, Alabama adheres to these guidelines when executing a writ of garnishment. Understanding these limits can help you plan your budget accordingly.

Yes, it is possible to stop a garnishment once it begins in Alabama. You can file a motion with the court to contest the garnishment or seek a hardship exemption based on your financial situation. Additionally, you can negotiate with the creditor to resolve the debt outside of court. Tools from platforms like US Legal Forms can guide you through the process effectively.

In Alabama, the amount of wages that can be garnished is limited by state law. Typically, the law allows up to 25% of your disposable earnings to be garnished for most debts. However, if you are subject to multiple garnishments, the total amount taken cannot exceed this limit. Knowing the specific rules around the Alabama writ of garnishment can help you manage your finances better.

A hardship letter for wage garnishment should explain your financial situation and the difficulties facing you due to the garnishment. Include details about your income, expenses, and any unique circumstances that impact your ability to meet your obligations. This type of letter is crucial, as it can influence the possibility of reducing the garnishment, especially under the guidelines of the Alabama Writ of Garnishment.

Filling out a challenge to garnishment form requires you to provide detailed information regarding your case, including your personal information and specific reasons for the challenge. Make sure to carefully follow the instructions provided with the form to ensure accuracy. You can find templates and guidance on platforms like USLegalForms, which can simplify this process related to the Alabama Writ of Garnishment.

A writ of execution and a writ of garnishment serve different purposes in the collection of debts. A writ of execution allows a creditor to seize property to satisfy a judgment, while a writ of garnishment specifically targets wages or bank accounts to collect a debt directly. Understanding this distinction can help you navigate your rights and obligations in Alabama regarding the Alabama Writ of Garnishment.

Writing an objection letter for wage garnishment involves clearly stating the reasons for your objection. Begin your letter with your personal information and the court details, followed by a detailed explanation of why the garnishment should not occur under the Alabama Writ of Garnishment. Include any supporting documents that validate your position to strengthen your objection.

To negotiate a garnishment settlement, start by reviewing your financial situation and understanding your creditor's position. Then, approach your creditor or their attorney to discuss a potential compromise. You can propose a lower payment amount or an alternative arrangement, such as a one-time payment, which may prevent further garnishment under the Alabama Writ of Garnishment.

A challenge to garnishment is a legal process that allows you to dispute the garnishment of your wages or bank account in Alabama. It involves filing a notice with the court where your case is being handled. By doing this, you can argue that the garnishment should not proceed, possibly due to improper procedure or eligibility issues related to the Alabama Writ of Garnishment.