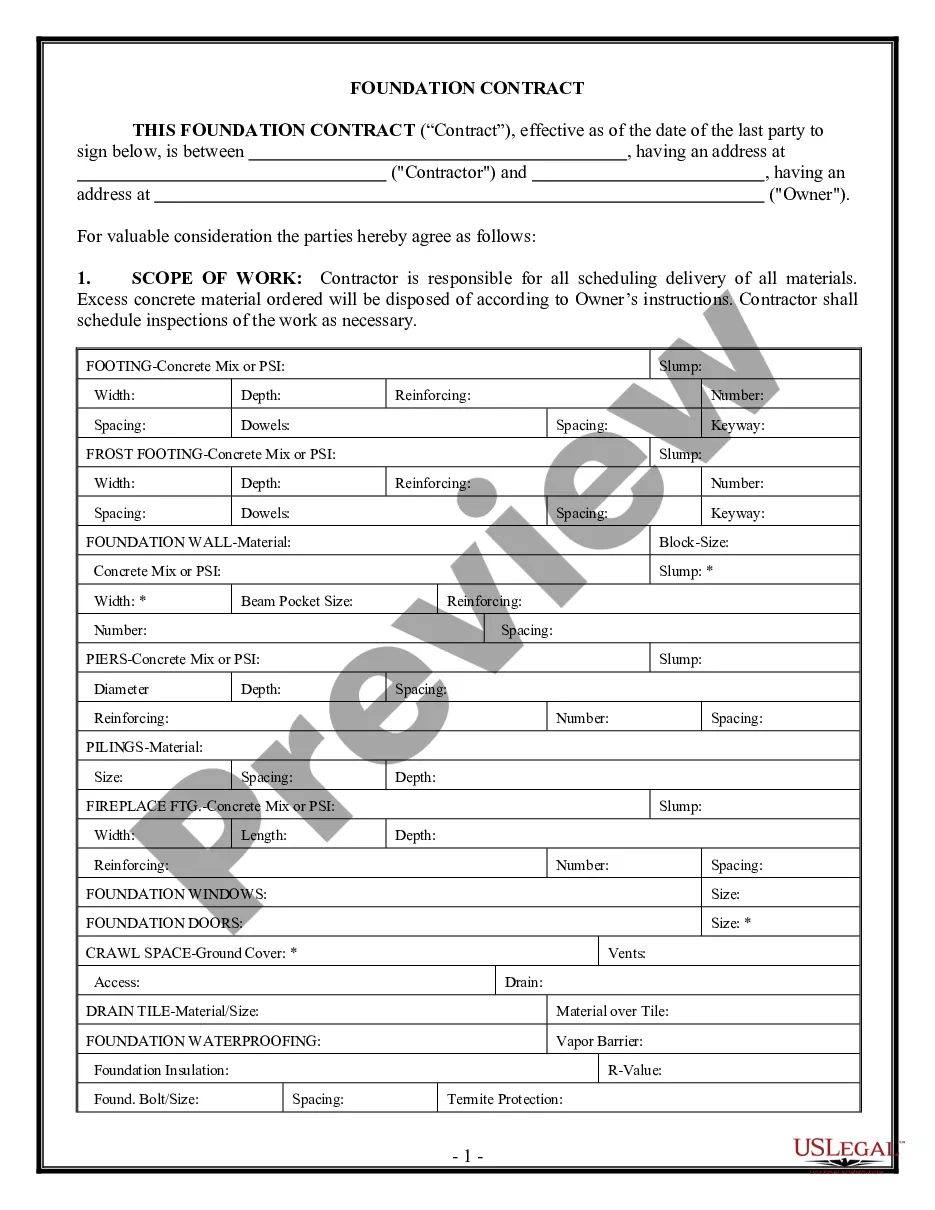

Partial Assignment of Note and Mortgage is an arrangement between two parties whereby a borrower (the mortgagor) assigns a portion of their interest in a note and mortgage to a third party (the assignee). This arrangement allows the assignee to receive a portion of the payments due on the note and mortgage, while the mortgagor remains responsible for the remaining payments. There are two types of Partial Assignment of Note and Mortgage: 1. Partial Assignment of Note: This type of partial assignment involves the assignment of a portion of the interest in a note to a third party. This allows the assignee to receive a portion of the payments due on the note, while the mortgagor remains responsible for the remaining payments. 2. Partial Assignment of Mortgage: This type of partial assignment involves the assignment of a portion of the interest in a mortgage to a third party. This allows the assignee to receive a portion of the payments due on the mortgage, while the mortgagor remains responsible for the remaining payments.

