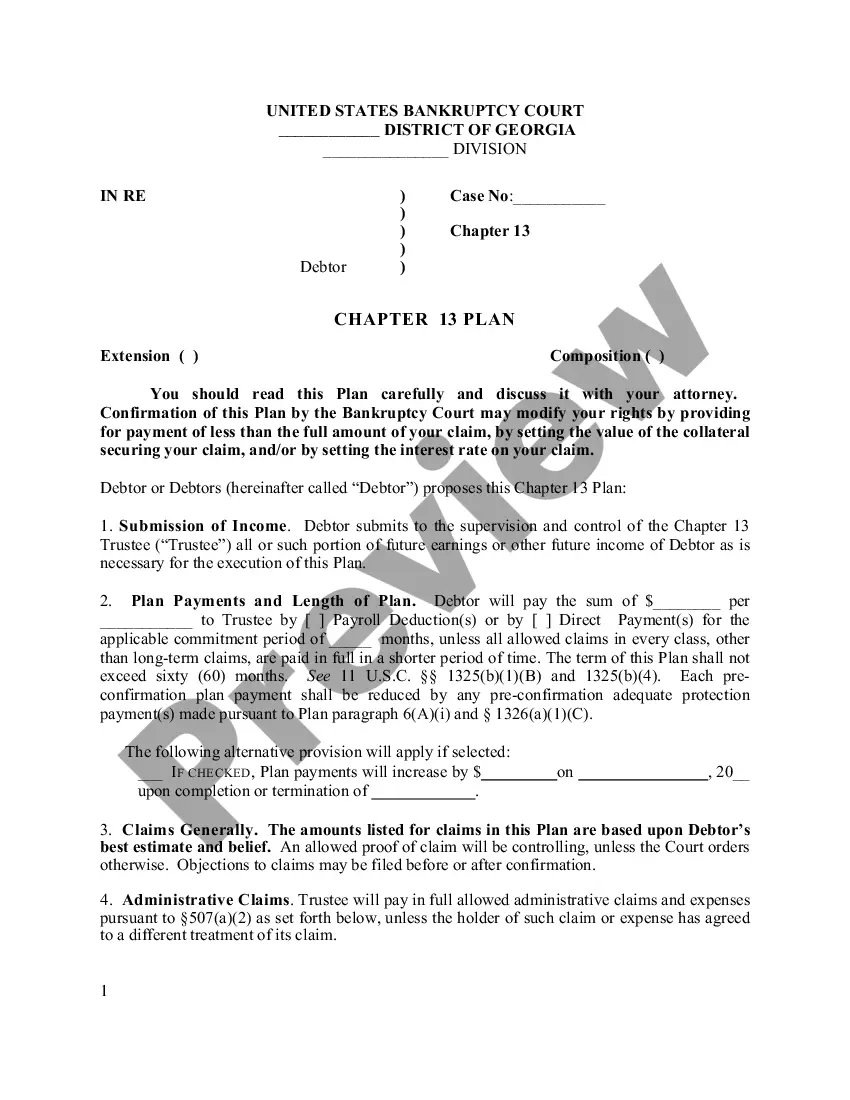

The chapter 13 plan provides that the debtor will pay the trustee a certain sum of money to be distributed among the creditors listed in the plan. The document provides information concerning: secured creditors, unsecured creditors, and the date of plan termination.

Georgia Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Georgia Chapter 13 Plan?

Access the most extensive collection of legal documents.

US Legal Forms is essentially a platform to discover any state-specific form in a few clicks, such as Georgia Chapter 13 Plan samples.

No need to waste hours searching for a court-acceptable example.

After selecting a payment plan, establish your account. Pay via card or PayPal. Download the template to your device by clicking the Download button. That's all! You should complete the Georgia Chapter 13 Plan template and verify it. To ensure everything is accurate, consult your local legal counsel for assistance. Register and easily explore 85,000 valuable templates.

- To utilize the document library, select a subscription and create an account.

- If you have already registered, simply Log In and click Download.

- The Georgia Chapter 13 Plan sample will be swiftly stored in the My documents section (a section for all forms you save on US Legal Forms).

- To create a new account, refer to the brief guidelines below.

- If you're using a state-specific document, ensure to select the appropriate state.

- If possible, examine the description to understand all the details of the document.

- Use the Preview feature if it’s available to review the document's content.

- If everything is accurate, click on the Buy Now button.

Form popularity

FAQ

Your Chapter 13 payment may seem high for several reasons. First, the Georgia Chapter 13 Plan requires you to repay a portion of your debts over three to five years, which can increase monthly payments based on your income and expenses. Additionally, your payment amount might include arrears, such as missed mortgage or car payments. If you have concerns about affordability, consider exploring options like adjusting your budget or seeking guidance from USLegalForms, which can help you navigate the Georgia Chapter 13 Plan effectively.

Filling out the forms for a Georgia Chapter 13 Plan involves gathering necessary financial documents and completing several specific forms, such as the petition and schedules. These forms require details about your income, expenses, liabilities, and assets. It is essential to ensure accuracy to create a viable repayment plan that the court will approve. If you find this process challenging, uslegalforms can guide you with templates and expert advice, helping you streamline your Chapter 13 filing.

To file a Georgia Chapter 13 Plan, you need to have a regular income and your unsecured debts must not exceed $419,275, while secured debts cannot exceed $1,257,850. This limit allows individuals with a relatively high debt load to restructure their finances and make manageable payments. Establishing a repayment plan can help you regain control of your financial situation. If you need assistance navigating these requirements, uslegalforms offers tools and resources specifically designed to help you initiate your Chapter 13 process.

The average monthly payment for a Georgia Chapter 13 Plan varies widely, depending on your income, debts, and expenses. Generally, payments range from $300 to $1,000, but they can be higher or lower based on your specific Financial situation. Using uSlegalforms can simplify calculating your payment plan and help you understand your options. This tool is valuable for budgeting and planning during your Chapter 13 process.

Yes, you can often keep your car when you file for a Georgia Chapter 13 Plan. The plan enables you to include your car payments in your repayment proposal, allowing you to catch up on overdue payments. As long as you continue making payments as proposed, you can maintain ownership of your vehicle. This provides peace of mind during your financial recovery.

While it is possible to file a Georgia Chapter 13 Plan on your own, it is often advisable to seek professional assistance. A lawyer can help navigate the complexities of bankruptcy laws and ensure that all necessary paperwork is filed correctly. This guidance can prevent costly mistakes and streamline your filing process. USLegalForms provides resources that can simplify your journey and enhance your understanding of the filing process.

Your monthly payment under a Georgia Chapter 13 Plan depends on several factors, including your income, debts, and living expenses. Typically, the payment is structured to be affordable while ensuring that your creditors receive something over the plan's duration. To get a more precise estimate, you can analyze your financial situation with tools or services from USLegalForms. Understanding your obligations will empower you to manage your finances better.

The maximum income for a Georgia Chapter 13 Plan depends on your household size and is measured against the state’s median income. This calculation helps determine your repayment plan and eligibility. If your income exceeds the median, it's still possible to qualify, but you may face different requirements. Consult a qualified attorney or use the resources from USLegalForms to clarify your income situation.