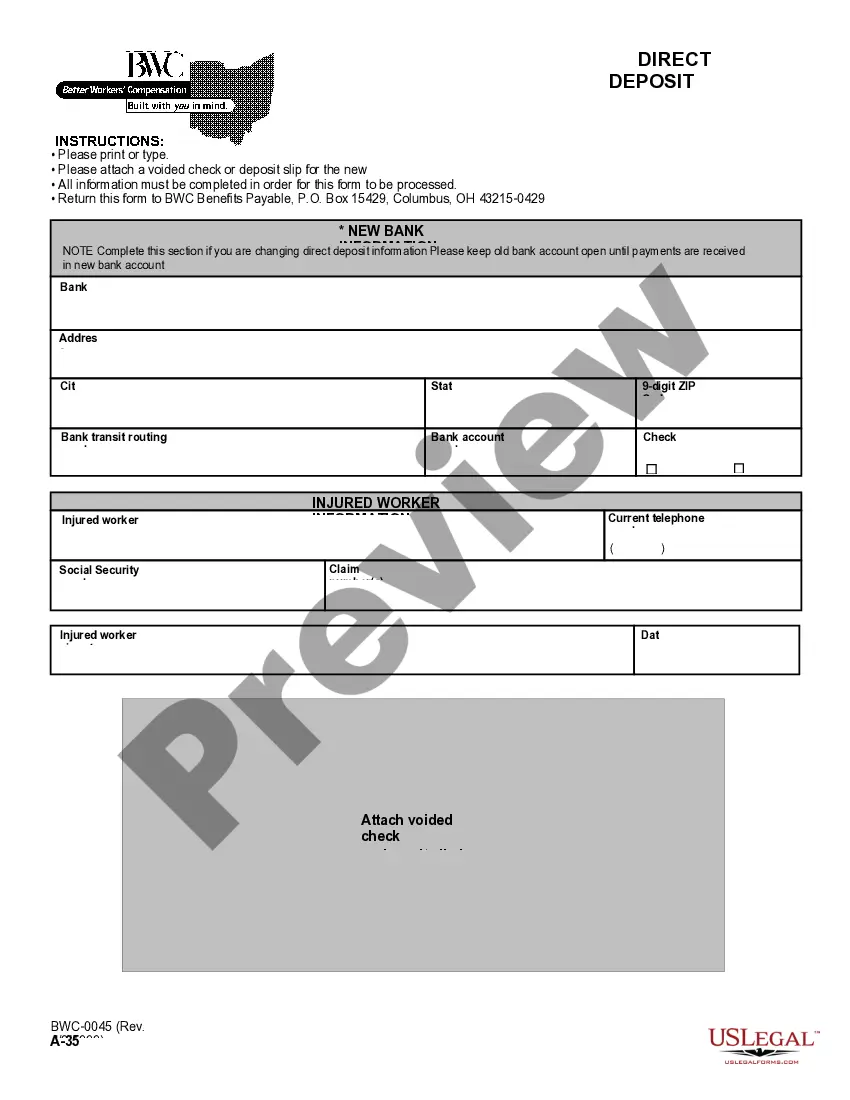

This is one of the official workers' compensation forms for the state of Ohio.

Ohio ACT Enrollment Form and Direct Deposit Authorization for Workers' Compensation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

