Release from Liability under Guaranty

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

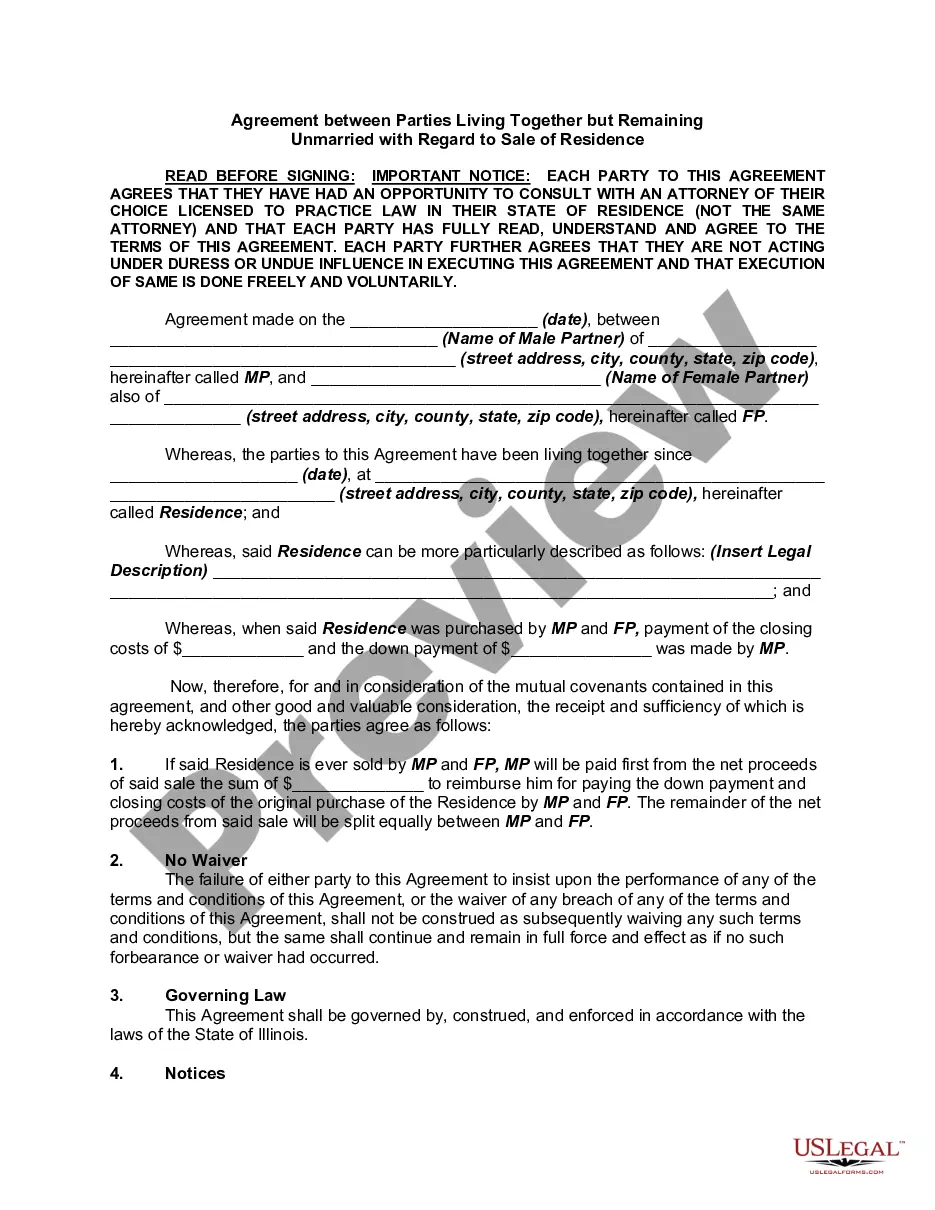

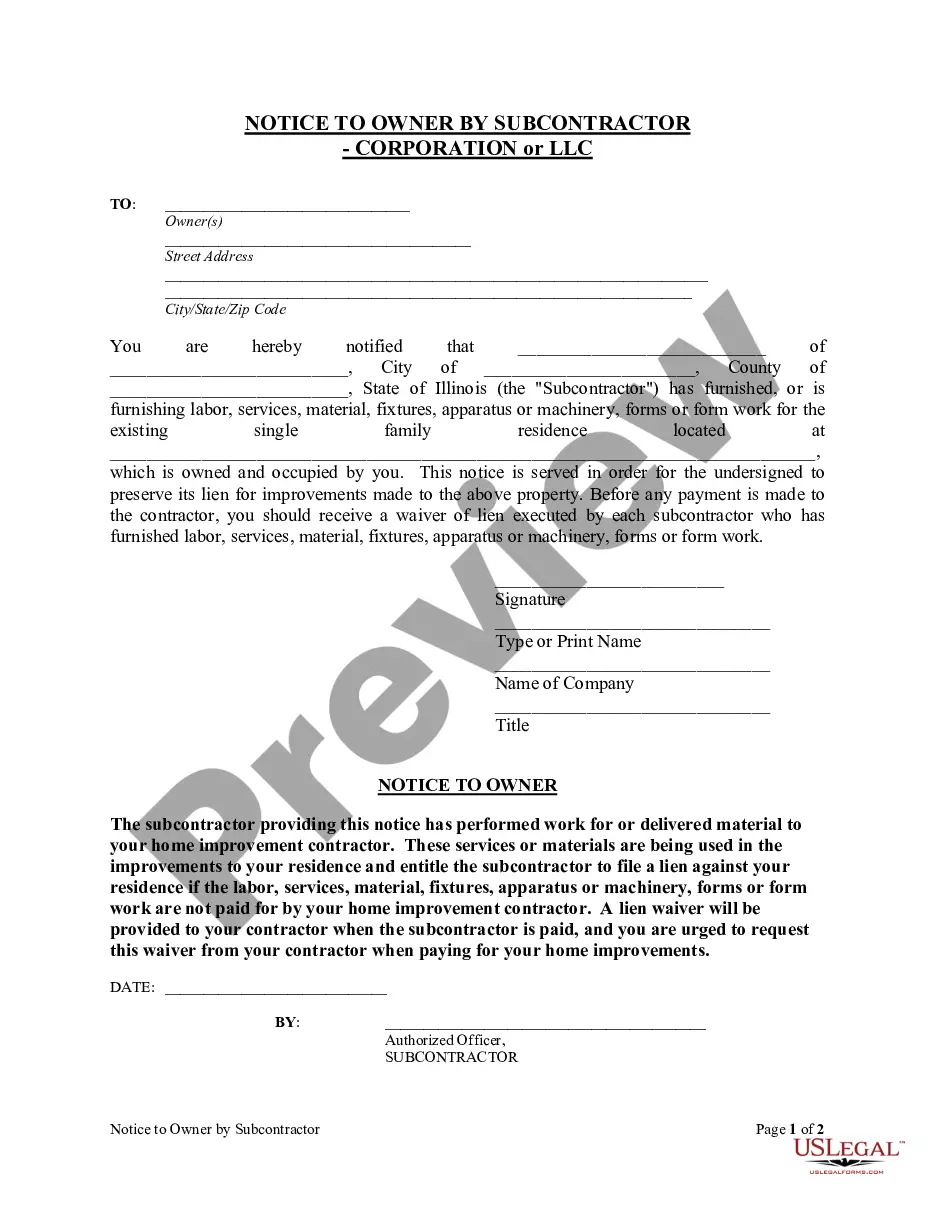

How to fill out Release From Liability Under Guaranty?

Make use of the most extensive legal catalogue of forms. US Legal Forms is the best place for getting up-to-date Release from Liability under Guaranty templates. Our platform offers a large number of legal forms drafted by certified lawyers and grouped by state.

To obtain a template from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our service, log in and choose the document you are looking for and purchase it. After buying forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your requirements.

- If the form has a Preview function, utilize it to check the sample.

- In case the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the debit/visa or mastercard.

- Select a document format and download the sample.

- Once it is downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and fill in the Form name. Join thousands of happy clients who’re already using US Legal Forms!

Form popularity

FAQ

As nouns the difference between guarantee and guarantor is that guarantee is anything that assures a certain outcome while guarantor is a person, or company, that gives a guarantee.

Contract your mortgage broker to review your financial situation. Arrange a bank valuation. Confirm the total loan amount. Make sure you meet the lender's criteria. Submit a partial release, or internal refinance. 6. (

Guaranteed Liability means any agreement, undertaking or arrangement by which any Person guarantees, endorses or otherwise becomes or is contingently liable upon (by direct or indirect agreement, contingent or otherwise, to provide funds for payment, to supply funds to, or otherwise to invest in, a debtor, or otherwise

In case of non-payment, a guarantor is liable to legal action. If the lender files a recovery case, it will file the case against both the borrower and the guarantor. A court can force a guarantor to liquidate assets to pay off the loan," added Mishra.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

Noun. a promise or assurance, especially one in writing, that something is of specified quality, content, benefit, etc., or that it will perform satisfactorily for a given length of time: a money-back guarantee.a person who gives a guarantee or guaranty; guarantor. a person to whom a guarantee is made.

A guarantee obligation is an example of a contingent obligation. Under the terms of the guarantee, the guarantor assumes liability for all guaranteed obligations, but its liability to make payments is conditional.

Put another way, a guaranty of collection requires that the debtor must exhaust certain remedies against the debtor before proceeding against the guarantor, while a guaranty of payment means that the lender can proceed directly against the guarantor even if the debtor is solvent and otherwise able to pay.