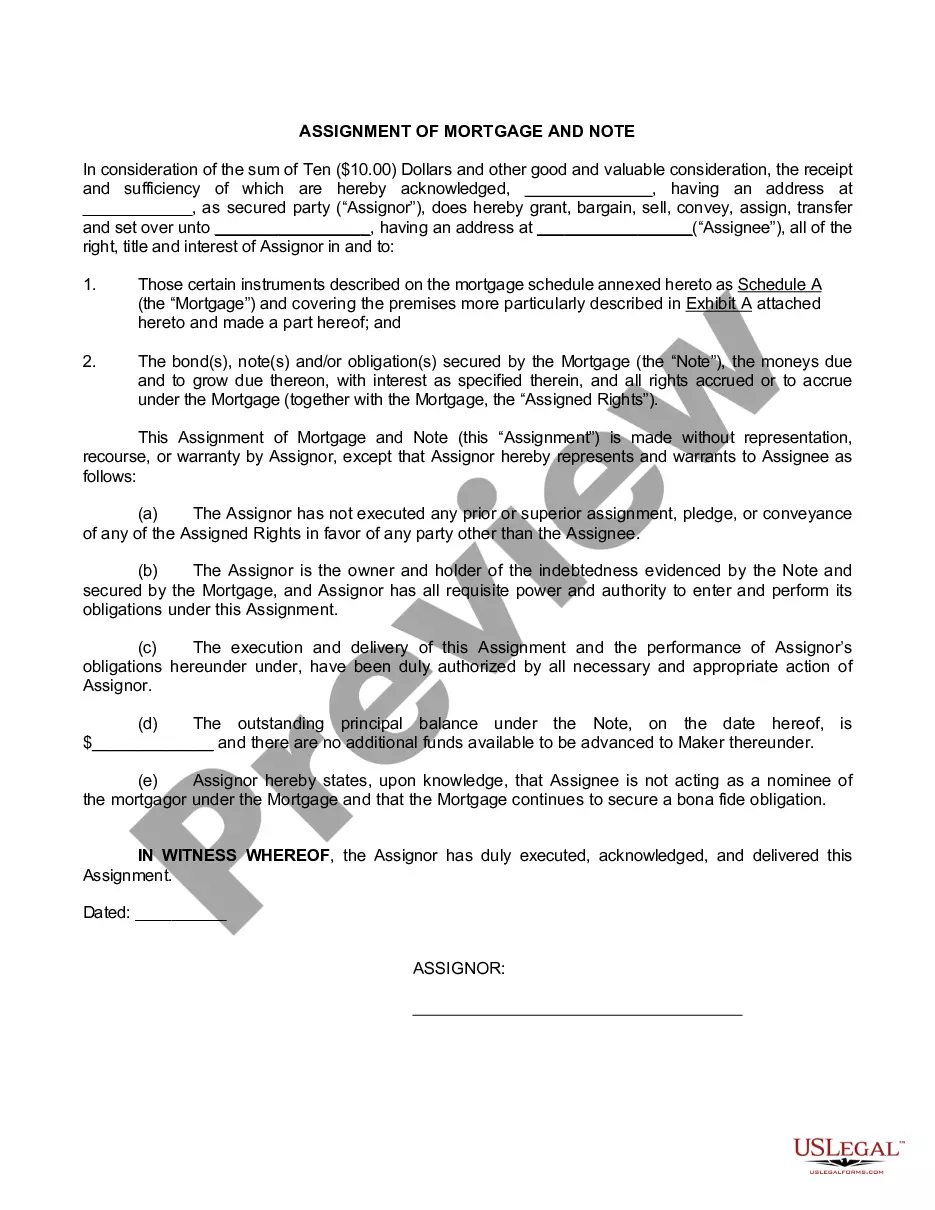

New York Assignment of Mortgage and Note

Category:

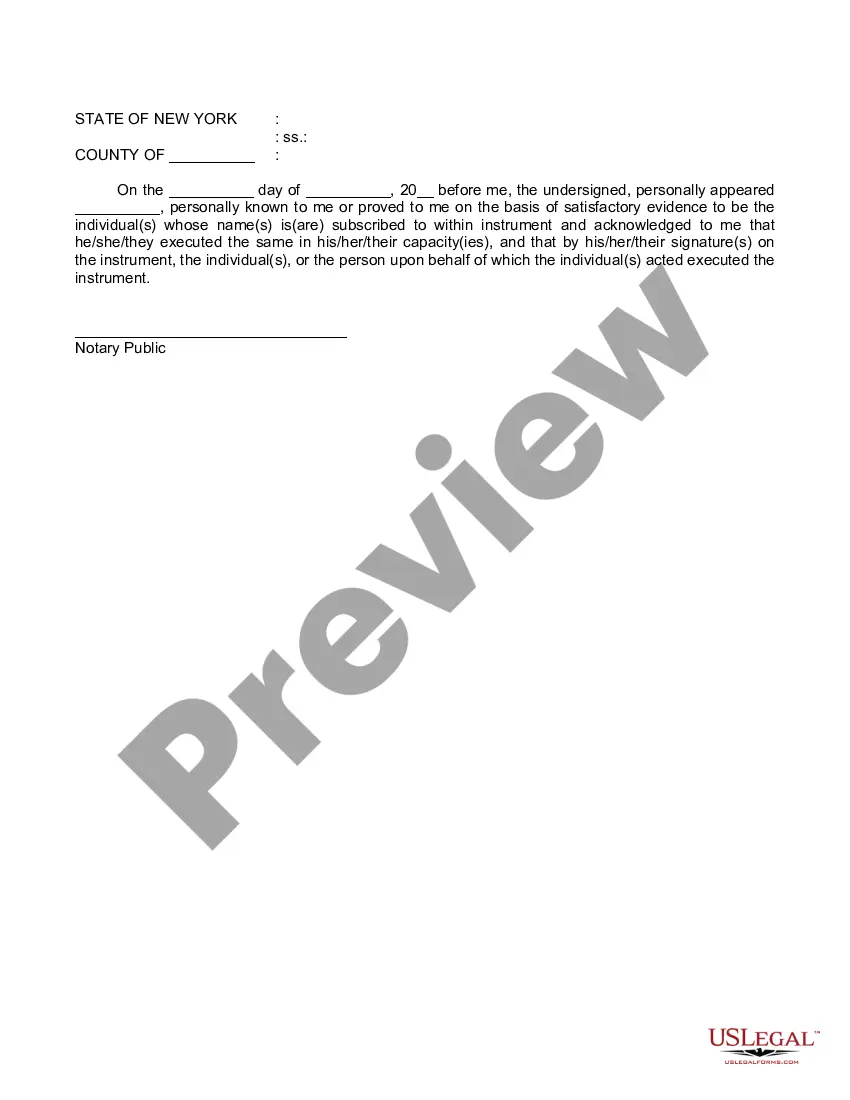

State:

New York

Control #:

NY-8004J

Format:

Word;

Rich Text

Instant download

Description

This is an assignment of mortgage form where the owner of the mortgage conveys the owner's interest in the mortgage to a third party or assignee.

Free preview