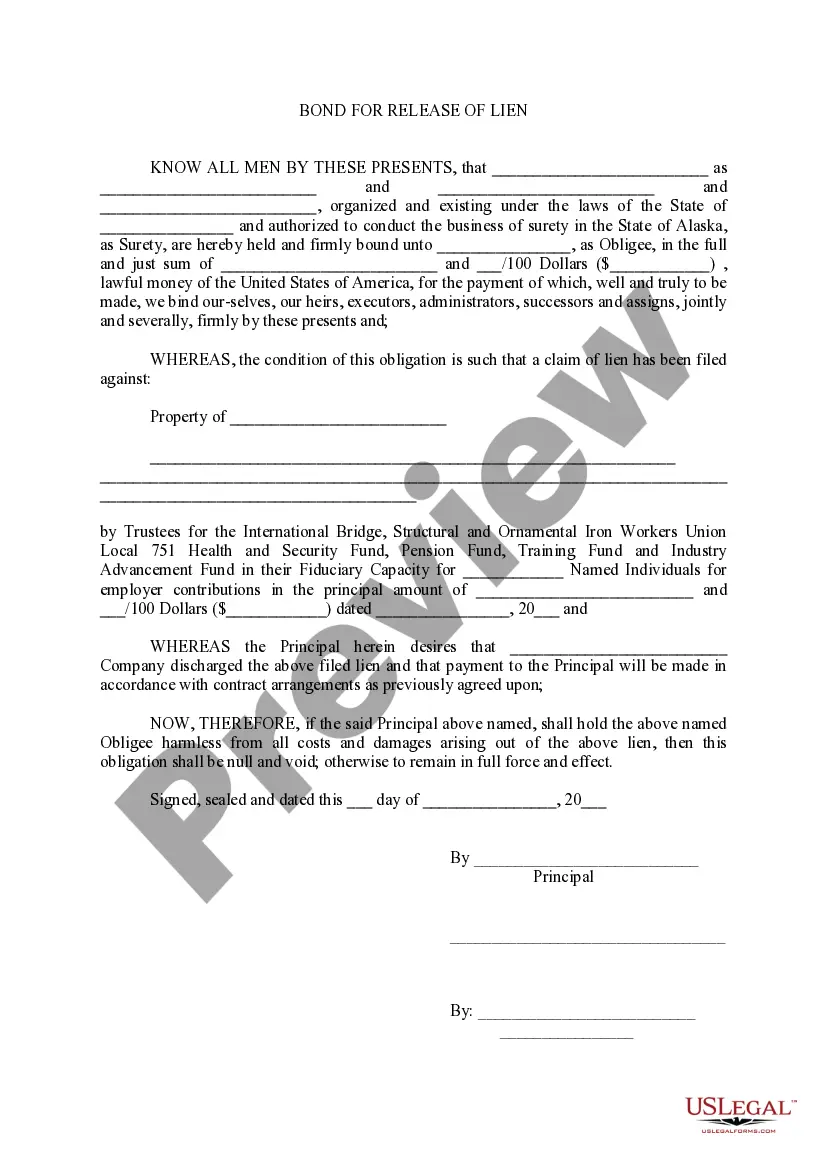

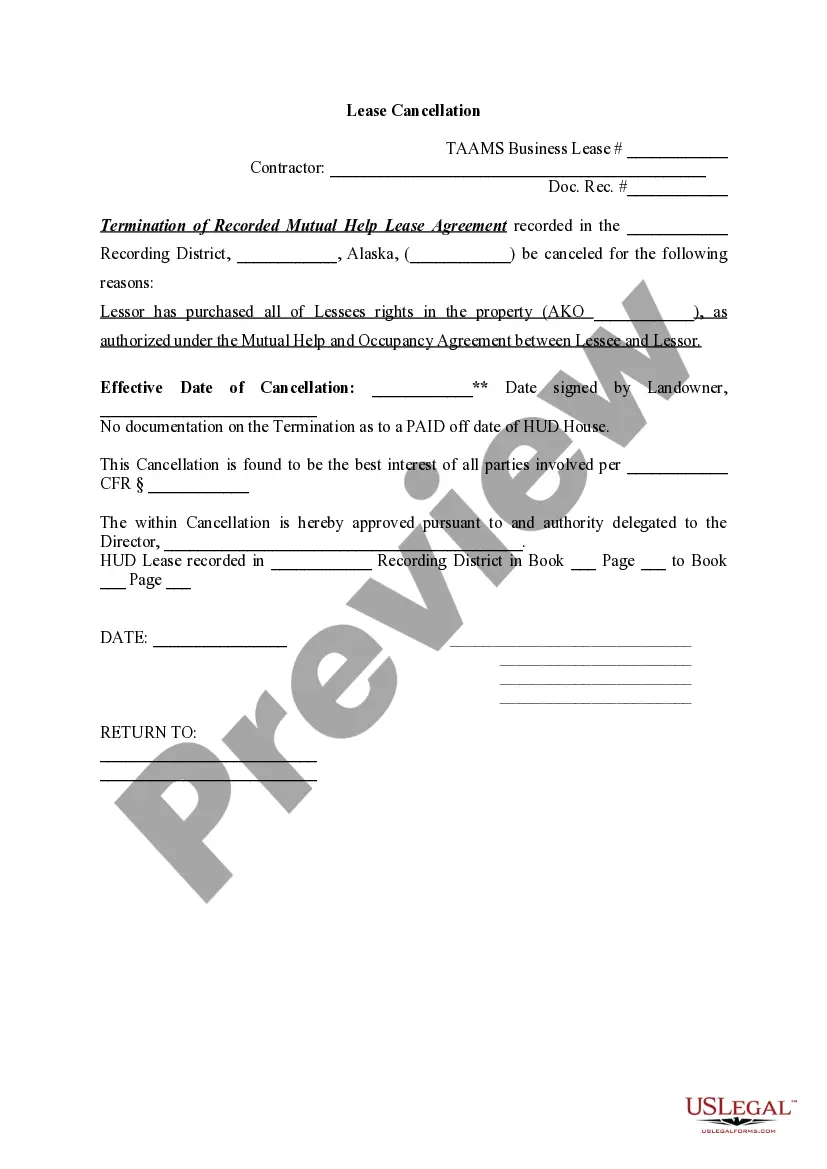

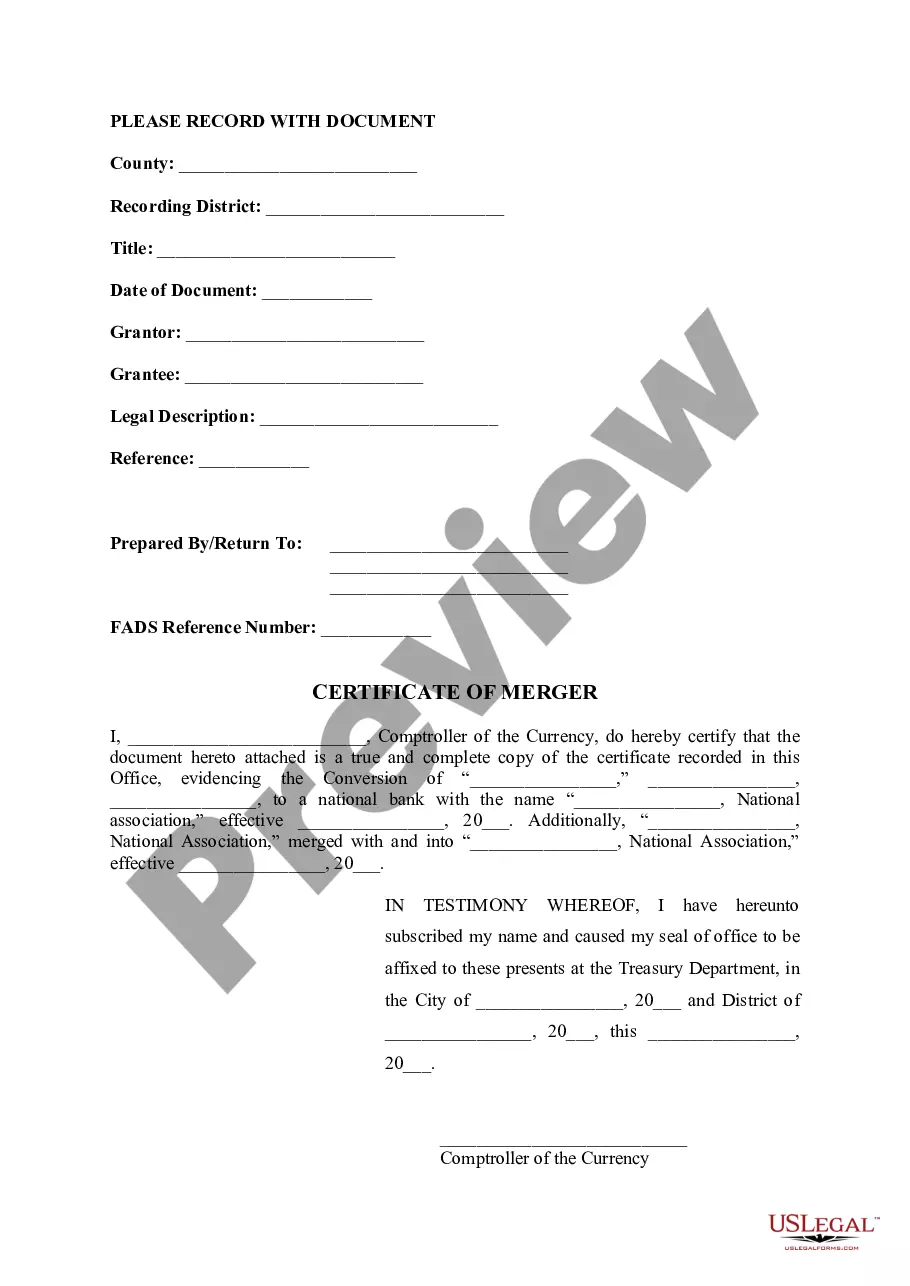

Looking for another form?

How to fill out Ohio ACT Enrollment Form And Direct Deposit Authorization For Workers' Compensation?

In terms of filling out Ohio ACT Enrollment Form and Direct Deposit Authorization for Workers' Compensation, you almost certainly imagine a long procedure that requires choosing a suitable sample among a huge selection of similar ones and then being forced to pay a lawyer to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific document in a matter of clicks.

In case you have a subscription, just log in and click Download to find the Ohio ACT Enrollment Form and Direct Deposit Authorization for Workers' Compensation template.

If you don’t have an account yet but need one, stick to the point-by-point guideline below:

- Be sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do this by reading the form’s description and also by clicking the Preview function (if readily available) to view the form’s content.

- Click Buy Now.

- Pick the proper plan for your financial budget.

