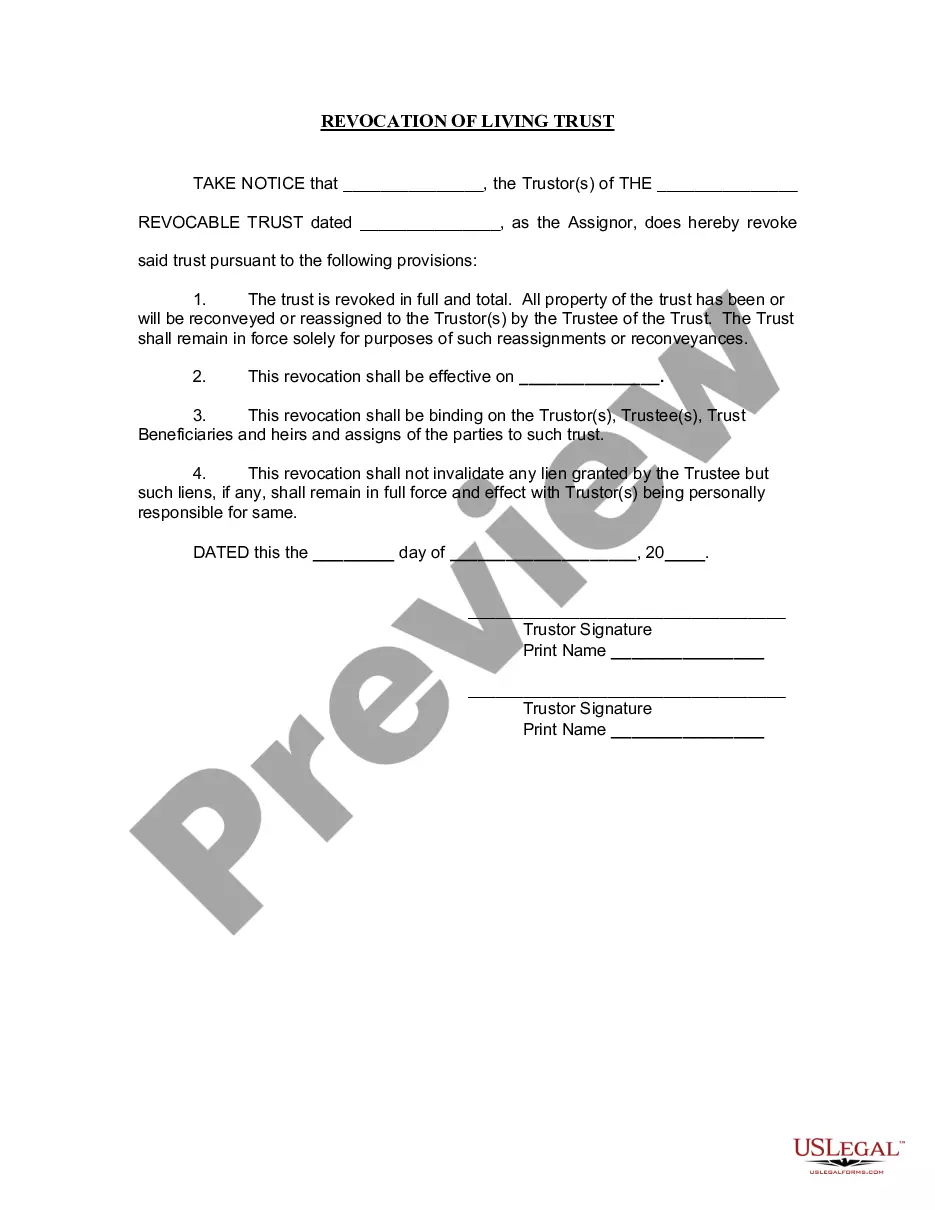

New York Instructions are legal documents that provide guidance to the public on how to comply with the laws of New York State. They are issued by the Office of Court Administration and are designed to clarify the requirements of the law and provide step-by-step instructions for filing legal documents, completing a court action, or obtaining a service. There are two main types of New York Instructions: General Instructions and Program Instructions. General Instructions are written for a broad audience and provide general information on how to comply with the laws of New York State. Program Instructions are tailored to specific programs or areas of law and provide more detailed information on how to comply with the relevant laws.

New York Instructions

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New York Instructions?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state laws and are checked by our experts. So if you need to fill out New York Instructions, our service is the perfect place to download it.

Obtaining your New York Instructions from our catalog is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the correct template. Later, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance check. You should attentively review the content of the form you want and check whether it suits your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New York Instructions and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

If you live in the state of New York or earn income within the state, it's likely you will have to pay New York income tax. And with that, comes completing and filing New York (NYS) tax forms. Read on to learn more about common NYS tax forms here!

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

Use Tax - applies if you buy tangible personal property and services outside the state and use it within New York State. Clothing and footwear under $110 are exempt from New York City and NY State Sales Tax. Purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax.

State Only Return Requirements ? New York returns can be transmitted with the Federal return or as a State Only return unlinked from the Federal return.

Your New York adjusted gross income is your recomputed federal adjusted gross income after certain New York additions and New York subtractions (modifications). New York State taxes certain items of income not taxed by the federal government.

Form IT-201, Resident Income Tax Return.

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.