Partial Assignment of Note and Mortgage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Partial Assignment of Note and Mortgage: This is a legal arrangement where the holder of a mortgage (lender) transfers a portion of their interest in the mortgage note to another party. This can be done for various reasons such as raising capital, risk distribution, or portfolio management. The mortgage note is essentially a promise to pay a specified amount of money, secured by a mortgage on property.

Step-by-Step Guide

- Review the Original Loan Agreement: Identify any clauses that may restrict or allow partial assignment.

- Identify a Suitable Assignee: Find a party interested in taking over a portion of the mortgage note.

- Negotiate Terms: Determine the terms of the assignment including the portion of the note being assigned and the financial arrangements.

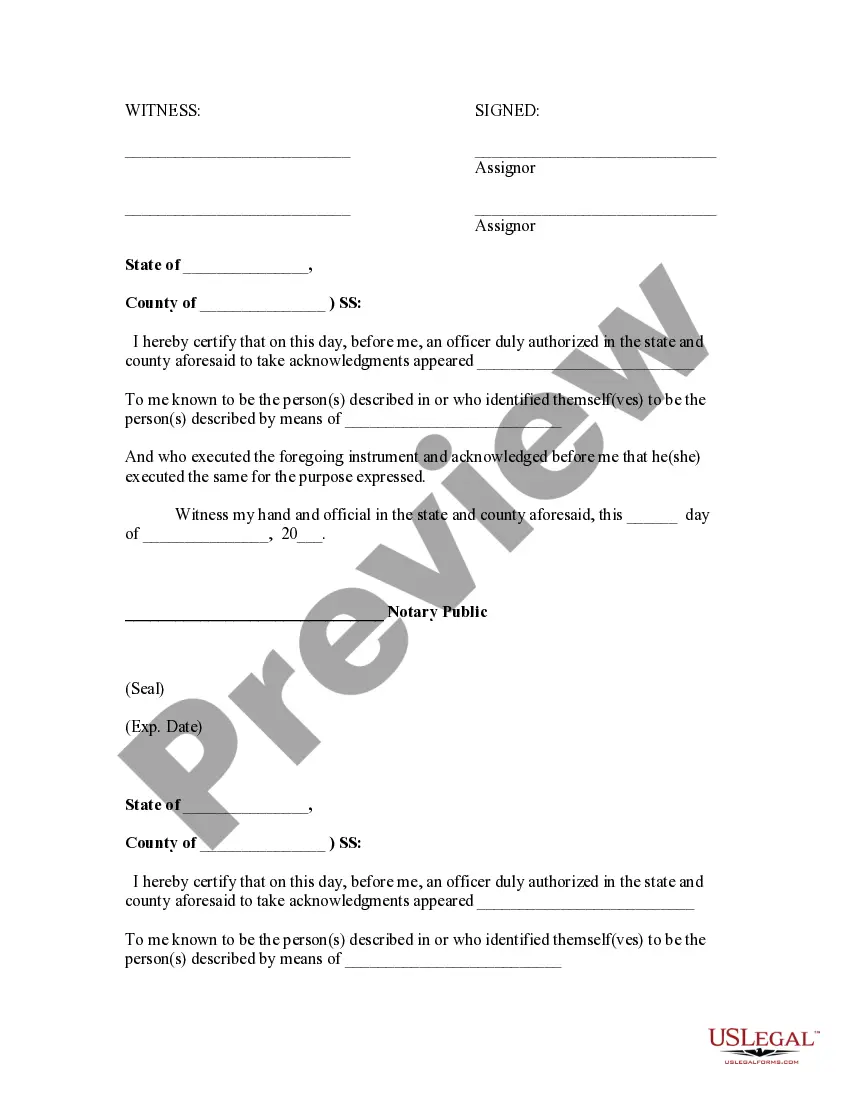

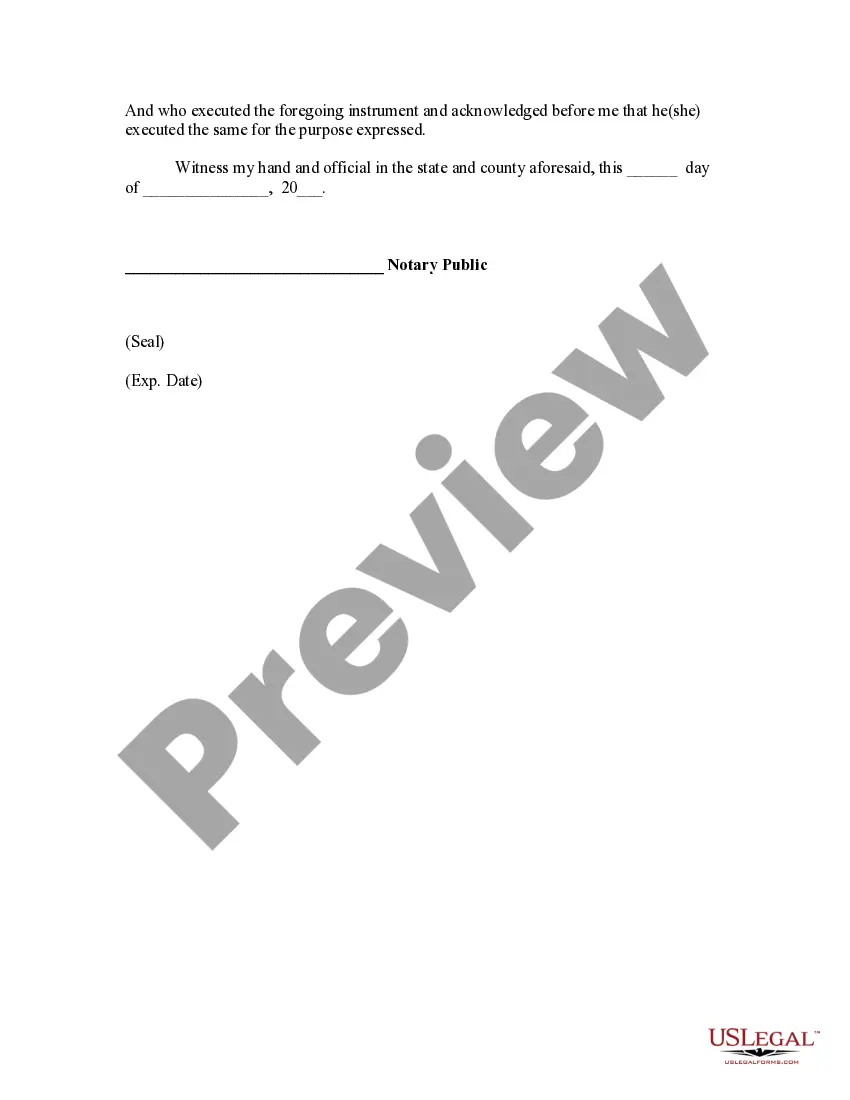

- Execute Assignment Agreement: Prepare and sign a formal agreement detailing the rights and obligations of all parties involved.

- Notify the Borrower: Inform the borrower of the assignment as they must acknowledge and agree to make payments to the new note holder.

- Record the Assignment: File the assignment with appropriate county or city offices to make it legally binding and enforceable.