- Sign up for an account and choose how you would like to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Professional lawyers draw up our templates to ensure after downloading, you don't have to bother about editing and enhancing content material outside of your individual information or your business’s info. Sign up for US Legal Forms and get your Ohio ACT Enrollment Form and Direct Deposit Authorization for Workers' Compensation example now.

Form popularity

FAQ

Get a direct deposit form from your employer Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.

Sign in to chase.com or the Chase Mobile® app. Choose the checking account you want to receive your direct deposit. We've pre-filled your direct deposit form to save you time. Download, print or email the form.

Employees will provide their bank account information and can choose how they would like their money to be paid. If you choose to offer Direct Deposit to your employees, they can designate a flat-dollar amount, a percentage, or the remainder of their money to be deposited into an unlimited number of bank accounts.

It's best not to spend the deposit until it's fully cleared into your account. Some deposits stay pending for three to five business days, and the amount of time your deposit stays pending might also depend on when you actually deposit it. For example, some banks have a cutoff time of 5 pm for deposits.

Ask for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF). Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.

Click your company name at the top right, and then click Payroll Settings. Click Direct Deposit under Payroll and Services. Look in the Action column in the Employer Info box. If you see Active, it means your direct deposit is all set up and ready to go.

Simply select the account you'd like your deposits to go to, and we'll pre-fill the form with your routing number, account number, and account type. Or you can download a blank Direct Deposit Information Form (PDF) and fill in the information yourself.

A direct deposit authorization form is a document that authorizes a third (3rd) party, usually an employer for payroll, to send money to a bank account by simply using the ABA routing and account numbers.

Sign in to chase.com or the Chase Mobile® app. Choose the checking account you want to receive your direct deposit. We've pre-filled your direct deposit form to save you time. Download, print or email the form.