Writ of Execution

Understanding this form

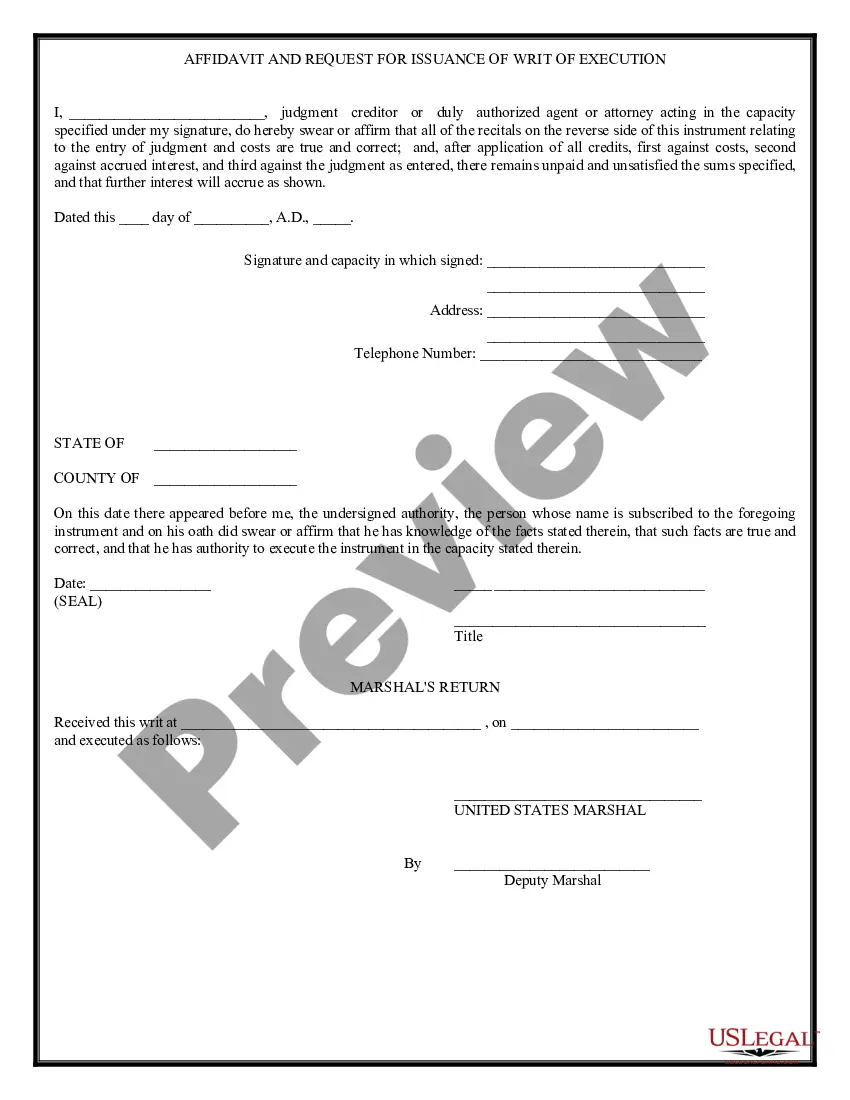

The Writ of Execution is a legal document used in federal court proceedings to enforce a judgment. It orders a United States Marshal to seize the assets of a judgment debtor in order to satisfy a court's ruling. This form is distinct from other collections-related documents, as it specifically authorizes law enforcement to take action in collecting the debt outlined in the judgment.

Form components explained

- Case number and relevant court district information.

- Details of the judgment creditor and debtor.

- Amount owed, including judgment, interest, and costs.

- Command for the marshal to execute the judgment.

- Affidavit section affirming the accuracy of the claims of unpaid amounts.

When this form is needed

This form should be used when a court has issued a judgment against a debtor who has failed to pay the ordered amount. It is necessary when a creditor seeks to enforce this judgment through the seizure of the debtor's property or assets. Use this form if you have exhausted other collection efforts and require official legal means to recover the owed funds.

Intended users of this form

This form is intended for:

- Creditors who have obtained a monetary judgment in federal court.

- Attorneys representing creditors seeking to enforce judgments.

- Any authorized agents or representatives acting on behalf of the judgment creditor.

Instructions for completing this form

- Fill in the case number and court details where the judgment was issued.

- Identify the judgment creditor and debtor by providing their full names and addresses.

- Specify the amount owed, including any accrued interest and costs calculated up to the date of the filing.

- Complete the affidavit section confirming the amounts stated and authorize the issuance of the writ.

- Sign the form and ensure it includes the appropriate date and corresponding official seals if required.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include the correct case number or court information.

- Not providing complete names and addresses for all parties involved.

- Incorrectly calculating the total amount owed, including judgment and interest.

- Omitting signatures or notarization where required.

Benefits of using this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows for easy updates and corrections.

- Access to professionally drafted forms that comply with legal standards.

What to keep in mind

- The Writ of Execution empowers the marshal to enforce court judgments.

- Proper completion of the form is essential to avoid delays in enforcement.

- It is crucial for creditors seeking to collect owed amounts after a judgment is rendered.

Looking for another form?

Form popularity

FAQ

A writ of execution is a process issued by the court directing the U.S. Marshal to enforce and satisfy a judgment for payment of money.

Texas Rules of Civil Procedure, Rule 629, indicates that the writ must be returnable to the court within 30, 60 or 90 days (as specified in the application for the writ). Accordingly, the writ is only good for a maximum of 90 days before it would need to be reissued.

Getting a Writ of Execution ), the court directs the sheriff or marshal to enforce the judgment in your case in the county where the assets are located. Writs of execution are only good for 180 days.

The writ gives the Sheriff the authority to seize property of the judgment debtor and is valid for 180 days after its issuance. You must give the Sheriff signed, written instructions to levy on (seize) and sell, if necessary, specific property belonging to the debtor to satisfy your judgment.

You do not appeal, you must file a claim of exemption sheriff/marshal.Sheriff will mail a copy of the judgment creditor to stop a writ of Execution in California, court note!

When a court issues a writ of execution, a sheriff, deputy sheriff, or a court official is usually charged with taking possession of any property that is owed to the plaintiff. If the property is money, the debtor's bank account may be frozen or the funds may be moved into a holding account.

The court-issued Writ of Execution allows execution of a judgment debt by law enforcement in Texas, such as constables or sheriff's officers, to seize and then sell real and personal property belonging to the judgment. debtor in order to help satisfy the judgment.

P) Writ of Execution refers to an order directing the Sheriff to enforce, implement, or satisfy the judgment which shall be effective for a period of five (5) years.

Except as provided in Rule 62(c) and (d), execution on a judgment and proceedings to enforce it are stayed for 30 days after its entry, unless the court orders otherwise. (b) Stay by Bond or Other Security. At any time after judgment is entered, a party may obtain a stay by providing a bond or other security.