Risk Analysis

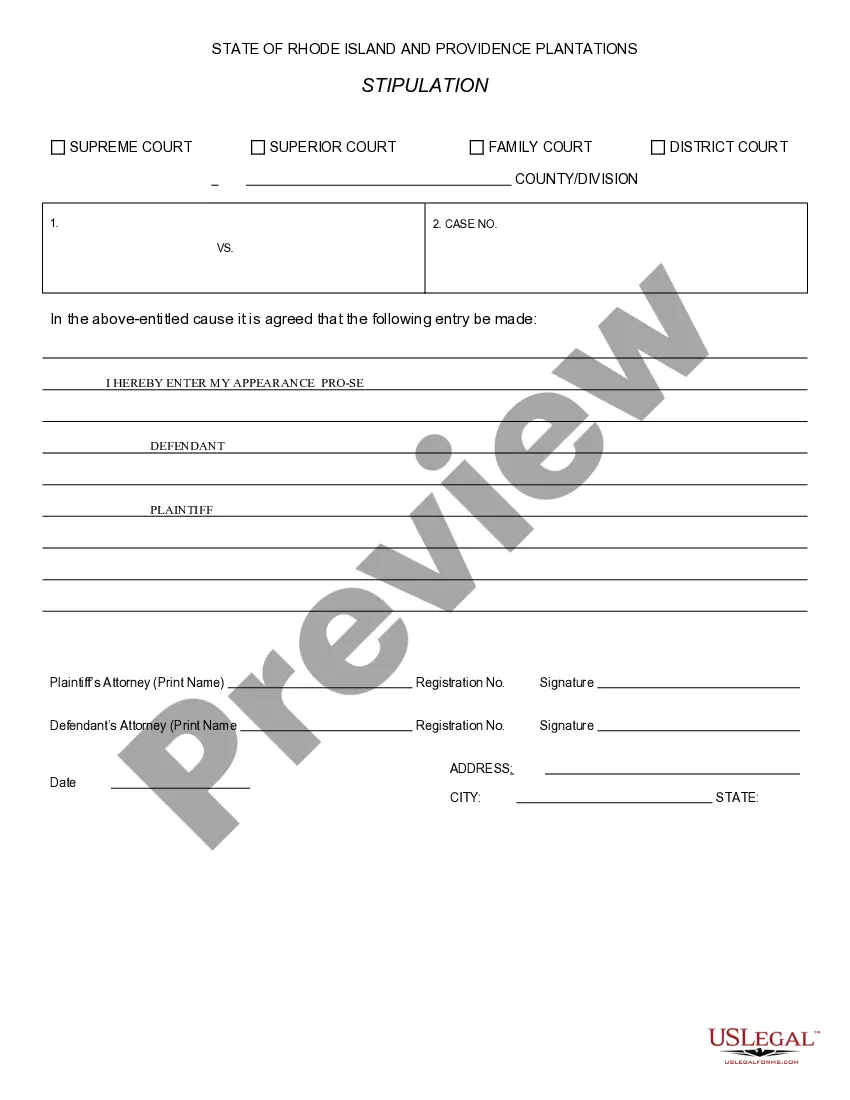

- Legal Compliance Risk: Failure to comply with local laws and loan agreement terms can lead to legal actions.

- Financial Risk: Incorrect valuation of the mortgage note part being assigned might lead to financial losses.

- Counterparty Risk: The new assignee might fail to fulfill their financial obligations or manage the loan effectively.

- Reputational Risk: Poor handling of the assignment process might affect relationships with other investors or borrowers.

Key Takeaways

- Partial assignment of note and mortgage allows mortgage holders to redistribute risk and liquidity.

- The process requires careful adherence to legal standards and original loan agreements.

- Full awareness and proper documentation are critical to protect the interests of all parties involved.

Best Practices

- Detailed Documentation: Maintain comprehensive records and contracts to avoid future disputes or legal complications.

- Professional Advice: Consult with legal and financial experts to navigate the complexities of mortgage assignments.

- Transparent Communication: Keep all parties informed throughout the process to ensure mutual understanding and cooperation.

FAQ

- What happens if the original borrower defaults? Both the original lender and the assignee have rights to pursue legal remedies depending on their agreement's terms.

- Can you partially assign a mortgage without the borrower's consent? Generally, borrower's consent is needed as they have to make payments to a new entity.

- Is partial assignment common in commercial or residential mortgages? It is more common in commercial mortgages due to their larger sizes and complexities.

How to fill out Partial Assignment Of Note And Mortgage?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state laws and are examined by our specialists. So if you need to complete Partial Assignment of Note and Mortgage, our service is the best place to download it.

Obtaining your Partial Assignment of Note and Mortgage from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the correct template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Partial Assignment of Note and Mortgage and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

For example, the debtor may have entered into an agreement with the assignor whereby the assignor agreed to accept a lesser amount of the debt owed by way of settlement. Because the assignee acquires the same rights and obligations of the assignor, the terms of that previous settlement agreement will bind the assignee.

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

In bank loan financings, the sale of all or part of the rights and obligations of a lender (the assignor) under a loan agreement to another party (the assignee).

The difference between assignment and transfer is that assign means it's legal to transfer property or a legal right from one person to another, while transfer means it's legal to arrange for something to be controlled by or officially belong to another person.

A partial assignment of contract occurs when the assignor of a contract is assigning a portion of his or her contractual right. This can only occur if the other involved party can perform that portion of the contractual obligation separately from the rest of the obligations.

However, the basic difference between participation and assignment is that the former involves the original lender continuing to manage the loan while the latter takes on the responsibility of doing so. As a rule, loan participation is a good option if the original lender does not want to keep the title of the loan.